Fillable Motor Vehicle Bill of Sale Document for Illinois

When buying or selling a car in Illinois, a crucial step in the transaction involves the Motor Vehicle Bill of Sale form. This document serves as a formal record of the sale, providing concrete proof of the change in vehicle ownership. It includes essential details such as the purchase price, specific information about the vehicle (like make, model, and year), and personal information about both the buyer and the seller. Not only does it facilitate a smoother transfer of ownership, but it also serves as an important piece of evidence for tax purposes and helps in resolving any potential disputes that may arise post-sale. Its significance cannot be overstated, as it protects all parties involved and ensures the legalities of the vehicle sale are properly documented. Understanding the form's major aspects and ensuring its correct completion is pivotal for anyone looking to navigate the process of buying or selling a vehicle in Illinois.

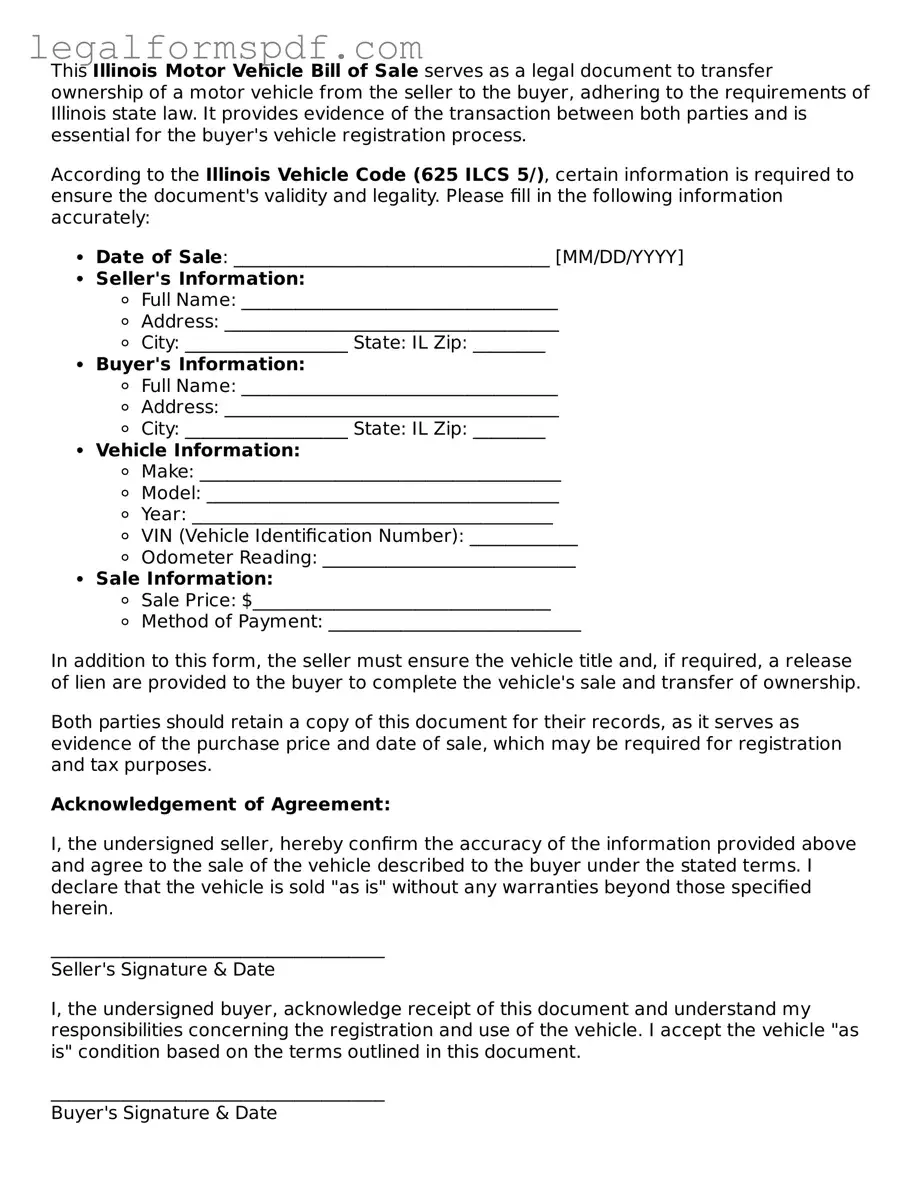

Document Example

This Illinois Motor Vehicle Bill of Sale serves as a legal document to transfer ownership of a motor vehicle from the seller to the buyer, adhering to the requirements of Illinois state law. It provides evidence of the transaction between both parties and is essential for the buyer's vehicle registration process.

According to the Illinois Vehicle Code (625 ILCS 5/), certain information is required to ensure the document's validity and legality. Please fill in the following information accurately:

- Date of Sale: ___________________________________ [MM/DD/YYYY]

- Seller's Information:

- Full Name: ___________________________________

- Address: _____________________________________

- City: __________________ State: IL Zip: ________

- Buyer's Information:

- Full Name: ___________________________________

- Address: _____________________________________

- City: __________________ State: IL Zip: ________

- Vehicle Information:

- Make: ________________________________________

- Model: _______________________________________

- Year: ________________________________________

- VIN (Vehicle Identification Number): ____________

- Odometer Reading: ____________________________

- Sale Information:

- Sale Price: $_________________________________

- Method of Payment: ____________________________

In addition to this form, the seller must ensure the vehicle title and, if required, a release of lien are provided to the buyer to complete the vehicle's sale and transfer of ownership.

Both parties should retain a copy of this document for their records, as it serves as evidence of the purchase price and date of sale, which may be required for registration and tax purposes.

Acknowledgement of Agreement:

