Fillable Motor Vehicle Bill of Sale Document for Georgia

When buying or selling a motor vehicle in Georgia, the transaction isn't just a simple exchange of money and keys. It involves clear documentation to ensure legality and protect both parties involved. This is where the Georgia Motor Vehicle Bill of Sale form comes into play. This critical document serves multiple purposes: It acts as a receipt for the transaction, provides a record that captures the details of the vehicle being transferred, and establishes the terms agreed upon by the buyer and seller. Not only does it include essential information like the make, model, and VIN of the vehicle, but it also documents the sale price and the names and signatures of the involved parties. In Georgia, this form not only facilitates a smoother transfer of ownership but also aids in the registration process and can be necessary for tax assessment purposes. Understanding its components and the role it plays in the legal landscape of vehicle sales in Georgia can make a significant difference in ensuring a transaction is both smooth and compliant with state laws.

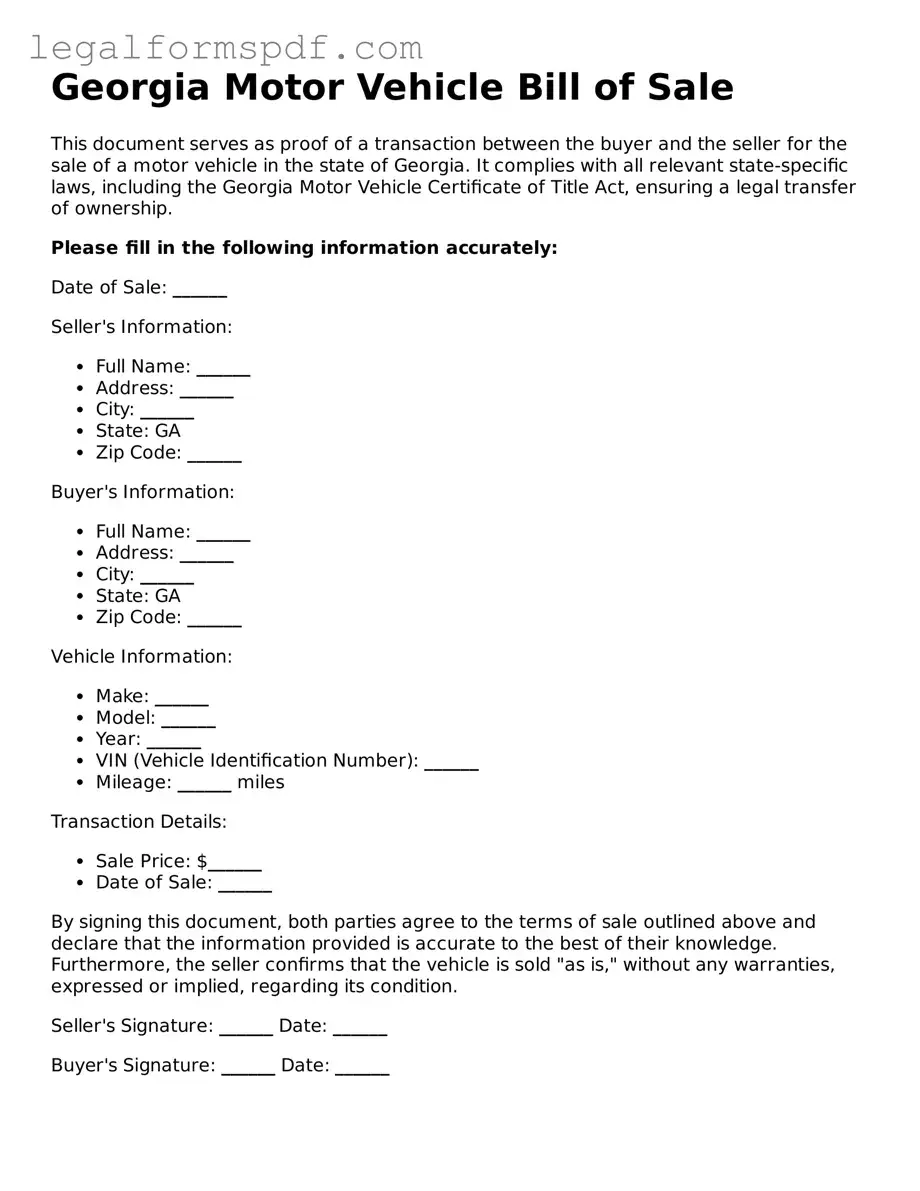

Document Example

Georgia Motor Vehicle Bill of Sale

This document serves as proof of a transaction between the buyer and the seller for the sale of a motor vehicle in the state of Georgia. It complies with all relevant state-specific laws, including the Georgia Motor Vehicle Certificate of Title Act, ensuring a legal transfer of ownership.

Please fill in the following information accurately:

Date of Sale: ______

Seller's Information:

- Full Name: ______

- Address: ______

- City: ______

- State: GA

- Zip Code: ______

Buyer's Information:

- Full Name: ______

- Address: ______

- City: ______

- State: GA

- Zip Code: ______

Vehicle Information:

- Make: ______

- Model: ______

- Year: ______

- VIN (Vehicle Identification Number): ______

- Mileage: ______ miles

Transaction Details:

- Sale Price: $______

- Date of Sale: ______

By signing this document, both parties agree to the terms of sale outlined above and declare that the information provided is accurate to the best of their knowledge. Furthermore, the seller confirms that the vehicle is sold "as is," without any warranties, expressed or implied, regarding its condition.

Seller's Signature: ______ Date: ______

Buyer's Signature: ______ Date: ______

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | The Georgia Motor Vehicle Bill of Sale form is a legal document that records the transfer of ownership of a motor vehicle from the seller to the buyer. |

| Requirement | It may be required by the Georgia Department of Revenue for the registration of the vehicle. |

