Fillable Horse Bill of Sale Document for Texas

The Texas Horse Bill of Sale is a crucial document for anyone buying or selling a horse in the Lone Star State. It serves not just as a proof of transaction, but as a legally binding agreement that details the terms and conditions of the sale. This form provides a clear record of the horse's description, including its breed, age, and health status, ensuring that both parties have a mutual understanding of what is being exchanged. Beyond the basic sales information, the form often includes guarantees about the horse's health and soundness, offering peace of mind to the buyer. The importance of this form extends beyond the immediate sale, as it plays a vital role in transferring ownership, establishing liability, and potentially averting future disputes. With provisions that protect both the buyer and seller, the Texas Horse Bill of Sale is designed to facilitate a smooth and fair transaction, reflecting the unique considerations involved in the sale of equine animals.

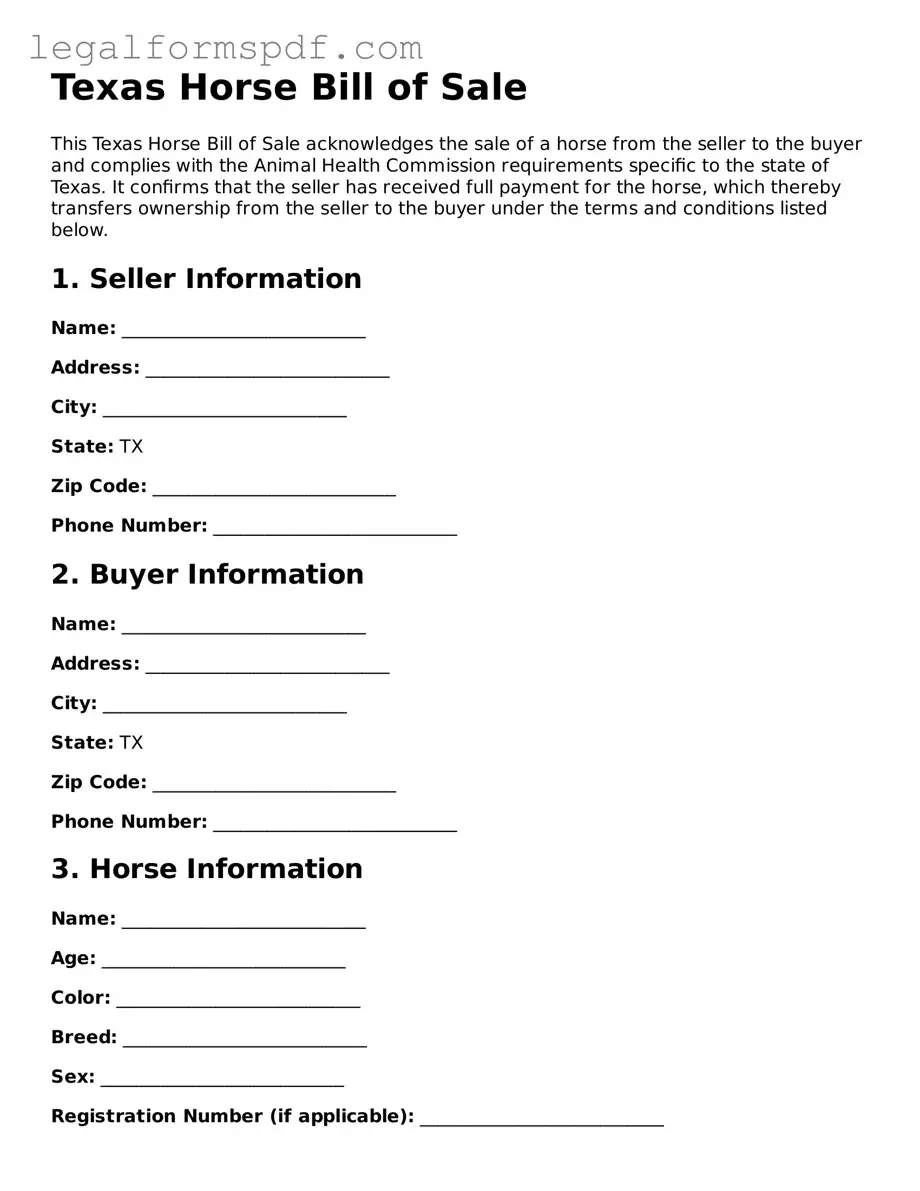

Document Example

Texas Horse Bill of Sale

This Texas Horse Bill of Sale acknowledges the sale of a horse from the seller to the buyer and complies with the Animal Health Commission requirements specific to the state of Texas. It confirms that the seller has received full payment for the horse, which thereby transfers ownership from the seller to the buyer under the terms and conditions listed below.

