Fillable Bill of Sale Document for Michigan

When individuals in Michigan decide to transfer ownership of personal property, such as vehicles, boats, or even smaller items like furniture or electronics, they often turn to a legal document known as the Bill of Sale form. This document serves as a crucial piece of evidence, confirming that a transaction has occurred between a buyer and a seller. It details the specifics of the sale, including a description of the item sold, the sale price, and the date of the transaction. Moreover, it provides vital information about the parties involved, highlighting their agreement to the terms and conditions of the sale. In Michigan, while not always legally required, the Bill of Sale form acts as a protective measure, offering peace of mind and legal clarity to both parties. It's especially important in situations where proof of ownership or the precise terms of the sale may be questioned, laying a clear trail of ownership transfer and helping to prevent potential disputes. This document, versatile and straightforward, epitomizes the importance of documenting private sales, embodying the principles of transparency and accountability in private transactions.

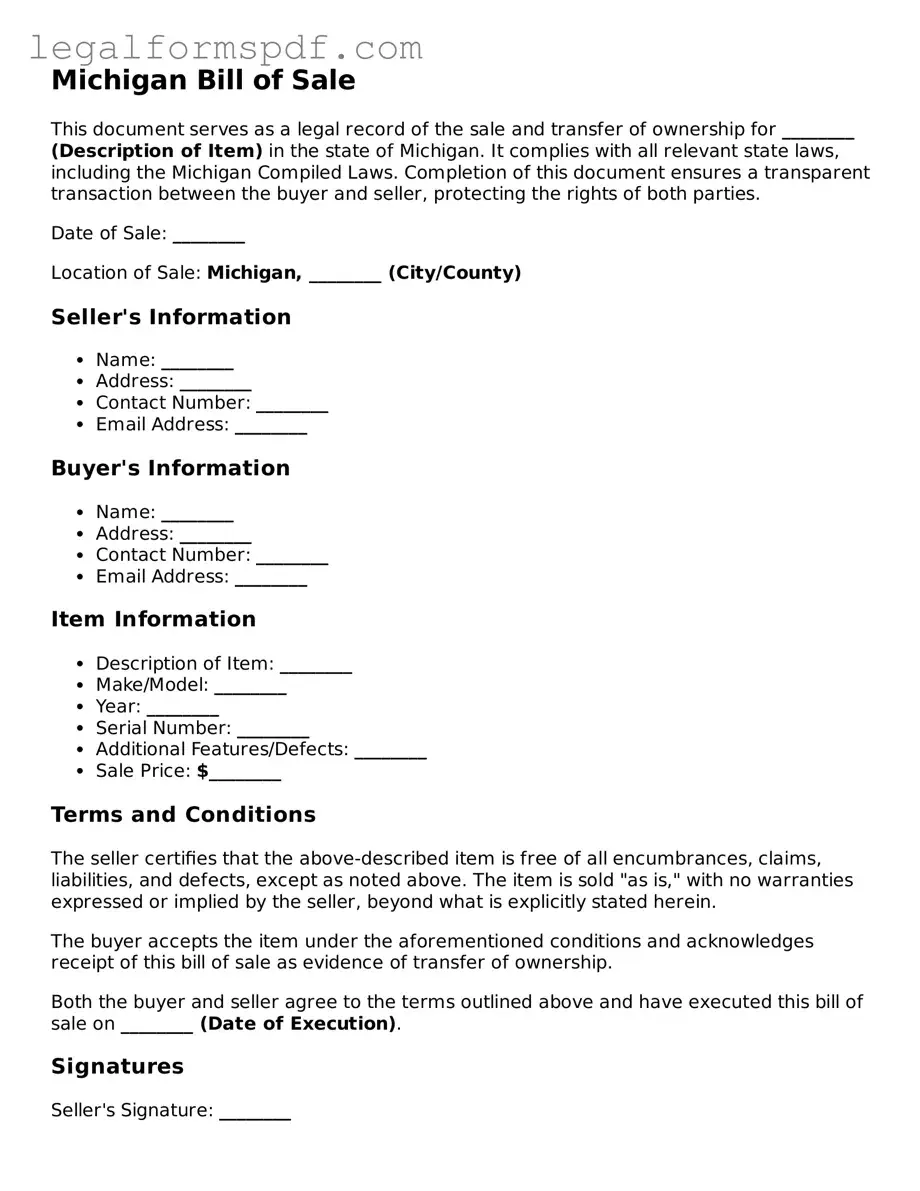

Document Example

Michigan Bill of Sale

This document serves as a legal record of the sale and transfer of ownership for ________ (Description of Item) in the state of Michigan. It complies with all relevant state laws, including the Michigan Compiled Laws. Completion of this document ensures a transparent transaction between the buyer and seller, protecting the rights of both parties.

