Fillable Motor Vehicle Bill of Sale Document for Ohio

In Ohio, when the ownership of a motor vehicle is transferred from one person to another, documentation of this transaction becomes essential, and that's where the Ohio Motor Vehicle Bill of Sale form steps in. Serving as a legal document, the form meticulously records the sale and purchase details of the vehicle, ensuring a clear understanding between the buyer and seller. The form encompasses several vital aspects, including but not limited to the identification of the vehicle (make, model, year, and VIN), the sale price, and the personal details of both the involved parties. This form not only facilitates an organized transition of ownership but also plays a critical role in the registration process of the vehicle under the new owner's name. Moreover, the Ohio Motor Vehicle Bill of Sale form acts as a significant piece of evidence for tax purposes, reinforcing its importance in safeguarding the rights and obligations of both the buyer and seller.

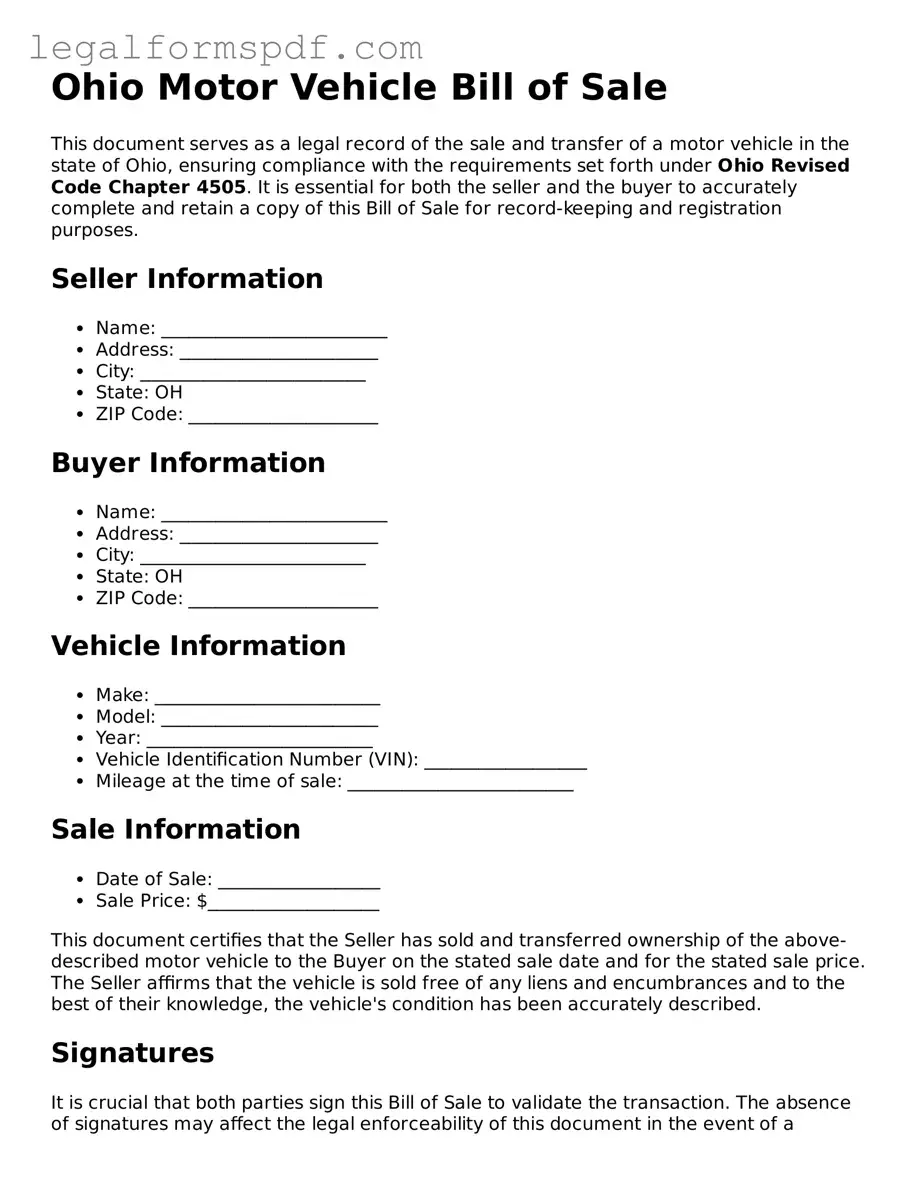

Document Example

Ohio Motor Vehicle Bill of Sale

This document serves as a legal record of the sale and transfer of a motor vehicle in the state of Ohio, ensuring compliance with the requirements set forth under Ohio Revised Code Chapter 4505. It is essential for both the seller and the buyer to accurately complete and retain a copy of this Bill of Sale for record-keeping and registration purposes.

Seller Information

- Name: _________________________

- Address: ______________________

- City: _________________________

- State: OH

- ZIP Code: _____________________

Buyer Information

- Name: _________________________

- Address: ______________________

- City: _________________________

- State: OH

- ZIP Code: _____________________

Vehicle Information

- Make: _________________________

- Model: ________________________

- Year: _________________________

- Vehicle Identification Number (VIN): __________________

- Mileage at the time of sale: _________________________

Sale Information

- Date of Sale: __________________

- Sale Price: $___________________

This document certifies that the Seller has sold and transferred ownership of the above-described motor vehicle to the Buyer on the stated sale date and for the stated sale price. The Seller affirms that the vehicle is sold free of any liens and encumbrances and to the best of their knowledge, the vehicle's condition has been accurately described.

Signatures

It is crucial that both parties sign this Bill of Sale to validate the transaction. The absence of signatures may affect the legal enforceability of this document in the event of a dispute.

Seller's Signature

________________________________

Date: ___________________________

Buyer's Signature

