Official Business Bill of Sale Document

When embarking on the journey of buying or selling a business, one document stands out for its crucial role in legitimizing the transaction: the Business Bill of Sale form. This instrument not only serves as definitive proof of the transfer of ownership but also details the terms agreed upon by both parties involved. Its significance is underscored by its function in recording the sale of business assets, ranging from physical inventory to intellectual property, ensuring that both buyer and seller have a clear record of what was exchanged and at what price. Moreover, the form acts as a safeguard, providing a legal footing for both parties in the event of future disputes. It meticulously outlines the specifics of the business sold, including any warranties or representations made by the seller, thereby offering a layer of protection to the buyer against potential undisclosed liabilities. The Business Bill of Sale is, therefore, not just a receipt but a comprehensive record that encapsulates the entirety of the transaction, making it an indispensable component of the business sale process.

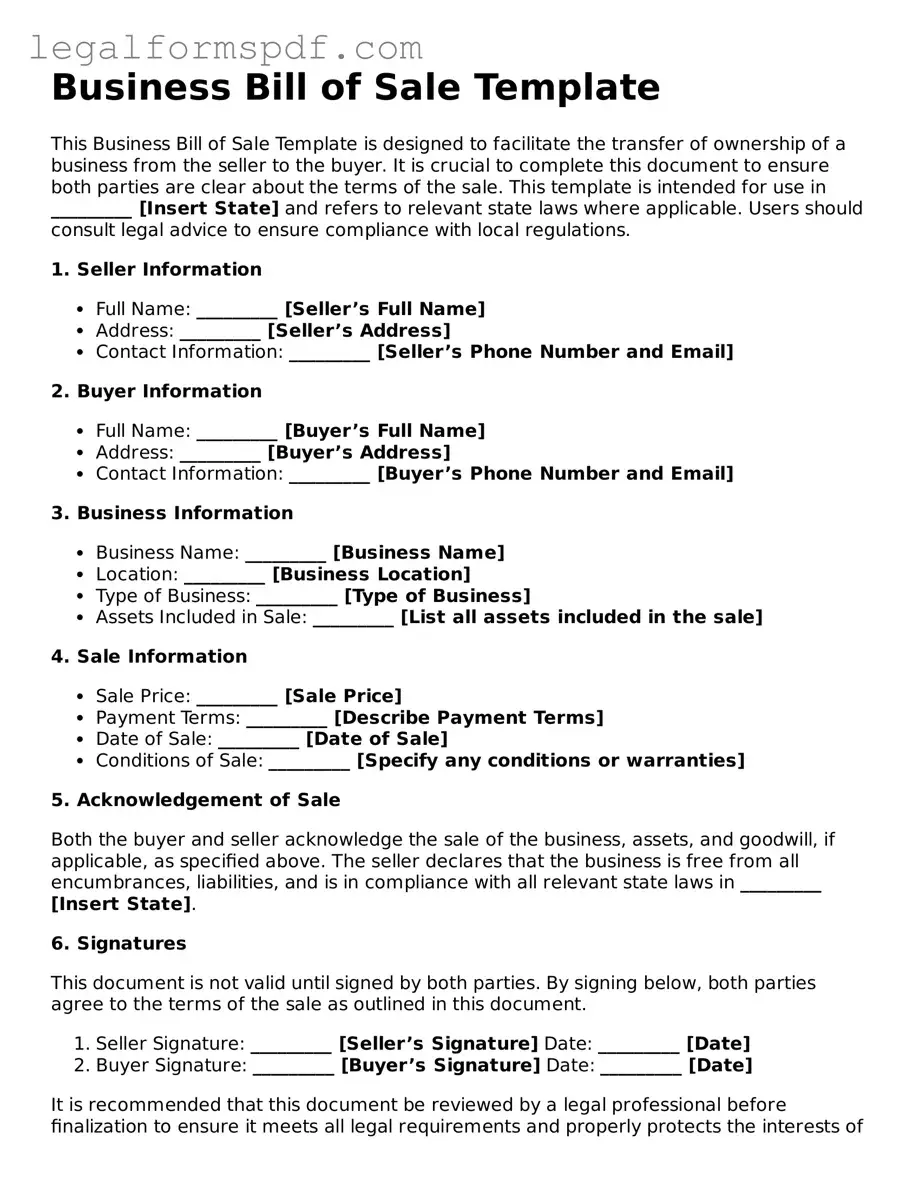

Document Example

Business Bill of Sale Template

This Business Bill of Sale Template is designed to facilitate the transfer of ownership of a business from the seller to the buyer. It is crucial to complete this document to ensure both parties are clear about the terms of the sale. This template is intended for use in _________ [Insert State] and refers to relevant state laws where applicable. Users should consult legal advice to ensure compliance with local regulations.

