Fillable Articles of Incorporation Document for Pennsylvania

When embarking on the exciting journey of starting a corporation in Pennsylvania, one of the first and most critical steps involves filling out the Articles of Incorporation form. This document lays the foundation for your corporate entity, serving as a formal announcement of its creation to the state. It encompasses vital details such as the corporation's name, purpose, duration, share structure, and information about incorporators. Additionally, it addresses the appointment of initial directors and the designation of a registered office or agent in Pennsylvania. The process may seem daunting, but understanding the essential components and requirements of the Articles of Incorporation can significantly smooth the path toward establishing your corporation's legal identity. By meticulously completing this form, entrepreneurs take a crucial step toward bringing their corporate visions to life, ensuring compliance with state regulations, and setting the stage for future success.

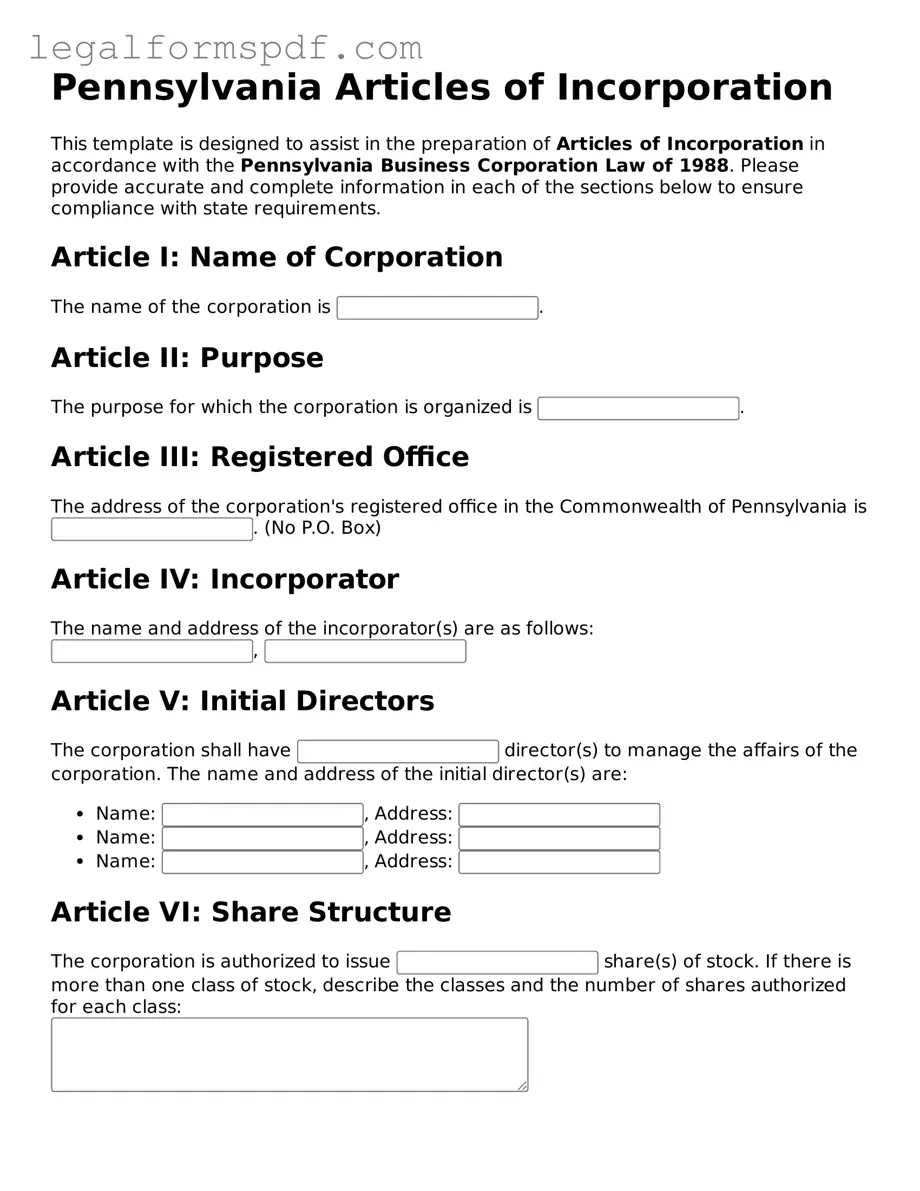

Document Example

Pennsylvania Articles of Incorporation

This template is designed to assist in the preparation of Articles of Incorporation in accordance with the Pennsylvania Business Corporation Law of 1988. Please provide accurate and complete information in each of the sections below to ensure compliance with state requirements.