________________________________

Date: ___________________________

Note: Upon completing the sale, the buyer must present this Bill of Sale along with the vehicle title to the Ohio Bureau of Motor Vehicles (BMV) for registration and title transfer. Retain a copy of this document for personal records.

PDF Specifications

| # | Fact | Description |

|---|---|---|

| 1 | Definition | An Ohio Motor Vehicle Bill of Sale is a legal document that records the sale and transfer of ownership of a motor vehicle from a seller to a buyer in the state of Ohio. |

| 2 | Principal Use | It serves as a proof of purchase and demonstrates that a transaction occurred between two parties, specifying the details of the motor vehicle involved. |

| 3 | Governing Law | While Ohio law does not mandate a bill of sale for private vehicle transactions, it is governed by the Ohio Revised Code in matters related to the sale of personal property and motor vehicle ownership. |

| 4 | Key Elements | The document typically includes the make, model, year, VIN, purchase price, and the date of the sale, alongside the printed names and signatures of the seller and buyer. |

| 5 | Notarization | In Ohio, notarization of a Motor Vehicle Bill of Sale is not mandatory but recommended, as it adds a layer of legality and authenticity to the document. |

Instructions on Writing Ohio Motor Vehicle Bill of Sale

Filling out the Ohio Motor Vehicle Bill of Sale form is a crucial step in documenting the sale of a vehicle from one party to another. This document serves as a record of the transaction and provides proof of ownership transfer. It is essential not only for the buyer's and seller's records but also for legal and tax purposes. Ensuring that this form is completed accurately and thoroughly is key to a smooth and dispute-free transfer of ownership.

To properly fill out the Ohio Motor Vehicle Bill of Sale form, follow these steps:

- Begin by writing the date of the sale at the top of the form.

- Enter the full legal name and address of the seller in the space provided.

- In the next section, write the full legal name and address of the buyer.

- Describe the vehicle being sold. This should include the make, model, year, color, VIN (Vehicle Identification Number), and odometer reading at the time of sale.

- Specify the sale price of the vehicle in dollars. This should be the total amount agreed upon by both parties.

- If applicable, include any additional terms of the sale. For example, if there are any warranties or conditions the buyer and seller have agreed upon, mention them here.

- Both the buyer and seller must sign the form. By signing, both parties acknowledge that the information provided is accurate and that the seller has legally transferred the vehicle's ownership to the buyer.