1. Seller Information

- Full Name: _________ [Seller’s Full Name]

- Address: _________ [Seller’s Address]

- Contact Information: _________ [Seller’s Phone Number and Email]

2. Buyer Information

- Full Name: _________ [Buyer’s Full Name]

- Address: _________ [Buyer’s Address]

- Contact Information: _________ [Buyer’s Phone Number and Email]

3. Business Information

- Business Name: _________ [Business Name]

- Location: _________ [Business Location]

- Type of Business: _________ [Type of Business]

- Assets Included in Sale: _________ [List all assets included in the sale]

4. Sale Information

- Sale Price: _________ [Sale Price]

- Payment Terms: _________ [Describe Payment Terms]

- Date of Sale: _________ [Date of Sale]

- Conditions of Sale: _________ [Specify any conditions or warranties]

5. Acknowledgement of Sale

Both the buyer and seller acknowledge the sale of the business, assets, and goodwill, if applicable, as specified above. The seller declares that the business is free from all encumbrances, liabilities, and is in compliance with all relevant state laws in _________ [Insert State].

6. Signatures

This document is not valid until signed by both parties. By signing below, both parties agree to the terms of the sale as outlined in this document.

- Seller Signature: _________ [Seller’s Signature] Date: _________ [Date]

- Buyer Signature: _________ [Buyer’s Signature] Date: _________ [Date]

It is recommended that this document be reviewed by a legal professional before finalization to ensure it meets all legal requirements and properly protects the interests of both parties involved.

PDF Specifications

| Fact | Description |

|---|---|

| Purpose | The Business Bill of Sale form is used to document the transfer of ownership of a business from the seller to the buyer. It helps ensure that the transaction is recorded formally and legally. |

| Components | This form typically includes details such as the names and addresses of the buyer and seller, description of the business being sold, purchase price, and date of sale. |

| Governing Law | While the form is widely used across the United States, state-specific laws may govern the execution and requirements of the Business Bill of Sale, ensuring it meets all legal standards within a specific jurisdiction. |

| Significance | Completing a Business Bill of Sale protects both the buyer and seller by providing a legally binding document that outlines the specifics of the business transaction, confirming the transfer of ownership under agreed terms. |

Instructions on Writing Business Bill of Sale

Filling out a Business Bill of Sale form is a crucial step in the process of buying or selling a business. This document serves as a formal agreement between the buyer and seller, outlining the conditions of the sale and transfer of ownership. It includes details about the business being sold, such as its assets and liabilities, and the terms agreed upon by both parties. Completing this form accurately is essential for protecting the interests of both the buyer and seller, ensuring clarity and legal standing in the transaction. Below are the steps required to fill out the form correctly.

- Begin with the Date of the sale at the top of the form. This should be the date when the transaction is finalized and ownership is officially transferred.

- Enter the Seller’s Details, including the full legal name, address, and contact information. This identifies who is selling the business.

- Fill in the Buyer’s Details similarly, providing the full legal name, address, and contact information to clearly identify the new owner.

- Describe the Business Being Sold. Include the business name, type, location, and any relevant identification numbers (e.g., tax ID or registration number). This section should paint a clear picture of what the business encompasses.

- List the Assets Included in the sale. This could encompass everything from physical assets, like furniture and inventory, to intangible assets, such as trademarks and customer lists. Be specific to avoid future disputes.

- Detail the Liabilities being transferred, if any. This could include outstanding loans or accounts payable that the buyer will assume responsibility for post-sale.

- State the Purchase Price, including how it’s structured (lump sum, installments, etc.) and any terms related to the payment. This clarity prevents misunderstandings about the financial aspects of the deal.

- If applicable, mention any Contingencies that must be met before the sale is finalized. This could include passing inspections, obtaining financing, or other conditions either party requires.

