Fillable Mobile Home Bill of Sale Document for Ohio

When it comes to transferring ownership of a mobile home in Ohio, the Bill of Sale form serves as a critical document, ensuring that the transaction is not only conducted legally but also documented properly for both parties involved. This document captures essential information such as the details of the mobile home, including make, model, year, and serial number, the names and addresses of both the seller and buyer, the sale amount, and the date of sale. Moreover, it may include terms of the sale, warranty information, and acknowledgment of the receipt of payment. The importance of this form extends beyond the mere act of sale; it is also a necessary document for the buyer to register the mobile home under their name. Failing to properly complete and retain this document can lead to significant legal and financial ramifications down the line. The Ohio Mobile Home Bill of Sale form represents an indispensable step in the process of a mobile home's sale and purchase, ensuring that all parties have a clear record of the transaction and protecting the interests of both the buyer and seller.

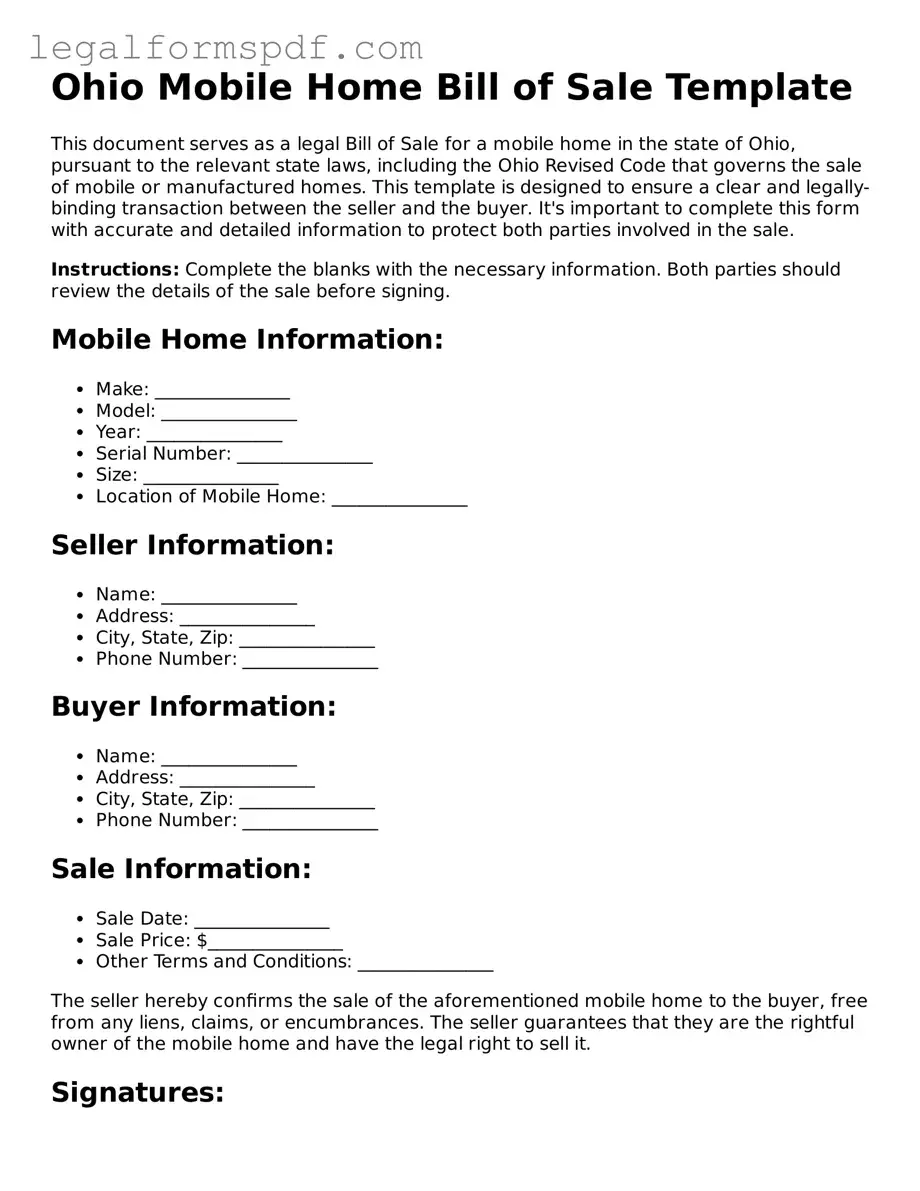

Document Example

Ohio Mobile Home Bill of Sale Template

This document serves as a legal Bill of Sale for a mobile home in the state of Ohio, pursuant to the relevant state laws, including the Ohio Revised Code that governs the sale of mobile or manufactured homes. This template is designed to ensure a clear and legally-binding transaction between the seller and the buyer. It's important to complete this form with accurate and detailed information to protect both parties involved in the sale.

Instructions: Complete the blanks with the necessary information. Both parties should review the details of the sale before signing.

Mobile Home Information:

- Make: _______________

- Model: _______________

- Year: _______________

- Serial Number: _______________

- Size: _______________

- Location of Mobile Home: _______________

Seller Information:

- Name: _______________

- Address: _______________

- City, State, Zip: _______________

- Phone Number: _______________

Buyer Information:

- Name: _______________

- Address: _______________

- City, State, Zip: _______________

- Phone Number: _______________

Sale Information:

- Sale Date: _______________

- Sale Price: $_______________

- Other Terms and Conditions: _______________

The seller hereby confirms the sale of the aforementioned mobile home to the buyer, free from any liens, claims, or encumbrances. The seller guarantees that they are the rightful owner of the mobile home and have the legal right to sell it.

Signatures:

The completion and signatures of this document officiate the sale and transfer of ownership of the mobile home described above from the seller to the buyer. It is recommended that this document be notarized to add an additional layer of legal protection.