- For added legality and assurance, consider having the form notarized. This step involves a notary public reviewing the document, witnessing the signatures, and then stamping it with their official seal.

Once the Ohio Motor Vehicle Bill of Sale form is fully completed and signed, both the buyer and the seller should keep a copy for their records. This document will play a vital role in registration, titling, and it can also serve as protection in disputes regarding the vehicle’s past ownership or condition. Taking the time to accurately fill out and file this document is a worthwhile investment in securing your vehicle transaction.

Understanding Ohio Motor Vehicle Bill of Sale

What is an Ohio Motor Vehicle Bill of Sale form?

An Ohio Motor Vehicle Bill of Sale form is a document that records the transfer of ownership of a vehicle from one party, the seller, to another, the buyer. It acts as evidence of the transaction and includes details such as the vehicle’s make, model, year, vehicle identification number (VIN), the purchase price, and the date of sale. This form plays a critical role in the buying and selling process in Ohio, ensuring that the transfer is documented and legal.

Do I need to notarize the Ohio Motor Vehicle Bill of Sale form?

In Ohio, notarizing the Motor Vehicle Bill of Sale form is not a mandatory requirement for it to be considered valid. However, having the document notarized can add an extra layer of authenticity and may help protect against legal issues or disputes in the future. It's recommended to check with local regulations or consult with a legal professional to understand the best practices in your specific situation.

Is the Ohio Motor Vehicle Bill of Sale form enough to register a vehicle?

No, the Ohio Motor Vehicle Bill of Sale form alone is not sufficient for registering a vehicle. While it is a crucial document for proving ownership transfer, the buyer must present additional documents to the Ohio Bureau of Motor Vehicles (BMV) to complete registration. These include the vehicle title, proof of insurance, valid identification, and payment for registration fees. The Bill of Sale complements these requirements by providing detailed information about the transaction.

What information is required on an Ohio Motor Vehicle Bill of Sale form?

The Ohio Motor Vehicle Bill of Sale form should include specific details to ensure its validity. The required information typically encompasses the seller's and buyer's full names and addresses, the vehicle's make, model, year, VIN, the sale price, the sale date, and signatures from both parties involved. Clear and accurate information helps to prevent misunderstandings and legal complications.

Can I create my own Ohio Motor Vehicle Bill of Sale form?

Yes, you are allowed to create your own Ohio Motor Vehicle Bill of Sale form. It’s vital that the document contains all the necessary information, such as the vehicle details, sale price, and parties' information, to be legally binding. While templates are available online, ensuring that your form meets all legal requirements in Ohio is important. Consulting with a legal professional or utilizing an officially recognized template can help in crafting a valid document.

What should I do after completing the Ohio Motor Vehicle Bill of Sale form?

After completing the Ohio Motor Vehicle Bill of Sale form, both the buyer and the seller should keep a copy for their records. The buyer will need the form, along with other necessary documents, to register the vehicle under their name at the Ohio BMV. Meanwhile, it serves as proof of release of liability for the seller. It's also wise to inform your insurance company about the sale and update or cancel your policy accordingly.

Common mistakes

Filling out the Ohio Motor Vehicle Bill of Sale form incorrectly can lead to numerous complications, ranging from delays in the transfer of ownership to legal issues. One common mistake is not including all necessary details about the vehicle, such as the make, model, year, and Vehicle Identification Number (VIN). These specifics are crucial for the identification of the vehicle and the validity of the bill of sale.

Another error is failing to accurately disclose the vehicle's condition. Sellers must be honest about the vehicle’s current state, including any known flaws or damages. Omitting such information can not only mislead the buyer but also result in legal consequences for the seller if discovered after the sale.

Individuals often neglect to check whether the form needs to be notarized according to Ohio law. While not all states require notarization for a bill of sale to be valid, knowing Ohio’s specific requirements is essential to ensure a legitimate transaction. Assuming all states have the same regulations can lead to an invalid bill of sale in Ohio.

