Official Furniture Bill of Sale Document

When embarking on the journey of buying or selling furniture, whether it's a cherished family heirloom, a vintage find, or simply a practical piece that no longer fits in a space, navigating the transaction with clarity and legal safety becomes paramount. Enter the Furniture Bill of Sale form, a crucial document that serves as a concrete record of the transfer of ownership from seller to buyer. It not only provides proof that the transaction took place but also details the specifics: the description of the furniture, the agreed-upon price, and the identities of the parties involved. This form acts as a safeguard, ensuring both parties are on the same page, thereby minimizing potential misunderstandings or disputes. Furthermore, it can play a significant role in more pragmatic areas such as taxation and warranties, making it indispensable in personal property transactions. Despite its significance, the form itself is designed to be straightforward and user-friendly, avoiding complex legal jargon to make sure it’s accessible to everyone involved in the process. This facilitates a smoother transaction, fostering a sense of trust and security that upholds the integrity of the sale. In essence, the Furniture Bill of Sale form symbolizes not just a transfer of physical items, but a smooth transition of ownership underpinned by mutual respect and transparency.

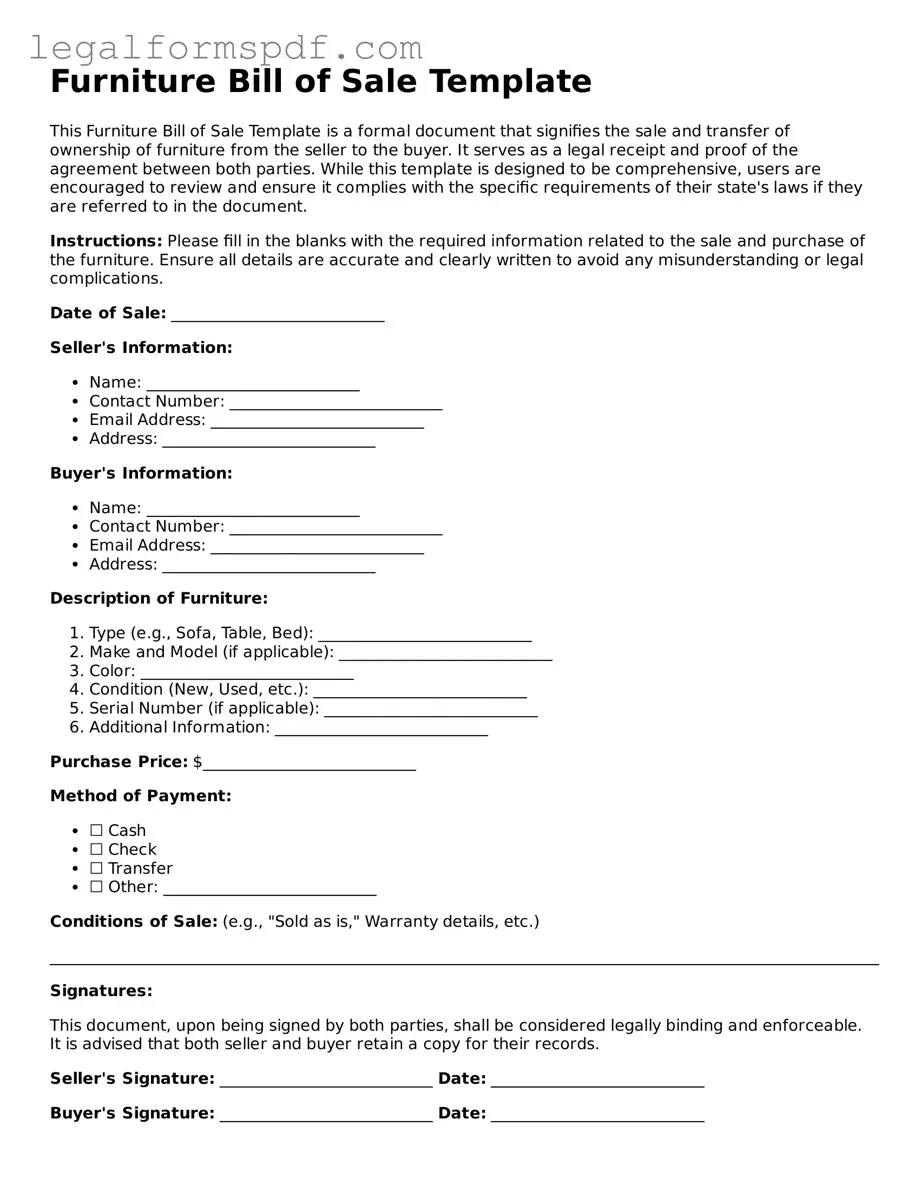

Document Example

Furniture Bill of Sale Template

This Furniture Bill of Sale Template is a formal document that signifies the sale and transfer of ownership of furniture from the seller to the buyer. It serves as a legal receipt and proof of the agreement between both parties. While this template is designed to be comprehensive, users are encouraged to review and ensure it complies with the specific requirements of their state's laws if they are referred to in the document.

Instructions: Please fill in the blanks with the required information related to the sale and purchase of the furniture. Ensure all details are accurate and clearly written to avoid any misunderstanding or legal complications.

Date of Sale: ___________________________

Seller's Information:

- Name: ___________________________

- Contact Number: ___________________________

- Email Address: ___________________________

- Address: ___________________________

Buyer's Information:

- Name: ___________________________

- Contact Number: ___________________________

- Email Address: ___________________________

- Address: ___________________________

Description of Furniture:

- Type (e.g., Sofa, Table, Bed): ___________________________

- Make and Model (if applicable): ___________________________

- Color: ___________________________

- Condition (New, Used, etc.): ___________________________

