Fillable Motor Vehicle Bill of Sale Document for Pennsylvania

Navigating the roads of vehicle ownership and sale in Pennsylvania involves important documentation, one of which is the Motor Vehicle Bill of Sale form. This critical piece of paperwork acts as a formal record of the transaction between the seller and the buyer, outlining the essential details of the vehicle’s sale. It includes the make, model, year, and VIN (Vehicle Identification Number), alongside the sale price and the date of the transaction. Additionally, it provides legal protection for both parties, serving as proof of ownership transfer and helping to ensure that the transaction is clear, transparent, and mutually agreed upon. For anyone looking to buy or sell a vehicle in Pennsylvania, understanding the intricacies of this form is essential. It not only facilitates a smoother transfer process but also helps in fulfilling state requirements, possibly including tax obligations associated with the sale. Its importance cannot be overstated, as it lays the groundwork for a successful and legally sound vehicle transaction.

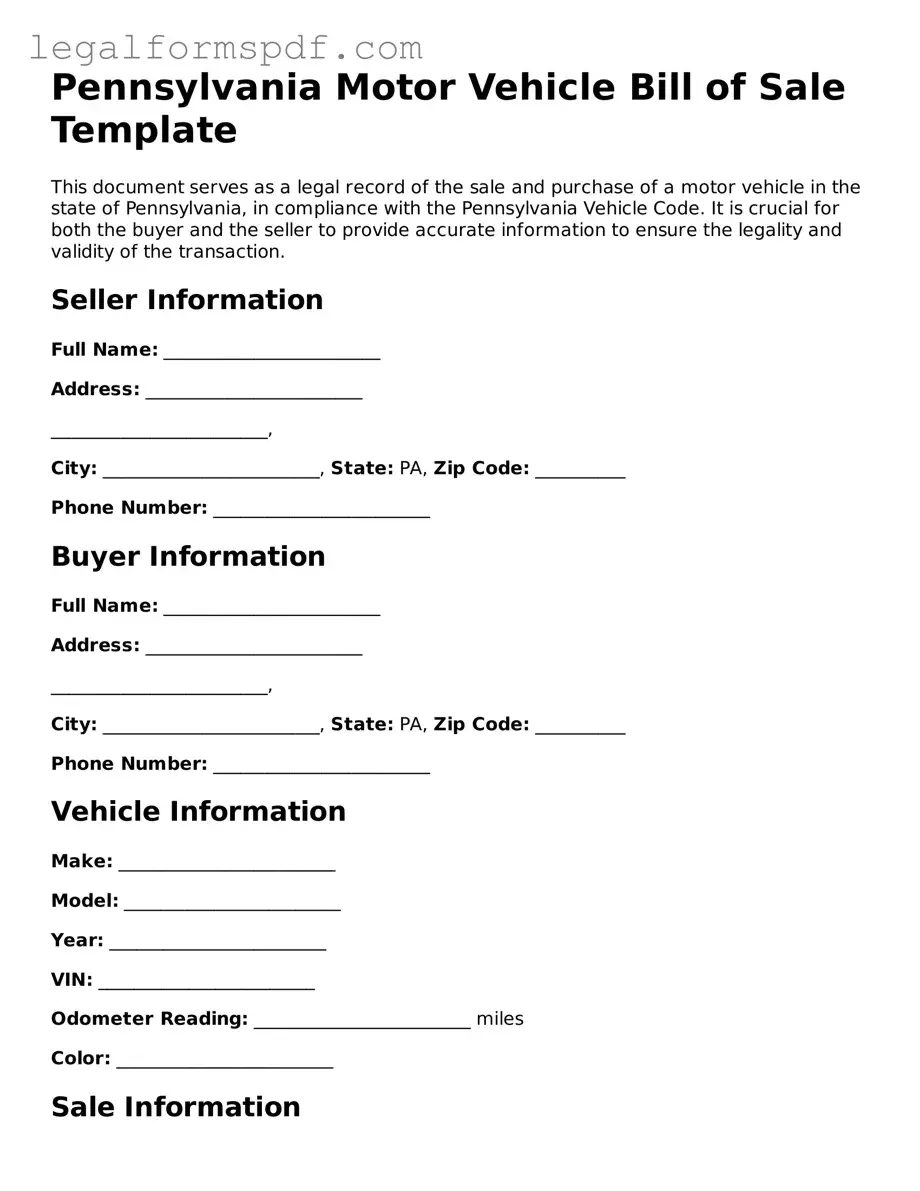

Document Example

Pennsylvania Motor Vehicle Bill of Sale Template

This document serves as a legal record of the sale and purchase of a motor vehicle in the state of Pennsylvania, in compliance with the Pennsylvania Vehicle Code. It is crucial for both the buyer and the seller to provide accurate information to ensure the legality and validity of the transaction.

Seller Information

Full Name: ________________________

Address: ________________________

________________________,

City: ________________________, State: PA, Zip Code: __________

Phone Number: ________________________

Buyer Information

Full Name: ________________________

Address: ________________________

________________________,

City: ________________________, State: PA, Zip Code: __________

Phone Number: ________________________

Vehicle Information

Make: ________________________

Model: ________________________

Year: ________________________

VIN: ________________________

Odometer Reading: ________________________ miles

Color: ________________________

Sale Information

Sale Date: ________________________

Sale Price: $________________________

Terms and Conditions

This bill of sale acknowledges the transfer of ownership of the above-stated vehicle from the seller to the buyer. The seller certifies that the vehicle is free from all liens and encumbrances and that the seller has the right to sell the vehicle. The vehicle is sold "as is" without any guarantees or warranties, either expressed or implied, by the seller.

