Fillable Horse Bill of Sale Document for Ohio

In the heart of the Buckeye State, where horsemanship is not just a pastime but a way of life for many, the importance of a solid, legally-binding document to memorialize the sale or purchase of a horse cannot be overstated. The Ohio Horse Bill of Sale form steps into this pivotal role, offering a crucial layer of protection and clarity for both buyer and seller in these transactions. Designed to encapsulate all the essential details, the form records the horse's description, the agreed-upon price, the date of sale, and the identities of the involved parties, providing a tangible record that can help prevent misunderstandings and disputes. The specifics of the document, while straightforward, carry significant legal weight, ensuring that all terms of the agreement are clear and enforceable. With the stakes so high in horse trading, where animals of significant value change hands, the Ohio Horse Bill of Sale becomes a necessary tool in the savvy equestrian's toolkit, fostering trust and transparency in an industry where reputation and reliability are everything.

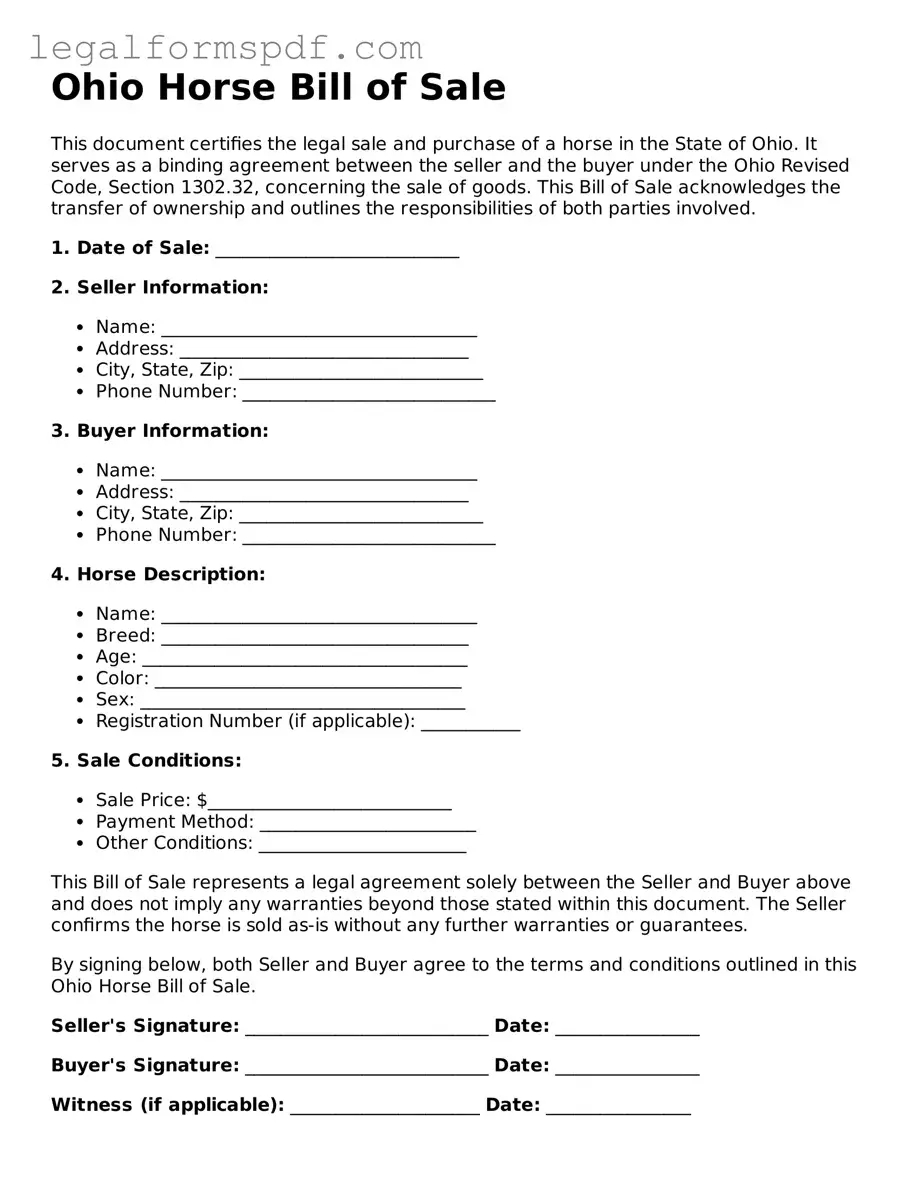

Document Example

Ohio Horse Bill of Sale

This document certifies the legal sale and purchase of a horse in the State of Ohio. It serves as a binding agreement between the seller and the buyer under the Ohio Revised Code, Section 1302.32, concerning the sale of goods. This Bill of Sale acknowledges the transfer of ownership and outlines the responsibilities of both parties involved.

1. Date of Sale: ___________________________

2. Seller Information:

- Name: ___________________________________

- Address: ________________________________

- City, State, Zip: ___________________________

- Phone Number: ____________________________

3. Buyer Information:

- Name: ___________________________________

- Address: ________________________________

- City, State, Zip: ___________________________

- Phone Number: ____________________________

4. Horse Description:

- Name: ___________________________________

- Breed: __________________________________

- Age: ____________________________________

- Color: __________________________________

- Sex: ____________________________________

- Registration Number (if applicable): ___________

5. Sale Conditions:

- Sale Price: $___________________________

- Payment Method: ________________________

- Other Conditions: _______________________

This Bill of Sale represents a legal agreement solely between the Seller and Buyer above and does not imply any warranties beyond those stated within this document. The Seller confirms the horse is sold as-is without any further warranties or guarantees.

By signing below, both Seller and Buyer agree to the terms and conditions outlined in this Ohio Horse Bill of Sale.