| Contents | Typically includes details such as the make, model, year, VIN (Vehicle Identification Number), purchase price, and the date of sale of the vehicle, in addition to personal details of the buyer and seller. |

| Governing Law | Guided by Georgia law, specifically under the regulations provided by the Georgia Department of Revenue. |

| Notarization | In Georgia, notarization of the Motor Vehicle Bill of Sale is not a mandatory requirement but is recommended for validation and legal protection. |

| Use Case | It serves as a receipt for personal records and is essential for legal protection in case of disputes over the ownership or terms of the sale of the vehicle. |

Instructions on Writing Georgia Motor Vehicle Bill of Sale

After deciding to buy or sell a vehicle in Georgia, the next step involves properly documenting the transaction through a Motor Vehicle Bill of Sale form. This document is crucial as it confirms the transfer of ownership of the vehicle in question. Filling out this form accurately is essential to ensure all parties are protected and the process complies with Georgia state requirements. Following these steps will guide you through filling out the form correctly.

- Gather all necessary information, including the vehicle's make, model, year, VIN (Vehicle Identification Number), and the current odometer reading.

- Enter the date of the sale at the top of the form.

- Write the full legal name of the seller and the buyer as it appears on their government-issued identification.

- Fill in the address information for both the seller and buyer, including the city, state, and zip code.

- Include a detailed description of the vehicle. Mention the make, model, body type, year, and color.

- Record the vehicle's VIN to ensure its identification is unmistakable.

- Enter the purchase price of the vehicle. Be sure to specify the form of payment (e.g., cash, check, trade).

- Both the buyer and the seller must sign the bill of sale. This step legally binds the transaction.

- Date the signatures, confirming when the transaction took place.

- For added protection, it's advised to have the signatures notarized, although it's not a mandatory step in Georgia.

Once completed, both the seller and buyer should keep a copy of the Bill of Sale for their records. It serves as a receipt for the buyer and proof of release of liability for the seller. The next steps usually involve the buyer registering the vehicle with the Georgia Department of Motor Vehicles (DMV). This requires submitting the Bill of Sale among other documentation. The process ensures that the vehicle is legally transferred and registered under the new owner's name.

Understanding Georgia Motor Vehicle Bill of Sale

What is a Georgia Motor Vehicle Bill of Sale?

