Fillable Mobile Home Bill of Sale Document for California

When buying or selling a mobile home in California, completing a Mobile Home Bill of Sale form is a critical step that should not be overlooked. This document not only records the transaction in writing but also serves multiple purposes, including providing evidence of the transfer of ownership, determining the sales tax, and protecting both parties in case of future disputes. It's imperative that the form is filled out with accuracy and detail, capturing information such as the make, model, year, and VIN of the mobile home, as well as the names and signatures of both the buyer and the seller. Additionally, including the sale date and the agreed-upon price in the bill of sale is necessary for it to be considered valid and complete. Due to the importance of this form in the transaction process, understanding its requirements and ensuring that it is properly executed can lead to a smoother and more efficient transfer of property.

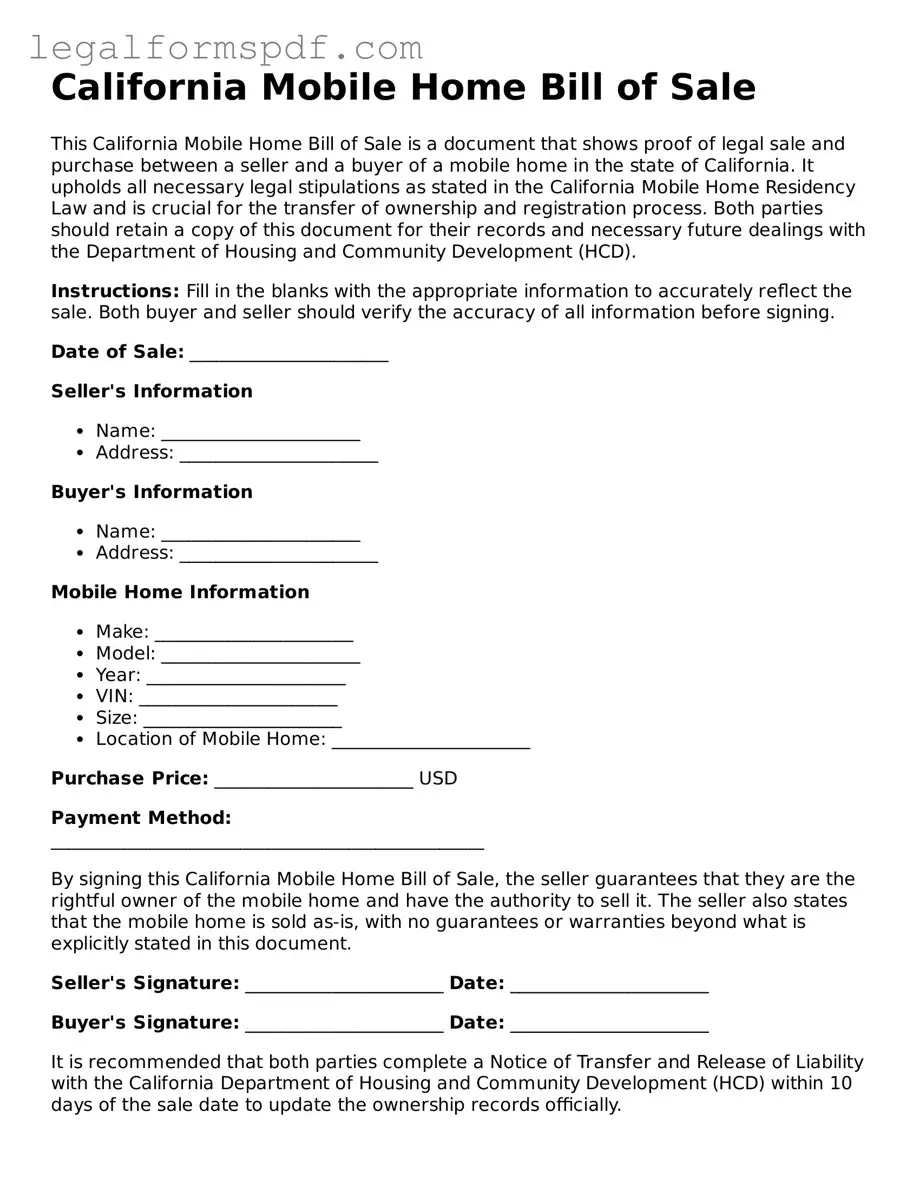

Document Example

California Mobile Home Bill of Sale

This California Mobile Home Bill of Sale is a document that shows proof of legal sale and purchase between a seller and a buyer of a mobile home in the state of California. It upholds all necessary legal stipulations as stated in the California Mobile Home Residency Law and is crucial for the transfer of ownership and registration process. Both parties should retain a copy of this document for their records and necessary future dealings with the Department of Housing and Community Development (HCD).

