Fillable Golf Cart Bill of Sale Document for Texas

For many, the concept of selling or purchasing a golf cart in Texas might appear straightforward until the intricacies of the transaction are considered. Enter the Texas Golf Cart Bill of Sale form, a crucial document ensuring that the transfer of ownership is conducted legally and effectively, safeguarding the interests of both the buyer and the seller. While the form itself is not a complex legal document, it encompasses significant details such as the description of the golf cart, the sale price, and the personal information of the parties involved. Its role in providing a record of the transaction cannot be understated, acting not only as proof of purchase but also as a protective measure against potential disputes. Moreover, the nuances of local regulations, requiring the form for the proper registration and operation of the golf cart, underscore its importance within the broader legal and practical framework of such transactions in Texas.

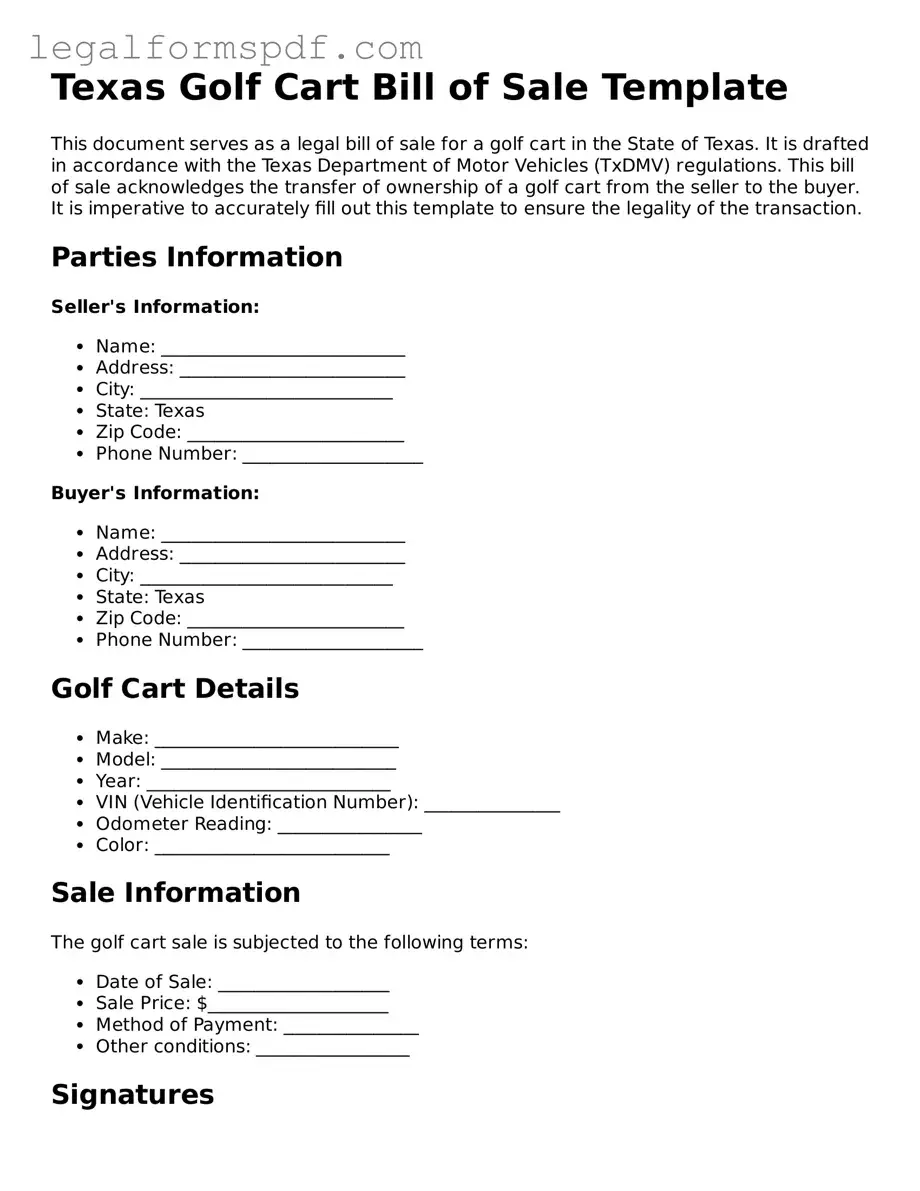

Document Example

Texas Golf Cart Bill of Sale Template

This document serves as a legal bill of sale for a golf cart in the State of Texas. It is drafted in accordance with the Texas Department of Motor Vehicles (TxDMV) regulations. This bill of sale acknowledges the transfer of ownership of a golf cart from the seller to the buyer. It is imperative to accurately fill out this template to ensure the legality of the transaction.

Parties Information

Seller's Information:

- Name: ___________________________

- Address: _________________________

- City: ____________________________

- State: Texas

- Zip Code: ________________________

- Phone Number: ____________________

Buyer's Information:

- Name: ___________________________

- Address: _________________________

- City: ____________________________

- State: Texas

- Zip Code: ________________________

- Phone Number: ____________________

Golf Cart Details

- Make: ___________________________

- Model: __________________________

- Year: ___________________________

- VIN (Vehicle Identification Number): _______________

- Odometer Reading: ________________

- Color: __________________________

Sale Information

The golf cart sale is subjected to the following terms:

- Date of Sale: ___________________

- Sale Price: $____________________

- Method of Payment: _______________

- Other conditions: _________________

Signatures

Both the seller and the buyer acknowledge the accuracy of the information provided in this Bill of Sale and agree to the transfer of ownership of the golf cart described above. It's mandatory for both parties to sign this document to validate the sale and purchase.

Seller's Signature: ___________________________ Date: ____________