Mistakes in the seller's and buyer's information, such as incorrect names, addresses, or identification numbers, are frequently made. Accurate details are necessary to establish the identities of both parties involved in the transaction. This facilitates contact between the buyer and seller if issues arise after the sale and for legal documentation and ownership transfer purposes.

Some people mistakenly believe they don't need to keep a copy of the Bill of Sale. However, retaining a copy is crucial for both the buyer and the seller. It serves as a legal proof of the transaction and ownership transfer, which can be invaluable in disputes or for tax purposes.

Forgetting to sign and date the document by both the buyer and the seller is a critical oversight. The signatures certify agreement to the terms and conditions of the sale, making the document legally binding. Without these, the bill of sale may be considered invalid.

A common misstep is not specifying the payment details, including the sale price and the form of payment. Clarifying whether the vehicle was paid for with cash, a check, or through a trade is important for financial records and potential tax implications.

Incorrectly handling the odometer disclosure is another frequent error. Federal law requires sellers to provide accurate odometer readings at the time of sale to prevent odometer fraud. Failing to include this information or providing a false statement can have serious legal ramifications.

Finally, some individuals complete the form in haste, leading to illegible handwriting. This can cause confusion and delays since all the information on the bill of sale must be clearly understood by all parties involved and any legal authorities who might review the document.

Documents used along the form

When transferring the ownership of a vehicle in Ohio, the Motor Vehicle Bill of Sale form is an essential document verifying the sale and purchase of the vehicle. However, this form is often accompanied by several other forms and documents to ensure the transfer is legally binding and compliant with state regulations. The list provided here covers important documents that buyers and sellers might need to complete or obtain during the process.

- Ohio Certificate of Title — This is the official document that proves ownership of the vehicle. Both the buyer and the seller must complete the transfer section of the title for the transaction to be legitimate.

- Odometer Disclosure Statement — Federal law requires that the seller provides an accurate mileage count of the vehicle at the time of sale. This document ensures that the buyer is aware of the vehicle’s mileage.

- Notarized Power of Attorney (if applicable) — If either party cannot be present to sign the required documents, a notarized Power of Attorney may be used to grant authority to another person to sign on their behalf.

- Lien Release (if applicable) — If there is a lien on the vehicle, this document from the lienholder is necessary to confirm that the lien has been satisfied and removed.

- Sales Tax Exemption Certificate — In some cases, sales tax may not be applicable. This document is needed to prove that the vehicle sale is exempt from sales tax.

- Temporary Tag Application — If the buyer needs to drive the vehicle before obtaining permanent registration, this form helps in securing a temporary tag.

- Application for Vehicle Registration — To legally operate the vehicle, the buyer must apply for a new registration. This document is submitted to the Ohio Bureau of Motor Vehicles.

- Emission Inspection Certificate — Depending on the county, an emission test might be required for the vehicle. This certificate proves that the vehicle has passed the necessary emission standards.

- Bill of Sale — While the Motor Vehicle Bill of Sale is specific to the sale, an additional, more detailed Bill of Sale might be prepared to include warranties or specific terms of the sale.

Together, these documents streamline the process of transferring vehicle ownership, ensuring that all legal requirements are met. Both buyers and sellers are encouraged to familiarize themselves with these documents to protect their interests and comply with Ohio state law. Ensuring that all relevant documents are in order makes the transfer process smoother and more efficient for all parties involved.

Similar forms

A Title Transfer Form is closely related to the Ohio Motor Vehicle Bill of Sale form, as it similarly documents the transfer of ownership of a vehicle from one party to another. The Title Transfer Form, however, is often more formal and is used by the Department of Motor Vehicles (DMV) to update records to reflect the new owner's details, including the transfer date and the odometer reading. This form is essential for legal acknowledgment of the new ownership, just as the Bill of Sale is vital for the purchase transaction record.

The Sales Receipt for Vehicle is another document that shares key characteristics with the Ohio Motor Vehicle Bill of Sale form. It serves as proof of payment for the purchase of the vehicle and usually includes information about the seller, the buyer, the purchase price, and the vehicle details. While both documents record the transaction, the Sales Receipt focuses more on the payment aspect, whereas the Bill of Sale may include additional terms of the sale.