Instructions: Fill in the blanks with the appropriate information to accurately reflect the sale. Both buyer and seller should verify the accuracy of all information before signing.

Date of Sale: ______________________

Seller's Information

- Name: ______________________

- Address: ______________________

Buyer's Information

- Name: ______________________

- Address: ______________________

Mobile Home Information

- Make: ______________________

- Model: ______________________

- Year: ______________________

- VIN: ______________________

- Size: ______________________

- Location of Mobile Home: ______________________

Purchase Price: ______________________ USD

Payment Method:

________________________________________________

By signing this California Mobile Home Bill of Sale, the seller guarantees that they are the rightful owner of the mobile home and have the authority to sell it. The seller also states that the mobile home is sold as-is, with no guarantees or warranties beyond what is explicitly stated in this document.

Seller's Signature: ______________________ Date: ______________________

Buyer's Signature: ______________________ Date: ______________________

It is recommended that both parties complete a Notice of Transfer and Release of Liability with the California Department of Housing and Community Development (HCD) within 10 days of the sale date to update the ownership records officially.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A California Mobile Home Bill of Sale form is a legal document that records the sale and transfer of ownership of a mobile home from the seller to the buyer within the state of California. |

| Primary Use | It is primarily used to document the sale of a mobile home, ensuring that the transfer of ownership is legally recorded. |

| Governing Law | In California, the sale and purchase of mobile homes are governed by the California Department of Housing and Community Development (HCD). |

| Essential Information | The form must contain the names and addresses of both the buyer and seller, the sale price, the mobile home’s description (including make, model, year, and serial number), and the date of the sale. |

| Signatures | Signatures from both the buyer and seller are required on the form to validate the transaction. Witness signatures may also be required for additional verification. |

| Additional Documentation | Completing a Bill of Sale for a mobile home often requires additional documentation, such as title transfer forms and certificates of title. |

| Importance | This document is crucial for the buyer’s proof of ownership and can also be required for taxation, financing, or insurance purposes. |

Instructions on Writing California Mobile Home Bill of Sale

When engaging in the sale of a mobile home in California, a crucial step involves correctly filling out a Mobile Home Bill of Sale form. This document serves as a record of the transaction, detailing the agreement between the seller and the buyer. It is essential for both parties to accurately complete this form to ensure a smooth transfer of ownership and to fulfill legal obligations. The information required will typically include details about the mobile home, the sale, and both the seller and the buyer. Following a clear, step-by-step guide can assist individuals in ensuring that the form is filled out correctly and comprehensively.

- Start by entering the date of the sale at the top of the form.

- Write the full legal names of the seller and the buyer in the designated fields.

- Describe the mobile home, including its make, model, year, and any identifying numbers such as a serial or VIN (Vehicle Identification Number).

- Input the physical address where the mobile home is located, including the city, county, and state.

- Specify the sale price of the mobile home in the section provided.

- Indicate the method of payment, such as cash, check, or another form. If applicable, detail any payment plan arrangements.

- Include any additional terms and conditions of the sale that both parties have agreed upon. This might cover warranties, the inclusion of furniture or appliances, or any specific responsibilities of the buyer or seller.

- Both the seller and the buyer should sign and print their names at the bottom of the form to validate the agreement. Ensure that the date of signing is accurately entered next to or beneath the signatures.

- If the form provides a section for a witness or notary public, have them sign and date the form as well, certifying the authenticity of the signatures.

Once the Mobile Home Bill of Sale form is fully completed and signed, it's important for both parties to keep a copy for their records. This document serves as proof of sale and ownership transfer, which might be required for registration, taxation, or legal purposes in the future. Handling this document with care and precision ensures that rights and interests are protected throughout the process of purchasing or selling a mobile home in California.

Understanding California Mobile Home Bill of Sale

What is a California Mobile Home Bill of Sale form?