Buyer's Signature: ___________________________ Date: ____________

This document is executed in good faith and is legally binding upon both parties, subject to Texas state laws.

PDF Specifications

| Fact | Detail |

|---|---|

| 1. Purpose | The Texas Golf Cart Bill of Sale form serves as a legal document to record the sale and transfer of ownership of a golf cart from one party to another. |

| 2. Requirement by Law | While not specifically required by Texas state law for private sales, this document provides a legal proof of purchase and can be important for registration and taxation purposes. |

| 3. Contents | The form typically includes details such as the make, model, and serial number of the golf cart, the sale price, and the names and signatures of the buyer and seller. |

| 4. Additional Documentation | In some cases, additional documentation, like a release of liability or an odometer disclosure statement, might be necessary alongside the Bill of Sale. |

| 5. Governing Law | Texas Transportation Code is the governing law for registering and operating golf carts in Texas, which might indirectly affect the requirements for a Bill of Sale. |

| 6. Use in Registration | The Golf Cart Bill of Sale can be used when registering the golf cart with local Texas authorities, if required in the specific county or city. |

| 7. Legal Protection | It offers legal protection to both the buyer and the seller by documenting the condition and details of the golf cart at the time of sale. |

| 8. Witness or Notarization | Though not mandated, having the Bill of Sale signed in the presence of a witness or notarized adds to the document’s credibility and legal standing. |

Instructions on Writing Texas Golf Cart Bill of Sale

When you're about to conduct a golf cart sale in Texas, a crucial step involves properly completing a Golf Cart Bill of Sale form. This document not only facilitates a smooth transaction by clearly outlining the terms of the sale but also serves as an important record for both the buyer and the seller. Let's guide you through the necessary steps to fill out this form correctly.

- Begin by writing the date of the sale at the top of the document. Ensure that you use the month, day, and year format.

- Next, detail the full legal names and addresses of both the buyer and the seller. Make sure to include any middle initials and suffixes if applicable.

- In the section designated for the golf cart description, provide the make, model, year, and vehicle identification number (VIN) of the golf cart. Double-check the VIN for accuracy to avoid future disagreements.

- State the sale price of the golf cart in the section provided. If the transaction includes any additional conditions, such as a trade or a gift, clearly specify these details.