I, the undersigned seller, hereby confirm the accuracy of the information provided above and agree to the sale of the vehicle described to the buyer under the stated terms. I declare that the vehicle is sold "as is" without any warranties beyond those specified herein.

_____________________________________

Seller's Signature & Date

I, the undersigned buyer, acknowledge receipt of this document and understand my responsibilities concerning the registration and use of the vehicle. I accept the vehicle "as is" condition based on the terms outlined in this document.

_____________________________________

Buyer's Signature & Date

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | The Illinois Motor Vehicle Bill of Sale form is a legal document that records the sale and purchase of a motor vehicle in the state of Illinois. |

| Purpose | It serves as proof of transaction and ownership transfer from the seller to the buyer. |

| Required Information | The form typically requires details such as the make, model, year, VIN (Vehicle Identification Number), purchase price, and the date of sale. |

| Signatories | Both the seller and the buyer must sign the document, indicating their agreement to the terms of the sale. |

| Governing Laws | Governed by Illinois state laws, specifically those regulating the sale of motor vehicles and the transfer of ownership. |

| Additional Requirements | In some cases, the form may need to be notarized, depending on local county requirements or the specifics of the transaction. |

| Usage | It is used to update records with the Illinois Department of Motor Vehicles (DMV) and may be required for tax purposes. |

| Limitations | While this form is crucial for the sale process, it may need to be accompanied by other documents to complete the transfer of ownership according to Illinois laws. |

Instructions on Writing Illinois Motor Vehicle Bill of Sale

Filling out the Illinois Motor Vehicle Bill of Sale form is a critical step when buying or selling a vehicle in the state. This document serves as a record of the transaction between the buyer and the seller, stating the transfer of ownership of the vehicle. Proper completion of this form is essential as it may be required for the registration process by the new owner and might be used for tax assessment purposes. The steps outlined below are designed to guide you through the accurate completion of the form to ensure that all necessary information is correctly captured.

- Begin by entering the date of the sale at the top of the form.

- Fill in the full legal name of the seller and the buyer along with their complete addresses.

- Describe the vehicle being sold. Include the make, model, year, body type (such as sedan, SUV, etc.), and the vehicle identification number (VIN).