A Georgia Motor Vehicle Bill of Sale is a legal document that records the sale and transfer of ownership of a motor vehicle from one party, the seller, to another, the buyer. This document typically includes details such as the make, model, year, VIN (Vehicle Identification Number), and the sale price of the vehicle, along with the names and signatures of both parties involved.

Why do I need a Motor Vehicle Bill of Sale in Georgia?

In Georgia, a Motor Vehicle Bill of Sale is an essential part of the documentation required for transferring a vehicle's title. It serves as a proof of purchase and can also be used for tax assessment purposes. Furthermore, it provides legal protection for both the buyer and the seller in the event of future disputes regarding the vehicle’s sale.

Does the Georgia Motor Vehicle Bill of Sale need to be notarized?

While Georgia law does not mandate the notarization of a Motor Vehicle Bill of Sale, having it notarized can add an additional layer of authenticity and may help in the prevention of legal issues arising from the sale of the vehicle. It is considered a best practice, although not a requirement.

What information is required on a Georgia Motor Vehicle Bill of Sale?

The form must include the date of the sale, the full names and addresses of both the seller and the buyer, a detailed description of the vehicle (including the make, model, year, and VIN), the sale price, and the signatures of both parties involved. For added legal protection, the odometer reading at the time of sale can also be included.

How do I obtain a Georgia Motor Vehicle Bill of Sale?

A Georgia Motor Vehicle Bill of Sale can be obtained by downloading a template from the Georgia Department of Revenue website or a reputable legal forms website. Alternatively, an individual can create their own Bill of Sale, as long as it contains all the required information.

Is a Bill of Sale enough to prove ownership of a vehicle in Georgia?

No, a Bill of Sale by itself is not enough to prove ownership of a vehicle in Georgia. The vehicle’s title must be officially transferred to the new owner to legally prove ownership. The Bill of Sale is a critical part of this process, but it must be accompanied by a completed title transfer.

Can I use a generic Bill of Sale for a vehicle sale in Georgia?

Yes, a generic Bill of Sale can be used for a vehicle sale in Georgia as long as it contains all the essential information required by the state for vehicle sales. However, using a form specifically designed for Georgia may help ensure that all necessary details are covered.

What happens if I lose my Bill of Sale?

If a Bill of Sale is lost, it’s advisable to contact the seller and request a duplicate. If this is not possible, a written statement that includes all the details of the original Bill of Sale, signed by both the seller and the buyer, may serve as a substitute. Keeping a digital copy of the Bill of Sale can prevent such issues.

Are there any penalties for not completing a Bill of Sale when selling a vehicle in Georgia?

While Georgia law may not specifically penalize individuals for not completing a Bill of Sale, failure to properly document the sale of a vehicle can lead to difficulties in the title transfer process and may result in legal and financial disputes between the buyer and seller. It is strongly recommended to complete a Bill of Sale for every vehicle transaction.

Common mistakes

When filling out a Georgia Motor Vehicle Bill of Sale form, one common mistake is neglecting to include all necessary details. This document must comprehensively capture information about the seller, buyer, and the vehicle being sold, including make, model, year, vehicle identification number (VIN), and the sale price. Omitting any of these critical elements can lead to potential legal hiccups, failing to provide a clear record of the transaction.

Another oversight often made is failing to verify the accuracy of the information entered on the form. Incorrect details, such as misspelled names, wrong vehicle identification numbers, or inaccurate sale prices, can invalidate the document or cause significant complications in the future. It's paramount for both parties to double-check all the information for accuracy before finalizing the sale.

Additionally, overlooking the requirement for notarization is a frequent mistake. In some scenarios, Georgia may require the Bill of Sale to be notarized to be considered legally binding. Skipping this step can render the document unofficial, which might complicate the vehicle's registration process or its legal standing in the event of a dispute.

A further common error is failing to provide complete payment details. The Bill of Sale should clearly outline the payment terms agreed upon by the buyer and seller, including any deposit amount, full payment details, and the schedule, if applicable. This omission can lead to misunderstandings or disagreements regarding the payment terms later on.

