Fillable Bill of Sale Document for California

In the vibrant state of California, a plethora of transactions takes place every day, involving the exchange of a wide range of personal property from vehicles and boats to smaller items like electronics and furniture. Essential to these transactions is a document, colloquially known as the California Bill of Sale form, which plays a pivotal role in the lawful transfer of ownership. This document not only provides concrete evidence of the sale but also details the terms and conditions agreed upon by both parties involved. It acts as a safeguard protecting the rights of both the seller and the buyer, by offering a verifiable record that can be utilized for registration, tax purposes, and even as a personal record for future reference. A thorough understanding of this form is indispensable for Californians engaging in private sales, ensuring that they navigate the complexities of personal property transactions with ease and legal assurance.

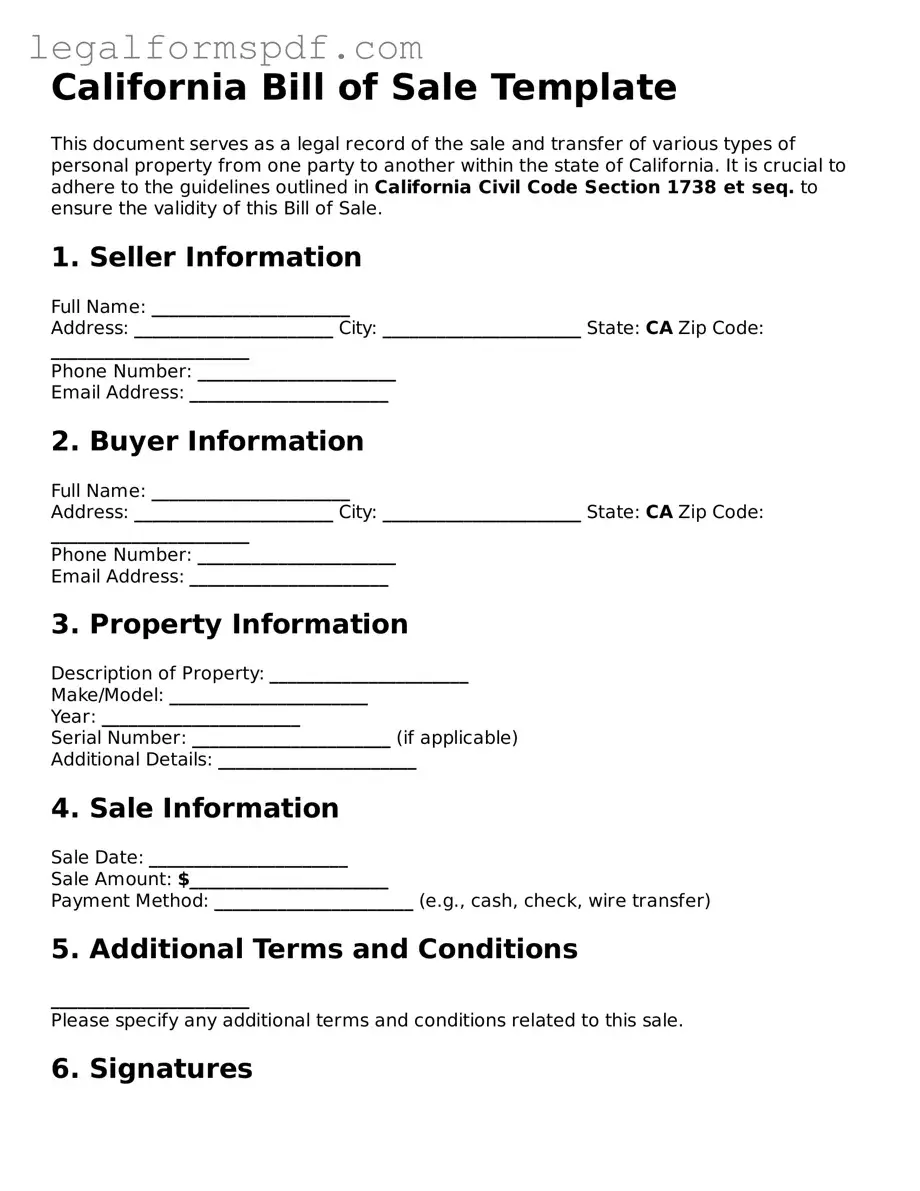

Document Example

California Bill of Sale Template

This document serves as a legal record of the sale and transfer of various types of personal property from one party to another within the state of California. It is crucial to adhere to the guidelines outlined in California Civil Code Section 1738 et seq. to ensure the validity of this Bill of Sale.