- Include any representations or warranties the seller is offering with the sale. If the golf cart is being sold "as is," specify this clearly to inform the buyer that they are accepting the golf cart in its current condition without any guarantees.

- Both the buyer and the seller should provide their signatures at the designated spots on the form. If the form includes a section for witnesses, ensure their signatures are also obtained. Remember, the presence of witness signatures may enhance the legal standing of the document.

- If applicable, fill out the section for the notary public. Having a notary public witness the signing of the document adds an extra layer of legal validation to the sale.

- Finally, provide copies of the completed Golf Cart Bill of Sale to both the buyer and the seller for their records. It’s wise to keep this document safe in case any disputes arise or for future reference.

By following these detailed steps, you can successfully complete the Texas Golf Cart Bill of Sale form. This document will serve as a legal acknowledgment of the sale and transfer of ownership of the golf cart, providing peace of mind for all parties involved. Remember, handling this form with attention to detail ensures a transparent and efficient transaction, paving the way for a smooth changeover from the seller to the buyer.

Understanding Texas Golf Cart Bill of Sale

What is a Texas Golf Cart Bill of Sale form?

A Texas Golf Cart Bill of Sale form is a legal document which records the sale and purchase transaction of a golf cart. It serves as proof of transfer of ownership from the seller to the buyer, detailing the transaction between the two parties. This form typically includes information such as the make, model, and serial number of the golf cart, as well as the names and signatures of both the seller and the buyer, the sale date, and the purchase price.

Is a Golf Cart Bill of Sale legally required in Texas?

In Texas, a Golf Cart Bill of Sale is not legally required for the sale of a golf cart. However, it is highly recommended as it provides a written record of the sale which can protect both the buyer and the seller in the event of disputes. Additionally, while it may not be mandated for the sale, it could be necessary for registration or insurance purposes.

What should be included in a Golf Cart Bill of Sale in Texas?

A comprehensive Golf Cart Bill of Sale in Texas should include the following information: the buyer and seller's full names and addresses; the golf cart's make, model, and serial number; the sale date; the sale price; signatures of both parties involved; and any other terms or conditions that were agreed upon. Including a description of the golf cart's condition and any included warranties can also be beneficial.

Can a Texas Golf Cart Bill of Sale form be used for golf carts purchased out of state?

Yes, a Texas Golf Cart Bill of Sale form can be used for golf carts purchased out of state, as it primarily serves to document the transaction between the buyer and seller. However, it is important to ensure that all necessary steps are taken to comply with Texas laws regarding the operation and registration, if applicable, of the golf cart within the state.

How does one ensure the Texas Golf Cart Bill of Sale is legally binding?

To ensure that a Texas Golf Cart Bill of Sale is legally binding, both the buyer and the seller should provide accurate and complete information on the form and sign it. It is recommended to have the signatures notarized, although not required, to further authenticate the document. Retaining a copy of the bill of sale for both parties is also advised for record-keeping purposes and potential future reference.

What steps should be taken after completing a Golf Cart Bill of Sale in Texas?

After completing a Golf Cart Bill of Sale in Texas, the buyer should take steps to formally register the golf cart if required by their local municipality or homeowners association. Additionally, the buyer should consider purchasing insurance to protect against potential damages or liability. Both parties should keep a copy of the bill of sale for their records, and the seller should ensure that any property taxes on the golf cart are up to date and transferred to the new owner if applicable.

Common mistakes

When completing the Texas Golf Cart Bill of Sale form, a common mistake is failing to provide complete identification details for both the buyer and the seller. These details typically include full legal names, addresses, and contact information. Without this information, establishing the legality of the transaction and the ownership history of the golf cart can be problematic. Accurate and complete details ensure a clear transfer of ownership and facilitate easier communication between parties after the sale.

Another frequent oversight is not properly describing the golf cart. The description should include the make, model, year, and the Vehicle Identification Number (VIN). Omitting any of these details can lead to ambiguities regarding the golf cart being sold. This information is crucial for future title registrations or in case the golf cart is ever reported stolen or lost.

