Fillable Bill of Sale Document for Illinois

When it comes to transferring ownership of personal property in Illinois, the Bill of Sale form plays a pivotal role in ensuring the transaction is legally binding and clearly documented. This crucial document serves multiple purposes, from offering legal protection to both the buyer and the seller to serving as a key piece of evidence in the registration process of certain types of property. It's a straightforward form that spells out the specifics of the item being sold, including details such as the price, condition, and any warranties. Not only does it act as a receipt for the transaction, but it also plays a significant role in the prevention of fraud, by providing a written record of the exchange. In Illinois, while not always mandatory for every type of personal property sale, its use is highly recommended, particularly for high-value items or where required by law, such as for vehicles or boats. Understanding its contents, importance, and when and how to use it can make a substantial difference in transaction security and peace of mind for involved parties.

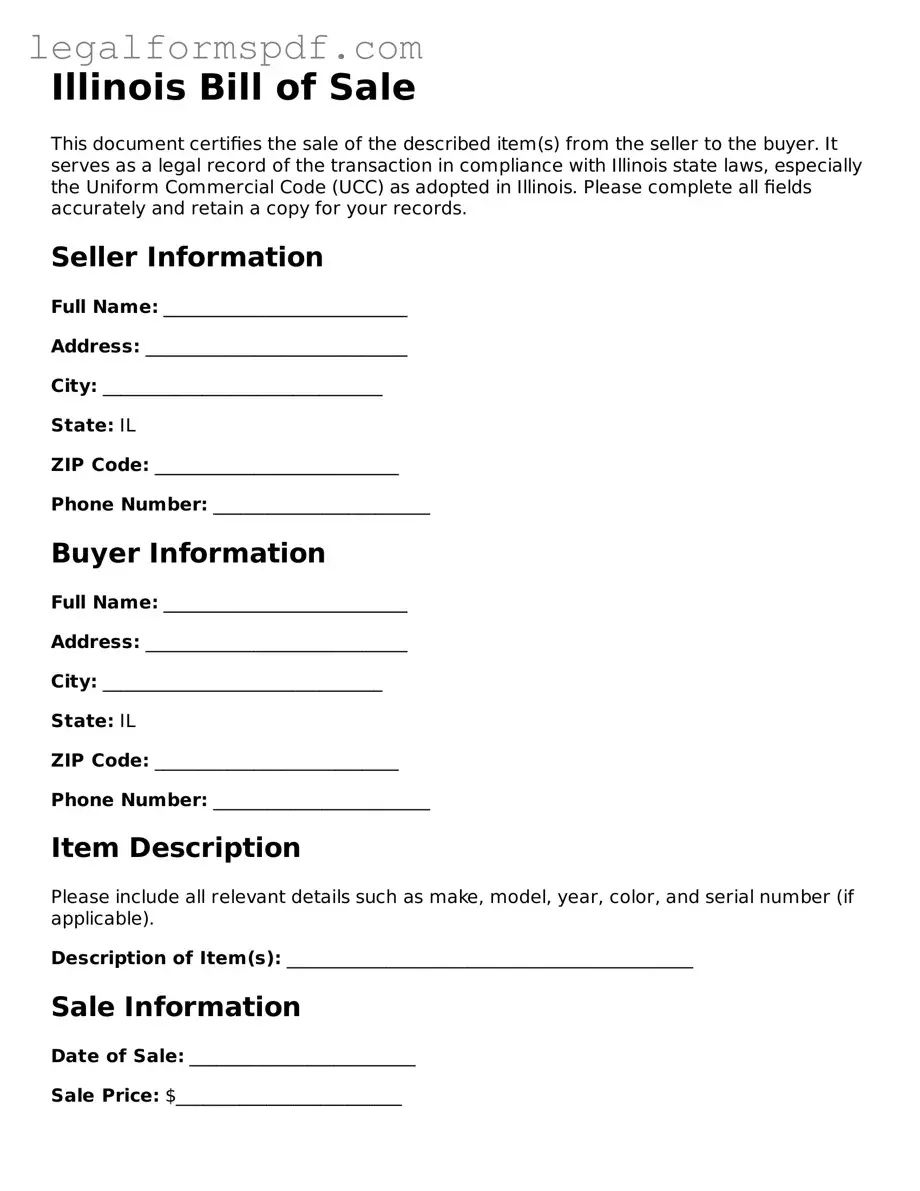

Document Example

Illinois Bill of Sale

This document certifies the sale of the described item(s) from the seller to the buyer. It serves as a legal record of the transaction in compliance with Illinois state laws, especially the Uniform Commercial Code (UCC) as adopted in Illinois. Please complete all fields accurately and retain a copy for your records.