1. Seller Information

Full Name: ______________________

Address: ______________________ City: ______________________ State: CA Zip Code: ______________________

Phone Number: ______________________

Email Address: ______________________

2. Buyer Information

Full Name: ______________________

Address: ______________________ City: ______________________ State: CA Zip Code: ______________________

Phone Number: ______________________

Email Address: ______________________

3. Property Information

Description of Property: ______________________

Make/Model: ______________________

Year: ______________________

Serial Number: ______________________ (if applicable)

Additional Details: ______________________

4. Sale Information

Sale Date: ______________________

Sale Amount: $______________________

Payment Method: ______________________ (e.g., cash, check, wire transfer)

5. Additional Terms and Conditions

______________________

Please specify any additional terms and conditions related to this sale.

6. Signatures

Both parties agree that this Bill of Sale is under the jurisdiction of the State of California and all related legal proceedings, if any, shall be conducted therein. Each party acknowledges receipt of a complete copy of this document.

Seller's Signature: ______________________ Date: ______________________

Buyer's Signature: ______________________ Date: ______________________

Notary Public (If applicable):

Signature: ______________________ Date: ______________________

Commission Number: ______________________

PDF Specifications

| Fact Number | Detail |

|---|---|

| 1 | The California Bill of Sale form is used to document the transfer of ownership of personal property from a seller to a buyer. |

| 2 | It's not mandatory for all sales, but highly recommended for legal protection and proof of purchase. |

| 3 | This form can be used for various items, including vehicles, boats, motorcycles, and more. |

| 4 | For vehicles, the California Department of Motor Vehicles (DMV) may require a bill of sale for private transactions. |

| 5 | The form should include detailed information about the item being sold, such as make, model, year, and serial number. |

| 6 | Buyer and seller information, including names, addresses, and signatures, must be filled out accurately. |

| 7 | Depending on the item, additional certifications or disclosures might be needed to accompany the bill of sale. |

| 8 | It acts as a receipt for the transaction and can be used for tax reporting and registration purposes. |

| 9 | The bill of sale should clearly state the sale price and the date of sale. |

| 10 | Governing laws for bills of sale in California can be found under the California Civil Code. |

Instructions on Writing California Bill of Sale

Completing a Bill of Sale form in California is a critical step in documenting the transfer of ownership of personal property from one person to another. This document serves as valuable evidence for both parties involved in the sale, helping to protect their rights and providing a clear record of the transaction for legal, personal, or taxation purposes. The following steps will guide you through the process of accurately filling out the form to ensure that all relevant information is clearly and correctly documented. It's important to complete this form diligently and keep a copy for your records to safeguard against any future disputes or discrepancies.

- Gather all necessary information regarding the sale, including the specifics of the item being sold, the sale price, and the personal details of both the seller and the buyer.

- Enter the date of the sale at the top of the form. Ensure that it reflects when the transaction actually took place.

- Fill in the seller’s complete information, including full name, address, and contact details.

- Provide the buyer’s full information in the designated section, mirroring the level of detail provided for the seller.

- Describe the item being sold. Include specific details such as make, model, year, color, size, serial number, or any other identifying characteristics to ensure there is no confusion about what is being transferred.

- Input the sale price. Clearly state the amount in dollars, and specify whether tax is included in the sale price.

- If there are any additional terms or conditions of the sale, document these in the allocated section. This might include warranties, return policies, or any other agreements made between the buyer and seller.

- Both parties should review the form thoroughly to confirm that all the information is accurate and reflects the terms of their agreement.

- Have the seller and buyer sign and date the form. It is advisable for both parties to print their names below their signatures for clarity.

- Make copies of the completed form. Give one to the buyer and keep one for the seller’s records. If applicable, a third copy should be provided to a legal advisor or kept in a safe place for future reference.

With the California Bill of Sale form duly filled out and signed, it acts as a concrete acknowledgment of the transfer between the seller and the buyer. This form not only provides legal protection but also ensures peace of mind by laying down the specifics of the sale on paper. Although it might seem like just one of the many steps in the transaction process, its importance cannot be understated for both immediate and long-term record-keeping.

Understanding California Bill of Sale

What is a California Bill of Sale form and why is it necessary?

A California Bill of Sale form is a document that records the transfer of ownership of an item from a seller to a buyer. It's necessary because it serves as evidence of the transaction, providing crucial details like the date of sale, information about the item sold, and the terms of the sale. This form is especially important for the registration of vehicles or boats but is useful for any type of personal property transaction. It helps protect both parties in the event of disputes or if proof of ownership is required later.