- Both the buyer and seller must Sign and Date the form. Depending on the jurisdiction, witness or notary signatures may also be required to authenticate the document.

Once the Business Bill of Sale form is filled out following the above steps, both parties should keep a copy for their records. This document will serve as proof of sale and transfer of ownership, and it may be needed for tax purposes or future legal inquiries. Preparing this form carefully and with attention to detail will contribute to a smooth transition and minimize potential disputes between the buyer and seller.

Understanding Business Bill of Sale

What is a Business Bill of Sale?

A Business Bill of Sale is a legal document that records the sale of a business from one party (the seller) to another (the buyer). It provides evidence that the business ownership has been transferred and details the terms of the sale, including the sale price and a description of the business assets being sold.

Why do I need a Business Bill of Sale?

Having a Business Bill of Sale is crucial because it officially records the sale and transfer of ownership. It helps both parties avoid any future disputes regarding the sale by providing clear documentation of the transaction, the parties involved, and the assets included in the sale. It's also necessary for tax purposes and may be required by lenders or government agencies when the buyer applies for permits or licenses.

What should be included in a Business Bill of Sale?

A comprehensive Business Bill of Sale should include the names and addresses of the buyer and seller, a detailed description of the business being sold, the sale price, payment terms, any warranties or representations, and the date of the sale. It may also specify the assets and liabilities being transferred, including inventory, equipment, and intellectual property, and any conditions or covenants related to the sale.

Is a Business Bill of Sale the same as a purchase agreement?

No, a Business Bill of Sale is not the same as a purchase agreement. While both documents are used in the sale of a business, a purchase agreement is a comprehensive contract that outlines the terms and conditions of the sale before it is finalized. In contrast, a Business Bill of Sale serves as a receipt for the transaction, confirming that the ownership of the business has been transferred after the sale is complete.

Do I need a lawyer to create a Business Bill of Sale?

While it is not strictly necessary to have a lawyer create a Business Bill of Sale, consulting a legal professional can ensure that the document accurately reflects the terms of the sale and complies with state laws. A lawyer can also help identify any potential issues or liabilities that could arise from the sale, providing peace of mind for both the buyer and seller.

How do I use a Business Bill of Sale?

Once the Business Bill of Sale is completed and signed by both parties, it should be retained as a record of the sale. The buyer may need to present the document to tax authorities, lenders, or when registering the business under their name. It can also be used to resolve any disputes or legal issues related to the transaction. Both the buyer and seller should keep copies of the Bill of Sale for their records.

Common mistakes

A Business Bill of Sale is a crucial document in the transaction of selling and buying a business, serving as a receipt and proving a change of ownership. It is essential to pay close attention to detail when filling out this document to ensure its legality and accuracy. Unfortunately, there are several common mistakes made in this process.

One significant error is failing to include a detailed description of the business being sold. This description should encompass not only the name and location of the business but also a comprehensive list of its assets. These assets might include physical items, intellectual property, and anything else of value that is being transferred. Without this specificity, disputes could arise regarding what was included in the sale.

Another mistake involves overlooking the need to clearly state the terms of the sale. This means specifying the sale price, payment method, and any conditions or warranties. Absence of this detailed information can lead to misunderstandings or legal disputes down the line. It is not enough to merely agree on a price; how and when the price is paid, and under what circumstances, are crucial details that must be recorded.

Omitting the signatures of both parties, or not ensuring these are witnessed, is a simple yet far-reaching oversight. For a Business Bill of Sale to be legally binding, it must be signed by both the buyer and the seller. Depending on the jurisdiction, witnesses or a notarization might also be required to authenticate the document.

Skipping the step of obtaining mutual agreement on the effective date of the sale is another common error. Both parties should be clear on when the ownership officially changes hands. This date affects various aspects of the transaction, including tax obligations and liability.

Some parties neglect to consult with a legal or financial advisor before completing the form. Given the document's legal and financial implications, professional guidance is highly recommended to avoid pitfalls and ensure that the agreement meets all legal requirements and protects both parties' interests.

Forgetting to include a dispute resolution clause is a mistake that can lead to lengthy and expensive litigation in the future. Specifying how disputes will be handled can save both parties time and money, providing a clear path to resolution without court intervention.

Finally, failing to keep copies of the signed document is a critical oversight. Both the buyer and the seller should keep a copy of the Business Bill of Sale for their records. This document serves as proof of purchase and ownership and may need to be referenced in future legal, tax, or business matters.