Last but not least, many people neglect to make copies of the signed Bill of Sale for their records. Keeping a copy is crucial for both parties as it serves as a personal record of the transaction’s specifics and proof of transfer of ownership until the buyer can register the vehicle in their name. Without this documentation, resolving any future issues regarding the vehicle's sale or ownership can become significantly more challenging.

Documents used along the form

In the process of buying or selling a vehicle in Georgia, the Motor Vehicle Bill of Sale form is a critical document that records the transaction between the buyer and the seller, providing proof of purchase and a change in ownership. However, this document does not stand alone. Several other forms and documents are often used in conjunction with the Motor Vehicle Bill of Sale to ensure the legality of the transaction and to comply with state laws and regulations. Here is a brief description of up to seven other forms and documents frequently used alongside the Georgia Motor Vehicle Bill of Sale.

- Vehicle Title: The vehicle title is the official document that proves ownership of the vehicle. When a vehicle is sold, the title must be signed over to the new owner, who then needs to apply for a new title in their name.

- Odometer Disclosure Statement: Federal law requires that the seller provide an accurate odometer reading at the time of sale. This document ensures the buyer is aware of the true mileage of the vehicle.

- Vehicle Registration: This document shows that the vehicle is registered to operate on public roads. After the sale, the new owner must transfer the registration into their name.

- Damage Disclosure Statement: In some cases, the seller must disclose any known damage that may affect the vehicle's value. This document is essential for an honest transaction.

- Emission Inspection Certificate: Depending on the county, an emissions inspection certificate might be required for the vehicle to be registered. This certificate proves the vehicle meets state emission standards.

- Bill of Sale for Personal Property: If the sale includes non-vehicle items (such as accessories or equipment not attached to the vehicle), a separate bill of sale for personal property might be needed.

- Loan Payoff Documents: If the vehicle is still under a loan, documents proving the loan has been paid off are necessary to transfer ownership free and clear.

In addition to the Georgia Motor Vehicle Bill of Sale, these documents collectively ensure that all aspects of the vehicle's sale are legally accounted for and transparent. It's essential for both buyers and sellers to understand the role of each document in the process to ensure a smooth and legally compliant transaction. Familiarity with these forms helps safeguard the interests of all parties involved and ensures that the transfer of ownership meets all state regulatory requirements.

Similar forms

The Vehicle Title Transfer Form is closely related to the Georgia Motor Vehicle Bill of Sale form. Both documents are essential in the process of transferring ownership of a vehicle from one party to another. The Vehicle Title Transfer form, alongside the Bill of Sale, provides legal evidence of the change in ownership and specifies the details of the vehicle being transferred. However, the Title Transfer form is specifically used to update the vehicle’s title to reflect the new owner’s name, making it a critical step in finalizing the sale and ensuring legal ownership.

Another similar document is the Vehicle Registration Application. Like the Georgia Motor Vehicle Bill of Sale, this application is crucial for vehicles’ lawful operation on public roads. While the Bill of Sale serves as a contractual record of the transaction between buyer and seller, the Vehicle Registration Application is used by the new owner to register the vehicle in their name with the state’s Department of Motor Vehicles (DMV), a step that is necessary for obtaining license plates and a registration certificate.

The Odometer Disclosure Statement shares similarities with the Georgia Motor Vehicle Bill of Sale in its role in vehicle sales. This statement is a required document that records the vehicle's mileage at the time of sale and helps verify the accuracy of the vehicle’s odometer reading. It is a crucial component of a transparent vehicle transaction, protecting the buyer from potential odometer fraud, much like the Bill of Sale protects both parties by outlining the terms of the sale, including the sale price and vehicle description.

A Promissory Note is somewhat similar to the Georgia Motor Vehicle Bill of Sale when financing is involved in a vehicle transaction. While the Bill of Sale confirms the sale and transfer of ownership of the vehicle, a Promissory Note is used when the buyer agrees to pay the seller the purchase amount over a specified period. This document outlines the loan details, including the repayment schedule, interest rate, and penalties for late payment, making it essential for clarifying the terms of the financial agreement.