What specific information needs to be included on a California Bill of Sale form?

A comprehensive California Bill of Sale form should include: the names and addresses of the seller and the buyer, a detailed description of the item being sold (including make, model, year, and identification number, if applicable), the sale price, the date of sale, and signatures of both parties involved. For motor vehicles, it's crucial to also include the odometer reading at the time of sale to ensure compliance with California law.

Do I need to notarize my California Bill of Sale form?

In California, notarization of a Bill of Sale form is not a legal requirement for most personal property transactions. However, for the sale of vehicles and boats, while notarization is not mandatory, it is highly recommended. Notarization adds an additional layer of authenticity to the document, potentially preventing legal complications and fraud. If you decide to notarize the bill of sale, ensure it is done correctly by a licensed notary public.

How does a Bill of Sale form protect me?

A Bill of Sale form provides legal protection for both the seller and the buyer. For the seller, it serves as proof that the item was sold "as is" and transfers responsibility to the buyer. For the buyer, it acts as evidence of ownership and the terms of sale, which can be invaluable if there are any future disputes about the item's condition or ownership. Keeping a copy of this document can be helpful for tax purposes and when registering the item, if applicable.

Common mistakes

Filling out the California Bill of Sale form is a critical step in the sale and purchase of goods, often signaling the formal transfer of ownership from one party to another. However, many individuals make errors during this process, potentially leading to legal complications or the invalidation of the transaction. One common mistake is neglecting to include a complete description of the item being sold. The description should cover make, model, year, and any identifying numbers or features. This detail ensures both parties recognize and agree on the exact item changing hands.

Another frequent error is failing to document the transaction date accurately. The date of sale is crucial for various reasons, including tax purposes and establishing the timeline of ownership. An incorrect or missing date can create confusion and disputes later on, possibly complicating future transactions related to the item.

Additionally, some people forget to include the buyer and seller information in full. Names, addresses, and contact information for all parties involved are essential. This not only identifies the involved parties but also serves as a point of contact should any questions or issues arise after the sale. Omitting these details can make it challenging to verify the legitimacy of the transaction.

A mistake often overlooked is not specifying the payment details within the Bill of Sale. Whether the item was exchanged for a set amount, traded, or given as a gift, this information should be clearly stated. Including the payment details outlines the agreement's terms and can prevent disputes about the transaction's nature.

Lastly, neglecting to get the Bill of Sale notarized when required is a significant misstep. While not all transactions demand notarization, some do, depending on the item's nature or the laws governing particular types of sales in California. A notarized Bill of Sale provides an additional layer of legal protection, verifying the identities of the signatories and the document's authenticity.

By paying careful attention to these common mistakes and ensuring the California Bill of Sale form is filled out correctly and completely, parties can secure their transaction legally and with confidence. It's always a smart strategy to review and double-check all details before finalizing the sale.

Documents used along the form

When transferring ownership of an item in California, the Bill of Sale form often plays a central role in documenting the transaction between the buyer and seller. However, this form rarely works alone during such transactions. Several other documents typically accompany or support the process, ensuring legal compliance and providing additional layers of protection for both parties involved. The forms and documents listed below are commonly used alongside the California Bill of Sale form to create a comprehensive and secure transaction record.

- Certificate of Title: This is the official document proving ownership of an item, such as a vehicle or boat. When an item is sold, the Certificate of Title must be transferred to the new owner, making it an essential companion to the Bill of Sale.

- Odometer Disclosure Statement: Required for the sale of vehicles, this document records the vehicle's actual mileage at the time of sale, helping to confirm the vehicle’s condition and value.

- Smog Certification: In California, sellers of certain vehicles must provide evidence that the vehicle meets state air quality standards. This certification is required for most vehicles, with a few exceptions based on vehicle type and age.

- Release of Liability Form: This form is submitted to the California Department of Motor Vehicles (DMV) by the seller to report the sale of a vehicle. It protects the seller from liability for any accidents or violations involving the vehicle after the sale.

- Notice of Transfer and Release of Liability: Similar to the Release of Liability Form, this document notifies the DMV about the change of ownership and releases the seller from responsibility for the vehicle.

- Loan Satisfaction Letter: If the item sold was previously financed, this document from the lender confirms that the loan on the item has been paid off in full and that the lien on the title can be released.

