Fillable Articles of Incorporation Document for Texas

Starting a corporation in Texas requires a fundamental step: filing the Texas Articles of Incorporation. This document is critical as it officially forms the corporation within the state, ensuring it can legally operate, enter into contracts, and conduct other business activities. The form covers essential information including the corporation's name, its purpose, the duration of its existence (which can be perpetual), and details about the corporation's registered agent and office location. Additionally, it outlines the number of shares the corporation is authorized to issue and the names and addresses of the incorporators. Filing the Texas Articles of Incorporation is a straightforward but vital process for any aspiring corporation, opening the door to legal and financial activities under the protection and regulation of Texas state law. The form serves as a public record, signaling the corporation's compliance with state requirements, which is beneficial for credibility and operational integrity.

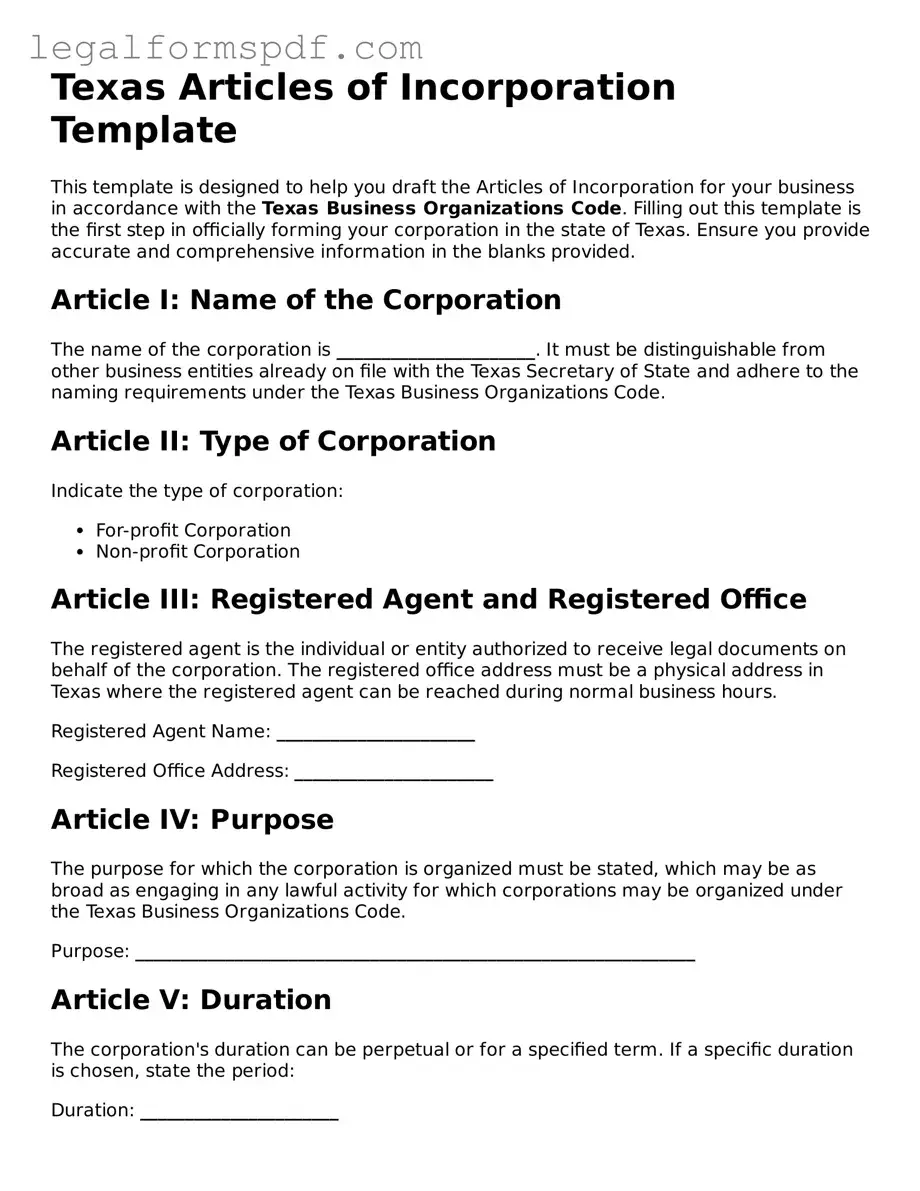

Document Example

Texas Articles of Incorporation Template

This template is designed to help you draft the Articles of Incorporation for your business in accordance with the Texas Business Organizations Code. Filling out this template is the first step in officially forming your corporation in the state of Texas. Ensure you provide accurate and comprehensive information in the blanks provided.