Incorrectly handling the section pertaining to the sale amount is also a common mistake. It's important to clearly state the sale price in numerals and words, to confirm the agreed amount and to avoid any confusion. Additionally, if the sale includes other conditions, such as a trade or partial gift, these should be explicitly noted to ensure a full understanding of the transaction terms.

Forgetting to outline the terms of the sale leads to misunderstandings between the seller and the buyer. This section should detail whether the golf cart is being sold "as is" or with a warranty. Clearly stating these terms helps avoid potential disputes regarding the golf cart's condition after the sale.

Another error involves the signatures on the form. Both parties must sign the bill of sale to validate the transaction. Occasionally, individuals neglect this step, leaving the document unofficial and potentially legally void. Additionally, the date of the signatures should accurately reflect the sale's completion date for record-keeping and legal purposes.

Notarization is another step that is often misunderstood or overlooked. While not always mandatory, notarizing the bill of sale can add a layer of legal protection and authenticity to the document. Ignoring notarization when recommended or required can undermine the document's credibility.

An additional pitfall is the failure to provide each party with a copy of the completed bill of sale. This document acts as a receipt and a legal record of the transaction, important for both parties for registration, tax, and liability purposes.

Lastly, many individuals mistakenly believe that a bill of sale is the only document needed to finalize the ownership transfer. However, in Texas, the transfer process might require additional steps or documentation with the local DMV. Not adhering to these requirements can lead to legal issues or a delay in the full legal transfer of the golf cart.

Documents used along the form

When transferring ownership of a golf cart in Texas, the Golf Cart Bill of Sale form is a critical document but is just a part of the documentation needed to ensure a smooth and legally compliant transaction. Beyond this essential document, a suite of other forms and documents often accompany the sale or purchase to provide comprehensive protection and legal compliance for both parties involved. Let's explore some of these key additional documents that are frequently used alongside the Golf Cart Bill of Sale.

- Title Transfer Form: This document is necessary when the golf cart has a title. It legally transfers the title from the seller to the buyer, ensuring the buyer becomes the official owner.

- Odometer Disclosure Statement: Required for vehicles, including golf carts if they have an odometer, to certify the accuracy of the mileage reported at the time of sale. This prevents odometer fraud.

- Proof of Insurance: Some states require proof of insurance for golf carts, especially if they are to be used on public roads. This document verifies that the golf cart meets the minimum insurance requirements.

- Sales Tax Payment Proof: This shows that any applicable sales tax on the purchase of the golf cart has been paid. In some locales, failure to provide this can create legal or financial liabilities.

- Registration Application: If the golf cart needs to be registered for use on public roads or communities, this application is necessary to obtain a license plate or registration sticker.

- Warranty Documents: If the golf cart is still under warranty, or if the seller is providing a warranty, these documents outline the specifics of coverage and protections for the buyer.

- Receipt of Sale: Separate from the Bill of Sale, this receipt provides a simple acknowledgment that the buyer has paid the seller the agreed upon amount for the golf cart.

- Release of Liability: This form protects the seller from being liable for any accidents or damages that occur after the sale, transferring all responsibility to the buyer upon sale completion.

- As-Is Acknowledgment: If the golf cart is being sold "as-is" without any warranty for its condition, this document ensures the buyer is aware of and accepts this condition, limiting the seller's liability for any future issues with the golf cart.

Together with the Golf Cart Bill of Sale, these documents provide a comprehensive framework for the legal sale and purchase of a golf cart in Texas, safeguarding the interests of both the buyer and the seller. It's advisable for parties involved in such transactions to familiarize themselves with these documents and ensure they are properly filled out and filed to avoid potential legal complications down the line.

Similar forms

The Texas Golf Cart Bill of Sale form shares similarities with the Vehicle Bill of Sale form used in automobile transactions. Both documents serve as legal evidence of a transfer of ownership between a seller and a buyer. They typically contain details about the item being sold (a golf cart or a vehicle), the sale amount, and the date of the sale. Additionally, they provide essential information about the seller and the buyer, including names and signatures, to authenticate the transaction.