- Serial Number (if applicable): ___________________________

- Additional Information: ___________________________

Purchase Price: $___________________________

Method of Payment:

- ☐ Cash

- ☐ Check

- ☐ Transfer

- ☐ Other: ___________________________

Conditions of Sale: (e.g., "Sold as is," Warranty details, etc.)

_________________________________________________________________________________________________________

Signatures:

This document, upon being signed by both parties, shall be considered legally binding and enforceable. It is advised that both seller and buyer retain a copy for their records.

Seller's Signature: ___________________________ Date: ___________________________

Buyer's Signature: ___________________________ Date: ___________________________

Witness (if applicable): ___________________________ Date: ___________________________

Please note that while this template aims to cover common aspects of a furniture sale transaction, it is important to consult with a legal professional to ensure it meets your specific needs and complies fully with your local laws and regulations.

PDF Specifications

| Fact | Description |

|---|---|

| Purpose | The Furniture Bill of Sale form serves as a legal document that records the sale and transfer of ownership of furniture from a seller to a buyer. |

| Components | Typically includes details like the names and addresses of the buyer and seller, a description of the furniture, the sale price, and the date of sale. |

| Governing Law | Varies by state, as each state may have specific requirements for what needs to be included in the bill of sale to be considered legally binding. |

| Importance | Provides proof of ownership and transaction details, which can be important for tax, warranty, and dispute resolution purposes. |

| Customization | While templates can be used as a starting point, the form should be customized to include all relevant details and comply with local laws. |

Instructions on Writing Furniture Bill of Sale

When completing a Furniture Bill of Sale, you ensure the legal transfer of furniture from the seller to the buyer. This form provides proof of change in ownership and details the transaction, making it a straightforward task. The following steps guide you through the filling process to ensure all necessary information is accurately documented.

- Start by entering the date of the sale at the top of the form.

- Next, fill in the seller's full name and address in the designated section.

- Provide the buyer's full name and address in the corresponding section.

- Describe the furniture being sold. Include details such as type, color, make, model, and any identifying features or conditions.

- Fill in the sale amount in words and then in numbers to clarify the price agreed upon by both parties.