Article I: Name of the Corporation

The name of the corporation is ______________________. It must be distinguishable from other business entities already on file with the Texas Secretary of State and adhere to the naming requirements under the Texas Business Organizations Code.

Article II: Type of Corporation

Indicate the type of corporation:

- For-profit Corporation

- Non-profit Corporation

Article III: Registered Agent and Registered Office

The registered agent is the individual or entity authorized to receive legal documents on behalf of the corporation. The registered office address must be a physical address in Texas where the registered agent can be reached during normal business hours.

Registered Agent Name: ______________________

Registered Office Address: ______________________

Article IV: Purpose

The purpose for which the corporation is organized must be stated, which may be as broad as engaging in any lawful activity for which corporations may be organized under the Texas Business Organizations Code.

Purpose: ______________________________________________________________

Article V: Duration

The corporation's duration can be perpetual or for a specified term. If a specific duration is chosen, state the period:

Duration: ______________________

Article VI: Initial Board of Directors

List the names and addresses of the initial directors who will serve on the board until the first annual meeting of shareholders or until their successors are elected and qualified. A minimum of one director is required.

- Name: ______________________, Address: ______________________

- Name: ______________________, Address: ______________________

- Name: ______________________, Address: ______________________

Article VII: Authorized Shares

The corporation is authorized to issue shares. State the total number of shares the corporation is authorized to issue and, if there are more than one class of shares, the classes and the rights and preferences of each class.

Total Authorized Shares: ______________________

Classes of Shares: ______________________

Article VIII: Incorporator(s)

The incorporator(s) are the individual(s) preparing and filing the Articles of Incorporation. Include the name(s) and address(es) of the incorporator(s).

Incorporator's Name: ______________________, Address: ______________________

Article IX: Supplementary Provisions

Include any additional provisions not addressed in the previous articles, such as indemnification of directors and officers, preemptive rights, or restrictions on share transfers.

Supplementary Provisions: ______________________________________________________________

Article X: Filing Party

Provide the name and contact information of the person to whom the Texas Secretary of State can return the filed document or direct any inquiries.

Name: ______________________

Contact Information: ______________________

By completing this template, you've taken the first step toward establishing your corporation in Texas. It is recommended to have a legal professional review your Articles of Incorporation before submitting to the Texas Secretary of State to ensure compliance with applicable laws and to address any specific legal needs your corporation may have.

Note: This template is a general guide and may not cover all circumstances or requirements for forming a corporation in Texas. The Texas Secretary of State's office can provide more detailed information and any specific forms or filing requirements.

PDF Specifications

| Fact | Description |

|---|---|

| 1. Purpose | The Texas Articles of Incorporation form is used to legally establish a corporation in the state of Texas. |

| 2. Governing Law | The form is governed by the Texas Business Organizations Code. |

| 3. Filing Authority | Submissions are processed by the Texas Secretary of State. |

| 4. Online Filing | Electronic filing is available and encouraged for faster processing. |

| 5. Required Information | Information needed includes the corporation's name, registered agent information, corporate purpose, and incorporator details. |

| 6. Signature Requirement | The form must be signed by an incorporator or an authorized representative. |

| 7. Nonprofit Status | A separate form is available for those looking to form a nonprofit corporation. |

| 8. Filing Fee | There is a mandated filing fee, which varies depending on the type of corporation being established. |

| 9. Amendment Process | Changes to the Articles of Incorporation require filing an amendment with the Secretary of State. |

Instructions on Writing Texas Articles of Incorporation

Upon deciding to incorporate a business in Texas, one critical step involves completing the Articles of Incorporation form. This legal document, pivotal in establishing your business as a corporation under Texas law, requires careful attention to detail. The process doesn't end with submission; following approval, businesses must comply with Texas regulations, including obtaining the necessary permits and adhering to state tax obligations. To navigate this process efficiently, follow these step-by-step instructions, ensuring your business sets off on the right legal footing.

- Begin by accessing the official Texas Secretary of State website. Locate and download the most current Articles of Incorporation form available.

- Read the instructions provided with the form carefully. These guidelines will help ensure all necessary information is correctly entered.