- Indicate the mileage of the vehicle at the time of sale. Be sure to specify whether the mileage is actual, not actual, or exceeds mechanical limits.

- State the sale price of the vehicle. Make sure to specify the currency, although typically, it would be in USD (U.S. Dollars).

- If any liens exist on the vehicle, provide the lienholder's name and address. If there are no liens, you may state "none."

- Both the buyer and the seller must sign and print their names at the designated sections at the bottom of the form. Include the date of signatures next to their names.

- If applicable, notarization may be required. This section should be completed by a licensed notary public, who will fill in the date, their name, the commission number, and seal as per Illinois state requirements.

Upon completion, the Illinois Motor Vehicle Bill of Sale should be kept by both the buyer and the seller. It acts as proof of transaction and ownership transfer, which is critical for both parties for future reference or if any disputes arise. It is advisable for the buyer to submit a copy to the Illinois Department of Motor Vehicles (DMV) as part of the vehicle registration process. Careful attention to detail when filling out this form will help streamline transactions and prevent potential legal issues.

Understanding Illinois Motor Vehicle Bill of Sale

What is an Illinois Motor Vehicle Bill of Sale?

An Illinois Motor Vehicle Bill of Sale is a legal document that records the sale and transfer of ownership of a motor vehicle from the seller to the buyer. It includes details about the seller, the buyer, the vehicle, and the sale, such as the date and purchase price. This document serves as proof of transaction and is essential for the buyer's vehicle registration process.

Do I need a Motor Vehicle Bill of Sale to sell a car in Illinois?

Yes, in Illinois, a Motor Vehicle Bill of Sale is highly recommended when selling a car. Although not always mandated by law, it provides both the seller and the buyer with a record of the sale, protecting the interests of both parties. For registration and title transfer purposes, the Illinois Secretary of State's office may require this document.

What information must be included in an Illinois Motor Vehicle Bill of Sale?

An Illinois Motor Vehicle Bill of Sale should include the full names and addresses of both the seller and the buyer, a detailed description of the vehicle (including make, model, year, and VIN), the sale date, the sale price, signatures of both parties, and any other agreements or warranties made at the time of sale.

How do I obtain an Illinois Motor Vehicle Bill of Sale form?

An Illinois Motor Vehicle Bill of Sale form can be downloaded from the Illinois Secretary of State's website or from various legal websites that provide state-specific forms. It's important to ensure the form complies with Illinois state requirements. Alternatively, a private sale can be documented using a generic form or drafting one that meets state criteria.

Is notarization required for a Motor Vehicle Bill of Sale in Illinois?

Notarization of a Motor Vehicle Bill of Sale is not generally required in Illinois, but it is recommended. A notarized Bill of Sale provides an extra layer of protection, verifying the identity of the parties involved and ensuring that the document's signatures are legitimate.

How does a Motor Vehicle Bill of Sale protect the buyer?

A Motor Vehicle Bill of Sale protects the buyer by documenting the transaction's specifics, such as the vehicle's condition, the purchase price, and the sale date. It serves as evidence that the buyer legally acquired the vehicle, which is crucial for resolving any disputes that may arise regarding ownership or terms of sale. Furthermore, it is necessary for registering the vehicle in the buyer's name.

How does a Motor Vehicle Bill of Sale protect the seller?

For the seller, a Motor Vehicle Bill of Sale acts as proof that he or she has legally transferred the ownership of the vehicle to the buyer. It can protect the seller from any future liabilities related to the vehicle, showing that the seller is no longer responsible for it from the date of sale specified in the document.

Can I use a generic Bill of Sale form for a motor vehicle transaction in Illinois?

While a generic Bill of Sale form can be used for a motor vehicle transaction in Illinois, it's important to ensure that the form includes all required information specific to Illinois law. To avoid potential issues during the vehicle's registration or if disputes arise, using a state-specific form or ensuring all pertinent details are included in a generic form is advisable.