1. Seller Information

Name: ___________________________

Address: ___________________________

City: ___________________________

State: TX

Zip Code: ___________________________

Phone Number: ___________________________

2. Buyer Information

Name: ___________________________

Address: ___________________________

City: ___________________________

State: TX

Zip Code: ___________________________

Phone Number: ___________________________

3. Horse Information

Name: ___________________________

Age: ___________________________

Color: ___________________________

Breed: ___________________________

Sex: ___________________________

Registration Number (if applicable): ___________________________

4. Sale Information

Sale Date: ___________________________

Sale Price: $___________________________

Payment Method: ___________________________

5. Terms and Conditions

This bill of sale states that the seller guarantees they have the full authority to sell the horse. The seller confirms that the horse is being sold free from all claims and offsets. Any warranties or additional agreements must be listed explicitly or will be considered non-existent.

6. Signatures

Seller's Signature: ___________________________ Date: ________________

Buyer's Signature: ___________________________ Date: ________________

7. Witness (if applicable)

Name: ___________________________

Signature: ___________________________ Date: ________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | The Texas Horse Bill of Sale form is a legal document proving the transaction and change of ownership of a horse in the state of Texas. |

| Governing Law | Governed by the Texas Uniform Commercial Code and relevant livestock or equine statutes. |

| Components | Includes details of the buyer, seller, horse (description, breed, age), sale amount, and any warranties or agreements. |

| Importance | Provides legal protection for both buyer and seller, clarifying the terms of the sale and ensuring transparency. |

| Necessity for Vet Inspection | Recommended but not legally required; ensures the horse's health status is known before the sale. |

| Witness Requirement | While not mandatory, having a witness or a notarized signature strengthens the enforceability of the document. |

| Limitations | Applies only within the state of Texas; transactions across state lines may be subject to additional regulations. |

| Filing Requirement | Not required to be filed with a state agency but should be kept by both parties for their records and possible future disputes. |

Instructions on Writing Texas Horse Bill of Sale

When buying or selling a horse in Texas, a Horse Bill of Sale form is a crucial document that both parties should complete and sign. This document officially records the transaction and provides proof of ownership transfer from the seller to the buyer. Filling out this form accurately is important to ensure that all details of the sale are properly documented. Here's a step-by-step guide to help you complete the Texas Horse Bill of Sale form smoothly.

- Start by entering the date of the sale at the top of the form.

- Next, fill in the full names and addresses of both the seller and the buyer. Make sure to include any relevant contact information such as phone numbers or email addresses.

- In the section provided, describe the horse being sold. Include important details such as the horse's name, breed, color, age, sex, registration number (if applicable), and any other distinguishing features or marks.

- Enter the purchase price of the horse in dollars. Be sure to spell out the amount and also represent it in numerical form for clarity.

- If there are any specific terms and conditions of the sale, document them clearly in the provided area. This can include payment plans, warranties, or other agreements specific to the sale.

- Both the seller and the buyer must sign and date the form. This is a crucial step as it legally binds both parties to the sale and acknowledges the transfer of ownership.

- As an optional step, it is recommended to have the form notarized. While this is not a legal requirement in Texas, having the document notarized can provide an additional level of authenticity and may be helpful in resolving any future disputes.

Once the Texas Horse Bill of Sale form has been completed and signed, both the buyer and the seller should keep a copy for their records. This document serves as an official record of the transaction and is important for both insurance and registration purposes. Ensure all information is clear and accurate before finalizing the sale to protect both parties involved.

Understanding Texas Horse Bill of Sale

What is a Texas Horse Bill of Sale form?

A Texas Horse Bill of Sale form is a legal document that proves the sale and transfer of ownership of a horse from a seller to a buyer in the state of Texas. It serves as a receipt for the transaction and includes key details such as the horse's description, sale price, and parties' information.

Why is a Horse Bill of Sale important in Texas?

This document is crucial for several reasons. It provides legal proof of the change of ownership, which can help in disputes. It also ensures transparency in the transaction, detailing the horse's condition and any warranties. For taxation and registration purposes, it serves as a record of the transaction's value.

What information should be included in a Horse Bill of Sale?

The form should include the names and addresses of both the buyer and seller, a detailed description of the horse (including age, breed, color, and any identifying marks), the sale price, the date of sale, and signatures of both parties. It may also cover warranties or conditions of the sale.