Seller Information

Full Name: ___________________________

Address: _____________________________

City: _______________________________

State: IL

ZIP Code: ___________________________

Phone Number: ________________________

Buyer Information

Full Name: ___________________________

Address: _____________________________

City: _______________________________

State: IL

ZIP Code: ___________________________

Phone Number: ________________________

Item Description

Please include all relevant details such as make, model, year, color, and serial number (if applicable).

Description of Item(s): _____________________________________________

Sale Information

Date of Sale: _________________________

Sale Price: $_________________________

Signatures

Both parties agree that the above information is accurate and that the item(s) are sold "as-is", with no warranties expressed or implied by the seller.

Seller's Signature: _________________________ Date: ____________

Buyer's Signature: _________________________ Date: ____________

Witness (if required)

Although not always required, it is highly recommended to have a witness present at the time of signing.

Witness's Signature: ______________________ Date: ____________

By signing, the witness affirms the identities of both the buyer and seller and the occurrence of the transaction on the date and place specified.

Additional Information

- Keep a copy of this document for personal records.

- Check with local government offices for any additional steps required to finalize the sale, such as title transfer and registration.

- This document does not constitute a title transfer. Ensure compliance with all Illinois state requirements to legally transfer ownership.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | Used to document the sale of personal property in Illinois. |

| Governing Law | Uniform Commercial Code as adopted by Illinois. |

| Necessity for Vehicles | Essential for transferring vehicle ownership; requirements may vary for vehicles. |

| Information Included | Typically includes details of the buyer, seller, item sold, and the sale price. |

| Witness Requirement | Not always required, but recommended for legal protection. |

| Other Uses | Can also be used for sales of other personal property like furniture or electronics. |

Instructions on Writing Illinois Bill of Sale

When a person decides to sell or buy a vehicle in Illinois, completing a Bill of Sale form is an essential step in the process. This document serves as a crucial piece of evidence, confirming the transaction between the seller and the buyer. It ensures that the transfer of ownership is legally recorded and recognized. Below are step-by-step instructions to correctly fill out the Illinois Bill of Sale form, ensuring a smooth and compliant transaction.

- Begin by entering the date of the sale. This should reflect the day, month, and year when the transaction is completed.

- Next, write down the full legal name of the seller followed by their complete address, including the city, state, and zip code.

- Repeat the previous step for the buyer's information, providing their full legal name and complete address.

- Describe the item being sold. In the case of a vehicle, include the make, model, year, VIN (Vehicle Identification Number), and the odometer reading at the time of sale.

- Determine the sale price of the item and write it down in the space provided. If the item was gifted, you should note a nominal amount or mention it was a gift.

- Both the buyer and the seller must sign the document. Ensure that these signatures are obtained to validate the Bill of Sale.

Once the Illinois Bill of Sale form is fully completed and signed by both parties, it acts as a legal document. It should be kept as a record by both the seller and the buyer. This document might be required for registration, taxation purposes, or to resolve any future disputes regarding the vehicle's ownership. It's important to note that this form may also need to be notarized depending on the local jurisdiction's requirements.

Understanding Illinois Bill of Sale

What is an Illinois Bill of Sale form?

A Bill of Sale form in Illinois is a legal document that records the transfer of ownership of personal property from a seller to a buyer. It acts as evidence of the transaction and typically includes details such as the description of the item sold, the sale price, and the names and signatures of the involved parties.

Is an Illinois Bill of Sale form required for private sales?

For certain types of private sales in Illinois, such as vehicles, a Bill of Sale form is highly recommended and sometimes required for legal and tax purposes. It provides proof of purchase and can be necessary for the registration or transfer of titles.

Does the Illinois Bill of Sale need to be notarized?

In most cases, Illinois does not require a Bill of Sale to be notarized. However, having it notarized can add an extra layer of legal protection and authenticity to the document, particularly for significant transactions like the sale of a vehicle.

What information should be included in the form?

An effective Illinois Bill of Sale form should include the date of the sale, a detailed description of the item being sold (including make, model, year, and serial number, if applicable), the sale price, and the printed names and signatures of the seller and buyer. Contact information for both parties and any warranties or conditions of the sale should also be clearly stated.