Common mistakes

When it comes to completing the Illinois Motor Vehicle Bill of Sale form, mistakes can creep in easily, but recognizing and avoiding these errors can ensure a smoother transaction. One common mistake is not double-checking the vehicle identification number (VIN). Since the VIN is crucial for identifying the vehicle's unique history and characteristics, any error in transcription can lead to significant issues down the line.

Another trap people often fall into is not specifying the sale price clearly or entirely in words and numbers. It's essential to accurately state the sale price in both formats to avoid confusion or disputes. Leaving out any relevant details about the transaction can make the document vague and open to interpretation, which is far from ideal in legal documents.

There's also a tendency to overlook the importance of including an accurate odometer reading at the time of sale. The mileage is a key factor in assessing a vehicle's value and condition. Providing either an inaccurate or incomplete odometer reading can affect the buyer's trust and lead to potential legal complications regarding the vehicle's true condition.

People sometimes fail to list any existing liens against the vehicle or inaccurately represent the vehicle's lien status, which can be a significant oversight. A lien indicates that a third party may have a legal right to the vehicle until a debt is paid off. Transparency about such details is crucial for a clear transfer of ownership.

A common error is neglecting to specify the sale's terms and conditions, such as whether the vehicle is sold "as is" or under warranty. This oversight can lead to misunderstandings about the seller's and buyer's responsibilities post-purchase. Always clarify the terms to ensure both parties are on the same page.

Not discussing and documenting any agreements about payment plans or due dates is another mistake. If the sale involves installment payments, these details must be meticulously documented to avoid future financial disputes. Clear terms help in maintaining a transparent and trustful transaction between buyer and seller.

When buyers and sellers ignore the importance of having the document witnessed or notarized, they risk the legality and enforceability of the bill of sale. Although not always mandatory, having an impartial witness or a notary public sign the document can add an extra layer of authenticity and protection for both parties involved.

Finally, a surprisingly common oversight is failing to keep copies of the completed bill of sale for personal records. Both the buyer and the seller should retain a copy of the bill of sale, as it serves as a receipt for the transaction and may be needed for registration, taxation, or legal reasons down the road. Keeping this document secure can save a lot of trouble and confusion in the future.

Documents used along the form

When transferring ownership of a vehicle in Illinois, the Motor Vehicle Bill of Sale form is a critical document that officially records the sale and purchase details. However, to ensure a smooth and legally compliant transaction, several other forms and documents should be prepared and submitted along with the Bill of Sale. These additional documents not only offer legal protection but also facilitate the registration and use of the vehicle by the new owner. We will discuss six key documents often used in conjunction with the Motor Vehicle Bill of Sale form.

- Odometer Disclosure Statement: This document is required for the seller to officially declare the vehicle's mileage at the time of sale. It's a necessary step to prevent odometer fraud and to ensure the buyer is aware of the vehicle’s correct mileage.

- Title Certificate: The Title Certificate proves ownership of the vehicle. The seller must provide this to the buyer during the sale. It needs to be transferred to the new owner’s name after the sale, through the local Department of Motor Vehicles (DMV).

- Notice of Sale Form: Some states require the seller to submit a notice of sale form, which officially informs the state that the vehicle has been sold. This can help release the seller from liability in case the vehicle is later involved in any legal issues.

- Vehicle Registration Application: The new owner must apply for a new registration under their name. The application is to be submitted to the DMV, along with the necessary fees and taxes.

- Proof of Insurance: Most states require proof of insurance before a vehicle can be registered. The new owner should obtain an insurance policy and provide proof to the DMV to complete the registration process.

- Loan Documents: If the vehicle is being purchased with a loan, or if there is an outstanding loan on the vehicle, the appropriate financial documents must be provided. This ensures that the lienholder’s interest is recorded or that the lien is properly released.

All these documents play a vital role in ensuring that the transfer of the vehicle is conducted lawfully and transparently. Completing and gathering these documents helps protect both the buyer's and seller's interests and ensures that all legal requirements are met for the sale and subsequent ownership of the vehicle. Individuals involved in the transaction should diligently collect and review all necessary documents to ensure a smooth transfer process.