Seller's Signature

___________________ Date: _______________

Buyer's Signature

___________________ Date: _______________

Note: It is advised to keep copies of this document for personal records and for reporting the sale to the Ohio Bureau of Motor Vehicles (BMV) if the mobile home is considered a vehicle.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Mobile Home Bill of Sale form is used to document the sale and transfer of ownership of a mobile home from the seller to the buyer. |

| Required by Law | In Ohio, a Bill of Sale for a mobile home is required to register and title the mobile home in the new owner's name. |

| Key Components | The form typically includes information about the buyer and seller, description of the mobile home (including make, model, year, and serial number), purchase price, and sale date. |

| Governing Law | Ohio Revised Code Section 4505.11 governs the sale and transfer of ownership for mobile homes. |

| Notarization | In some cases, notarization of the Bill of Sale may be required to validate the signatures of the parties involved. |

| Additional Documentation | Besides the Bill of Sale, other documents such as a certificate of title and release of any liens may be necessary to complete the sale. |

| Benefits | A properly completed Bill of Sale provides legal protection for both the buyer and seller, clarifying the terms of the sale and ensuring the transfer of ownership is recognized by law. |

Instructions on Writing Ohio Mobile Home Bill of Sale

When you decide to sell or buy a mobile home in Ohio, using a Mobile Home Bill of Sale form is crucial. This document serves as proof of the transaction, outlining the details concerning the buyer, seller, and the mobile home itself. It ensures that the rights and interests of both parties are protected and clearly communicates the terms of the sale. To efficiently complete the Ohio Mobile Home Bill of Sale form, follow these detailed steps:

- Gather necessary information including the full names and addresses of the buyer and seller, the make, model, year, and serial number of the mobile home, and the sale price.

- Enter the date of the sale at the top of the form.

- Write the full name and address of the seller in the designated section.

- Provide the full name and address of the buyer.

- Describe the mobile home by including its make, model, year, and serial number.

- Specify the sale price in U.S. dollars and the terms of the sale, such as whether it is sold “as is” or under certain conditions.

- If any appliances or additional items are included in the sale of the mobile home, list them in the designated section.

- Both the buyer and seller should carefully review the information entered. Any corrections should be made prior to signing.