Seller's Signature: ___________________________ Date: ________________

Buyer's Signature: ___________________________ Date: ________________

Witness (if applicable): _____________________ Date: ________________

PDF Specifications

| Fact | Detail |

|---|---|

| Purpose | The Ohio Horse Bill of Sale form serves as a legal document to record the sale and transfer of ownership of a horse from the seller to the buyer. |

| Required Information | It typically includes details such as the names and addresses of the buyer and seller, a description of the horse, the sale price, and the date of sale. |

| Governing Law | This form is governed by the laws of the State of Ohio, which dictate the sale and purchase of horses within the state. |

| Signatures | The document must be signed by both the seller and the buyer to be considered valid and legally binding. |

| Additional Provisions | It may also include other terms and conditions agreed upon by both parties, such as warranties or specific agreements regarding the horse's care or transportation. |

Instructions on Writing Ohio Horse Bill of Sale

Filling out the Ohio Horse Bill of Sale form is a crucial step in the process of buying or selling a horse within the state. This document serves as a legal record of the transaction, detailing the agreement between the buyer and the seller. It offers protection and clarity to both parties involved, ensuring that the transfer of ownership is recognized by law. Proper completion of this form is essential to its validity, so attention to detail is paramount throughout the process. Follow these instructions carefully to ensure that every section of the form is filled out correctly.

- Begin by entering the date of the sale at the top of the form. This should reflect the day the transaction is completed and ownership is transferred.

- Write the full legal name and address of the seller in the designated area. This should include street address, city, state, and zip code.

- In the respective section, fill in the buyer’s full legal name and address, following the same format as the seller's information.

- Detail the horse’s description, including name, breed, date of birth, color, and any identifying marks or registration numbers. This section is critical for the identification of the horse being sold.

- Enter the purchase price of the horse in U.S. dollars, and specify the terms of the sale. Indicate whether the sale is for cash, a trade, or other conditions as agreed upon by both parties.

- If applicable, list any additional terms or conditions of the sale that have been agreed upon. This could include items such as payment plans, return policies, or responsibilities for veterinary checks.