Another document resembling the Golf Cart Bill of Sale is the Boat Bill of Sale form. This form is also utilized to document the sale and purchase of a watercraft. Like the golf cart form, it includes specifics about the boat being sold, such as its make, model, and serial number, alongside the sale price and the parties involved. Both forms act as a protective measure for the buyer and seller, offering proof of ownership and the terms of the sale agreement.

The General Bill of Sale form is akin to the Golf Cart Bill of Sale, as it is used for selling and buying various items beyond vehicles or boats, such as electronics, livestock, or machinery. This document contains information about the item sold, the sale amount, and the parties involved. Despite the broader scope of items it covers, the purpose remains the same: to record the details of a transaction and secure legal proof of the change in ownership.

Comparable to the Golf Cart Bill of Sale, the Firearm Bill of Sale form is designed for the specific transaction of selling and buying firearms. Despite the different items involved, both forms serve a similar purpose: they document key transaction details, including the item's description, the agreed-upon price, and the identification of the buyer and seller. These forms also ensure that the sale abides by applicable state laws, thus providing a layer of legal protection and accountability for both parties.

The Equipment Bill of Sale form is closely related to the Golf Cart Bill of Sale due to its role in transactions involving large or expensive pieces of equipment. Whether selling a piece of farm machinery or a golf cart, these forms capture vital information such as the make, model, and condition of the item, the sale price, and the identities of the involved parties. This documentation is crucial for tax, warranty, and legal purposes, ensuring a smooth transfer of ownership.

Similarly, the Texas Golf Cart Bill of Sale form shares characteristics with the Pet Bill of Sale form, which is used for transactions involving animals. Both documents formalize the transfer of ownership and include descriptions of the sale item (or animal), the purchase price, and personal details about the buyer and seller. While the items being sold differ greatly, the underlying principle of establishing a legally binding agreement through documented, mutual consent is the same.

Lastly, the Furniture Bill of Sale form is of a piece with the Golf Cart Bill of Sale because it documents the transfer of ownership for pieces of furniture. Both forms include detailed descriptions of the item being sold, the agreed-upon price, and information about the seller and buyer. While furniture and golf carts cater to different needs, the legal purpose of these forms—to provide a record of sale and safeguard against future disputes—remains identical.

Dos and Don'ts

When preparing a Texas Golf Cart Bill of Sale form, it is essential to approach the process with attention to detail and a clear understanding of what is required. The following lists outline five key actions you should take and five actions you should avoid to ensure the document is correctly filled out and legally binding.

Do:

Verify all the details: Double-check the golf cart's make, model, year, and vehicle identification number (VIN) to ensure they are accurately recorded.

Include all parties' information: Clearly print the full legal names, addresses, and contact information of both the seller and the buyer to ensure there's no ambiguity regarding the parties involved.

Detail the transaction: Specify the sale date and the total purchase price. If the sale includes additional terms or conditions, such as warranties or as-is status, make sure these are articulated clearly.

Obtain all necessary signatures: Ensure that both the buyer and the seller sign the bill of sale. The signatures validate the agreement between the parties.

Keep a copy for your records: After the bill of sale is completed and signed, make a copy for both the buyer and the seller. This document serves as proof of purchase and ownership transfer.

Don't:

Leave blank spaces: Avoid leaving any fields empty. If a section does not apply, mark it with N/A (Not Applicable) to indicate that it has been considered and deemed irrelevant to the current transaction.

Rush through the process: Take your time to review all sections of the bill of sale before signing. This ensures that all information is correct and that you understand the terms of the sale.

Skip the VIN: The Vehicle Identification Number is crucial for identifying the specific golf cart being sold. Make sure this number is present and accurate.

Ignore state laws: Each state can have its regulations regarding the sale of personal property, including golf carts. Familiarize yourself with Texas laws to ensure compliance.