Date of Sale: ________

Location of Sale: Michigan, ________ (City/County)

Seller's Information

- Name: ________

- Address: ________

- Contact Number: ________

- Email Address: ________

Buyer's Information

- Name: ________

- Address: ________

- Contact Number: ________

- Email Address: ________

Item Information

- Description of Item: ________

- Make/Model: ________

- Year: ________

- Serial Number: ________

- Additional Features/Defects: ________

- Sale Price: $________

Terms and Conditions

The seller certifies that the above-described item is free of all encumbrances, claims, liabilities, and defects, except as noted above. The item is sold "as is," with no warranties expressed or implied by the seller, beyond what is explicitly stated herein.

The buyer accepts the item under the aforementioned conditions and acknowledges receipt of this bill of sale as evidence of transfer of ownership.

Both the buyer and seller agree to the terms outlined above and have executed this bill of sale on ________ (Date of Execution).

Signatures

Seller's Signature: ________

Buyer's Signature: ________

This document is a legally binding agreement in the state of Michigan, ensuring a secure transaction and transition of ownership. It is advised that both parties retain a copy of this bill of sale for their records and possible future reference.

PDF Specifications

| Fact Number | Description |

|---|---|

| 1 | The Michigan Bill of Sale form serves as a legal document to record the sale of personal property from one party to another within the state of Michigan. |

| 2 | It is commonly used for the sale of vehicles, boats, motorcycles, and other valuable items. |

| 3 | The form contains details about the seller, the buyer, the item being sold, and the sale terms to ensure both parties understand the agreement. |

| 4 | While not always required by law for all transactions, it's highly recommended to have a Bill of Sale as a proof of purchase or sale agreement. |

| 5 | For vehicle transactions, Michigan law sometimes requires the Bill of Sale to be notarized, especially when the title does not have space for the sale price or when a title is not required for the transaction. |

| 6 | The document may need to include the vehicle's or boat's make, model, year, VIN (Vehicle Identification Number), and odometer reading at the time of the sale. |

| 7 | Governed by Michigan law, the Bill of Sale is a crucial part of registering and titling of the purchased item (if applicable) within the state. |

| 8 | Signing the Bill of Sale protects both the seller and buyer by providing a documented timeline of the sale which can be important for tax and liability purposes. |

| 9 | Both the buyer and seller should keep copies of the completed Bill of Sale for their records and any future disputes or queries regarding the transaction. |

Instructions on Writing Michigan Bill of Sale

Once a private sale for an item like a car, boat, or a piece of heavy equipment is agreed upon in Michigan, a Bill of Sale form serves as an official record detailing the transaction between the buyer and seller. This document is not only useful for personal record-keeping but is often required for registration and tax purposes. Filling out the Bill of Sale correctly is crucial to ensure that all parties involved have an accurate and legally binding document that reflects the terms of the sale. Follow these steps to complete the Michigan Bill of Sale form properly.

- Determine the specific type of Bill of Sale form required for your transaction, as different items like vehicles, boats, or other property may have specific forms in Michigan.

- Enter the date of the sale at the top of the form.

- List the full names and addresses of both the seller and the buyer. Ensure accuracy for legal and contact purposes.

- Describe the item being sold. Include make, model, year, and identification number if applicable. For vehicles, this would be the VIN (Vehicle Identification Number).

- Include the sale price. Specify the amount agreed upon by both parties.

- Detail any additional terms and conditions of the sale that are pertinent. This may include warranties, as-is condition statements, or other agreements specific to the sale.

- Both parties should sign and date the form. In some cases, witness signatures may also be required.

- Make copies of the completed form. Provide one to both the buyer and the seller for their records. Retain a copy for any future needs or disputes.

Completing the Michigan Bill of Sale form is a vital step in documenting the transaction accurately and legally. Both the buyer and seller should ensure all information is correct and keep a signed copy of the form. This document will serve as a proof of purchase, help in the registration process, and may be necessary for tax reporting. Being thorough and precise during this process can help safeguard the interests of both parties involved in the transaction.

Understanding Michigan Bill of Sale

What is a Bill of Sale form in Michigan?

A Bill of Sale form in Michigan is a legal document that records the transfer of ownership of personal property from a seller to a buyer. It serves as evidence of the transaction and typically includes details such as the description of the item being sold, the sale price, and the names and signatures of the parties involved.

Is a Bill of Sale form required for all sales transactions in Michigan?