- If applicable, document any additional terms and conditions of the sale that the buyer and seller have agreed upon. This could include payment plans, delivery details, or the condition of the furniture at the time of sale.

- Both the buyer and the seller must sign and print their names at the bottom of the form. Include the date of signing next to their signatures.

- For additional validation, if available, have a witness sign and print their name, providing the date of their signature as well.

Completing the Furniture Bill of Sale accurately is essential for documenting the sale's details and protecting both parties' interests. Once filled out, it's advisable for both the buyer and seller to keep a copy of the document for their records.

Understanding Furniture Bill of Sale

What is a Furniture Bill of Sale?

A Furniture Bill of Sale is a written document that records the sale of furniture from one party, the seller, to another, the buyer. It serves as a proof of transaction and includes essential details such as the description of the furniture, the sale price, and the date of sale. This document is useful for both personal record-keeping and legal purposes should any disputes arise regarding the transaction.

Why do I need a Furniture Bill of Sale?

Having a Furniture Bill of Sale is important because it officially documents the transaction, providing evidence that the furniture has legally changed hands. For the buyer, it serves as a receipt and proof of ownership, while for the seller, it can help avoid any future disputes over the item's condition or ownership. Additionally, this document can be crucial for insurance purposes or when dealing with estate matters.

What information should be included in a Furniture Bill of Sale?

A comprehensive Furniture Bill of Sale should include the names and addresses of the buyer and seller, a detailed description of the furniture (including make, model, condition, and any identifying marks), the sale price, the date of sale, and payment details. It's also advisable to include signatures of both parties and, if possible, a witness to the transaction.

Do I need to notarize my Furniture Bill of Sale?

In most cases, notarization of a Furniture Bill of Sale is not a requirement for it to be legally valid. However, having it notarized can add an extra layer of authenticity and may be beneficial in ensuring the document is acknowledged as legally binding by all parties involved. It's always a good idea to check local laws and regulations, as requirements can vary by jurisdiction.

Can I create a Furniture Bill of Sale myself?

Yes, it is certainly possible to create a Furniture Bill of Sale by yourself. There are many templates available online that can serve as a guide. However, it's important to ensure that the document includes all necessary information and meets any specific requirements your local jurisdiction may have. For more complex transactions or to guarantee legal validity, you may want to consult with a legal professional.

Is a verbal agreement enough when selling furniture?

While verbal agreements can be legally binding in some cases, relying solely on one when selling furniture is not advisable. Without written documentation, it can be extremely difficult to prove the terms of the agreement or even the fact that the sale took place, should any disputes arise. A written Furniture Bill of Sale provides a clear, enforceable record of the transaction.

What should I do after completing a Furniture Bill of Sale?

After completing a Furniture Bill of Sale, both parties should keep a copy of the signed document for their records. The seller should ensure that the furniture is delivered to the buyer, and any agreed-upon terms of the sale are fulfilled. As a buyer, it's also important to update any insurance policies or homeowners' records to reflect the new acquisition.

Can I use a Furniture Bill of Sale for used furniture?

Yes, a Furniture Bill of Sale can be used for both new and used furniture. In fact, it's especially important to use one when buying or selling used furniture, as it can help document the item's condition at the time of sale and prevent future disputes about its value or state.

Does a Furniture Bill of Sale need to be witnessed?

While not always a requirement, having a third-party witness sign the Furniture Bill of Sale can lend additional credibility to the document. A witness can help verify that the transaction indeed took place and that both parties agreed to the terms listed in the bill of sale. Again, specific requirements may vary by jurisdiction, so it's beneficial to check local laws.

Can a Furniture Bill of Sale be used as tax documentation?

In some instances, a Furniture Bill of Sale can be used for tax purposes, such as deducing the purchase of business-related furniture or claiming a loss from the sale of used furniture. It's advisable to consult with a tax professional to understand how the document can be used in your individual or business tax return, as tax regulations can be complex and vary widely.