- Both the buyer and the seller must sign and date the form. These signatures legally bind both parties to the terms of the bill of sale and acknowledge their understanding and agreement.

- For added validity, it is recommended to have the document witnessed and signed by a neutral third party. Although not always required, this step can lend additional legal weight to the document.

Once the Ohio Horse Bill of Sale form is fully completed and signed, both the buyer and the seller should keep a copy for their records. This document not only confirms the transfer of ownership but also serves as evidence of the conditions and terms under which the sale took place. It is an essential piece of any horse sale transaction within Ohio, safeguarding the rights and interests of both parties involved.

Understanding Ohio Horse Bill of Sale

What is an Ohio Horse Bill of Sale Form?

An Ohio Horse Bill of Sale Form is a legal document used in the state of Ohio to record the sale and transfer of ownership of a horse from the seller to the buyer. This form typically includes details such as the name and address of both parties involved in the transaction, a description of the horse being sold, the sale price, and any other terms or conditions agreed upon by both parties. It serves as proof of purchase and can be essential for registration, insurance, and legal purposes.

Why do I need a Horse Bill of Sale in Ohio?

In Ohio, a Horse Bill of Sale is crucial for several reasons. It provides a written record of the sale, which can help to prevent future disputes over the ownership of the horse. Additionally, it outlines the details of the transaction, providing clear evidence of the terms agreed upon by both the seller and the buyer. This document can also be necessary for tax purposes and is important for the buyer to have when registering the horse or obtaining insurance.

What information should be included in a Horse Bill of Sale?

A comprehensive Ohio Horse Bill of Sale should include the date of the sale, the names and addresses of both the buyer and seller, a detailed description of the horse (including breed, color, age, sex, and any identifying marks), the sale price, any warranties or guarantees provided by the seller, and the signatures of both parties involved. It may also detail specific terms and conditions, such as trial periods or return policies.

Is notarization required for a Horse Bill of Sale in Ohio?

While notarization is not specifically required by Ohio law for a Horse Bill of Sale to be considered valid, having the document notarized can add a layer of legal protection and authenticity. Notarization helps to verify the identity of the parties and the genuineness of their signatures, which can be particularly useful in preventing disputes or in court proceedings.

Can I write a Horse Bill of Sale by hand in Ohio?

Yes, you can write a Horse Bill of Sale by hand in Ohio. However, it is essential to ensure that the handwriting is legible and that all the required information is accurately included. Using a typed or pre-formatted document is often preferred to reduce the risk of misunderstandings or errors that can arise from hard-to-read handwriting.

What happens if I lose my Horse Bill of Sale?

If you lose your Horse Bill of Sale, it's important to act quickly. Contact the other party involved in the transaction and request a copy. If that's not possible, legal advice might be necessary to explore options for verifying the sale and ownership of the horse. It’s wise to keep a digital backup of the document to prevent such situations.

Are digital signatures accepted on Ohio Horse Bill of Sale forms?

As technology advances, digital signatures are becoming more accepted across various legal documents for their convenience and security. However, it’s crucial to ensure that both parties are comfortable with digital signatures and that the method used complies with Ohio's laws regarding electronic signatures. Always check the current legal standards or consult with a legal professional before proceeding with digital signing.

Common mistakes

When dealing with the Ohio Horse Bill of Sale form, buyers and sellers often make mistakes that can lead to complications down the line. One common error is not providing complete details about the horse, including its age, breed, color, and any identifying marks. This information is crucial for accurately identifying the animal and avoiding disputes about its condition or ownership.

Another frequent oversight is failing to specify the sale terms clearly. These terms should cover the purchase price, payment schedule (if applicable), and any other conditions agreed upon by both parties. Without this clarity, misunderstandings can arise, potentially leading to legal issues.