- Have both parties sign and date the form. It’s recommended to sign in the presence of a notary, though not required by Ohio law.

- Keep copies of the completed form for both the buyer and seller’s records, as it serves as a legal proof of purchase and sale.

Once the Mobile Home Bill of Sale is filled out and signed, the next steps involve transferring the title and registration of the mobile home, if applicable, to the new owner's name. This process may require a visit to the local Bureau of Motor Vehicles (BMV) or a similar agency overseeing mobile home titles and registrations in Ohio. To complete this title transfer, be prepared to provide the BMV with the completed bill of sale, the mobile home’s current title, and any other documentation they may require. Additionally, consider verifying with the local tax office to ensure all property taxes on the mobile home have been paid before finalizing the transaction. This extra step can help prevent potential legal issues related to tax liabilities.

Understanding Ohio Mobile Home Bill of Sale

What is a Mobile Home Bill of Sale form used for in Ohio?

In Ohio, a Mobile Home Bill of Sale form is used as a legal document to record the sale and purchase transaction of a mobile home between two parties. It serves as evidence that the seller has transferred all rights and interests in the mobile home to the buyer for an agreed-upon amount of money. This document is essential for legalizing the change of ownership and may be required for registration, tax purposes, and as proof of ownership.

Is a Mobile Home Bill of Sale mandatory in Ohio?

Yes, when selling or buying a mobile home in Ohio, it is highly recommended to complete a Mobile Home Bill of Sale. This document is vital for the buyer's protection and serves as a record of the transaction details, including the sale date, price, and identification information about the mobile home. Additionally, local authorities may require this document for registration or taxation purposes.

What information is necessary to include in an Ohio Mobile Home Bill of Sale?

An Ohio Mobile Home Bill of Sale should include the full names and addresses of both the seller and the buyer, a detailed description of the mobile home (including make, model, year, and serial number), the sale price, the sale date, and any terms or conditions of the sale. It should also state that the seller has legal rights to sell the mobile home and that it is being sold as-is, unless otherwise agreed upon. Both parties should sign and date the document, possibly in the presence of a notary public for additional legal standing.

Does the Mobile Home Bill of Sale need to be notarized in Ohio?

While not always mandatory, getting the Mobile Home Bill of Sale notarized in Ohio is advisable. Notarization adds a level of verification that the signatures on the document are genuine and can help protect against legal disputes. It formally records the execution of the document, ensuring that it stands up better in a court of law, should any disputes arise.

Can a Mobile Home Bill of Sale be used for both selling and buying?

Yes, the Mobile Home Bill of Sale works for both the seller and the buyer. For the seller, it provides proof that they have legally transferred the rights of the mobile home to the buyer. For the buyer, it serves as evidence of ownership and is crucial for registering the mobile home in their name, among other legal necessities. It is a mutual record of the transaction and protects the rights of both parties.

How should a buyer verify the information on the Mobile Home Bill of Sale?

Before finalizing the purchase, the buyer should conduct a thorough review of the Mobile Home Bill of Sale. This includes verifying the accuracy of the mobile home's description, confirming the make, model, year, and serial number against the mobile home itself, and ensuring that the sale price and terms match the agreed conditions. The buyer should also check the seller's identity and their legal right to sell the mobile home. Consulting a legal professional can also provide an added layer of verification.

What are the next steps after completing a Mobile Home Bill of Sale in Ohio?

After completing the Mobile Home Bill of Sale, both parties should keep a copy of the document for their records. The buyer should use this document to register the mobile home in their name at the local Ohio Bureau of Motor Vehicles (BMV) or relevant local authority, which may require additional documentation such as proof of insurance and a valid ID. The buyer should also check if they are responsible for paying sales tax on the purchase. Finally, the buyer might need to take steps to ensure the mobile home complies with local zoning and housing codes.

Common mistakes

Filling out the Ohio Mobile Home Bill of Sale form is a critical step in transferring ownership, yet it can often be mishandled. One common mistake is not verifying the accuracy of the information. Buyers and sellers might rush through this process, leading to errors in names, addresses, or identification numbers. Such inaccuracies can not only delay the sale but, in some cases, invalidate the entire agreement. Ensuring every piece of information is correct and matches legal documents is paramount.