Is a Horse Bill of Sale required by law in Texas?

While Texas law does not specifically require a bill of sale for the private transaction of horses, having one is highly advisable. It not only provides legal protection but also ensures clear terms of sale and ownership transfer, preventing future disputes.

Does the Horse Bill of Sale need to be notarized in Texas?

Notarization is not a legal requirement for a Horse Bill of Sale in Texas. However, having the document notarized can add a layer of legal credibility and assurance, verifying the identity of the signatories and the authenticity of their signatures.

What if there are issues with the horse after the sale?

If problems arise with the horse after the sale, the bill of sale's terms and conditions will guide the resolution. If the sale was "as is," the buyer might have limited recourse. However, if warranties regarding the horse's condition were included, the buyer might seek remedies based on those warranties.

Can a Horse Bill of Sale be used for registering a horse in Texas?

Yes, a Horse Bill of Sale can be used as part of the documentation required for registering a horse in Texas. However, additional paperwork may be required by specific registries or organizations, so it's advisable to check their particular requirements.

How can I create a Texas Horse Bill of Sale?

To create a Horse Bill of Sale in Texas, you can use a template specific to the state or draft one ensuring all necessary information is included. It's advisable to consult with a legal professional to ensure the document meets all legal standards and fully protects your interests.

Common mistakes

When filling out the Texas Horse Bill of Sale form, one common mistake is neglecting to provide a complete description of the horse. This detail is crucial for identifying the animal and avoiding future disputes. The description should include the horse's age, breed, color, markings, and any unique identifiers such as tattoos or microchip numbers. Leaving out any of these details can create confusion and pose problems if the horse's ownership is ever contested.

Another error is failing to specify the sale conditions clearly. This section should outline whether the sale includes warranties or is being made on an "as is" basis. Without this clarity, buyers may assume they are entitled to certain guarantees about the horse's health and fitness for a particular purpose. If the sale is intended to be "as is," explicitly stating this protects the seller from future claims that the horse did not meet the buyer's expectations.

Not correctly detailing the payment terms is also a significant oversight. The bill of sale should clearly mention the total purchase price, a breakdown of initial deposits or installment payments if applicable, and the due dates for these payments. This information is vital to avoid misunderstandings or disputes over financial arrangements. Additionally, specifying acceptable payment methods can prevent disagreements over how and when the payment is made.

Lastly, many individuals forget to facilitate the necessary acknowledgments for the bill of sale to be legally binding. This includes ensuring the document is signed and dated by both the buyer and the seller. Furthermore, it's advisable to have the signatures notarized to confirm the identity of the parties involved. Ignoring this step could affect the legal enforceability of the document, making it more challenging to resolve any disputes that arise.

Documents used along the form

When engaging in the purchase or sale of a horse in Texas, the Horse Bill of Sale form is crucial, but it's just one of a number of important documents involved in the process. These documents collectively ensure the legality and smoothness of the transaction, considering the welfare of the animal, and meeting the regulatory and financial requirements. Here’s a list of other forms and documents commonly used alongside the Texas Horse Bill of Sale form:

- Coggins Test Certificate: This certificate provides proof that the horse has been tested for Equine Infectious Anemia (EIA) within the last 12 months. It's a crucial health requirement for the sale and transport of horses.

- Health Certificate: Issued by a veterinarian, this document confirms that the horse is in good health at the time of sale. It's often required for transporting the horse across state lines.

- Pre-Purchase Examination (PPE) Certificate: A document that details the findings of a comprehensive veterinary exam conducted before the sale. It helps the buyer make an informed decision.

- Proof of Ownership: This document establishes the seller's legal ownership of the horse and the right to sell it. It can take various forms, including previous bills of sale or registration papers.

- Transfer of Ownership Documentation: Required by breed or sport registries when ownership changes, to update the horse’s registered details.

- Warranty of Fitness: A document that may be provided by the seller guaranteeing the horse’s fitness for a specific purpose, such as racing or breeding.

- Boarding Agreement (if applicable): If the horse will be boarded, this document outlines the terms and conditions of its care, including fees, services, and liabilities.

- Training Agreement (if applicable): Similar to the boarding agreement, this document details the arrangements and expectations for the horse’s training under a new or continuing trainer.

- Payment Plan Agreement (if applicable): When the sale involves installment payments, this document specifies the schedule, amounts, and other conditions of the payment agreement.