Signatures

Seller's Signature: ________________________ Date: __________

Buyer's Signature: ________________________ Date: __________

Witness (If Applicable)

Witness's Signature: ________________________ Date: __________

Additional Notes

__________________________________________________________________________

__________________________________________________________________________

It is recommended that both parties retain a copy of this document for their records and for future verification purposes. The buyer must present this Bill of Sale along with other required documents to the Pennsylvania Department of Transportation (PennDOT) when registering the vehicle.

PDF Specifications

| Fact | Description |

|---|---|

| Definition | A Pennsylvania Motor Vehicle Bill of Sale form is a document that details the transfer of ownership of a vehicle from the seller to the buyer. |

| Primary Use | It serves as legal proof of purchase and ownership transfer, and it's often used for vehicle registration and title transfer processes. |

| Governing Law | This form is governed by Pennsylvania state law, specifically under the Pennsylvania Department of Transportation (PennDOT) regulations. |

| Key Components | The form includes crucial details such as the vehicle's make, model, year, VIN, sale price, and the names and signatures of the parties involved. |

| Notarization | In Pennsylvania, notarization of the bill of sale is not mandatory but is highly recommended for the authentication of the document. |

Instructions on Writing Pennsylvania Motor Vehicle Bill of Sale

Filling out the Pennsylvania Motor Vehicle Bill of Sale form is an important step in the process of selling or buying a vehicle within the state. It creates a legal record of the sale, including details about the buyer, seller, and the vehicle itself. This document can be essential for titling and registering the vehicle in the new owner's name. Ensuring that the form is completed accurately can help protect both parties in case of disputes or questions about the sale. Below are the steps needed to fill out the form properly.

- Start with the date of sale: At the top of the form, write the date on which the sale is taking place.

- Fill in seller information: Enter the full name, address, and contact details of the person selling the vehicle.

- Enter buyer information: Include the full name, address, and contact details of the buyer purchasing the vehicle.

- Describe the vehicle: Provide the make, model, year, vehicle identification number (VIN), and the odometer reading of the vehicle being sold.