To ensure the legality and validity of the Business Bill of Sale, it’s essential to avoid these common mistakes. Attention to detail and adherence to legal requirements can save considerable time and resources, ensuring a smooth transaction for both parties involved.

Documents used along the form

When transferring business ownership, a Business Bill of Sale form is crucial; however, it is often just one of several important documents needed to ensure a complete and secure transaction. To facilitate a smooth transition, accompanying documents play vital roles, ranging from verifying the legality of the sale to detailing the specifics of the transferred assets. The following documents are commonly used alongside the Business Bill of Sale:

- Asset Purchase Agreement: This document outlines the specific assets and liabilities being bought or sold, providing a detailed inventory and terms of the sale. It serves as a comprehensive agreement between the buyer and seller.

- Warranty Deed: In real estate transactions involving the business, a warranty deed guarantees that the property title is clear and transfers ownership from the seller to the buyer. It assures the buyer of the legality of the property sale.

- Promissory Note: If the purchase involves financing, a promissory note details the terms of repayment. This document is essential for formalizing the loan agreement between the buyer and seller or a third-party lender.

- Non-Competition Agreement: This agreement prevents the seller from starting a new, competing business within a certain timeframe and geographic area, protecting the buyer’s investment in the purchased business.

- Employment Agreement: New or existing employment agreements may be necessary when a business is sold. These documents outline the terms of employment for individuals who will work for the new owner, ensuring clarity and continuity.

- Closing Statement: The closing statement itemizes all financial transactions associated with the sale, including the purchase price, adjustments, and closing costs. It offers a final accounting of the entire transaction for both parties.

Together, these documents help ensure that all aspects of a business sale are clearly understood and legally binding, offering protection and clarity to both the buyer and seller. They work in conjunction with the Business Bill of Sale to provide a thorough record of the transaction, facilitating a smoother transition of ownership.

Similar forms

The Business Bill of Sale is closely related to the General Bill of Sale. Both serve the purpose of recording the sale of property, with the main distinction being the specificity to businesses in the former. A General Bill of Sale is versatile, used for personal property ranging from cars to electronics, emphasizing the agreement between buyer and seller over a wide variety of items. Similarly, both documents include essential details about the transaction, such as a description of the sold item, the sale price, and the parties involved, thereby providing a legal record of the transfer of ownership.

Another document similar to the Business Bill of Sale is the Warranty Deed. While the Business Bill of Sale is used for the sale of a business or business assets, a Warranty Deed is employed in real estate transactions to transfer property ownership. Both serve the critical function of legally documenting the change of ownership and guaranteeing the seller's right to transfer the property. However, the Warranty Deed offers added protection to the buyer, affirming that the property is free from liens or claims, a feature specific to real estate transactions.

The Asset Purchase Agreement shares similarities with the Business Bill of Sale but is more comprehensive. It details the sale of a business's assets rather than the business entity itself, often including terms and conditions beyond the simple transfer of ownership. This document outlines specifics such as payment schedules, representations and warranties, and condition of the assets. Though both documents are pivotal in business sales, the Asset Purchase Agreement encompasses a broader scope, addressing numerous transactional aspects to prevent future disputes.

The Sales and Purchase Agreement (SPA) is akin to the Business Bill of Sale, especially in transactions involving large or complex sales, such as real estate or corporate acquisitions. Like the Business Bill of Sale, an SPA outlines the agreed-upon conditions of the sale, identifies the parties, and lists the sale price and a detailed description of the property or asset being sold. However, the SPA is typically more detailed, covering additional terms of the agreement, including payment plans, contingencies, and closing details, making it integral for more intricate transactions.

Dos and Don'ts

When filling out the Business Bill of Sale form, it's important to keep certain dos and don'ts in mind to ensure the process is conducted smoothly and effectively. Below are the key points to consider:

Do:Ensure all the information is accurate and complete. This includes the business name, address, description of the business being sold, and the details of both the buyer and the seller.

Include a detailed description of all assets being transferred. This might range from physical assets, like equipment, to intangible assets, like trademarks and customer lists.

State the sale price clearly and ensure it matches the agreed amount between the buyer and the seller. If there are payment terms, such as installments, clearly outline these as well.