Another error is neglecting to specify the condition of the mobile home at the time of sale. Unlike traditional homes, mobile homes can vary significantly in condition and features, which should be precisely outlined in the bill of sale. This includes any existing damages or modifications. Failure to disclose the condition can result in disputes after the sale, potentially leading to legal complications or financial loss for either party.

Many people overlook the importance of including a detailed description of the mobile home. It's not enough to just list the make and model. The year, size, and any included appliances or furniture should also be documented. This is crucial for valuation and insurance purposes. Without a comprehensive description, determining the mobile home's actual worth can become a point of contention.

Additionally, some people forget to confirm the legal status of the mobile home. In Ohio, if the mobile home is considered real property (permanently affixed to the land with the intent to remain), a different set of legal requirements and forms might apply. Buyers and sellers should verify whether the mobile home is classified as personal property or real estate and proceed accordingly. Mistakes in this aspect can lead to significant legal and financial repercussions.

Last but not least, failing to get the bill of sale notarized is a critical oversight. While not always a legal requirement in Ohio, notarization adds a layer of authenticity and legal protection. It confirms that both parties have willingly signed the document, reducing the risk of future claims that the signature was forged or that one party didn't understand the agreement. This simple step can provide peace of mind and safeguard against potential disputes.

Documents used along the form

When transferring ownership of a mobile home in Ohio, the Mobile Home Bill of Sale form plays a pivotal role. However, this critical document often works in concert with a suite of other important forms and documents to ensure a seamless and legally compliant transaction. These additional documents help to clarify the terms of sale, confirm the identities and responsibilities of the parties involved, and protect everyone's interests throughout the process.

- Title Certificate: This document serves as proof of ownership for the mobile home. It's essential for legally transferring ownership from the seller to the buyer. The Title Certificate must be updated with the current owner's information and provided to the buyer at the time of sale.

- Residential Purchase Agreement: This detailed agreement outlines the terms of the mobile home sale, including the purchase price, financing arrangements, and any conditions or contingencies that must be met before the sale can be finalized.

- Promissory Note: If the buyer is financing the purchase through the seller, a promissory note outlines the repayment terms, interest rates, and schedules. It serves as a legal agreement to repay the loan.

- Occupancy Agreement: In cases where the mobile home resides within a park or leased land, an occupancy agreement is necessary. It outlines the terms under which the buyer can occupy the space, including rent, rules, and regulations of the community.

- Personal Property Bill of Sale: For transactions that include the sale of personal property within the mobile home, such as furniture or appliances, a separate bill of sale for these items may be needed to properly transfer ownership.

- Home Inspection Report: While not always required, a home inspection report can be invaluable. It details the condition of the mobile home and any issues that need addressing, offering peace of mind to both buyer and seller.

- Manufactured Home Tax Clearance Certificate: In Ohio, this certificate verifies that all property taxes on the mobile home have been paid up to the point of sale. It's crucial for ensuring that the new owner doesn't inherit unpaid taxes.

- Release of Liability: This form protects the seller from future liability regarding the mobile home once the sale is complete. It's a critical document that officially documents the transfer of responsibility to the buyer.

Successfully navigating the sale of a mobile home involves keen attention to detail and a thorough understanding of the required documentation. Each of these documents plays a unique role in the process, ensuring that all legal, financial, and communal responsibilities are addressed. Together, they create a comprehensive framework that underpins the Mobile Home Bill of Sale, providing clarity and security for both parties involved in the transaction.

Similar forms

The Ohio Mobile Home Bill of Sale form shares similarities with the Automobile Bill of Sale. Both documents serve as legal evidence that a transaction has taken place, transferring ownership from one party to another. Each document requires detailed information about the item being sold, the sale price, and the parties involved, ensuring a clear understanding of the transaction's terms.