Together, these documents play a fundamental role in ensuring that transactions involving horses are conducted fairly, transparently, and with due consideration for the animals' welfare. Whether you are a buyer or a seller, it is important to be familiar with these forms and documents to ensure a smooth and lawful transaction.

Similar forms

The Texas Horse Bill of Sale form is closely related to the Vehicle Bill of Sale, commonly used during the sale of cars, motorcycles, and boats. Both documents serve as proof of purchase and transfer of ownership from seller to buyer. They typically include critical information such as the description of the item being sold (be it an animal or a vehicle), the sale price, and the date of sale. Both forms also require the signatures of both parties involved in the transaction to legitimize the agreement and often need to be notarized to add an extra layer of authenticity and legal protection.

Another document similar to the Texas Horse Bill of Sale form is the General Bill of Sale. This document is more versatile, covering the sale of various items aside from animals, like furniture, electronics, or other personal property. The General Bill of Sale serves the same primary purpose: to record the transaction details and transfer ownership from the seller to the buyer. Like the Horse Bill of Sale, it includes descriptions of the items being sold, the agreed-upon price, and both parties' signatures.

The Livestock Bill of Sale shares a specific similarity with the Texas Horse Bill of Sale form as it is also used in the sale of animals. However, the Livestock Bill of Sale can apply to various farm animals, including cows, pigs, sheep, and goats, not just horses. It ensures that information pertinent to the livestock, such as breed, age, and health status, is officially documented alongside the transaction’s financial and identification details.

Similar to the Texas Horse Bill of Sale, the Pet Bill of Sale is used for transactions involving animals; however, it focuses on pets like dogs, cats, birds, and exotic animals. This document proves ownership transfer and typically includes specifics about the pet, such as breed, date of birth, health information, and any other unique identifiers. Both the Pet and Horse Bills of Sale are designed to protect all parties involved in the transaction, ensuring clarity and responsibility regarding pet welfare.

The Equipment Bill of Sale is akin to the Texas Horse Bill of Sale but revolves around the purchase and sale of equipment, such as machinery, tools, or office supplies. While it serves a similar function in recording the sale and transferring ownership, the details included focus on the equipment's description, condition, serial number, and any warranties or disclaimers. This document is important for both individual and business transactions where equipment of significant value is exchanged.

The Firearm Bill of Sale, much like the Texas Horse Bill of Sale, is a legally binding document specifically designed for a certain type of property, in this case, firearms. It meticulously records the transfer of ownership of a gun from the seller to the buyer and includes detailed information such as make, model, caliber, and serial number, along with the sale price and the parties' signatures. This document is particularly important due to the legal regulations surrounding firearm ownership and transfer.

The Real Estate Bill of Sale, although related to the sale of property rather than animals, operates under a similar principle as the Texas Horse Bill of Sale. It is used to document the transaction between buyer and seller for the transfer of real estate ownership. While it deals with much more complex transactions, the core elements remain: a description of the property being sold, the agreed-upon price, and legally binding signatures. This document helps ensure clarity and legal standing for both parties in a real estate transaction.

The Artwork Bill of Sale is another document with purposes akin to the Texas Horse Bill of Sale, focusing on transactions involving pieces of art. It serves as a record of the sale and transfer of ownership of artwork between a seller and a buyer. Essential information such as the artwork's creator, title, medium, dimensions, and authenticity, alongside the sale price and the date of sale, are included. Both parties’ signatures on the document solidify the transaction and protect the interests of both the buyer and the artist or seller.

Dos and Don'ts

When filling out the Texas Horse Bill of Sale form, it's important to ensure that the process is conducted with attention to detail and adherence to legal requirements. This document serves as a legal record of the sale and transfer of ownership of a horse. To assist with this, here are some do's and don'ts that should be carefully considered:

Do's- Provide complete information: Ensure that all fields in the form are filled out with accurate and complete information. This includes the names and addresses of both the buyer and seller, detailed description of the horse, and the sale date and price.

- Describe the horse accurately: Include a full description of the horse being sold, such as breed, color, age, sex, and any identifying marks or registration numbers. This helps prevent any disputes about which horse was sold.

- Sign in front of a witness or notary: Though not always legally required, getting the bill of sale signed in front of a witness or notarized adds an extra layer of protection and authenticity to the document.

- Keep copies of the bill of sale: Both the buyer and seller should keep a copy of the bill of sale for their records. This document serves as proof of purchase and can be important for registration, insurance, or tax purposes.