- Fill in the name of the corporation. Ensure it meets Texas naming requirements and does not infringe on any existing trademarks or business names.

- Specify the type of corporation you are registering: non-profit, profit, professional, etc. This will determine the regulatory framework your business falls under.

- Enter the registered agent's information. A registered agent is responsible for receiving legal documents on behalf of the corporation. This must be a physical address in Texas.

- List the initial board of directors. Texas requires the names and addresses of the individuals who will serve on the board at the time of incorporation.

- Include the corporation’s purpose. While broad descriptions are often acceptable, being specific can prevent confusion or legal issues down the line.

- Decide on the share structure if applicable. For corporations that will have shareholders, outline the number of shares authorized to be issued and any classifications of those shares.

- Enter the incorporator's information. This is the person filling out the form, who may or may not be a stakeholder in the corporation.

- Review the completed form for accuracy. Make sure all required fields are filled out and that the information is correct.

- Sign and date the form as required. The form may need signatures from the incorporator, directors, or other parties, depending on the corporation's structure.

- Submit the form along with any required filing fee to the Texas Secretary of State. This can often be done online, by mail, or in person.

- Wait for confirmation. The state will review the submission and, if everything is in order, officially register your corporation. Keep an eye on the mail or email for this confirmation.

Filling out the Articles of Incorporation is a foundational step in building your business. It formally marks its creation and sets the legal groundwork for all your future operations. Attention to detail and thoroughness in this process not only ensure compliance with state laws but also protect your business's legal standing moving forward.

Understanding Texas Articles of Incorporation

What are the Texas Articles of Incorporation?

The Texas Articles of Incorporation is a document required by the Texas Secretary of State to legally establish a corporation within the state. This form sets out critical details about the corporation, including its name, type, duration, addresses, and information about its shares, directors, and registered agent.

How do I submit the Texas Articles of Incorporation?

Submission can be done online through the Texas Secretary of State's website or by mailing a paper form to the designated office. Online filing is typically faster and allows for easier tracking of the submission status.

Is there a fee to file the Texas Articles of Incorporation?

Yes, there is a filing fee which must be paid at the time of submission. The fee amount varies depending on the type of corporation being established. Updated fee schedules can be found on the Texas Secretary of State's website or by contacting their office directly.

Can I reserve a corporation name before filing the Articles of Incorporation?

Yes, Texas allows for the reservation of a corporation name. This can be done by submitting a name reservation application and fee to the Texas Secretary of State prior to filing your Articles of Incorporation. This reservation holds the name exclusively for you for a set period.

What information is needed to complete the Articles of Incorporation?

When completing the form, you will need to provide the corporation's proposed name, its purpose, the duration of the corporation (if not perpetual), the registered agent's name and address, the initial board of directors' names and addresses, and information about the corporation's authorized shares.

Who can act as a Registered Agent for my corporation?

A Registered Agent can be an individual who resides in Texas or a business entity authorized to conduct business in Texas. The agent must have a physical Texas street address (not a P.O. Box) and consent to serving as the Registered Agent for the corporation.

What are the differences between a profit and non-profit corporation in the context of the Texas Articles of Incorporation?

Profit and non-profit corporations are differentiated by their purposes and the manner in which they distribute profits. Non-profit corporations must specifically state that they are formed for a non-profit purpose and are subject to different tax exemptions and regulations. The filing process and required information might also vary slightly between the two.

How long does it take to process the Texas Articles of Incorporation?

Processing times can vary based on the submission method and the current workload of the Secretary of State's office. Online filings are generally processed quicker than paper submissions. The state offers expedited services for an additional fee.

Do I need an attorney to file the Texas Articles of Incorporation?

While it is not a legal requirement to have an attorney, consulting with one can prove beneficial in ensuring the form is completed accurately and that the corporation is set up in compliance with all state laws and regulations.

After filing, what are the next steps?

After the Texas Articles of Incorporation are filed and approved, the corporation will need to obtain any necessary licenses or permits, set up a corporate records book, issue stock certificates to the initial shareholders, and hold an initial meeting of the board of directors. Additionally, it may need to apply for an EIN (Employer Identification Number) from the IRS for tax purposes.

Common mistakes

When filling out the Texas Articles of Incorporation form, one common mistake people make is not providing a specific enough purpose for the corporation. The form requires a detailed description of the company's business activities. A general statement such as "to engage in any lawful activity" might not be sufficient. It's essential to outline the specific nature of the business to avoid delays or rejection of the form.