A Vehicle Registration Form is necessary for registering a vehicle with the state's DMV, akin to how the Ohio Motor Vehicle Bill of Sale form is used to document the sale of a vehicle. The Registration Form outlines specific information about the vehicle, such as make, model, year, and VIN, in addition to owner information. While the Bill of Sale signifies a change in ownership, the Registration Form is imperative for legally operating the vehicle on public roads.

A Warranty Document for a vehicle sale is somewhat similar to the Ohio Motor Vehicle Bill of Sale form, as it provides details about the terms of the sale. The Warranty Document specifically outlines any guarantees or promises made by the seller regarding the condition of the vehicle, such as coverage for repairs or maintenance within a certain period after the sale. The Bill of Sale may reference the warranty but focuses on transaction details.

A Promissory Note is often used in conjunction with the Ohio Motor Vehicle Bill of Sale form when the purchase involves financing arranged between the buyer and seller. This document outlines the repayment schedule, interest rate, and other terms of the loan agreement. While the Bill of Sale records the sale transaction, the Promissory Note deals with the financial arrangement for paying the purchase price over time.

An Odometer Disclosure Statement, required by federal law during the sale of a vehicle, documents the mileage of the vehicle at the time of sale and confirms that the reading is accurate to the best of the seller's knowledge. This form is essential for preventing odometer fraud and ensuring the buyer is aware of the vehicle's condition. It complements the Ohio Motor Vehicle Bill of Sale form, which includes transaction details but may not focus on the vehicle’s mileage.

A Liability Release Form is related to the Ohio Motor Vehicle Bill of Sale in that it can be a part of the sales transaction, designed to protect the seller from legal claims related to the condition of the vehicle after the sale. It typically states that the buyer accepts the vehicle "as is" and releases the seller from responsibility for any future issues. While the Bill of Sale documents the transaction specifics, the Liability Release Form focuses on limiting the seller's post-sale legal exposure.

Dos and Don'ts

Whether you're buying or selling a vehicle in Ohio, completing the Motor Vehicle Bill of Sale form accurately is crucial for a seamless transfer of ownership. Below are the recommended practices to ensure the process goes smoothly.

Do:

- Ensure all information is legible and accurate. Details such as the make, model, year, and VIN (Vehicle Identification Number) of the vehicle should be double-checked for accuracy.

- Include the sale price clearly. This should reflect the agreed amount between the buyer and seller without ambiguity.

- Fill in the date of sale. This confirms when the transaction took place and can be important for both legal and registration purposes.

- Have both the buyer and seller sign the document. Their signatures are essential to validate the transaction and its terms.

Don't:

- Avoid leaving any sections incomplete. An incomplete form may result in delays or rejection of the document for registration or legal purposes.

- Refrain from guessing information. If unsure about certain details like the VIN or vehicle specifications, verify with official documents or the vehicle itself.

- Do not use pencil. Entries should be made in ink to prevent alterations and ensure the document’s durability over time.

- Avoid signing without the other party present unless previously arranged. Ideally, both the buyer and seller should review all the information together before signing.

Misconceptions

When buying or selling a vehicle in Ohio, the process requires understanding certain documents, one of which is the Motor Vehicle Bill of Sale. There are several misconceptions about this form that can confuse both sellers and buyers. Let’s clarify some of these common misunderstandings:

Misconception 1: The Motor Vehicle Bill of Sale is the only document you need to transfer ownership. In reality, while important, the Bill of Sale is part of several documents required by the Ohio Bureau of Motor Vehicles (BMV) for a legal transfer of ownership. This includes the vehicle title, proper identification, and sometimes an odometer disclosure statement.

Misconception 2: A Bill of Sale must be notarized in Ohio. Notarization isn't a statewide requirement for a Vehicle Bill of Sale in Ohio. However, it's often recommended to have the document notarized to authenticate the signatures, especially since other documents involved in the process may need notarization.