- State the purchase price: Clearly write the total amount the buyer is paying for the vehicle.

- Include any additional terms or conditions: If there are any special agreements or conditions between the seller and buyer, list them clearly on the form.

- Signatures of the parties: Both the buyer and the seller must sign the form to validate the agreement. Make sure the signatures are dated.

- Witness and/or notarize (if necessary): Depending on local regulations or personal preference, you might need a witness to sign the form or to have it notarized. Check the requirements for your specific situation.

After completing these steps, make sure that both the buyer and the seller have a copy of the bill of sale for their records. This document serves as proof of purchase and may be needed for various legal or administrative procedures. Keeping a copy in a safe place is recommended.

Understanding Pennsylvania Motor Vehicle Bill of Sale

What is a Pennsylvania Motor Vehicle Bill of Sale?

A Pennsylvania Motor Vehicle Bill of Sale is a legal document that records the sale of a motor vehicle in the state of Pennsylvania. It includes important details such as the vehicle's description, the sale price, and the names and signatures of the buyer and seller. This document serves as proof of the transaction and can be used for registration and taxation purposes.

Is a Motor Vehicle Bill of Sale required in Pennsylvania?

In Pennsylvania, a Motor Vehicle Bill of Sale is not mandatory for the sale of a vehicle, but it is highly recommended. While the Pennsylvania Department of Motor Vehicles (DMV) does not require this document to transfer ownership, it serves as a valuable record of the transaction for both the buyer and the seller. It can also be helpful for personal record-keeping and may be required by your local tax assessor or for legal reasons.

What information should be included in a Pennsylvania Motor Vehicle Bill of Sale?

A comprehensive Pennsylvania Motor Vehicle Bill of Sale should include the following information: the date of the sale, the names and addresses of the buyer and seller, a detailed description of the vehicle (including make, model, year, VIN), the sale price, the odometer reading at the time of sale, and the signatures of both parties involved in the transaction. Optionally, it can also include terms of the sale and any warranties or “as is” statements.

Do both the buyer and the seller need to sign the Bill of Sale?

Yes, for the Pennsylvania Motor Vehicle Bill of Sale to be considered valid, both the buyer and the seller must sign the document. Their signatures attest to the accuracy of the information provided and confirm their agreement to the terms of the sale. It’s advisable for both parties to keep a signed copy of the Bill of Sale for their records.

How does a Motor Vehicle Bill of Sale protect the buyer?

A Motor Vehicle Bill of Sale protects the buyer by providing a record of the sale and the condition of the vehicle at the time of purchase. It can serve as evidence if there are any disputes about the sale terms or if the vehicle has undisclosed problems. Furthermore, it verifies the buyer's ownership of the vehicle until the title transfer is completed.

How does a Motor Vehicle Bill of Sale protect the seller?

For the seller, a Motor Vehicle Bill of Sale acts as evidence that the legal ownership of the vehicle has been transferred to the buyer. This can be particularly important if the vehicle is involved in any legal issues or liabilities after the sale. It provides a layer of protection by documenting the end of the seller's responsibility for the vehicle.

Can a Pennsylvania Motor Vehicle Bill of Sale be used for vehicles purchased out of state?

Yes, a Pennsylvania Motor Vehicle Bill of Sale can be used for vehicles purchased out of state, but it should comply with Pennsylvania's legal requirements for such documents. When registering an out-of-state vehicle in Pennsylvania, the buyer must present documentation that meets the Pennsylvania Department of Motor Vehicles' standards, along with other required documents for registration.

What steps should be taken after completing a Motor Vehicle Bill of Sale?

After completing a Motor Vehicle Bill of Sale in Pennsylvania, the next steps include submitting the necessary documents to the Pennsylvania DMV for the vehicle's title transfer and registration. The buyer should ensure that they receive the vehicle's title from the seller and may also need to obtain insurance for the vehicle. Both parties should keep copies of the Bill of Sale for their records.