The Sales and Use Tax Form for Vehicle Purchase also complements the use of the Georgia Motor Vehicle Bill of Sale. After purchasing a vehicle, this tax form is used to calculate and pay the necessary sales tax on the transaction. While the Bill of Sale provides the details of the sale, including the purchase price that is the basis for tax calculation, the Sales and Use Tax Form focuses on the financial responsibilities of the buyer to the state, ensuring compliance with state tax laws.

Lease Agreement Forms for vehicles share commonalities with the Georgia Motor Vehicle Bill of Sale, particularly in transactions where a vehicle is leased instead of sold outright. These agreements detail the terms under which the leaseholder can use the vehicle, including duration, payments, and mileage limits, much like how the Bill of Sale outlines the terms of a sale. However, Lease Agreements are unique in that they do not transfer ownership of the vehicle to the lessee but grant them the right to use it under the lease terms.

A Gift Affidavit for a motor vehicle is relatable to the Georgia Motor Vehicle Bill of Sale in scenarios where a vehicle is transferred as a gift rather than sold. Even though no sale price is involved, a Gift Affidavit serves a similar purpose by officially recording the transfer of the vehicle’s ownership from the giver to the recipient. It includes vital information about the vehicle and both parties, ensuring the transfer is recognized legally, just as the Bill of Sale acknowledges the agreement between buyer and seller.

The Warranty of Vehicle form is another document that bears resemblance to the Georgia Motor Vehicle Bill of Sale. This form specifically comes into play when a vehicle is sold with a warranty. It outlines the terms of the warranty that the seller extends to the buyer, covering specific components or issues that may arise after the sale, thus offering protection to the buyer similar to the reassurances a Bill of Sale provides regarding the terms of the sale.

Finally, the Power of Attorney for Vehicle Transactions is akin to the Georgia Motor Vehicle Bill of Sale in that it facilitates vehicle transactions, albeit indirectly. This legal document grants someone else the authority to act on behalf of an individual in matters related to the vehicle, including selling, buying, or completing paperwork for the vehicle. It is particularly useful when the principal cannot be present to handle these transactions themselves, ensuring that the vehicle’s sales process or other related actions can proceed smoothly and legally.

Dos and Don'ts

When filling out the Georgia Motor Vehicle Bill of Sale form, it's important to approach the task with diligence and precision. This document is a crucial piece of legal evidence that demonstrates a vehicle's change of ownership. Below are lists of essential dos and don'ts to guide you through the process.

Do:

- Verify the accuracy of all the information you include on the form. This encompasses the full names and addresses of both the buyer and the seller, alongside the vehicle's make, model, year, vehicle identification number (VIN), and the sale price.

- Ensure that the date of the sale is clearly and correctly documented. This detail is vital for both registration purposes and for any potential legal or tax implications.

- Use a pen with black or blue ink for enhanced legibility. This makes the document easier to read and photocopy, and reduces the likelihood of errors during processing.

- Have all parties involved sign and date the form. Signatures are the foundational element that confer legal validity to the document, binding both buyer and seller to the agreed terms.

- Keep a copy of the completed form for your records. This serves as personal proof of the transaction and may be required for tax reporting or in case of disputes.

- Comply with any additional specific requirements set forth by Georgia law, such as notarization, if applicable. Familiarizing yourself with the state's guidelines ensures the document is legally binding.

Don't:

- Leave any fields blank. Incomplete documents may not only lead to processing delays but could also render the bill of sale void.

- Use pencil or any erasable writing tool. This compromises the permanence of the information, making it susceptible to unauthorized alterations.

- Forget to check the buyer's or seller's identification to ensure the names match those on the form. This step helps prevent potential fraud or misunderstandings.

- Omit the odometer reading, if required. Accurately reporting the vehicle's mileage is a necessary part of the sale process and is legally mandated in many jurisdictions.

- Sign the document without thoroughly reviewing all the information for accuracy and completeness. Mistakes or omissions could lead to legal complications down the line.

- Assume the bill of sale alone is enough to finalize the transfer of ownership. Remember, the vehicle must also be properly registered with the Georgia Department of Motor Vehicles (DMV) under the new owner's name.

Misconceptions

When it comes to the Georgia Motor Vehicle Bill of Sale form, various misconceptions float around that might lead to confusion. Identifying these misunderstandings is the first step towards a smooth vehicle transaction process. Below, we have outlined eight common misconceptions about this important document.