Misconception 3: The buyer is responsible for preparing the Bill of Sale. While it’s true that either party can prepare the Bill of Sale, it's generally the seller’s responsibility to provide this document. It serves as a receipt for the transaction and details the agreement between the buyer and seller.

Misconception 4: If you lose the Bill of Sale, the sale is no longer valid. Losing this document can be inconvenient, but the validity of the sale is not solely dependent on retaining the Bill of Sale. However, it is crucial to keep this document for record-keeping, tax purposes, and to resolve any disputes that may arise.

Misconception 5: The Bill of Sale can be a verbal agreement. For the purposes of motor vehicle sales in Ohio, a verbal agreement is not sufficient. The state requires a written Bill of Sale to document the details of the transaction, including the sale price, vehicle information, and the parties’ agreement.

Misconception 6: The Bill of Sale determines the tax amount. The county or city may use the sale price listed on the Bill of Sale for tax purposes, but taxes are ultimately determined by the county or state's valuation of the vehicle, which may differ from the sale price.

Misconception 7: The Bill of Sale is the same as a title. The Bill of Sale and the vehicle title are two distinct documents. The title is a legal document that proves ownership and is required by the state to register and title a vehicle. The Bill of Sale details the transaction between buyer and seller but does not prove ownership.

Understanding these nuances can help streamline the buying or selling process, ensuring both parties meet their legal obligations, and maintain clear records of the sale.

Key takeaways

When it comes to selling or purchasing a motor vehicle in Ohio, the Motor Vehicle Bill of Sale form plays a crucial role in facilitating a smooth transfer of ownership. It serves as a legal document that provides proof of purchase and details the transaction between the buyer and the seller. Understanding how to properly fill out and use this form is essential for both parties involved. Here are five key takeaways to consider:

- Complete All Required Information: The Ohio Motor Vehicle Bill of Sale form requires specific information to be valid. This includes the full names and addresses of both the buyer and the seller, a detailed description of the vehicle (make, model, year, VIN), the sale price, and the date of sale. Ensuring that all fields are accurately filled out is critical for the document's legitimacy.

- Signatures Are Mandatory: For the bill of sale to be legally binding, it must be signed by both the seller and the buyer. The signatures acknowledge that both parties agree to the terms of the sale, including the purchase price and the condition of the vehicle. It's a good practice for both parties to sign in the presence of a witness or a notary public, though this is not a legal requirement in Ohio.

- Keep Records for Future Reference: Retaining a copy of the bill of sale is beneficial for both the seller and the buyer. For the seller, it serves as proof that the legal ownership of the vehicle has been transferred and can help in resolving any future disputes. For the buyer, it is necessary for registering the vehicle in their name and may be needed for tax purposes.

- Verification of the Vehicle's Condition: While the bill of sale primarily documents the transaction and transfer of ownership, it can also reflect any warranties or "as is" statements concerning the vehicle's condition. Stating clearly in the bill of sale that the vehicle is sold "as is" indicates that the buyer accepts the vehicle in its current condition, and the seller is not liable for future repairs.

- Necessity for Vehicle Registration: In Ohio, the Motor Vehicle Bill of Sale form is not only a record of the sale but often a requirement for registering the vehicle. The buyer must present this form, along with other necessary documents, to the Ohio Bureau of Motor Vehicles (BMV) to officially transfer the vehicle's title into their name and to register the vehicle. Without this document, the registration process cannot be completed.

Effectively managing the Motor Vehicle Bill of Sale form is instrumental in ensuring that the sale or purchase of a vehicle is recognized by the law. Both the buyer and the seller should pay careful attention to accurately completing the form and adhere to the guidelines mentioned above to avoid any potential issues in the future.

More Motor Vehicle Bill of Sale State Forms

Ga Bill of Sale - Including the odometer reading at the time of sale, this document ensures transparency in the transaction.

Texas Department of Motor Vehicle - It is advisable for buyers to verify the information on the form with the vehicle's actual condition and legal status.

Bill of Sale for Vehicle Example - It includes crucial details such as the car’s make, model, year, and VIN, along with the sale price and date.