Can you use an Illinois Bill of Sale form for all types of personal property?

Yes, an Illinois Bill of Sale form can be used for the sale of various types of personal property, such as vehicles, boats, firearms, and more. However, specific items like vehicles may require additional documentation for the transfer of ownership to be legally recognized.

Common mistakes

When completing an Illinois Bill of Sale form, it's crucial to avoid common mistakes to ensure the document is valid and serves its intended purpose. A Bill of Sale is a legal document that records the transfer of ownership of an item from the seller to the buyer. It's often used for the private sale of vehicles, but it can also apply to other personal property. Preparing this document accurately is essential for both parties involved.

One common error is not including detailed descriptions of the item being sold. For vehicles, this means the make, model, year, VIN (Vehicle Identification Number), and odometer reading at the time of sale should be clearly stated. A vague or incomplete description can lead to disputes or confusion regarding what was actually sold.

Another mistake is failing to verify the accuracy of the buyer's and seller's information. Names should be written as they appear on official identification, and addresses should be current. Incorrect or outdated information can complicate future communications or legal proceedings related to the sale.

Often, individuals omit important details such as the sale date and price. The date of sale is critical for establishing when the ownership officially changed hands, while the sale price can have tax implications for both parties. Neglecting these details undermines the document's validity.

A significant oversight is not specifying the condition of the item, particularly "as is" or with a warranty. This clarification is vital as it informs the buyer of their rights and protections regarding the item's condition at the time of purchase. Failing to address this could lead to legal disputes if the item does not meet the buyer's expectations.

Additionally, individuals often neglect to obtain signatures from both parties or to date these signatures. This step is crucial for the Bill of Sale to be legally binding. Without the signatures and dates, the document may not hold up as evidence of the transaction in a court of law.

Some fail to make or keep copies of the completed form. Both the buyer and the seller should retain a copy for their records. Keeping a copy helps in resolving any future disputes and is necessary for registration and tax purposes.

Ignoring state-specific requirements is also a critical error. Certain states may have additional stipulations for a Bill of Sale to be considered valid. In Illinois, for instance, it's important to ensure compliance with all state laws concerning the sale of personal property.

A mistake frequently made is using an incorrect or outdated form. Always use the most current form available from a reliable source to ensure that it meets all legal requirements.

Another frequent mistake is not clarifying payment terms. Clearly state if the payment is in full, in installments, or involves a trade. Any ambiguity regarding payment can lead to legal complications.

Lastly, a common pitfall is processing the Bill of Sale without a witness or notary, when required. While not always mandated, having the form witnessed or notarized can add a layer of authenticity and may protect against disputes about the legitimacy of the signatures.

Avoiding these mistakes can save individuals from potential legal headaches and ensure that the Illinois Bill of Sale effectively transfers ownership of property from one party to another. Being meticulous and thorough when filling out this document is in the best interest of both the seller and the buyer.

Documents used along the form

When transferring ownership of personal property in Illinois, a Bill of Sale form serves as a key document. It provides written evidence of the transfer between the seller and the buyer. However, this form is often supported by various other documents to ensure the legality of the transaction, establish the history of the item, and fulfill state requirements. The following list elaborates on some of these additional documents often used alongside an Illinois Bill of Sale form.

- Odometer Disclosure Statement: Required for the sale of vehicles, this document records the vehicle's mileage at the time of sale and ensures accuracy for the buyer.

- Title Certificate: For the sale of a vehicle or boat, the title certificate proves ownership and is needed to transfer ownership to the buyer.

- Warranty Document: If the item being sold comes with a warranty, this document details the warranty's terms, ensuring the buyer knows what is guaranteed.

- As-Is Sales Agreement: Indicates that the item is sold in its current condition, with the seller not responsible for future repairs or problems once the sale is complete.

- Service Records: For items like vehicles or machinery, service records show the history of maintenance and repairs, providing valuable information to the buyer.

- Promissory Note: If the purchase involves a payment plan, this document outlines the details of the repayment schedule, interest, and penalties for late payments.

- Release of Liability Form: For vehicle sales, this form protects the seller from liability for any accidents or violations involving the vehicle after the sale.

- Registration Documents: Necessary for vehicles and boats, these documents are required for the buyer to register the item in their name with the state.