Common mistakes

When filling out the Pennsylvania Motor Vehicle Bill of Sale form, one common mistake people make is neglecting to ensure that all details are accurate and complete. Accuracy in documenting the vehicle's make, model, year, Vehicle Identification Number (VIN), and the odometer reading is crucial. These specifics must be correctly entered, as they are essential for the legal transfer of ownership. Errors or incomplete information can lead to complications in title transfers, potentially causing legal issues for both the buyer and the seller.

Another area where mistakes frequently occur is in the assignment of the sales price and date of sale. It's imperative to clearly state the agreed-upon sales price of the vehicle and the exact date of sale. This is not just a formality; these details have significant implications for tax purposes and for the establishment of legal ownership. Failing to accurately document these aspects can create discrepancies that may not only delay the process but also impact the legal standing of the sale itself.

Moreover, many individuals overlook the importance of obtaining the necessary signatures on the form. The buyer and the seller must both sign the Pennsylvania Motor Vehicle Bill of Sale to validate the transaction. Without these signatures, the document may be considered invalid, placing the legal transfer of ownership in jeopardy. This oversight can be particularly problematic, as it can hinder the buyer's ability to register and legally operate the vehicle.

Lastly, there is often a failure to acknowledge the need for notarization. Depending on the requirements at the time of the transaction, the Pennsylvania Motor Vehicle Bill of Sale may need to be notarized to confirm the authenticity of the signatures. Notarization acts as a preventive measure against fraud, ensuring that the document is legally sound. Neglecting this step, when required, can nullify the bill of sale, exposing both parties to potential legal vulnerabilities.

In sum, when completing the Pennsylvania Motor Vehicle Bill of Sale, it is essential to pay careful attention to the details, ensuring the accuracy and completeness of all information, properly documenting the sales price and date, securing necessary signatures, and adhering to any notarization requirements. Avoiding these common mistakes can help facilitate a smoother and legally compliant vehicle sale transaction.

Documents used along the form

When transferring vehicle ownership in Pennsylvania, a Motor Vehicle Bill of Sale is a crucial document, but it's just one part of the documentation process. Several other forms and documents are often required to ensure a smooth and legally compliant transaction. These materials aid in establishing a clear record of the sale, protecting both the buyer and the seller, and fulfilling state requirements. Let's review some common documents that are typically used alongside the Pennsylvania Motor Vehicle Bill of Sale for a comprehensive understanding of the process.

- Certificate of Title: This is the primary document that proves ownership of the vehicle. It must be transferred to the new owner upon the sale of the vehicle, with all necessary sections filled out accurately.

- Odometer Disclosure Statement: Required for most vehicle transactions, this statement records the vehicle's mileage at the time of sale, helping to prevent odometer fraud.

- Vehicle History Report: While not a requirement, a vehicle history report can provide the buyer with important information about the car, such as past accidents or maintenance issues.

- Notice of Transfer and Release of Liability: This form notifies the state that the vehicle has been sold and releases the seller from liability for tickets or violations involving the vehicle after the sale.

- Application for Vehicle Registration: If the buyer is planning to register the vehicle in their name, this application must be completed and submitted to the Pennsylvania Department of Transportation.

- Sales Tax Form: When transferring vehicle ownership, sales tax may be applicable. This form facilitates the calculation and payment of any taxes due.

- Emission Inspection and Maintenance Records: In some areas of Pennsylvania, vehicles are required to undergo emissions testing. These records demonstrate compliance with state regulations.

- Proof of Insurance: New owners must provide proof of insurance when registering a vehicle. This document verifies that the vehicle is insured according to state law.

- Loan Documentation: If there is an existing loan on the vehicle, or if the new owner is financing the purchase, all relevant loan documents should be exchanged to ensure all parties are informed of the financial arrangements.