Another frequent error is neglecting to appoint a registered agent or failing to provide the registered agent's complete and accurate information. A registered agent is crucial as this person or entity receives legal and tax documents on behalf of the corporation. If the registered agent's name, address, or consent is not correctly filled out, the corporation may face issues with receiving important legal documents.

Incorrectly stating the number of shares the corporation is authorized to issue is also a common mistake. The form requires the corporation to specify the number of shares and the class of shares it is authorized to issue. Sometimes, people either leave this section blank or enter information that doesn't align with their business plan. This oversight can have significant legal and financial implications for the corporation's structure and funding.

Many people also forget to include the duration of the corporation if it is not perpetual. While many corporations are set up to exist perpetually, some may have a specific end date. Failing to specify this can lead to confusion and administrative complications in the future, especially if the corporation is meant to dissolve after achieving its purpose or after a certain period.

Filling out the names and addresses of the initial board of directors incorrectly or incompletely is another mistake. The Texas Articles of Incorporation form requires the names and addresses of all directors. Sometimes, information is missing, inaccurately entered, or not fully updated. This mistake can hinder the corporation's ability to operate effectively, as these individuals play a crucial role in governance and compliance from the onset.

Last but not least, people often overlook the necessity of obtaining all necessary signatures before submission. Every incorporator or authorized person must sign the form. Missing signatures can lead to the state rejecting the form. Ensuring that all relevant parties review and sign the document is essential for the successful filing of the Articles of Incorporation.

Documents used along the form

In addition to the Texas Articles of Incorporation form, various other documents and forms are often required during the incorporation process. These forms are critical because they provide additional necessary details and comply with state legal requirements. Understanding these documents can significantly streamline the incorporation process, ensuring that all legal obligations are fulfilled smoothly.

- Bylaws: These are internal documents that outline the corporation's basic management structure and operational rules. While not filed with the state, bylaws are essential for guiding the corporation's internal affairs and governance.

- Initial Report: Some states require newly incorporated entities to file an initial report after the Articles of Incorporation are filed. This report typically includes basic information about the corporation, such as the names and addresses of directors and officers.

- Statement of the Registered Agent: This form identifies the registered agent responsible for receiving legal and tax documents on behalf of the corporation. It is crucial for ensuring that the corporation can be reliably contacted by the state and other entities.

- DBA (Doing Business As) Filing: If a corporation intends to operate under a name different from its legal name, a DBA filing may be required. This allows the corporation to legally conduct business under an alternate name, providing flexibility in branding and marketing.

The completion and submission of these documents are fundamental steps in the corporation setup process. They complement the Texas Articles of Incorporation, each serving its purpose to ensure the corporation is legally compliant and operationally ready. It’s important for businesses to carefully prepare and submit these documents to establish their corporations successfully and maintain good standing within the state.

Similar forms

The Articles of Organization for an LLC (Limited Liability Company) share a close resemblance to the Texas Articles of Incorporation. Both documents serve a foundational role in the legal establishment of a business, specifying key details like the entity's name, purpose, registered office, and the details of the registered agent. While the Articles of Incorporation are used to establish a corporation, the Articles of Organization fulfill a similar purpose for establishing an LLC, making them counterparts tailored to the type of business structure being formed.

The Bylaws of a Corporation, although not filed with a state entity, are akin to the Articles of Incorporation as they provide a framework for the corporation's internal operations, governance, and management. Where the Articles of Incorporation lay the legal groundwork for the establishment of the corporation, the Bylaws delve into the specifics of meetings, board composition, and the roles and duties of officers. Both play crucial roles in delineating the structure and operational protocols of the corporation, albeit at different stages of its lifecycle.

A Certificate of Formation is another document similar to the Texas Articles of Incorporation, particularly in states other than Texas where it serves as the official filing to legally create a corporation or LLC. It contains information about the entity's name, type, duration, addresses, and management structure, functioning as the birth certificate of the entity in the respective state. The terminology differs by state, but the purpose and core contents remain closely aligned with those of the Articles of Incorporation.

The DBA (Doing Business As) Registration forms share a functional similarity with the Articles of Incorporation in that they are both filings that impact the legal identity and operation of a business. A DBA allows a business to operate under a name different from its legal, registered name. While the Articles of Incorporation establish the corporation's legal name and structure, a DBA filing allows the corporation or another business entity to publicly operate under an alternate name.