No, a Bill of Sale form is not required for all sales transactions in Michigan. However, it is highly recommended to complete one for the sale of valuable items or when the sale involves personal property that does not have a title, such as furniture, tools, or electronics, to create a legal record of the transaction.

Does a Bill of Sale form in Michigan need to be notarized?

In Michigan, notarization of a Bill of Sale form is not a mandatory requirement for it to be considered valid. Despite this, having the form notarized can add an extra layer of legal protection and authenticity to the document, especially in cases of high-value transactions or potential disputes.

What information should be included in a Michigan Bill of Sale form?

A Michigan Bill of Sale form should include the full names and addresses of the buyer and seller, a detailed description of the item being sold (including make, model, year, and serial number if applicable), the sale price, the date of sale, and signatures of both the buyer and seller. It may also include terms of the sale and any warranties or as-is statements regarding the condition of the item.

Can a Bill of Sale form be used for both motor vehicles and personal property sales in Michigan?

Yes, a Bill of Sale form can be used for both motor vehicles and personal property sales in Michigan. However, specific details relevant to the sale of motor vehicles, such as the VIN (Vehicle Identification Number), mileage, and the vehicle's condition, should be included for vehicle sales. It's crucial to also transfer the title of the vehicle to finalize ownership transfer.

What are the consequences of not having a Bill of Sale form in Michigan?

Without a Bill of Sale form, it may be difficult to prove ownership or the terms of the sale if a dispute arises between the buyer and seller. This lack of documentation can lead to legal challenges, especially when there's no other evidence of the transaction. It's always safer to have a Bill of Sale to back up the details of the transaction.

Can a Michigan Bill of Sale form be created and signed digitally?

Yes, a Michigan Bill of Sale form can be created and signed digitally, as electronic signatures are legally recognized in Michigan. Ensure that the digital platform used for the document and signatures offers secure verification and storage methods to maintain the document's integrity and legal significance.

Where can one find a template for a Michigan Bill of Sale form?

Templates for a Michigan Bill of Sale form can be found through various online resources, legal document providers, or state government websites. It's important to ensure that any template used is specific to Michigan to meet the state requirements and includes all the necessary information pertinent to a legally binding Bill of Sale.

Common mistakes

Completing a Michigan Bill of Sale form can often seem straightforward, but small errors can have big consequences. One common mistake is not including all pertinent details about the item being sold. This includes the make, model, year, and serial number if applicable. These specifics are crucial for clarity’s sake and for future reference, should any misunderstandings arise or if the item's history needs to be traced.

Another area where mistakes often occur is in the personal information section. Buyers and sellers sometimes fill out their information inaccurately or incompletely, particularly with contact details. A valid address, phone number, and email are essential, not only for immediate communication needs but also for legal purposes should any disputes arise in the future.

The date of the sale is often overlooked or incorrectly recorded. It’s important to remember that this is the date when the transaction officially takes place, not necessarily when the form is filled out. This date is key for warranty start times, if applicable, and for historical records.

Many individuals mistakenly believe that a witness or notary's signature isn’t needed. While the requirements can vary, having an additional signatory can provide an extra layer of legal protection and authenticity to the document. This is especially vital if a disagreement about the sale emerges later on.

Omitting the sale price is another frequent oversight. Even if the item is a gift, it’s important to state this clearly on the form. If a price is involved, it needs to be accurately reflected. This figure has implications for tax purposes and can also serve as a piece of evidence in legal scenarios.

Terms of sale, including any warranties or "as is" statements, are sometimes neglected. Clarifying these terms at the time of sale can prevent misunderstandings and disagreements later. Whether the item comes with a warranty or is being sold in its current condition, stating this explicitly is beneficial for all parties involved.

A mistake that can nullify the effectiveness of a Bill of Sale is forgetting to sign and date the document. Every party involved in the transaction needs to do this for the document to be legally binding. This basic step is surprisingly easy to overlook but is perhaps the most crucial.

Last but not least, failing to keep a copy of the signed document can lead to headaches down the road. Each party should keep a copy for their records. This copy is crucial for verifying the transaction, for tax purposes, or in the event of a legal dispute.

Documents used along the form

When transferring ownership of property in Michigan, a Bill of Sale form is a critical document that proves the transaction took place. However, this document generally does not stand alone. There are several other forms and documents that are often used in conjunction with the Michigan Bill of Sale to ensure that the transfer is legal, thorough, and properly recorded. Understanding these associated documents will provide a comprehensive framework, securing both the buyer's and seller's interests.

- Title Transfer Form: This is particularly important when the sale involves a vehicle. The Title Transfer Form legally transfers the title of the property (often a car) from the seller to the buyer, officially recording the change of ownership with the state.