- Inspection Reports: For items that require it, such as vehicles, an inspection report provides an official assessment of the item's condition at the time of sale.

While the Bill of Sale form is a crucial component of a personal property transaction, these additional documents help to clarify the terms, protect both parties, and comply with state requirements. They provide a comprehensive overview of the item's condition, history, and any terms of the agreement, ensuring a clear and legal transfer of ownership.

Similar forms

The Illinois Vehicle Title Transfer Form, much like the Illinois Bill of Sale, is a document necessary for proving a change of ownership. It is specifically tailored for vehicles, ensuring the legal transfer from seller to buyer is recognized by the state. Both documents must be filled out accurately to ensure a smooth transition and to satisfy legal requirements, emphasizing the need for precise information about the parties involved and the item being transferred.

A Warranty Deed is another document sharing similarities with the Illinois Bill of Sale, as it is used to transfer property ownership. However, the Warranty Deed goes further by guaranteeing the buyer that the property is free from any liens and encumbrances. This similarity lies in the formal handing over of rights from one party to another, although the Warranty Deed offers more in terms of the seller's guarantees.

The Quitclaim Deed, much like the Bill of Sale, is used in the transfer of property but without any warranties regarding the quality of the title. The primary similarity is in its function to convey ownership rights, albeit with the Quitclaim Deed specifically focusing on relinquishing any interest the grantor may have in the property without stating that the interest is valid.

The Sales Agreement document closely mirrors the Illinois Bill of Sale by outlining the specific terms and conditions of a sale between two parties. It provides detailed information about the product or service, including price, condition, and terms of sale, similar to the Bill of Sale's requirement for detailed descriptions of the item being sold and the agreement terms.

A General Receipt is similar to the Bill of Sale in that it serves as proof of a transaction between two parties. However, it is more general and can be used for various types of transactions, not limited to the sale of goods. Both documents serve the critical function of providing written evidence of the transfer of value from one person to another.

The Promissory Note shares similarities with the Bill of Sale by establishing an agreement between two parties. In a Promissory Note, one party promises to pay a certain amount to the other, often related to the sale. While the Bill of Sale finalizes the transaction of ownership, the Promissory Note focuses on the transaction of repayment, underlining the exchange aspect contained in both documents.

Conditional Sales Contracts are akin to the Illinois Bill of Sale in that they document the sale of an item, but with the addition of conditions that must be met before the full ownership is transferred. This similarity lies in their foundational purpose to document a sale, with the Conditional Sales Contract taking a step further to protect both parties until certain terms are fulfilled.

The Loan Agreement can be compared to the Illinois Bill of Sale as it records an agreement between two parties, but instead of a sale, it details the terms under which one party lends money to another. Both are contractual agreements that outline specific conditions agreed upon by both parties, ensuring clarity and legality in personal and professional dealings.

The Security Agreement shares a common goal with the Illinois Bill of Sale, which is to specify the parameters of a transaction. While the Bill of Sale documents the sale of personal property, the Security Agreement is used to provide a lender a security interest in the property. This is done as collateral for a loan, showing both documents' role in providing legal safeguards for transactions.

Finally, the Commercial Lease Agreement, like the Bill of Sale, is essential for documenting the terms between two parties, this time for the lease of commercial property. It specifies the lease terms, from duration to payment details, akin to how the Bill of Sale outlines the sale details. Though one focuses on leasing and the other on selling, both serve to formalize an agreement and protect the interests of all parties involved.

Dos and Don'ts

When filling out the Illinois Bill of Sale form, it's important to approach the task with attention and care. This document plays a crucial role in the process of selling and buying property, as it provides legal proof of the transaction. To ensure accuracy and legality, here are five dos and don'ts to keep in mind:

Do:- Provide complete information on both the seller and the buyer. This includes full names, addresses, and contact details. Accuracy here is paramount for the validity of the document.

- Describe the item being sold in detail. This description should include make, model, year, and any other identifying features or serial numbers. The more detailed, the better.

- Include the sale date and the purchase price. Clearly stating when the transaction took place and for how much ensures a transparent record of the sale.

- Make sure both parties sign the document. The signatures of both the buyer and the seller are necessary to confirm the agreement and its terms.

- Keep a copy for your records. After completing the form, both the seller and the buyer should keep a copy. This serves as a receipt and a legal record.