State Business License Applications, while broader in scope, are parallel to the Articles of Incorporation in their role in legitimizing an entity to operate within a state. The license application doesn’t create the entity but grants it the permission to conduct business, often specifying the kind of business activities allowed. Both documents are crucial in transitioning a business concept from an idea to a legally operating entity under state laws.

The Shareholder Agreement complements the Articles of Incorporation through its focus on the relationships between the shareholders themselves and between the shareholders and the corporation. While the Articles of Incorporation deal with the external establishment of the corporation in legal terms, the Shareholder Agreement delves into the internal mechanics of ownership, voting rights, and profit distribution, helping to solidify the operational framework within which the corporation functions.

The Operating Agreement for an LLC, much like its counterpart the Bylaws for a corporation, parallels the Articles of Incorporation but from the perspective of an LLC. This document outlines the LLC's operational and financial decisions, including rules, regulations, and provisions for running the company. It complements the Articles of Organization, providing detailed insights into the governance of the LLC, similarly to how the Articles of Incorporation lay down the foundational legal structure for a corporation.

Intellectual Property Assignment Agreements might not seem directly related to the Articles of Incorporation at first glance. Still, they are integral in transferring rights from individuals to the corporation, thus affecting its asset base and legal standing. Such agreements ensure that inventions, trademarks, or copyrights created by founders or employees belong to the corporation, contributing to the establishment's value and proprietary advantage, akin to how the Articles of Incorporation establish its legal identity.

Trademark Registration forms bear a resemblance in purpose to the Articles of Incorporation, as they both aim at legally protecting aspects of a business’s identity. While the Articles of Incorporation secure the company's name and corporate structure at the state level, Trademark Registration protects a business's brand identity - such as logos and brand names - at a federal level, ensuring exclusive rights to use them in commerce. Both filings contribute to the legal foundation and protection of the entity's commercial identity.

Dos and Don'ts

When embarking on the journey of creating a corporation in Texas, filling out the Articles of Incorporation form is a pivotal step. This document lays the foundation for your corporation's legal existence and, as such, demands careful attention. Below are essential dos and don'ts to guide you through this crucial process with clarity and precision.

Do's:

- Ensure all information provided is accurate and up-to-date. This includes the corporation's name, its purpose, the registered agent’s information, and the names of the incorporators.

- Choose a unique name for your corporation that complies with Texas state requirements, including the appropriate suffix (e.g., Inc., Corporation, etc.) to indicate its corporate status.

- Designate a registered agent with a physical address in Texas. The agent must be available during regular business hours to receive legal documents on behalf of the corporation.

- Clearly state the corporation's purpose, even if it is as broad as engaging in any lawful activity for which corporations may be organized under Texas law.

- Determine the number of authorized shares the corporation will be allowed to issue, and if there will be more than one class of shares, provide the rights and preferences of each class.

- Include the name and address of each incorporator. These individuals are responsible for executing the Articles of Incorporation.

- Check and double-check the submission for any errors or omissions before filing with the Texas Secretary of State.

Don'ts:

- Don't overlook the requirement to have a registered agent or fail to maintain an agent. Without one, the corporation could miss critical legal notices.

- Don't use generic terms in the corporation name that could confuse your corporation with a government agency (e.g., FBI, Treasury, State Department, etc.).

- Don't provide a P.O. Box as the address for the registered agent. A physical address in Texas is required.

- Don't forget to specify any director liability limitations or share issuance rules if these are important for your corporation's operational structure.

- Don't leave the incorporator section blank. Even if a service is used to fill out the form, the incorporator's name and address must be included.

- Don't neglect to sign and date the form. An unsigned form is incomplete and will be rejected by the Texas Secretary of State.

- Don't delay in submitting the form and the appropriate filing fee, as delays can impact your corporation's start date and legal standing.

Misconceptions

When discussing the Texas Articles of Incorporation, several misconceptions frequently arise. These misunderstandings can lead to confusion about the process of incorporating a business in Texas. By clarifying these, individuals seeking to form a corporation can more effectively navigate the legal requirements and implications.

The Texas Articles of Incorporation are the only document needed to start a corporation. This is a common misconception. In reality, while filing the Articles of Incorporation with the Texas Secretary of State is a critical step, other requirements must also be met, such as obtaining an Employer Identification Number (EIN) from the IRS, creating corporate bylaws, and holding an organizational meeting.