A California Mobile Home Bill of Sale form is a legal document used during the sale of a mobile home in California. It records the transaction between the seller and the buyer, detailing the mobile home’s purchase price, description, and the parties' information. This form serves as a receipt and proof of ownership transfer.

Do I need a California Mobile Home Bill of Sale to sell or buy a mobile home?

Yes, having a California Mobile Home Bill of Sale is crucial when selling or buying a mobile home in the state. It not only provides legal proof of the sale and transfer of ownership, but it also may be required for registration purposes and tax assessments at the local county office.

What information should be included in the California Mobile Home Bill of Sale?

The form should include the buyer’s and seller’s names and addresses, a detailed description of the mobile home (including make, model, year, and VIN or serial number), the sale date, the purchase price, and any warranty information. Both parties must sign and date the form, possibly in front of a notary public for additional legal standing.

Is notarization required for a California Mobile Home Bill of Sale?

While notarization is not always legally required for a California Mobile Home Bill of Sale, it is highly recommended. Notarizing the document can add a layer of fraud protection and may be necessary for registration or financing purposes. It verifies the identities of the parties involved and the validity of their signatures.

After filling out a California Mobile Home Bill of Sale, what are the next steps?

After completing the form, the buyer should register the mobile home at the local county office in California where the mobile home will be located. This process may require presenting the Bill of Sale, proof of insurance, and potentially undergoing a safety inspection. Check with the specific county office for any additional requirements or fees.

Common mistakes

When filling out the California Mobile Home Bill of Sale form, people often encounter a range of common mistakes that can delay the process or even invalidate the form. Understanding these errors is crucial for a swift and correct execution of this essential document.

One frequent mistake is not providing detailed information about the mobile home. This includes the make, model, year, and serial number. These details are crucial for identifying the mobile home in question, ensuring that there is no confusion about which property is being sold. Without this information, the bill of sale might not provide enough legal clarity to be effective.

Another common error is forgetting to include the sale price or writing it unclearly. The sale price must be clearly stated in the document to avoid any future disputes or misunderstandings about the transaction's financial aspects. Moreover, including the payment method or terms, when relevant, is vital for a comprehensive agreement.

Often, individuals fail to provide information about the warranty status of the mobile home. Specifying whether the mobile home is being sold "as is" or with a warranty can significantly impact the agreement's terms. This oversight might lead to disagreements about the condition of the mobile home after the sale.

Not properly identifying both the buyer and the seller with full names and addresses is another typical oversight. This complete identification is crucial for the legal enforceability of the document. Both parties' contact information ensures that there's a clear record of who is involved in the transaction.

A surprisingly common mistake is not having the bill of sale signed and dated by all parties. Signatures are what legitimize the document, and without them, the bill of sale might not be legally binding. Additionally, the date of the transaction is important for record-keeping and establishing when the ownership officially changed hands.

Often, sellers neglect to acknowledge the receipt of payment within the document. Confirming that the payment has been received, or stating the arrangement for payment if it has not been fully paid, is essential for clarifying that the transaction has occurred or will occur under agreed terms.

Disregarding local regulations or requirements specific to California can also lead to issues. Each state may have unique stipulations for the sale of mobile homes, including specific disclosures or additional documentation that must be included with the bill of sale.

Finally, a significant mistake is failing to keep a copy of the bill of sale for both the buyer's and seller's records. A copy of this document serves as proof of ownership transfer and can be vitally important for tax purposes or in case any legal questions arise concerning the transaction.

Avoiding these mistakes ensures a smoother, more legally sound process when transferring the ownership of a mobile home. Both buyers and sellers should pay close attention to the details of the bill of sale, ensuring all information is complete and accurate for a successful and trouble-free transaction.

Documents used along the form

When transferring ownership of a mobile home in California, employing a Mobile Home Bill of Sale form is pivotal. However, additional forms and documents are often required to ensure a smooth and legally binding transaction. These documents collectively provide a comprehensive legal framework that helps in verifying the deal, ensuring its legitimacy, and fulfilling state-specific legal requirements. Here are five key documents commonly used in conjunction with the California Mobile Home Bill of Sale form.

- Certificate of Title: This document serves as proof of ownership of the mobile home. It is essential to transfer the title to the new owner after the sale, to ensure the buyer legally owns the property.

- Property Tax Clearance Certificate: In California, it's important to ensure that all property taxes on the mobile home have been paid before the transfer of ownership. This certificate confirms no outstanding taxes, which is crucial for a smooth transition.