- Leave sections blank: Do not skip any sections or leave blanks on the form. If a section does not apply, it is better to write "N/A" (not applicable) rather than leaving it empty.

- Rush through the process: Take the necessary time to review all information entered into the form. Accuracy is crucial for any legal document, and rushing could lead to mistakes or omissions that could complicate future transactions.

Misconceptions

When it comes to trading horses in Texas, the Horse Bill of Sale is an important document that confirms the transaction between buyer and seller. However, several misconceptions about this form can lead to confusion. It's crucial to debunk these myths for a clear understanding of its significance and requirements.

You don't need a Horse Bill of Sale if you trust the other party. This is a dangerous misconception. Regardless of trust, having a written document protects both parties if any disputes or questions about the sale arise in the future.

A verbal agreement is just as good as a written Bill of Sale. While verbal agreements might be legally binding, proving their terms becomes incredibly difficult if disagreements occur. A written, signed Horse Bill of Sale serves as concrete evidence of what was agreed upon.

Any form of written agreement will serve as a Horse Bill of Sale. Not all written agreements meet the necessary legal requirements. A valid Horse Bill of Sale in Texas should include specific information such as the date of sale, detailed descriptions of the horse, and the terms of the sale.

There's no need to describe the horse in detail on the Bill of Sale. A detailed description of the horse, including age, breed, color, and any identifying marks, is crucial. This ensures there's no ambiguity about which horse is being sold and protects both parties.

The Horse Bill of Sale doesn't have to be signed. For a Horse Bill of Sale to be legally binding in Texas, it must be signed by both the seller and the buyer. In some cases, witness signatures or notarization could also be required for additional verification.

Once the Bill of Sale is signed, the buyer assumes all responsibility for the horse immediately. While this is typically the case, the actual transfer of responsibility can be subject to the terms agreed upon in the Bill of Sale. Sometimes, there might be conditions affecting the immediate transfer of responsibility.

You don't need a lawyer to create a Horse Bill of Sale. While it's possible to prepare a Horse Bill of Sale without legal assistance, consulting a lawyer can ensure that all the necessary legal requirements are met and that both parties' interests are adequately protected.

A Horse Bill of Sale is only helpful if there's a dispute. While it's invaluable in disputes, a Horse Bill of Sale also provides a clear record of ownership transfer, which can be helpful for registration, tax purposes, or even personal records.

Understanding these misconceptions and ensuring a properly executed Horse Bill of Sale can prevent potential legal headaches and ensure a smooth transaction for both the buyer and seller of a horse.

Key takeaways

Completing and utilizing the Texas Horse Bill of Sale form is a pivotal step in the sale and purchase of a horse within the state. This document not only serves as proof of the transaction but also ensures the protection of all parties involved. Here are five key takeaways to consider:

Comprehensive Information is Crucial: Both the seller and the buyer must provide detailed information. This includes names, addresses, and contact details. The horse's description—such as age, breed, color, and any identifying marks—should be meticulously detailed to ensure there are no misunderstandings.

Clear Terms of Sale: The document should clearly outline the terms of the sale. This includes the sale price, payment plan (if any), and the date of sale. Clarity on these terms is essential to avoid future disputes or confusion.

Warranties or Guarantees: If the seller offers any warranties or guarantees about the horse’s health or capabilities, these must be explicitly stated in the bill of sale. Absence of these terms means the buyer accepts the horse "as is," potentially limiting recourse if issues arise post-sale.

Signatures are Necessary: The bill of sale must be signed by both the buyer and the seller. These signatures are crucial, as they represent each party’s agreement to the sale's terms and acknowledgment of the transaction. It's a good practice for each party to keep a copy of the signed document.

Notarization is Not Mandatory but Recommended: While Texas law does not mandate the notarization of the Horse Bill of Sale, having it notarized adds an extra layer of authenticity. Notarization can serve as a safeguard against disputes or claims that the document is fraudulent or that a signature was forged.

Utilizing the Texas Horse Bill of Sale form correctly is vital for a smooth transaction. Both parties are encouraged to review the document thoroughly before signing it, ensuring all information is accurate and complete. Awareness and adherence to these key points can significantly contribute to a successful and dispute-free transfer of ownership.

More Horse Bill of Sale State Forms

Free Horse Bill of Sale - Can include signatures from both parties, as well as witnesses, to certify that the information provided is accurate and agreed upon.

Equine Bill of Sale - It's essential to have a Horse Bill of Sale notarized, especially in transactions where significant amounts of money are involved, to add an extra layer of legal protection.