Similar forms

The Illinois Motor Vehicle Bill of Sale form is similar to the Vehicle Title Transfer form. Both documents are used in the process of transferring ownership of a vehicle. The Bill of Sale acts as a proof of transaction and details the purchase price, while the Title Transfer legally changes the owner of the vehicle in public records. Each document ensures the buyer and seller acknowledge the sale and transfer of the vehicle's ownership.

It is also comparable to a Warranty Deed used in real estate transactions. Similar to how a Bill of Sale outlines the details of a vehicle transaction, a Warranty Deed contains details about the sale of a property, including the legal description and the terms of the warranty. Both serve to legally transfer ownership from one party to another and guarantee the seller has the right to sell the asset.

A Promissory Note is another document with similarities. While a Motor Vehicle Bill of Sale records the sale of a physical asset, a Promissory Note documents the agreement to pay a specified amount of money over a period. Both are legally binding and detail the terms agreed upon by the parties involved, providing a record of financial obligations or transactions.

The General Bill of Sale is closely related as well. This document is more broad and can be used for the sale of any type of personal property, not just vehicles. Like the Motor Vehicle Bill of Sale, it documents the sale and transfer of ownership between a buyer and a seller, including details such as price and condition of the item sold.

Similarly, the Receipt of Sale functions much like a Bill of Sale. While it may not always be used for the official transfer of title, it acts as proof of a transaction between two parties. Both documents provide evidence that an agreement has been made and that an item, such as a vehicle, has changed hands, often detailing the price and conditions of the sale.

A Loan Agreement shares characteristics with the Motor Vehicle Bill of Sale when a vehicle purchase involves financing. It outlines the terms of the loan, such as interest rate and repayment schedule, similar to how a Bill of Sale details the terms of a vehicle's sale. Both are indispensable in their respective fields for documenting the agreements made between parties.

The Commercial Lease Agreement, though used for renting property rather than selling, shares the aspect of agreed terms between parties. It records details like payment, duration, and use of the property, analogous to how a Bill of Sale records the sale price, date, and description of the vehicle. Each ensures a mutual understanding and formalizes the transaction or agreement.

An Equipment Bill of Sale is similar but specific to the sale of equipment. Like the Motor Vehicle Bill of Sale, it details the sale of a piece of equipment between a buyer and seller, including the purchase price and condition. Both forms are necessary for transferring ownership and establishing the terms of the sale, tailored to their specific asset type.

Lastly, the Quitclaim Deed resembles the Motor Vehicle Bill of Sale in its function to transfer interest in an asset, though it's primarily used in real estate to transfer ownership without a sale, or 'as-is'. Both documents facilitate a change in ownership, but the Bill of Sale often includes detailed terms of sale, whereas a Quitclaim Deed may not guarantee the title's quality.

Dos and Don'ts

Successfully completing the Illinois Motor Vehicle Bill of Sale requires attention to detail and thoroughness. Here are essential dos and don'ts to ensure the process is handled efficiently and accurately:

Do:

- Verify the accuracy of all vehicle details, including the make, model, year, vehicle identification number (VIN), and mileage. These are crucial for both the buyer’s and seller’s protection.

- Ensure that both the buyer and the seller provide clear and legible signatures on the document. Their signatures are a fundamental part of the legality of the document, confirming the agreement between both parties.

- Include the sale date and the sale price accurately. This information is important for tax assessment and future reference if disputes arise.

- Prepare two copies of the bill of sale. One for the buyer and one for the seller. This action guarantees that both parties hold evidence of the transaction and terms agreed upon.

- Consult or notify the Illinois Department of Motor Vehicles (DMV) about the sale. Some states require submission of the bill of sale as part of the vehicle registration process or for title transfer.

Don't:

- Leave any sections blank. Incomplete forms may be considered invalid or may delay the process of vehicle registration or title transfer.

- Guess on any information about the vehicle. Incorrect information can lead to complications in future vehicle-related processes and diminish the legal standing of the document.