While the Motor Vehicle Bill of Sale is an essential component of a vehicle transaction in Pennsylvania, these additional forms and documents play vital roles in ensuring the legality and smoothness of the sale. By preparing and utilizing these documents effectively, all parties involved can navigate the process with greater ease and confidence. It's important for both buyers and sellers to familiarize themselves with these documents to ensure a successful and compliant vehicle transfer.

Similar forms

The Vehicle Title Transfer Form shares similarities with the Pennsylvania Motor Vehicle Bill of Sale. Both documents are essential in the process of transferring ownership of a vehicle, but they serve slightly different purposes. The Vehicle Title Transfer Form is an official document required to finalize the change of ownership and update the vehicle's title with the Department of Motor Vehicles (DMV). It legally records the new owner's details and the date of the transfer. Like the Bill of Sale, it is a critical document for both buyers and sellers, ensuring the legality of the vehicle's ownership change.

A Deed of Sale for Real Estate is another document that parallels the Pennsylvania Motor Vehicle Bill of Sale, albeit for the transfer of property ownership rather than a vehicle. Both documents serve as legal evidence of the transaction; they detail the agreement between the buyer and the seller, including the price and a description of the assets sold (a vehicle in one case and real estate in the other). Protection and clarity for both parties in the transaction are the primary purposes of these documents, highlighting their importance in their respective contexts.

An Equipment Bill of Sale is closely related to the Pennsylvania Motor Vehicle Bill of Sale, reflecting a transaction for items other than motor vehicles, such as machinery, office equipment, or any other type of personal property. Similar to the Motor Vehicle Bill of Sale, it outlines the transaction's specifics, including the buyer, the seller, the sale price, and a description of the items being sold. This document is vital for both buyers and sellers, as it provides a record of ownership transfer and can be used for warranty and taxation purposes.

The Warranty Deed is akin to the Pennsylvania Motor Vehicle Bill of Sale in that it guarantees the seller has the right to sell the property (real estate in this instance) and that there are no liens or encumbrances against it. While the Warranty Deed is used in real estate transactions to transfer property ownership with a guarantee about the property's title, the Motor Vehicle Bill of Sale serves a similar function for vehicles without implying a warranty. Both documents are instrumental in providing peace of mind and legal assurance to buyers.

The Receipt of Sale is another document similar to the Pennsylvania Motor Vehicle Bill of Sale, often used for more minor transactions in everyday commerce. A Receipt of Sale provides proof of a transaction between a buyer and a seller and includes information about the transaction date, the items purchased, and the payment amount. Although it is less formal than the Motor Vehicle Bill of Sale, both documents serve a shared purpose: to record the specifics of a sale and confirm the transfer of ownership for goods or services rendered.

Dos and Don'ts

When filling out the Pennsylvania Motor Vehicle Bill of Sale form, it's important to ensure all details are accurately represented. A properly completed form facilitates a smooth transition of vehicle ownership and helps avoid legal complications. Here are essential dos and don'ts to guide you through the process:

- Do ensure all sections of the form are filled out completely. An incomplete form may be considered invalid.

- Do verify the vehicle identification number (VIN) on the form matches the vehicle's VIN exactly. Any discrepancies could result in processing delays or legal issues.

- Do print clearly in ink to ensure all information is legible. Hard-to-read information might lead to mistakes or processing delays.

- Do include the sale price and ensure it is accurate. This is essential for tax assessment purposes.

- Do check that both the buyer and seller sign and date the form. Signatures are required to validate the bill of sale.

- Don't leave any sections blank. If a section doesn't apply, write "N/A" (not applicable) to indicate this.

- Don't use white-out or make corrections on the form. If an error is made, it's safer to start with a fresh form to maintain its integrity.

- Don't sign the form without verifying all information is correct. Once signed, it becomes a legal document.

- Don't forget to provide a copy of the completed bill of sale to both the buyer and the seller for their records. This document serves as proof of purchase and ownership transfer.