- Residency Agreement or Lease Contract: If the mobile home is located within a mobile home park, a copy of the current lease or residency agreement may be required. This document outlines the terms and conditions of living within the park and must be agreed upon by the new owner.

- HCD Form 433A: In cases where the mobile home is affixed to a permanent foundation, the California Department of Housing and Community Development requires Form 433A. This form records that the home is affixed and is considered real property.

- Disclosure Statements: Sellers are required to provide certain disclosures regarding the mobile home, such as condition, any repairs needed, or if there are any liens against the property. These statements help in providing transparency and protecting the rights of the buyer.

Together with the Mobile Home Bill of Sale, these documents facilitate a transparent, lawful, and effective transfer of ownership. Ensuring all necessary paperwork is complete and accurate not only protects both parties involved in the transaction but also complies with California's legal requirements. It's advisable for buyers and sellers to familiarize themselves with these documents early in the sales process, as preparation and understanding can significantly streamline the transaction.

Similar forms

A Vehicle Bill of Sale is quite similar to the California Mobile Home Bill of Sale in its function and structure. Both documents serve as official records that document the sale and transfer of ownership from a seller to a buyer. Just like a mobile home bill of sale, a vehicle bill of sale typically includes important information such as the make, model, year, vehicle identification number (VIN), and the agreed sale price. It also contains the names and signatures of the parties involved, providing legal proof of the transaction and change of ownership.

Another document resembling the California Mobile Home Bill of Sale is a Real Estate Bill of Sale. This document is used for the purchase or sale of property land and, in some cases, the structures on it. While mobile homes are not always considered real estate, the principles of documenting the transaction details, such as the description of the property, sale amount, and the parties' details, mirror those found in a mobile home bill of sale. The key distinction lies in the nature of the item being sold; one deals with movable living spaces, whereas the other concerns immovable property.

The General Bill of Sale is also closely related to the California Mobile Home Bill of Sale, serving as a broad document that can be used to transfer ownership of personal property from one party to another. Items like furniture, electronics, or even animals can be sold using a general bill of sale, making it a versatile document. Similar to a mobile home bill of sale, it captures essential details of the transaction, including a description of the item, the sale price, and the parties involved, ensuring there is a legal record of the transfer.

Finally, the Boat Bill of Sale shares several commonalities with the California Mobile Home Bill of Sale. It is specifically used for documenting the sale and transfer of ownership of a watercraft. Much like the mobile home bill of sale, it includes detailed information about the boat being sold, such as its make, model, year, hull identification number (HIN), and an odometer reading if applicable. This document too requires the signatures of both the seller and buyer, serving as a legal record of the sale and protecting the interests of both parties involved.

Dos and Don'ts

When filling out the California Mobile Home Bill of Sale form, it's important to pay close attention to detail and ensure all the information provided is accurate and complete. This document is crucial for the legal transfer of ownership and may be required for registration purposes or tax assessments. Here are some guidelines to follow:

Do:

- Verify the accuracy of the mobile home’s make, model, year, and serial number. Mistakes in these details can cause significant issues in the ownership transfer process.

- Include the full legal names and addresses of both the seller and the buyer to ensure there's no ambiguity about the parties involved.

- Specify the sale date and the total purchase price to establish a clear timeline and financial understanding of the transaction.

- Ensure that both the buyer and seller sign and date the form. In some cases, witness or notary signatures may also be required for added legal validity.

- Keep a copy of the fully completed form for your own records. Both the buyer and the seller should retain a copy to protect their interests and for future reference.

- Check with local county offices if any additional documentation is needed to accompany the Bill of Sale, as requirements can vary.

Don't:

- Leave any fields blank. If a section does not apply, mark it with N/A (Not Applicable) rather than leaving it empty.

- Forget to check the form for any specific requirements unique to the county where the mobile home is located. Local laws may have additional stipulations.

- Use unclear language or abbreviations that might confuse the parties or officials reviewing the document.

- Rely solely on verbal agreements or understandings. The Bill of Sale serves as a legal document and should contain all agreements in writing.

- Dismiss the importance of a thorough inspection of the mobile home before completing the sale. Any issues discovered post-sale should ideally be documented and agreed upon in the Bill of Sale.

- Ignore the necessity to report the sale to the California Department of Housing and Community Development (HCD) if required, as failing to do so can lead to legal and financial complications.