Common mistakes

When filling out a Furniture Bill of Sale form, a common mistake is not providing a detailed description of the furniture. Buyers and sellers often underestimate how crucial it is to include specifics such as the furniture's color, make, model, condition, and any unique identifiers. This oversight can lead to disputes about the items' condition or authenticity, complicating the transaction and potentially leading to legal challenges.

Another frequent error is failing to clarify the terms of sale. Many people neglect to specify whether the sale is as-is, which indicates that the buyer accepts the furniture in its current state, or if there are warranties or guarantees attached. Omitting these details can result in misunderstandings or discontent if the buyer finds the furniture does not meet their expectations based on the agreed terms.

Incorrectly listing the purchase price or not specifying the payment method in the Furniture Bill of Sale can also create significant issues. It's essential to clearly state the sale amount and whether the payment will be made in cash, check, transfer, or other means. This clarity helps avoid disputes over payment and ensures a smooth transaction process.

Forgetting to include both parties' contact information is a common blunder as well. A comprehensive Furniture Bill of Sale should have the full names, addresses, and contact details of both the buyer and seller. This information is crucial for legal purposes and any future communication regarding the sale.

Last but not least, neglecting to secure signatures from both the buyer and the seller can invalidate the whole document. A signature represents each party's agreement to the terms and conditions of the sale laid out in the document. Without this, enforcing the bill of sale's terms becomes nearly impossible, stripping it of its intended legal weight and leaving both parties vulnerable.

Documents used along the form

When engaging in the sale or purchase of furniture, particularly in transactions that go beyond casual, peer-to-peer exchanges, several additional forms and documents can play critical roles in ensuring the legitimacy, clarity, and legality of the transaction. These documents not only support the Furniture Bill of Sale form but also establish a comprehensive record of the transaction, condition of the items sold, and responsibilities of each party involved. Understanding these forms will assist both buyers and sellers in navigating the complexities of a furniture sale.

- Receipt of Purchase: This document provides proof of the transaction and usually includes details such as the date of purchase, the price, and the parties involved. It often serves as a buyer's immediate proof of payment and ownership until more formal documents are exchanged.

- Warranty Document: When the furniture being sold is new or comes with a guarantee of condition, a warranty document is crucial. It outlines the conditions under which repairs or replacements may be made, the duration of the warranty, and any actions that could void the warranty.

- Condition Report: A detailed report of the furniture's condition at the time of sale can be invaluable, especially for used items. This document lists any existing damage or wear and is often supported by photographs.

- Delivery Receipt: If the furniture is being delivered, a delivery receipt confirms that the item was received by the buyer in the condition stated in the sales agreement and condition report.

- Certificate of Authenticity: For antique or high-value items, a certificate of authenticity can be extremely important. It verifies the item's provenance, age, and, in some cases, the artist or craftsman.

- Return Policy Agreement: This document outlines the conditions under which a buyer can return the furniture and receive a refund or exchange. It includes time limits, condition requirements, and any fees associated with a return.

- Financing Agreement: If the furniture purchase involves financing, this document lays out the terms of the loan, including the interest rate, repayment schedule, and consequences of default.

- Assembly Instructions: For furniture that requires assembly, detailed assembly instructions are not only helpful but may be necessary. They ensure the buyer can safely and correctly assemble the furniture, preventing damage or misuse.

Together with the Furniture Bill of Sale, these documents create a comprehensive framework that protects the interests of both parties, ensures clarity regarding the condition and terms of the sale, and provides legal recourse should disputes arise. Sellers and buyers are encouraged to familiarize themselves with these documents to facilitate a smooth and transparent transaction, enhancing trust and satisfaction on both sides.