- Warranty Document: When an item is sold with a warranty, this document outlines the warranty’s terms and conditions, providing protection for the buyer against certain defects or problems.

Together, these documents complement the California Bill of Sale form, ensuring that all aspects of the sale are legally documented and both parties are protected. While the Bill of Sale proves that a transaction took place and details the agreement between buyer and seller, the accompanying documents verify the item’s legal status, condition, and compliance with California laws. It's crucial for sellers to understand not only the need for a Bill of Sale but also the importance of these additional documents in facilitating a smooth, transparent, and legally sound transaction.

Similar forms

A California Bill of Sale form shares similarities with a Sales Agreement. Both documents serve as proof that a transaction took place between a seller and a buyer, detailing what was sold and for what price. While a Bill of Sale often focuses on personal property such as cars or boats, a Sales Agreement can be used for a broader range of goods and may include additional terms and conditions of the sale.

Similar to a Warranty Deed, a California Bill of Sale provides assurance about the current state of the item being sold, mainly focusing on whether the seller has the legal right to sell the property and ensuring that the property is sold without any hidden liens or claims. However, a Warranty Deed is used specifically for real estate transactions, offering protections that the property's title is clear.

The California Bill of Sale is akin to a Promissory Note in that both are legal documents concerning the sale of an item. However, a Promissory Note is a form of financing: it details an agreement to repay a loan for the purchased item over time. It is often used alongside a Bill of Sale in transactions like buying a vehicle or expensive personal items on credit.

Receipts and the California Bill of Sale serve a similar purpose by providing proof of a transaction. A receipt usually accompanies smaller, more routine purchases, offering limited details such as the date of purchase, the amount paid, and a brief description of the item. In contrast, a Bill of Sale is more formal, offering detailed information about the transaction and the parties involved.

Another document akin to the California Bill of Sale is a Quitclaim Deed, which is used to transfer property rights without any guarantees about the property's clear title. Both documents involve a transfer of ownership, but a Bill of Sale typically comes with more assurances concerning the item’s condition and legal status.

The Loan Agreement is another legal document that shares similarities with a California Bill of Sale, specifically when the sale involves financed items. While a Bill of Sale documents the transfer of ownership of an item, a Loan Agreement lays out the terms under which money is lent for the purchase of that item, stipulating repayment schedules, interest rates, and other conditions.

Transfer on Death Deeds and the California Bill of Sale both facilitate the passing of property from one party to another. A Transfer on Death Deed allows individuals to designate beneficiaries for their real estate, effective upon their death, without the need for probate. Unlike a Bill of Sale, it's used exclusively for real estate and becomes effective under very specific circumstances.

Finally, a Gift Deed bears resemblance to a California Bill of Sale in that it records the transfer of ownership. However, a Gift Deed is used when an item is given without any exchange of money, highlighting the intent of the gift and certifying that the transfer is voluntary. Unlike a Bill of Sale, no purchase price is documented since the transaction is not a sale but a gift.

Dos and Don'ts

When the time comes to document the sale of personal property in the state of California, utilizing a Bill of Sale form is a fundamental step in the process. This document not only confirms the transfer of ownership but also serves as a vital record for both buyer and seller. To ensure the form is filled out correctly and effectively, here are five key dos and don'ts to consider:

Do:Provide clear and accurate information about both the buyer and seller, including full names, addresses, and contact details. This precision is crucial for establishing a solid legal foundation for the transaction.

Describe the item being sold in detail. Include make, model, year, color, condition, and any identification numbers (such as VIN for vehicles). This description eliminates any ambiguity about what is being transferred.

Confirm the sale price and state it clearly on the form. If the item was gifted, this should be noted instead, along with the fair market value for tax purposes.

Ensure all parties involved sign and date the form. In California, while notarization is not always mandatory, it adds a layer of verification and authenticity to the document.

Keep a copy of the completed form for your records. This copy can be a crucial piece of evidence in disputes or for tax documentation.

Gloss over any pre-existing damage or issues with the item being sold. Being transparent about the condition of the item helps prevent potential legal issues down the line.

Forget to verify the buyer's or seller's identity. This step helps prevent fraud and ensures that the agreement is enforceable.

Leave spaces blank. If a section does not apply, write “N/A” (not applicable) to indicate that you didn’t overlook it; this keeps the document tidy and complete.

Rush through the process. Taking the time to review the form for accuracy and completeness can save a lot of trouble and confusion in the future.

Assume the form alone is enough for all items. Some items, like vehicles, may require additional documentation or steps for the transfer to be recognized by the California Department of Motor Vehicles or other agencies.