Forget to check buyer/seller identification: To prevent fraud, it's important to verify the identity of both the buyer and the seller. This means checking that the names on the bill of sale match their government-issued ID.

Misconceptions

Many misconceptions surround the Texas Golf Cart Bill of Sale form. Understanding these misconceptions is crucial for buyers and sellers in Texas who wish to conduct transactions involving golf carts. Here are seven common misunderstandings:

- The Bill of Sale is the only document needed to legally drive a golf cart in Texas. This is incorrect. While the Bill of Sale is an essential document for transferring ownership, golf cart drivers also need to comply with local ordinances, which may require additional permits or registration.

- A Bill of Sale for a golf cart must be notarized in Texas. Not necessarily. The state of Texas does not require a notarization of the Golf Cart Bill of Sale form. However, having it notarized can add legal weight to the document.

- The form is complex and requires an attorney to fill out. The Texas Golf Cart Bill of Sale form is straightforward and designed for easy completion by the general public. While consulting an attorney can provide additional assurance, most individuals can fill it out without legal assistance.

- You can use the Golf Cart Bill of Sale form for other types of vehicles. This is a misconception. The form is specifically designed for golf carts. Other vehicle transactions require different forms that account for specific information relevant to those vehicles.

- The form provides legal permission to operate a golf cart on public roads. This statement is false. The Bill of Sale transfers ownership but doesn’t grant the right to operate the golf cart on public roads. Local laws and vehicle requirements determine where a golf cart may be legally driven.

- Once the Bill of Sale is signed, no further action is required. This overlooks important steps post-sale. After the transaction, the new owner may need to register the golf cart with local authorities, depending on local regulations, and also ensure that the golf cart meets any specific equipment standards.

- There’s a state-wide standard form that everyone must use. Actually, while Texas provides a general format for a Bill of Sale, it’s not mandatory to use a specific state-provided form. Parties can create their own Bill of Sale as long as it includes all necessary information. However, using the recognized format can simplify the process.

Understanding these misconceptions ensures that both buyers and sellers are better prepared for the legal responsibilities and requirements when transferring ownership of a golf cart in Texas. It is always beneficial to conduct thorough research or consult a professional for guidance tailored to your specific situation.

Key takeaways

When dealing with the Texas Golf Cart Bill of Sale form, there are several key points to remember that ensure a smooth and legally compliant transaction. This document is crucial for both the seller and the buyer, as it provides a written record of the sale, including details about the golf cart and terms of the sale. Here are seven key takeaways:

- Complete Information: It's important that all fields in the Texas Golf Cart Bill of Sale form are filled out completely. This includes the full names and addresses of both the seller and the buyer, detailed information about the golf cart (make, model, year, and VIN), and the sale price.

- Accuracy: Ensure that all the information provided on the form is accurate. Mistakes or inaccuracies can lead to legal complications or disputes down the line.

- Date of Sale: The date of the sale must be clearly stated on the bill of sale. This is crucial for documentation and, in some cases, for tax purposes.

- Signatures: Both the seller and the buyer must sign the bill of sale. Their signatures officially confirm the agreement and terms of the sale, making the document legally binding.

- No Alterations: Once completed and signed, the bill of sale should not be altered in any way without the written consent of both parties. Any changes could invalidate the agreement.

- Keep Copies: Both the seller and the buyer should keep a copy of the bill of sale for their records. This document can serve as proof of purchase, and may be required for registration, taxation, or legal purposes.

- Registration: In Texas, golf carts may have specific registration requirements depending on where they are used. The bill of sale may be required for the registration process, so it's important to complete it accurately and retain a copy.

Following these guidelines when filling out and using the Texas Golf Cart Bill of Sale form will help protect the interests of both parties involved in the transaction. It ensures that the sale is conducted legally and provides a clear record of the agreement and details of the golf cart sold.

More Golf Cart Bill of Sale State Forms

How to Write a Bill of Sale for a Car in Georgia - Avoids potential legal hassles by detailing the exchange, acting as a contract between buyer and seller.