Filing Articles of Incorporation automatically provides protection for personal assets. Incorporating a business does offer some level of liability protection for the owners' personal assets from the company's debts and obligations. However, this protection is not absolute. Proper corporate formalities must be observed consistently to maintain this separation of personal and business assets.

There is a standard form that fits all types of corporations. While Texas provides a general form for the Articles of Incorporation, different types of corporations—such as non-profit, professional, and close corporations—may have unique requirements and may need to provide additional information.

Once filed, the Articles of Incorporation never need to be updated. Changes in the corporation, such as amendments to the corporate name, purpose, or share structure, require filing updated articles or amendments with the Secretary of State to reflect these modifications.

The filing fee is the same for all corporations. The filing fee can vary depending on the type of corporation being established and other factors. It is important to check the current fee schedule provided by the Texas Secretary of State.

Electronic filing is not available for the Texas Articles of Incorporation. The Texas Secretary of State does offer an electronic filing option. This method can be quicker and more convenient than traditional paper filings for many users.

Incorporation requires approval from the Internal Revenue Service (IRS). While the IRS does not approve the Articles of Incorporation, corporations must apply to the IRS to obtain an Employer Identification Number (EIN), and may also seek certain tax statuses, such as 501(c)(3) for non-profits.

All corporations are subject to the same level of regulation and reporting requirements. The extent of regulation and the specific reporting requirements can vary significantly based on the type of corporation, its size, and its business activities. For example, publicly traded companies face more stringent reporting requirements under federal and state securities laws than closely held corporations.

Understanding these aspects of the Texas Articles of Incorporation can aid in the smooth establishment and operation of a corporation within the state. It is always recommended to consult with legal and financial professionals to ensure compliance with all relevant laws and requirements.

Key takeaways

When setting up a corporation in Texas, the Texas Articles of Incorporation form is a critical document. This form marks the beginning of your corporation's legal existence. It's important to approach this task with care and attention to ensure compliance and smooth operations. Here are key takeaways to help guide you through filling out and using the Texas Articles of Incorporation:

- Understand the Requirements: Before you start, familiarize yourself with the specific requirements for the Articles of Incorporation in Texas. This includes mandatory information such as the corporation’s name, its purpose, the registered agent’s details, stock information, and more.

- Choose a Unique Name: Your corporation's name must be unique and not too similar to existing names in Texas. Conduct a thorough search through the Texas Secretary of State to ensure your desired name is available.

- Select a Registered Agent: You must designate a registered agent who has a physical address in Texas. This agent will be responsible for receiving important legal and tax documents on behalf of your corporation.

- Detail Shares Information: Clearly specify the number of shares the corporation is authorized to issue. If there are different classes of shares, this should also be detailed in the Articles of Incorporation.

- Include Incorporators Information: The incorporator(s) are the individuals preparing and filing the Articles of Incorporation. Their names and addresses must be included in the document.

- Ensure Accuracy: Double-check all entered details for correctness. Errors or omissions can delay the filing process or lead to complications down the road.

- Know the Filing Process: The Texas Articles of Incorporation can typically be filed online, by mail, or in person. Each method has its own set of instructions, which should be carefully followed. A filing fee is required at the time of submission.

- Maintain a Copy: Once filed, ensure you obtain and maintain a stamped copy of the Articles for your records. This document serves as proof of your corporation's legal existence and may be required for various business activities and banking purposes.

Filling out and using the Texas Articles of Incorporation form is a foundational step in establishing your corporation. Approaching this process with a thorough understanding and attention to detail will help set the stage for your business’s long-term success. Remember, these guidelines serve as a starting point; it might also be beneficial to consult with a legal professional or business advisor familiar with Texas corporate law.

More Articles of Incorporation State Forms

How to Incorporate in Nc - Properly completing and filing the Articles of Incorporation can help avoid legal and administrative hurdles, enabling a smoother launch and operation of your corporation.

Georgia Secretary of State Corporations - Accuracy and completeness in the Articles of Incorporation are paramount to avoid complications in the corporation's legal and operational status.

How to Open a Corporation in Ny - Also addresses the issuance of shares to the initial shareholders, a crucial step in securing capital and defining ownership.

Ohio Secretary of State Business Search Ohio - It is the first step in establishing a corporation's eligibility to enjoy certain tax benefits, subject to compliance with other tax laws and regulations.