Many people also neglect to verify or provide the horse's health and vaccination records. These documents are essential for the buyer’s peace of mind and for ensuring the horse's well-being. By omitting this information, sellers risk the buyer's dissatisfaction or accusations of misrepresentation.

A critical mistake often made is not getting the bill of sale notarized. Though not always a legal requirement, having the document notarized adds a layer of authenticity and can be invaluable in cases where the sale is later disputed.

Buyers and sellers sometimes forget to list any warranties or guarantees being made about the horse. Whether it's a guarantee of the horse’s health for a certain period or warranties regarding its suitability for specific activities, these assurances should be explicitly stated to avoid future legal challenges.

Overlooking the need to include a return policy or trial period in the bill of sale is another common error. This can lead to issues if the buyer discovers a problem with the horse that was not apparent at the time of purchase.

Incorrectly dating the document or failing to include the date at all can also lead to difficulties. The sale date is crucial for establishing when the ownership officially transferred and for any related warranties or guarantees.

Another misstep is failing to provide contact information for both the buyer and the seller, including addresses and phone numbers. This oversight can significantly complicate future communications regarding the horse.

Some people mistakenly believe that a handshake agreement or verbal understanding is sufficient and fail to create a written bill of sale. This is perhaps the most significant error, as a written document is vital for legally documenting the transaction and protecting both parties' interests.

Finally, it's not uncommon for individuals to rely on generic sales forms without ensuring that all aspects of the document comply with Ohio's specific legal requirements. Tailoring the bill of sale to meet state-specific regulations is essential for its effectiveness and enforceability.

By avoiding these common mistakes, buyers and sellers can ensure a smoother and more legally secure transaction when transferring ownership of a horse in Ohio.

Documents used along the form

When buying or selling a horse in Ohio, a Horse Bill of Sale is a critical document that officially records the transaction and transfer of the animal from the seller to the buyer. However, to ensure the legality and safety of the transaction, several other forms and documents may be used alongside the Horse Bill of Sale. Each of these documents serves a specific purpose, contributing to a transparent, lawful, and smooth transfer process.

- Pre-Purchase Exam Certificate: Before a sale, the horse might undergo a pre-purchase examination. This certificate provides a professional veterinarian's assessment of the horse's health and condition, ensuring the buyer is informed of any potential issues.

- Coggins Test Certificate: A crucial health document that shows the horse has tested negative for Equine Infectious Anemia (EIA). Most states, including Ohio, require this test for horse sales and transportation.

- Health Certificate: Issued by a licensed veterinarian, this certificate confirms the horse's overall health and is often required for transporting the horse across state lines.

- Proof of Ownership: A document or previous bill of sale demonstrating the seller's legal ownership of the horse. This assures the buyer of a rightful purchase.

- Registration Papers: If the horse is registered with any breed associations, these documents verify its pedigree, breed, and registration status, enhancing its value and authenticity.

- Warranty Deed: Although not as common, a warranty deed guarantees the buyer that the horse is free from any liens or encumbrances, offering peace of mind regarding legal issues.

- Boarding Agreement: If the horse will remain at its current stable or be moved to a new one, a boarding agreement outlines the terms and conditions of its care, including fees and services.

- Training Records: For a horse that has received professional training, these records detail the training history and achievements, offering insight into the horse's capabilities and behavior.

- Insurance Documents: If the horse is insured, these documents provide details about the coverage scope, helping protect the buyer's investment against future health issues or accidents.

Together with the Ohio Horse Bill of Sale, these documents create a comprehensive packet that ensures the sale is conducted legally and ethically, protecting both the buyer and the seller. It's important for all parties involved in the transaction to understand these documents' relevance and ensure they are properly filled out and up to date. This not only helps in avoiding legal troubles but also ensures the well-being and proper management of the horse involved in the transaction.