- Registration Forms: For items that require registration, such as vehicles, boats, or trailers, new owners must submit registration forms to the appropriate state department. These forms typically require information about the new owner, the sale, and the item being registered.

- Odometer Disclosure Statement: When selling a vehicle, federal law requires the disclosure of the vehicle’s odometer reading at the time of sale. This statement ensures that the buyer is aware of the vehicle’s actual mileage, which can significantly impact its value and legality.

- Warranty or As-Is Agreement: Depending on the agreement between the buyer and seller, an item may be sold with a warranty or on an "as-is" basis. This document outlines the conditions of the warranty or explicitly states that no warranty is offered, detailing what the seller is responsible for after the sale.

Employing these documents alongside a Michigan Bill of Sale can greatly smooth the process of buying or selling valuable items. They not only offer protection and peace of mind but also ensure adherence to Michigan’s legal requirements. For both buyer and seller, understanding and using these documents effectively is crucial for a successful and dispute-free transaction.

Similar forms

The Michigan Bill of Sale form shares similarities with a Sales Agreement. Like the Bill of Sale, a Sales Agreement outlines the terms of a transaction between a buyer and seller, detailing the sale of goods or services. However, the Sales Agreement often provides a more comprehensive outline of the terms, including payment schedules, delivery details, warranties, and dispute resolution mechanisms. Both documents serve to protect the interests of all parties involved and confirm the transfer of ownership, but the Sales Agreement tends to be more detailed and is used for more complex transactions.

Another document similar to the Michigan Bill of Sale is the Promissory Note. A Promissory Note is used to outline the terms of a loan between two parties, specifying the amount borrowed, interest rate, and repayment schedule. While it is primarily financial, detailing the promise to pay a debt, its similarity to the Bill of Sale lies in its legal nature and its function to solidify an agreement between two parties. The Bill of Sale confirms a sales transaction, and the Promissory Note confirms a financial agreement, both serving as legally binding documents.

The Warranty Deed is also comparable to the Michigan Bill of Sale, albeit more specific to real estate transactions. It not only transfers ownership of property from the seller to the buyer but also guarantees the buyer protection against future claims to the property. Similar to the Bill of Sale, it is a legal document that signifies a change in ownership, but it is specific to real estate and includes guarantees about the title's status, which is not typically within the scope of a Bill of Sale.

Finally, the Gift Deed has similarities with the Michigan Bill of Sale, in that both document the transfer of ownership of property. However, unlike a Bill of Sale, which involves a purchase, a Gift Deed transfers property as a gift, without consideration or payment from the recipient. Both documents are crucial for recording the change in ownership and have legal significance in protecting the parties' rights, but the key difference lies in the presence (Bill of Sale) or absence (Gift Deed) of financial consideration.

Dos and Don'ts

When you're filling out the Michigan Bill of Sale form, it's crucial to get it right. This document is a key piece of any sale and purchase transaction, serving as proof of your deal. To help you navigate this process smoothly, here are some essential do's and don'ts. Keep these in mind to ensure the form is completed accurately and effectively.

Do:- Include all necessary details: Make sure to fill in every required field, such as the names and addresses of both the buyer and the seller, a description of the item being sold (like a car, boat, or personal property), the sale price, and the date of sale.

- Verify accuracy: Double-check each piece of information for its correctness. Ensuring everything is accurate now can prevent issues later on.

- Use clear, legible handwriting: If filling out the form by hand, write neatly so that every word is easily understandable.

- Keep it official: Use a pen with blue or black ink for a professional appearance and to ensure the form is suitable for official records.

- Make copies: After completing the form, create copies for both the buyer and the seller to keep for their records.

- Include witness information: If possible, have a witness sign the form to validate the transaction further.

- Check for notarization requirements: In some cases, a bill of sale must be notarized to be considered legal. Check if this applies to your situation and act accordingly.

- Leave blank spaces: Empty fields can lead to misunderstandings or potential legal issues. Fill out every part of the form, or indicate "N/A" (not applicable) where necessary.

- Rush the process: Taking your time to ensure every detail is correct is better than hurrying and making mistakes.

- Forget to specify the condition of the item: Clearly stating whether the item is new, used, or being sold "as is" can prevent disputes between the buyer and seller later on.

- Use pencil or erasable ink: These can be altered easily, which might lead to questions about the document's authenticity.

- Overlook signatures: Both the buyer and the seller must sign the bill of sale. Missing signatures can invalidate the document.

- Ignore state laws: Be aware of Michigan's specific requirements for a bill of sale. State laws vary, and what's optional in one state might be mandatory in another.