Similar forms

A Vehicle Bill of Sale is quite similar to a Furniture Bill of Sale in that both serve as proof of transaction between a buyer and a seller for a specific item of value. For vehicles, this document often includes details such as the make, model, year, and VIN (Vehicle Identification Number), closely paralleling the way a Furniture Bill of Sale might list the type, brand, and serial number of the furniture sold. These records play a crucial role in transferring ownership legally and are essential for registration and tax purposes.

A Real Estate Bill of Sale parallels the Furniture Bill of Sale in its role of documenting the sale and transfer of ownership of property. However, the Real Estate Bill of Sale deals with real property (land and buildings) as opposed to personal property (movable items). Both documents similarly outline the transaction details, including the agreed sale price and a description of the property sold, to ensure a clear and legally binding transfer of ownership.

General Bill of Sale forms share common ground with a Furniture Bill of Sale, serving as written evidence of a sale and transfer of various items between two parties. These could range from electronics to tools, significantly diversifying the scope beyond furniture or vehicles. Like the Furniture Bill of Sale, a General Bill of Sale includes critical transaction details such as the date of sale, purchase price, and parties' information, thus offering a blanket of legal protection for both buyer and seller across a multitude of transactions.

The Equipment Bill of Sale is closely related to a Furniture Bill of Sale, both being tailored to the sale of specific items. The primary distinction lies in the nature of the items sold: the Equipment Bill of Sale focuses on machinery, office equipment, or heavy-duty tools, while the Furniture Bill of Sale is directed towards items of home or office furnishing. Despite this differentiation, both documents function to confirm the details of the transaction and officially transfer ownership from the seller to the buyer.

A Boat Bill of Sale shares similarity with a Furniture Bill of Sale by providing a legally binding document that records the sale and purchase of a boat, much like furniture. What sets them apart is the subject of the sale, yet both documents include seller and buyer information, a description of the item sold (including model and serial number for boats, similar to furniture specifications), and the sale price, facilitating a smooth ownership transition recognised by law.

Pet Bills of Sale, while focused on the sale and purchase of animals, relate closely to Furniture Bills of Sale in their function as transaction records. These documents detail the exchange between buyer and seller, listing information such as the breed, age, and health of the pet, paralleling the way a Furniture Bill of Sale would describe the item in question. Both serve to protect the rights of both parties, ensuring the transaction is clear, agreed upon, and legally documented.

A Business Bill of Sale is akin to a Furniture Bill of Sale as it documents the sale of assets, though it specifically pertains to business-related transactions. This might include the sale of a company's assets, inventory, or equipment, unlike the typically more narrowly focused Furniture Bill of Sale. Despite these differences, both documents record transaction details such as sale price, date, and party information, providing evidence of ownership transfer.

Lastly, an Artwork Bill of Sale is comparable to a Furniture Bill of Sale, with the distinction lying in the nature of the items being sold—art pieces versus furniture. In both instances, these documents record crucial details about the sale, including the description of the piece sold, the identity of the buyer and seller, and the agreed-upon price, offering legal protection and proof of ownership to the parties involved.

Dos and Don'ts

When filling out the Furniture Bill of Sale form, it's important to approach the process with attention to detail and accuracy. This document serves as a legally binding agreement between the buyer and seller, documenting the sale of furniture. Below, you'll find guidance on what you should and shouldn't do to ensure the form is completed correctly and effectively.

What You Should Do:

- Include detailed information about the furniture - Make sure to describe the furniture being sold, including its condition, size, brand, and any other relevant details. This clarity helps prevent any future disputes over what was agreed upon.

- Verify the accuracy of all provided information - Double-check the details entered on the form, such as the names and addresses of both parties, to ensure they are correct. Mistakes could lead to legal complications or issues in transferring ownership.

- Sign and date the form in front of a witness or notary - This adds an extra layer of legality and verification to the document, providing both parties with peace of mind that the agreement is legally recognized.

- Keep a copy of the signed document - Both the buyer and seller should keep a copy of the fully executed bill of sale. This will serve as a proof of purchase and can be crucial for tax purposes, warranty claims, or any disputes that may arise.