Similar forms

The Ohio Horse Bill of Sale is a document many might find similar in purpose and structure to a Vehicle Bill of Sale. Both serve as legal agreements that document the sale and transfer of ownership from one party to another. In the case of a vehicle, it's from the seller to the buyer of the car, motorcycle, or any motor vehicle, ensuring all details about the transaction and the vehicle itself are clearly stated. This is much like how a Horse Bill of Sale outlines specifics about the horse being sold, including its description and the terms of the sale.

Another document comparable to the Ohio Horse Bill of Sale is the General Bill of Sale. Used for selling and buying personal property, the General Bill of Sale covers a broad range of items beyond horses or vehicles, like furniture or electronics. While the specific details tailored to the item being sold differ, the core function of the document—to cement the transfer of ownership under agreed-upon conditions—remains constant, making it fundamentally akin to the Horse Bill of Sale.

The Warranty Deed also shares similarities with the Ohio Horse Bill of Sale, albeit in the context of real estate transactions. A Warranty Deed is used to transfer ownership of property with the guarantee that the seller holds a clear title to the property in question. While it deals with real estate as opposed to horses, the essence of ensuring a rightful, legal transfer of property from one party to the other aligns closely with the purpose behind the horse sale documentation.

Similarly, the Quit Claim Deed, which is utilized to transfer any interests in real property from the grantor to the grantee without any guarantee about the quality of the property title, echoes the essence of a Bill of Sale. Like the Horse Bill of Sale, the Quit Claim Deed records a specific agreement between parties, albeit with less formal guarantee concerning the title being transferred. The fundamental principle of documenting a transfer is a common thread between the two.

The Pet Bill of Sale can also be compared to the Ohio Horse Bill of Sale, as both are tailored to transactions involving animals. However, the Pet Bill of Sale typically encompasses a wide array of animals other than horses, possibly including details suited to pets like dogs, cats, or exotic animals. Despite this difference, both documents serve the primary function of recording the sale, including details such as the animal’s identity, health conditions if applicable, and terms agreed upon by the buyer and seller.

An Adoption Certificate, while not a bill of sale, shares thematic similarities with the Ohio Horse Bill of Sale in terms of formalizing a change in custody or ownership. This document is most often used in the context of legally adopting a child or pet, recording the event and certifying the adoptee's new relationship with their adoptive parent or owner. Although its purpose diverges in terms of not facilitating a sale, the underlying principle of documenting a new guardianship stands parallel.

Lastly, the Livestock Bill of Sale hews closely to the specific intent and content of the Ohio Horse Bill of Sale, specifically tailored for livestock transactions, including cattle, pigs, sheep, and more. It outlines details of the livestock being sold and the transaction's conditions, reflecting the structure and intention behind the Horse Bill of Sale, with a more specific focus on farm animals. This document is crucial for recording the specifics of agricultural or breeding business transactions, further emphasizing its similarity in ensuring a clear, legal change in ownership.

Dos and Don'ts

When you're filling out an Ohio Horse Bill of Sale form, it's crucial to ensure that the process is done correctly to protect both the buyer and the seller. Here are some do's and don'ts to help guide you through the process:

- Do verify the identity of both the buyer and the seller. Make sure to have valid identification for both parties.

- Do include a detailed description of the horse. Mention the horse's breed, age, color, and any identifying marks.

- Do state the sale price clearly on the form. Also, clarify the payment method and terms of sale.

- Do specify any warranties or guarantees being made about the horse's health or capabilities.

- Do get the form notarized if required by state law to add an extra layer of legality to the document.

- Don't leave any fields blank. If something doesn't apply, it's better to write "N/A" than to leave it empty.

- Don't forget to include any additional agreements or terms that have been mutually agreed upon by both parties.

- Don't neglect to give a copy of the bill of sale to both the buyer and the seller for their records.

- Don't rely on verbal promises or agreements. Ensure everything agreed upon is written down in the bill of sale.

Remember, a Horse Bill of Sale not only serves as a receipt for the transaction but also as a crucial document that can prevent future disputes. Adhering to these guidelines will help make the sales process smoother and more transparent for both parties involved.