Sign and date the form in the presence of a notary public. This step is crucial for the document’s legal authentication.

Exclude any liabilities that are being transferred with the business. It’s essential that these are clearly stated to avoid any future disputes.

Forget to check local and state requirements. Some regions may have specific clauses or additional documentation that needs to be included.

Overlook the need for witness signatures, if required. While not always necessary, some situations or jurisdictions may require witnesses in addition to the notarization.

Leave any sections incomplete. Even if a section does not apply, mark it with an N/A (not applicable) instead of leaving it blank to show that you did not mistakenly overlook it.

Misconceptions

When discussing the Business Bill of Sale form, various misconceptions often arise. These documents are pivotal in the sale and purchase of businesses, marking the transfer of ownership from seller to buyer. Misunderstandings about their nature and necessity can lead to significant legal complications. To clarify, let's address six common misconceptions.

A Business Bill of Sale is the same as a property deed. This is not accurate. A Business Bill of Sale documents the transfer of ownership for the assets of a business, including equipment, inventory, and intangible assets. In contrast, a property deed transfers ownership of real estate. While both are legal documents indicating a transfer of ownership rights, they apply to different types of properties.

It's only necessary for the sale of large businesses. Regardless of size, when a business changes hands, a Business Bill of Sale is crucial. It formalizes the sale, providing a legally binding record. Small and medium-sized enterprises also benefit from the clarity and security it offers, preventing future disputes over ownership and terms of the sale.

Creating a Business Bill of Sale is complicated and expensive. While legal support can ensure accuracy and compliance with local laws, creating a Business Bill of Sale doesn’t have to be complex or costly. Many regions provide templates or guidelines, enabling business owners to compile a comprehensive and compliant document without excessive expenses.

It only covers the physical assets of a business. A common misconception is that the Business Bill of Sale is limited to physical assets. However, it often includes intangible assets such as goodwill, intellectual property, and customer lists. These elements can be as valuable, if not more so, than physical assets in a business transaction.

Verbal agreements are just as binding. While verbal agreements can be legally binding, proving the specifics of such agreements in court can be tremendously difficult. A written Business Bill of Sale offers clear, indisputable evidence of the terms agreed upon by both parties, protecting their rights and minimizing potential conflicts.

It's only useful at the time of sale. Beyond the initial transaction, a Business Bill of Sale serves several ongoing purposes. It can be essential for tax purposes, detailing the value of assets for depreciation. Additionally, it can be required by banks or investors as proof of ownership for financing or investment considerations.

Key takeaways

When dealing with the Business Bill of Sale form, it's essential to have a clear understanding of its purpose and how to accurately complete and utilize it. This document is pivotal for both buyers and sellers in the transaction of a business, ensuring that the transfer of ownership is recognized formally and legally. Below are key takeaways to guide you through this process:

- Accuracy is key: Ensure all information on the form is accurate, including the names of the buyer and seller, business details, and transaction specifics.

- Date and Signatures: The date of the sale and signatures from both parties are necessary to validate the form. Without them, the document may not be legally binding.

- Description of the Business: Provide a detailed description of the business being sold, including assets, inventory, and any other relevant components.

- Clarify Payment Details: The form should clearly state the sale price and the terms of payment. This includes whether the payment is in full, in installments, or involves trade.

- Legal Compliance: Ensure the sale aligns with state and local laws. Some regions may require additional documentation or steps.

- Witnesses and Notarization: Having witnesses or notarizing the document can add an additional layer of legitimacy, though not always required.

- Retain Copies: Both parties should keep a copy of the signed form. It serves as a receipt and proof of ownership transfer.

- Inventory List: Attach an inventory list if applicable. This specifies what is included in the sale, providing clarity and preventing future disputes.

- Amendments: If any information changes before the transaction is completed, the form should be updated and signed again.

- Seek Legal Advice: If there are any doubts or questions, consulting with a legal professional can ensure the transaction follows the law and protects both parties’ interests.

Completing and using the Business Bill of Sale form properly is crucial for a smooth transition of ownership. By following these key takeaways, both buyers and sellers can navigate the process with confidence, knowing they have taken the right steps to formalize the transaction securely and legally.

Consider More Types of Business Bill of Sale Forms

Bill of Sale Snowmobile - Completing this form helps both parties keep a record of the transaction, which is useful for tax reporting and personal record-keeping.