Similar to the Ohio Mobile Home Bill of Sale, the Motorcycle Bill of Sale form is necessary for the legal transfer of ownership. It includes detailed information about the motorcycle, such as VIN, make, model, and year, mirroring the mobile home form’s requirement for identifying specifics to avoid future disputes and clarify the transaction scope.

The Boat Bill of Sale form also aligns with the Ohio Mobile Home Bill of Sale in function and importance. It includes specific details about the boat, including registration numbers and hull identification, ensuring that the transfer of ownership is recognized by legal and maritime authorities, analogous to the way the mobile home bill facilitates rightful ownership transfer.

Like the Ohio Mobile Home Bill of Sale, a General Bill of Sale is a versatile document used to transfer ownership of personal property not specifically covered by more specialized forms. It provides a legal record of the sale, listing the items sold, sale date, and parties involved, offering protection and clarity in a wide range of transactions.

The Aircraft Bill of Sale mirrors the mobile home bill in its purpose for transferring ownership of a highly specialized item. It must include specific details about the aircraft, such as serial numbers and model, ensuring the transaction is well-documented and legally binding, which is vital for registration and legal purposes.

Equine Bill of Sale forms resemble the Ohio Mobile Home Bill of Sale because they formalize the sale of horses, detailing the animal's pedigree, physical condition, and any warranties. By providing a clear record of the transaction, both parties are assured of the terms, mirroring the transparency and protection offered by the mobile home bill.

The Firearm Bill of Sale is akin to the Ohio Mobile Home Bill of Sale in that it is crucial for the legal transfer of potentially dangerous goods. This document includes specific information about the firearm, such as make, model, and serial number, ensuring responsible ownership transfer and adherence to legal requirements, similar to the mobile home sale's need for precise detail.

The Business Bill of Sale shares a purpose with the Ohio Mobile Home Bill of Sale, documenting the sale of an entire business or part of its assets. It includes detailed lists of the items being sold, valuations, and terms, ensuring both buyer and seller agree on what is being transferred, similar to how a mobile home bill clarifies the sale of a residence.

Similarly, the Artwork Bill of Sale functions like the mobile home version by providing proof of ownership transfer for pieces of art. It details the artwork's creator, description, and provenance, akin to how the mobile home bill of sale includes identifying information to secure the transaction and protect both parties’ interests.

The Property (Real Estate) Bill of Sale, though more commonly related to land or buildings firmly attached to land, parallels the mobile home bill in its essence of transferring ownership rights. It specifies the property details and the agreement's terms, ensuring a transparent and binding agreement much like the mobile home bill secures the sale of a manufactured home.

Dos and Don'ts

Filling out an Ohio Mobile Home Bill of Sale form is a key step in the transfer process of a mobile home. It's essential to get it right to ensure a smooth transfer of ownership. Here are some dos and don'ts to guide you through the process.

- Do ensure all the information provided is accurate. Double-check names, addresses, and the identification number of the mobile home for errors.

- Do include a detailed description of the mobile home. Note the make, model, year, and size to ensure clear identification.

- Do verify that the seller has the right to sell the mobile home. This step is crucial to avoid legal issues regarding ownership down the line.

- Do make sure that both the buyer and the seller sign the bill of sale. Their signatures legally bind the transaction.

- Do keep a copy of the bill of sale for your records. It acts as proof of purchase and can be important for tax and registration purposes.

- Don't leave any sections of the form blank. If a section does not apply, mark it as "N/A" (not applicable) instead of leaving it empty.

- Don't forget to specify the sale price and the date of sale. This information is critical for both legal and tax reasons.

- Don't rely on oral agreements. Make sure all terms of the sale are written down and agreed upon in the bill of sale.

- Don't hesitate to seek legal advice if you're unsure about any part of the bill of sale form. Getting it right is important to protect your interests.

Misconceptions

When discussing the Ohio Mobile Home Bill of Sale form, various misconceptions tend to circulate, leading to confusion about its usage and requirements. By addressing these misunderstandings directly, individuals involved in the sale or purchase of a mobile home in Ohio can proceed with greater clarity and legal assurance.