- Don't hesitate to seek legal advice if you're unsure about any aspects of the bill of sale. Professional insight can prevent future disputes or legal issues.

Following these guidelines will help ensure the process of selling or buying a vehicle in Pennsylvania goes smoothly and legally. It's about providing clear, accurate information that protects both parties involved in the transaction.

Misconceptions

In Pennsylvania, the process of buying or selling a vehicle can seem straightforward, but there are several common misconceptions about the Motor Vehicle Bill of Sale form that can lead to confusion. Here, we address five of these misunderstandings to provide clearer guidance.

A Bill of Sale is all you need to transfer ownership. This is a common misconception. In Pennsylvania, the official transfer of a vehicle's title from the seller to the buyer is what legally transfers ownership. While the Bill of Sale is an important record of the transaction, it alone is not sufficient to complete the transfer of ownership. Additional documents, such as the vehicle title and a completed Application for Pennsylvania Certificate of Title, are required.

The Bill of Sale must be notarized to be valid. In Pennsylvania, notarization of the Bill of Sale is not a requirement for it to be considered valid. Although having the document notarized can add an extra layer of legal protection for both parties, it is not a necessity for the document to fulfill its purpose of recording the details of the transaction.

There's a specific state-issued form that must be used. Pennsylvania does not require a specific state-issued Motor Vehicle Bill of Sale form. Parties can create their own document, provided it includes key information about the sale, such as the date of sale, purchase price, and details about the buyer, seller, and vehicle. It’s the content that matters more than the format.

All you need is the Bill of Sale to register the vehicle. This misunderstanding can cause problems for buyers expecting to register their new vehicle. In Pennsylvania, the vehicle registration process requires additional documents beyond the Bill of Sale, including proof of insurance, a valid Pennsylvania driver's license, and the vehicle title properly signed over to the buyer.

The Bill of Sale is only important for legal disputes. While the Bill of Sale can indeed be crucial in resolving legal disputes, its importance extends beyond these situations. It serves as a receipt for the transaction and can be necessary for tax assessment, obtaining insurance, and for personal record-keeping. It is an all-around important document for both the buyer and seller.

Key takeaways

The Pennsylvania Motor Vehicle Bill of Sale form is an important document for both the seller and buyer in the transfer of ownership of a vehicle. It serves as a legal record that a vehicle sale has taken place. Here are key takeaways to consider when filling out and using this form:

- The form should include detailed information about the vehicle being sold, such as the make, model, year, VIN (Vehicle Identification Number), and odometer reading.

- Both the seller and the buyer must provide accurate personal information, including full names, addresses, and contact details.

- The sale price of the vehicle must be clearly stated in the Bill of Sale. This is crucial for tax assessment and for personal records.

- It is essential for the seller to disclose the condition of the vehicle honestly, including any known faults or damages. This can help avoid legal issues post-sale.

- The date of the sale should be recorded on the form. This date marks when the ownership of the vehicle transfers from the seller to the buyer.

- Both parties should sign the Bill of Sale. These signatures formally seal the agreement and confirm the accuracy of the information provided.

- It is recommended to have the form notarized to authenticate the signatures, although not always required. This step adds an additional layer of legal protection.

Using a Pennsylvania Motor Vehicle Bill of Sale form not only makes the sale official but also protects both the seller and buyer should any disputes arise. Keeping a copy of the completed and signed form is advisable for both parties' records.

More Motor Vehicle Bill of Sale State Forms

Michigan Vehicle Bill of Sale Pdf - It provides a historical record of ownership change, which can be helpful for future transactions or inquiries.

Nc Title - The document outlines any warranties or guarantees provided by the seller at the time of sale.

Simple Bill of Sale Florida - This documentation is particularly crucial for classic or collector cars, where provenance and ownership history significantly affect the vehicle's value and authenticity.

Bill of Sale for Vehicle Example - Sellers can use this form to release their liability from the vehicle, transferring responsibility to the new owner.