Misconceptions

In discussing the Ohio Horse Bill of Sale, it's important to address common misconceptions that surround this document. People often misunderstand its purpose, requirements, and implications. Below are seven misconceptions explained to provide clarity.

A Horse Bill of Sale is not necessary in Ohio. This is a common misconception. While some may think it's not required, having a Bill of Sale is crucial when buying or selling a horse in Ohio. It serves as proof of the transaction and provides details about the sale, which can protect both the buyer and the seller from future disputes.

It's just a simple receipt. Another misunderstanding is viewing the Horse Bill of Sale as merely a receipt. In reality, it is a comprehensive document that includes critical information such as the horse's description, sale price, warranty information, and any special terms agreed upon by the parties. This makes it a key document in the sale process.

Any generic form will do. Often, individuals believe that any generic Bill of Sale form will suffice. However, a Horse Bill of Sale in Ohio should include specific details related to the animal, the transaction, and state-specific requirements to ensure it is legally binding and adequately protects all parties involved.

The buyer is the only one who needs a copy. This is false. Both the buyer and the seller should retain a copy of the Bill of Sale. Having a copy is essential for both parties for record-keeping, tax purposes, and to resolve any potential disputes that may arise after the sale.

Witnesses or notarization aren't necessary. While Ohio law does not always require a witness or notarization for a Horse Bill of Sale to be considered valid, having these can add an extra layer of legitimacy and protection. Particularly in cases of later disputes, a notarized document with witness signatures can prove invaluable.

It only includes information about the horse. While the primary focus is on the horse being sold, including its description and any specific identifiers, a comprehensive Horse Bill of Sale also encompasses terms of sale, payment details, and any representations or warranties made by the seller. This includes if the horse is being sold "as is" or with specific guarantees.

Legal assistance is not required to draft one. Many believe they can navigate the process without any help. Although it's possible to create a Bill of Sale on your own, consulting with a professional experienced in equine law can ensure all legalities are properly addressed, and the document meets all requirements, thus safeguarding all parties involved in the transaction.

Understanding these misconceptions is vital for anyone involved in the sale or purchase of a horse in Ohio, ensuring a smoother and legally sound transaction.

Key takeaways

When buying or selling a horse in Ohio, utilizing a Horse Bill of Sale form is not only good practice but essential for several reasons. This document serves as a legal proof of transaction, offers protection for both parties, and helps in accurately defining the terms of the sale. To ensure the form is filled out and used correctly, there are some key takeaways to consider.

- Accurate Information is Crucial: All details provided in the Ohio Horse Bill of Sale must be accurate and comprehensive. This includes the names and addresses of both the buyer and seller, a thorough description of the horse (age, breed, color, markings), and the sale price. Ensuring all information is precise helps prevent disputes and misunderstands down the line.

- Verification of the Horse's Condition: It's important for the Bill of Sale to include a detailed statement about the horse's current health and condition, as well as any known issues. This transparency is critical in building trust and accountability in the transaction.

- Witnesses or Notarization Enhance Validity: Though not always a legal requirement, having the Bill of Sale signed in the presence of witnesses or notarized can significantly increase its validity. This step offers an additional layer of protection and assurance for both parties involved in the transaction.

- Keep Copies for Record Keeping: After the completion of the sale, it's advisable for both the buyer and seller to retain copies of the Bill of Sale. It serves as a receipt, provides legal protection, and is useful for record-keeping purposes. Should any legal issues or questions about the transaction arise in the future, having this document readily available can be invaluable.

By taking these considerations into account, both buyers and sellers can ensure a smoother and more transparent horse transaction process in Ohio. Not only does the Horse Bill of Sale solidify the terms of the agreement, but it also fosters a sense of security and trust between all parties involved.

More Horse Bill of Sale State Forms

Equine Bill of Sale - Having this document can reassure the buyer of the legitimacy of the sale and the history of the horse being purchased.