It serves as a title. One of the most prevalent misconceptions is that the Bill of Sale can serve as a vehicle's title. In reality, it's a document that records the transaction between the buyer and seller, proving the transfer of ownership. But, for the vehicle to be legally operated, the title must be transferred at the Department of Motor Vehicles (DMV).

Notarization is always required. While notarization adds a layer of authentication, the State of Georgia does not mandate that a Bill of Sale be notarized for it to be valid. However, ensuring it's notarized can be beneficial, especially if disputes arise later.

All you need to register a vehicle. Some think that a Bill of Sale is all you need to register a vehicle in Georgia. The truth is, registration requires additional documents, including a title transfer and proof of insurance.

Only the buyer needs a copy. Ensuring both the buyer and seller hold a copy of the Bill of Sale is critical. It serves as a receipt for the buyer and as proof of release of liability for the seller.

A Bill of Sale is optional. While some may consider the Bill of Sale optional, Georgia law requires a Bill of Sale for motor vehicle transactions. It's a crucial document for both legal protection and record-keeping.

There is a universal form for all states. Each state has its specific requirements for a Bill of Sale. What is acceptable in one state may not meet the legal requirements of another, including Georgia. Always use the form tailored for Georgia's regulations.

The form is too complicated. The misconception that the form is overly complicated and filled with legal jargon can deter individuals from completing it correctly. In fact, Georgia's Motor Vehicle Bill of Sale form is straightforward and requires only essential information about the sale and the vehicle.

Any faults or issues with the vehicle must be included. While not a legal requirement, disclosing any known problems with the vehicle on the Bill of Sale is highly advisable. This practice fosters transparency and reduces liability, but the form itself doesn't demand these details.

Understanding what the Georgia Motor Vehicle Bill of Sale form is—and what it isn't—can significantly streamline the process of buying or selling a vehicle. It's about more than just filling out paperwork; it's about ensuring protection and compliance for all parties involved.

Key takeaways

When completing or utilizing the Georgia Motor Vehicle Bill of Sale form, individuals should keep several critical takeaways in mind. This document is pivotal for both the buyer and the seller during the transfer of vehicle ownership. Below are key takeaways to ensure that the process goes smoothly and all legal requirements are met:

- Complete Accuracy: Ensure all information provided on the form is accurate. This includes details about the vehicle (make, model, year, VIN) and personal information of both parties (names, addresses).

- Include Vehicle Price: Clearly state the sale price of the vehicle. This is important for tax purposes and for future potential disputes.

- Date of Sale: Document the exact date of the transaction. This date is critical for legal and record-keeping purposes.

- Signature Requirement: Both the buyer and the seller must sign the Bill of Sale to validate the transaction. Without both signatures, the document may not be legally binding.

- Notarization: Though not always required, having the form notarized can add an extra layer of legal protection and authenticity to the document.

- Keep Copies: Both parties should keep a copy of the signed Bill of Sale for their records. This document serves as proof of purchase and can be important for tax reporting and future disputes.

- Odometer Disclosure: Accurately report the vehicle’s odometer reading at the time of sale to prevent any future legal issues regarding vehicle condition or fraud.

- Liability Release: Filling out this form releases the seller from future liabilities regarding the vehicle. It is crucial for the seller to ensure this document is properly completed and submitted.

- Registration: Buyers should be aware that the Bill of Sale is often required for vehicle registration at the Department of Motor Vehicles (DMV). Prompt registration after the sale is advised.

By adhering to these guidelines, parties can ensure a seamless and legally compliant transfer of vehicle ownership in Georgia. Remember, this document not only facilitates the sale but also protects both the buyer and seller’s interests.

More Motor Vehicle Bill of Sale State Forms

Used Car Bill of Sale - The specifics required on the form can vary by state, so it's essential to check local requirements.

Texas Department of Motor Vehicle - The document is crucial for registering the vehicle in the buyer’s name at the DMV.

Nc Title - It's a practical way to confirm that all agreed-upon sale conditions have been met by both parties.