It's just a simple document; legal advice isn't necessary. Many believe that completing the Ohio Mobile Home Bill of Sale is straightforward and doesn't require legal guidance. However, given that this document is a legal record of the transaction, consulting a lawyer can help prevent issues related to property rights and responsibilities.

It's identical to a standard Bill of Sale. While it serves a similar purpose, the Ohio Mobile Home Bill of Sale has specific requirements and details unique to the sale of mobile homes, such as HUD certification numbers and whether the mobile home is considered personal property or real estate.

Any form found online will suffice. Not all forms available online meet Ohio's legal requirements. Using an outdated or incorrect form could render the document invalid, leading to possible legal complications.

It must be notarized to be valid. Ohio law does not require a Bill of Sale for a mobile home to be notarized. However, having it notarized can add a layer of legal protection and authenticity to the transaction.

It replaces the title transfer. This is a common misunderstanding. The Bill of Sale is part of the transaction process but does not substitute the need for a formal title transfer through the Ohio Bureau of Motor Vehicles (BMV) or the county recorder's office, depending on whether the mobile home is considered personal property or real estate.

Only the buyer needs to keep a copy. Both the buyer and the seller should retain copies of the Bill of Sale. This document serves as proof of purchase and transfer of ownership, which can be critically important for tax purposes, future disputes, or for the registration of the mobile home.

The Bill of Sale is only necessary if financing is involved. Whether a mobile home purchase is financed or paid for in cash, a Bill of Sale is crucial. It records the transaction details, providing legal evidence of the sale and terms agreed upon by both parties.

Filling out the form incorrectly can easily be fixed later on. Errors on the Bill of Sale can complicate or even invalidate the sale. It's essential to ensure all information is accurate before both parties sign. Correcting mistakes often requires issuing a new Bill of Sale, which can delay the transaction.

It's only useful for legal disputes. Beyond its importance in legal disputes, the Bill of Sale is necessary for tax assessment, insurance purposes, and as a record of sale for both buyer and seller. It serves multiple purposes beyond merely proving ownership.

A verbal agreement is as good as a written Bill of Sale in Ohio. Verbal agreements can be extremely difficult to prove and enforce, making a written Bill of Sale essential for documenting the transaction's details clearly and legally.

Key takeaways

Ensure all parties involved have a clear understanding of the mobile home's condition. Before filling out the form, thoroughly inspect the mobile home and disclose any known issues. This helps avoid disputes post-sale.

Complete the Ohio Mobile Home Bill of Sale with accurate information. This includes the full names and addresses of both the seller and buyer, a detailed description of the mobile home (e.g., make, model, year, VIN), and the sale price.

Include any additional terms or conditions of sale. If there are specific agreements between the buyer and seller, such as payment plans or responsibilities for repairs, document these clearly in the bill of sale.

Verify the legality of the mobile home's status. Ensure that the mobile home's title is clear and can be legally transferred to the buyer without any liens or encumbrances.

Sign and date the form in the presence of a notary public. For the sale to be legally binding, both the buyer and seller should sign the bill of sale, and having it notarized adds an extra layer of legitimacy.

Keep copies of the bill of sale for personal records. Both parties should keep a copy of the signed document for their records, as it serves as proof of purchase and ownership transfer.

Understand the tax implications. Be aware that the sale of a mobile home may have tax implications for both the buyer and seller. It’s advisable to consult with a tax professional to understand these aspects fully.

Complete any additional required paperwork by Ohio law. Depending on the local jurisdiction, you may need to file additional documents with the county or state. Check with the local authorities to ensure compliance.

Remember that the bill of sale is just one step in the process. Transferring ownership officially may require submitting the bill of sale and other documents to the Ohio Bureau of Motor Vehicles or another appropriate state agency.

More Mobile Home Bill of Sale State Forms

Manufactured Home Bill of Sale - Valuable for settling any future disagreements on what was promised at the time of sale.

Mobile Home Bill of Sale Template - A legally recognized form that documents the change of ownership of a mobile home, specifying transaction details.