Misconceptions

When dealing with the sale or purchase of a mobile home in California, the Mobile Home Bill of Sale form plays a crucial role. However, there are several misconceptions about this document that can lead to confusion and misunderstanding. It's important to clarify these misconceptions to ensure both buyers and sellers are well-informed about the process.

A Mobile Home Bill of Sale is all that's needed for ownership transfer. - Many people believe that completing a Mobile Home Bill of Sale is sufficient for legally transferring ownership. However, this form is just one part of the process. In California, ownership is officially transferred when the Department of Housing and Community Development (HCD) records the change. The bill of sale supports the transfer but does not replace the need for proper registration and titling through the HCD.

Notarization is required for the form to be legal. - Unlike some other legal documents, the Mobile Home Bill of Sale in California does not require notarization to be considered valid. While having the document notarized may add an extra layer of verification, it's not a legal necessity for the sale of a mobile home in California.

The form is the same regardless of where you buy the mobile home in California. - While the basics of a Mobile Home Bill of Sale form are consistent, local jurisdictions may have additional requirements or clauses that need to be included. It's crucial for both parties to check with local authorities to ensure all local regulations and requirements are met.

There is no need to report the sale to any other entity. - This is a common misconception. Aside from submitting a Mobile Home Bill of Sale, you must report the sale to the California Department of Housing and Community Development (HCD). Reporting the sale ensures that the state records are updated accordingly, and is essential for tax and registration purposes.

Any form found online will suffice. - While it's true that many templates for a Mobile Home Bill of Sale can be found online, it's essential to use a form that complies with California's specific requirements. Utilizing an incorrect form might lead to issues during the ownership transfer process. It is recommended to use forms from reliable sources or directly from the California Department of Housing and Community Development (HCD) website.

Understanding these key points about the Mobile Home Bill of Sale in California helps buyers and sellers navigate the process more effectively, ensuring that all legal obligations are met and the transition of ownership goes smoothly.

Key takeaways

Filling out and using the California Mobile Home Bill of Sale form is a critical step in the process of buying or selling a mobile home within the state. This document serves not just as a receipt for the transaction, but as a legal record establishing the change of ownership. Understanding the essentials of completing and utilizing this form can help both parties ensure a smooth transfer of ownership. Here are seven key takeaways to consider:

- Accuracy is crucial when completing the California Mobile Home Bill of Sale. Every detail, from names and addresses to the description of the mobile home, including make, model, year, and serial number, must be documented accurately to avoid future disputes or legal challenges.

- The price of the transaction should be clearly stated on the bill of sale. This is important not only for tax assessment purposes but also as a proof of the agreed-upon sale price between buyer and seller.

- Both parties must sign and date the bill of sale. These signatures legally bind the document, confirming the agreement and terms outlined within the bill of sale. It is advisable for both parties to keep a copy of this signed document for their records.

- The bill of sale should be notarized, especially if required by local or state regulations. While not always mandatory, having the bill of sale notarized adds a layer of verification and legal protection for both parties involved.

- It is essential to verify and comply with local regulations. Some jurisdictions may have additional requirements beyond the state-level mandates for the sale of a mobile home, such as specific disclosures or inspections.

- Use the bill of sale in conjunction with the title transfer. The bill of sale alone does not prove ownership; it must be accompanied by a properly executed title transfer, which officially records the change of ownership with the state’s housing authority or department of motor vehicles.

- Finally, the completed bill of sale acts as a key document in the buyer's application for title and registration of the mobile home. Without it, the process can become significantly more complicated, underscoring its importance in the overall process.

By diligently following these guidelines, parties involved in the transfer of a mobile home in California can ensure that their transaction adheres to state laws and regulations, thereby avoiding potential legal issues and making the transition as smooth as possible.

More Mobile Home Bill of Sale State Forms

Bill of Sale for Mobile Home - Before the sale, both parties should agree on the details to be included in the Mobile Home Bill of Sale.

Mobile Home Bill of Sale Template - Details the transaction between buyer and seller for a mobile home, including identification details of the mobile home.

Title Transfer Online - A contract that establishes the buyer and seller’s agreement in the sale of a mobile home, including payment terms.

Bill of Sale for Mobile Home - Serves as the basis for insurance policies, where insurers may require a copy to verify the ownership and details of the mobile home.