What You Shouldn't Do:

- Leave fields blank - Avoid leaving any sections of the form incomplete. If a section does not apply, mark it as “N/A” (not applicable) instead of leaving it blank to maintain the integrity of the document.

- Use vague language - Be as specific as possible when describing the furniture and the terms of the sale. Ambiguities can lead to misunderstandings or legal challenges later on.

- Forget to specify the payment details - Clearly outline the payment amount, method (e.g., cash, check, transfer), and any payment plan if applicable. This minimizes the risk of payment disputes.

- Ignore the importance of a witness or notarization - While it might seem like an extra step, having the form witnessed or notarized is crucial for authenticating the document and protecting both parties' interests.

Misconceptions

When it comes to transferring ownership of furniture from one person to another, a Furniture Bill of Sale form plays a crucial role. However, several misconceptions surround its usage and significance. Let's clear the air on some common misunderstandings:

It's Only Necessary for New Furniture: Many people believe that a Furniture Bill of Sale is only required when buying or selling brand-new items. This is not the case. Whether the furniture is new or used, documenting the transaction can protect both the buyer and the seller, proving ownership and the terms of the sale.

Any Template Will Do: While there are many templates available online, not all of them may meet the specific requirements of your state or locality. It's important to use a form that complies with local laws to ensure that the sale is legally binding and that all necessary details are properly recorded.

No Need for Witness or Notarization: Some people think that a Furniture Bill of Sale doesn't need to be signed by a witness or notarized to be valid. This isn't always true. Depending on where you live, having the document witnessed or notarized can add an extra layer of legal protection, confirming the identities of the parties involved and the authenticity of their signatures.

It's Purely a Formality: Viewing a Furniture Bill of Sale as just a formality is a mistake. Beyond being a mere receipt, it serves as a legal document that outlines the specifics of the transaction, including the price, condition of the furniture, and warranties. It can be a critical piece of evidence in case of disputes, returns, or for insurance purposes.

Understanding these misconceptions can help ensure that when you're involved in buying or selling furniture, you handle the transaction smartly and legally.

Key takeaways

When engaging in transactions involving the sale of furniture, ensuring the proper completion and utilization of a Furniture Bill of Sale is critical. This document not only facilitates a smooth exchange between parties but also serves as a vital record of the sale, offering protection and clarity. The following key takeaways are instrumental for individuals involved in these transactions:

- Accuracy in Documentation: All information entered on the Furniture Bill of Sale must be precise and thorough. This includes the full names and addresses of both the buyer and seller, a detailed description of the furniture (including condition, make, model, and serial number, if applicable), and the sale price. Accurate documentation is essential for the legality and validity of the sale.

- Legal Protection: The Furniture Bill of Sale acts as a legally binding document that provides evidence of the transaction. In disputes or for warranty claims, this document can serve as a crucial piece of evidence to clarify the terms of the sale, thereby offering protection to both parties.

- Witness or Notarization: While not always mandatory, having a witness sign the Furniture Bill of Sale or getting it notarized can add an additional layer of security and authenticity to the transaction. This step is highly recommended, especially for high-value items, to prevent potential disputes.

- Retention of Copies: Both the buyer and seller should retain copies of the completed Furniture Bill of Sale. Maintaining this record is important for personal record-keeping, tax reporting, and as proof of ownership or sale. It ensures that both parties can reference the document in the future if necessary.

By adhering to these guidelines, individuals can navigate the sale of furniture with confidence, knowing that their interests are safeguarded and that the transaction is conducted professionally.

Consider More Types of Furniture Bill of Sale Forms

California Bill of Sale - The Motor Vehicle Bill of Sale contains signatures from both parties, making it a binding agreement.

Bill of Sale California Template - Can be used to specify any liens or encumbrances on the boat, providing clarity and protecting the buyer's interests.

Pwc Bill of Sale - Signatures from both parties on the form legally bind the transaction.