- Discard the original copy: Keep the original document safe as it's the most valid form of proof for your transaction.

Misconceptions

When dealing with the Michigan Bill of Sale form, several misconceptions commonly arise. These misunderstandings can lead to confusion and potentially legal complications. To ensure clarity, let's debunk some of these myths:

It's only needed for vehicles. While it's true that the Bill of Sale form is often used in the sale of motor vehicles, it's also important for the transfer of ownership of other types of personal property such as boats, motorcycles, and even large pieces of equipment.

Notarization is always required. Not every Michigan Bill of Sale form needs to be notarized. The requirement for notarization varies depending on the type of property being transferred and the specific requirements of local jurisdictions.

It serves as proof of ownership. A common misunderstanding is that the Bill of Sale itself serves as definitive proof of ownership. While it does document the transaction, the actual proof of ownership is typically a title or similar document. The Bill of Sale supports the transfer of this title or ownership from the seller to the buyer.

A verbal agreement is just as valid. While verbal agreements can be legally binding, proving their terms and the parties' agreement in court can be exceptionally challenging. A written Bill of Sale provides clear evidence of the terms agreed upon by both parties.

One standard form is used for all transactions. There is no one-size-fits-all Michigan Bill of Sale form. Different forms might be required for different types of transactions or property. It's crucial to use the version that best suits the specific transaction.

The buyer is responsible for preparing the form. Either party can prepare the Bill of Sale, but it's commonly the seller's responsibility. The seller provides documentation that they have transferred ownership of the item to the buyer.

It's only necessary for high-value transactions. Regardless of the value of the transaction, a Bill of Sale is beneficial. It provides legal protection and clear documentation for both parties, even for lower-value items.

The Bill of Sale must be filed with the state. Unlike titles for cars or boats, the Bill of Sale does not typically need to be filed with any state agency. However, it's an important document to keep for personal records, tax purposes, and potential future disputes.

Any defects or issues with the item need not be mentioned. Disclosing the condition of the item being sold, including any defects or issues, is not just good practice—it can also be a legal requirement. Failure to disclose such information can lead to legal disputes and accusations of fraud.

It protects the seller from future liability. The Bill of Sale documents the transaction but does not necessarily absolve the seller from future liability, such as warranty claims or damages unless explicitly stated in the agreement. Both parties should clearly understand their rights and responsibilities.

By understanding the facts about the Michigan Bill of Sale form, individuals can navigate the process more effectively, ensuring both parties' protection and peace of mind.

Key takeaways

When dealing with transactions involving the sale of personal property in Michigan, utilizing a Bill of Sale form is a crucial step for both buyers and sellers. Here are some key takeaways to understand when filling out and using the Michigan Bill of Sale form:

- Accuracy is key: It's of utmost importance to provide accurate information about the item being sold and the parties involved in the transaction. This includes detailed descriptions, serial numbers (when applicable), and personal identification details.

- Verification of the information: Before signing, both parties should verify all details on the form for accuracy. This prevents future disputes regarding the terms of the agreement.

- Signature requirements: The Bill of Sale must be signed by both the buyer and seller. For additional legal strength, consider having the signatures notarized.

- Need for a witness: While not always mandatory, having a witness sign the document can add an extra layer of validity and protection for both parties.

- Keep multiple copies: After signing, both the buyer and seller should keep a copy of the Bill of Sale for their records. This document serves as proof of ownership and transaction.

- Legal protection: The Bill of Sale provides legal protection by documenting the transfer of ownership. It can be used in disputes if questions arise concerning the transaction's legitimacy.

- Requirement in sales: Though not always legally required for private sales, using a Bill of Sale is considered best practice and is necessary for motor vehicles, boats, and other major transactions.

- Completeness: Ensure all sections of the form are filled out. Incomplete forms may not provide adequate legal protection or proof of transaction.

- Consultation: When in doubt, consulting with a legal expert can help ensure that the Bill of Sale complies with Michigan laws and meets all the necessary legal standards.

By paying close attention to these considerations, individuals can smoothly facilitate transactions, safeguarding both parties' interests and ensuring that the process adheres to Michigan state laws.

More Bill of Sale State Forms

Bill of Sale Pennsylvania - For used vehicle sales, the document offers a safeguard against potential odometer fraud, as it includes the current mileage.

Free Bill of Sale Georgia - In estate planning and settlement, a Bill of Sale can document the transfer of personal property.

North Carolina Vehicle Bill of Sale - Using a Bill of Sale solidifies the legitimacy of a transaction, offering a layer of security against scams or counterfeit payments.