- Forget to check for any liens against the vehicle. Selling a vehicle with an undisclosed lien can result in legal and financial repercussions for the seller.

- Overlook the importance of ensuring that both the buyer and the seller have a complete understanding of their rights and responsibilities as defined in the bill of sale.

- Postpone the submission or notification to the Illinois DMV if required. Delaying this step can complicate the vehicle’s transfer of ownership and use.

Misconceptions

When dealing with the Illinois Motor Vehicle Bill of Sale form, various misconceptions can lead to confusion or errors in the sales process. It's crucial to clear up these misunderstandings to ensure smooth vehicle transactions. Here are five common misconceptions:

- A Bill of Sale is the only document needed to transfer vehicle ownership. This is a common misconception. While the Bill of Sale is an important document proving the transaction between the buyer and the seller, the vehicle's title must be officially transferred with the Illinois Secretary of State for the ownership change to be legally recognized.

- The Illinois Motor Vehicle Bill of Sale form needs to be notarized. Unlike some states, Illinois does not require the Bill of Sale to be notarized. It simply needs to be filled out accurately and signed by both parties involved in the transaction.

- Any Bill of Sale form will work for an Illinois vehicle transaction. Although generic Bill of Sale forms can sometimes be used for vehicle sales, it's recommended to use the Illinois-specific form or to ensure that the form includes all the information required by Illinois law, such as the vehicle's make, model, year, VIN, and the sale price.

- The Bill of Sale can be submitted electronically. As of the last knowledge update, the Illinois Motor Vehicle Bill of Sale form needs to be printed and filled out in ink for a vehicle sale. Electronic submissions are not typically accepted for this particular document in Illinois.

- If you lose the Bill of Sale, it's impossible to get a duplicate. While losing the original Bill of Sale can be inconvenient, it's not the end of the world. The seller can provide a written statement detailing the sale, including the vehicle's information and the transaction's specifics, as a substitute. However, both parties should try to keep copies of the original document to avoid any future disputes.

Key takeaways

When transferring the ownership of a motor vehicle in Illinois, completing a Motor Vehicle Bill of Sale form is an essential step. Here are seven key takeaways to guide you through the process and ensure the transaction is smooth and compliant with state laws.

- Accurate Information is Crucial: Both the seller and the buyer should fill out the form with accurate and complete information. This includes the full names, addresses, and signatures of both parties, as well as detailed information about the vehicle (make, model, year, VIN).

- Verification of the Vehicle Identification Number (VIN): The VIN should be double-checked for accuracy. This unique identifier is vital for the registration of the vehicle and for tracking its history.

- Condition of the Vehicle: Clearly state the condition of the vehicle on the bill of sale. Any known defects or issues should be noted, as this document can serve as proof of the vehicle's condition at the time of sale.

- Include the Sale Price: The document must include the sale price of the vehicle. This is important for tax purposes and for validating the sale. In some cases, a notarized bill of sale may be required for registration.

- Odometer Disclosure Statement: Illinois law requires that the seller provide an accurate odometer reading at the time of sale. This should be included in the Motor Vehicle Bill of Sale or on a separate Odometer Disclosure Statement.

- Keep Copies: It’s important for both the buyer and the seller to keep copies of the completed bill of sale. This document serves as a receipt and provides legal protection in case any disputes arise after the sale.

- Additional Documentation may be Required: Depending on the specific situation, additional documentation such as a release of liability or a title transfer form may be required. Check with the Illinois Department of Motor Vehicles (DMV) for any additional steps needed to complete the transfer of ownership.

Adhering to these guidelines will help ensure that the sale of your motor vehicle adheres to Illinois law and protects both parties involved in the transaction.

More Motor Vehicle Bill of Sale State Forms

Texas Department of Motor Vehicle - It's a simple yet essential form for conducting private car sales safely and legally.

How to Write Up a Bill of Sale for a Car - The form can also influence the tax implications of the vehicle sale, offering necessary information for tax filings.