- Leave blanks on the form. Unfilled sections can lead to misunderstandings or exploitation. If a section doesn't apply, mark it as “N/A” to show it was not overlooked.

- Use abbreviations or unclear terms. To avoid confusion, spell out words fully and use terms that are universally understood.

- Rush through the process. Taking the time to double-check information can prevent legal issues down the line.

- Forget to verify the buyer’s or seller’s identity. Ensuring that all parties are who they claim to be is crucial for a valid transaction.

- Assume it's the only document you need. Depending on the item being sold and local laws, additional paperwork may be required. Always check current state requirements.

Misconceptions

When discussing the Illinois Bill of Sale form, it's important to clarify common misconceptions that often arise. Misunderstandings can lead to confusion or legal mishaps, which, in this context, could affect the legitimacy of a transaction or the registration of property. Here, we aim to dispel some of these fallacies with accurate information.

The Bill of Sale is optional in Illinois: This is a common misconception. While not all transactions require a Bill of Sale, Illinois law does require this document for the private sale of vehicles and in cases where the title does not have space for the sale price and the odometer reading. It acts as a legal record of the transaction, offering protection to both the buyer and the seller.

Any Bill of Sale form will work: Another misunderstanding is that any Bill of Sale form found online would suffice. Illinois has specific requirements that a valid Bill of Sale must meet, including the inclusion of certain information like the date of the sale, purchase price, and detailed information about the item sold. Using an inadequately detailed form could invalidate the document.

Only the seller needs to sign the Bill of Sale: It's a widespread belief that only the seller's signature is necessary. However, for the document to hold more significant legal weight, both the buyer and the seller should sign it. This practice ensures that the transaction is mutually recognized and agreed upon, increasing the document's enforceability.

A Bill of Sale replaces a title: Some people think that having a Bill of Sale is enough to prove ownership and that it can replace a title. This is not true. In the case of vehicles, for example, a title transfer must occur for legal ownership to change hands. The Bill of Sale complements the title by proving the transaction took place but does not replace the title itself.

The Bill of Sale does not need to be notarized in Illinois: Generally, this statement is accurate; Illinois does not require a Bill of Sale to be notarized for it to be considered valid. Nonetheless, having the document notarized can add a layer of protection and authenticity, serving as evidence that the signatures on the document are genuine, should any disputes arise.

Addressing these misconceptions head-on helps in navigating the complexities of private sales and registrations in Illinois, ensuring that all parties are adequately protected and that transactions comply with state requirements. For any specific concerns or situations, consulting with a legal expert is always advisable.

Key takeaways

When handling transactions involving the sale of personal property, vehicles, or other items in Illinois, the Illinois Bill of Sale form plays a pivotal role. Here are some key takeaways that should be understood and followed to ensure a smooth process:

- Verification of Details: Ensure that the form includes accurate descriptions of the items being sold, including serial numbers, model types, and any identifying characteristics. This verification helps protect both the buyer and the seller.

- Complete All Required Fields: The Illinois Bill of Sale form requires specific information, such as the names and addresses of both the buyer and the seller, the sale amount, and the date of sale. Leaving fields blank can lead to misunderstandings or legal complications.

- Signature of Both Parties: The document is not legally binding unless signed by both the buyer and the seller. Make sure these signatures are placed on the form to validate the transaction.

- Witnesses or Notarization: Depending on the nature of the sale, it may be beneficial to have the signatures witnessed or the document notarized to add an extra layer of authenticity and protection.

- Make Copies: After the form is fully executed, it's important to make copies for both parties. Having a copy of the bill of sale can serve as a receipt and proof of ownership transfer.

- Possession of the Form: Retain the bill of sale for as long as you own the item. It could be requested by various government agencies or financial institutions to prove ownership.

- Legal Importance: Understand that the Illinois Bill of Sale is a legally binding document. It can be used in legal disputes regarding ownership or terms of the sale. Therefore, it's critical to ensure the accuracy and completeness of this document.

Following these guidelines when completing and using the Illinois Bill of Sale form can provide legal protections and peace of mind for both the buyer and the seller. It serves not only as a receipt for the transaction but also as an important legal document in case any disputes arise.

More Bill of Sale State Forms

Can You Do a Title Transfer Online - This form can protect a buyer from claims by previous owners or creditors of the seller, making it a crucial document in the sale process.

Printable:onqmighvyqw= Bill of Sale - With pets or animals, it may include additional details such as breed, age, and health status.