Misconceptions

When it comes to transferring ownership of personal property in California, the Bill of Sale form plays a crucial role. However, misconceptions surrounding its use and requirements can complicate what should be a straightforward process. This clarification aims to dispel some of the most common misunderstandings:

- Only for Motor Vehicles: A common belief is that the Bill of Sale form is solely for the sale of motor vehicles. While it's often used in these transactions, it's also applicable to the sale of other items, such as boats, furniture, and electronics.

- Legally Required for All Sales: Another misconception is that a Bill of Sale is a legal requirement for all sales transactions in California. In reality, while it provides a record of sale and is crucial for personal property transactions, it's not mandatory for every sale. However, certain transactions, particularly involving vehicles, boats, and firearms, do require this documentation for registration and title transfer processes.

- One-Size-Fits-All: People often think one generic form works for every type of sale. However, different items may require specific information to be included in the Bill of Sale to be effective and meet any regulatory requirements.

- No Need for Witnesses or Notarization: While California doesn't generally require a Bill of Sale to be witnessed or notarized, having these validations can add an extra layer of legal protection, particularly in disputes.

- Informal Agreements Suffice: Relying on verbal agreements or informal receipts instead of a properly executed Bill of Sale can lead to misunderstandings and legal complications in proving ownership or terms of sale.

- Signature of Buyer Not Necessary: It's a common misconception that only the seller needs to sign the Bill of Sale. While California law may not explicitly require the buyer's signature for the document to be valid, having both parties sign can prevent future disputes about the sale's terms and conditions.

- A Bill of Sale Transfers Ownership Immediately: The act of signing a Bill of Sale itself doesn't transfer ownership; it serves as evidence of the transaction. The actual transfer of ownership may require additional steps, such as delivering the item and completing any necessary registration procedures.

- Any Format Works: Assuming any written format can serve as a Bill of Sale is risky. To be effective and comprehensive, the document should contain specific information, including a detailed description of the item sold, the sale price, and the parties' details.

- No Financial Protections Offered: Some believe that a Bill of Sale doesn't offer any financial protections. On the contrary, it can serve as a critical piece of evidence in disputes, providing details about the transaction that protect both parties' financial interests.

- Not Important for Tax Purposes: The notion that Bills of Sale aren't important for tax purposes is misleading. They can be essential records for reporting the sale of personal property, calculating capital gains or losses, and for use in audits.

Understanding the facts about California's Bill of Sale requirements ensures that individuals can navigate the sale and purchase of personal property with confidence, avoiding potential legal pitfalls and misunderstandings.

Key takeaways

A California Bill of Sale form is a critical document for both buyers and sellers in the state, acting as proof of transfer and ownership of various items. Understanding its elements and proper use is essential for a smooth transaction. Below are seven key takeaways to guide you through filling out and using this important form:

- Complete All Required Information: Ensure that you fill in all the necessary details on the form, including the full names and addresses of both the buyer and seller, a detailed description of the item being sold (including make, model, year, and serial number, if applicable), the sale price, and the date of sale.

- Signature Requirements: Both the buyer and seller must sign the form. This act validates the document, making it a legal record of the transaction.

- Notarization May Be Necessary: Depending on the type of property being sold, notarization of the Bill of Sale might be required. Although not always mandatory, getting the document notarized can lend additional legal weight to it.

- Keep Copies: It is crucial for both the buyer and the seller to keep copies of the completed Bill of Sale. This record can serve as a receipt, helping to resolve any future disputes over the sale or ownership of the item.

- Use for a Variety of Items: The California Bill of Sale can be used for the sale of numerous types of personal property, such as vehicles, boats, motorcycles, and even smaller items like furniture or electronics.

- Proof of Ownership Transfer: For certain items, particularly vehicles, the Bill of Sale serves as evidence that the title of the item has been legally transferred from the seller to the buyer.

- Registration Purposes: When it comes to vehicles, boats, or any other items that require registration, the Bill of Sale is typically needed to complete the registration process in the new owner’s name.

Understanding these key aspects of the California Bill of Sale can make the process smoother and protect the interests of both parties involved in the transaction. Always ensure that the information provided on the form is accurate and complete, and that the document is stored safely for future reference.

More Bill of Sale State Forms

Texas Bill of Sale Form - Includes critical details like the sale price, item description, and warranties or guarantees if any.

North Carolina Vehicle Bill of Sale - It helps in the calculation and payment of sales taxes or fees associated with the transfer of ownership.