Article I: Name of Corporation

The name of the corporation is .

Article II: Purpose

The purpose for which the corporation is organized is .

Article III: Registered Office

The address of the corporation's registered office in the Commonwealth of Pennsylvania is . (No P.O. Box)

Article IV: Incorporator

The name and address of the incorporator(s) are as follows:

,

Article V: Initial Directors

The corporation shall have director(s) to manage the affairs of the corporation. The name and address of the initial director(s) are:

- Name: , Address:

- Name: , Address:

- Name: , Address:

Article VI: Share Structure

The corporation is authorized to issue share(s) of stock. If there is more than one class of stock, describe the classes and the number of shares authorized for each class:

Article VII: Incorporation Statement

We, the undersigned, being the incorporator(s) of the corporation named herein, declare under penalty of perjury that this document and the facts stated in it are true. Executed on this , at , Pennsylvania.

Article VIII: Compliance

Compliance with additional requirements as mandated by the Commonwealth of Pennsylvania and the federal government, including but not limited to tax registration, employer requirements, and necessary permits or licenses, must be ensured by the incorporators and the board of directors.

Article IX: Effective Date

The effective date of incorporation shall be the date of filing these articles with the Pennsylvania Department of State unless a later date is specified:

By filling out this template, you acknowledge that this is an initial step in forming a corporation in Pennsylvania. It is recommended to seek legal advice to ensure all corporation activities adhere to state and federal laws.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose Specification | In Pennsylvania, the Articles of Incorporation must specify the purpose for which the corporation is being formed. |

| Governing Law | The Pennsylvania Articles of Incorporation are governed by the Pennsylvania Business Corporation Law of 1988. |

| Authorized Share Classification | The form requires information about the classes of shares and the number of shares that the corporation is authorized to issue. |

| Incorporator Requirements | At least one incorporator, who may be an individual or an entity, must sign the Pennsylvania Articles of Incorporation. |

Instructions on Writing Pennsylvania Articles of Incorporation

Filling out the Articles of Incorporation is a crucial step when you're starting a corporation in Pennsylvania. This document formally registers your business with the Pennsylvania Department of State. It's important to fill out the form carefully to ensure that all the information about your corporation is accurate and complies with state laws. Once submitted, your corporation will be officially recognized. Here are the steps you need to follow to accurately complete the Pennsylvania Articles of Incorporation form.

- Begin by downloading the most recent version of the Articles of Incorporation form from the Pennsylvania Department of State's website.

- Enter the proposed name of your corporation, ensuring it complies with Pennsylvania's naming requirements and does not resemble any existing business names too closely.

- Specify the type of corporation you are registering (e.g., non-profit, professional, business, etc.).

- Provide the address of the corporation's initial registered office in Pennsylvania. Note that P.O. Boxes are not acceptable; a physical address is required.

- Include information on the number of shares the corporation is authorized to issue, if applicable.

- If there are any specific provisions for the management of the corporation, details of these should be attached on a separate sheet.

- Specify the name and address of each incorporator. Incorporators are the individuals preparing and signing the Articles of Incorporation.

- Ensure the incorporator(s) sign the document, as their signature(s) officially acknowledges their role and the authenticity of the information provided.

- If required, include additional documents. Some corporations may need to attach certain additional documents, depending on the nature of their business or if they are claiming a specific tax status.

- Lastly, review all the information provided for accuracy, and then submit the form along with the prescribed fee to the Pennsylvania Department of State. The submission can usually be done online or through mail, depending on your preference.

After you've submitted your Articles of Incorporation and the state of Pennsylvania has reviewed and approved them, your corporation will be legally formed. You'll receive a confirmation document, often a certificate of incorporation, which is your green light to start operating your business under the corporation's name. From here, you can move forward with obtaining any necessary licenses and permits, opening a bank account, and kicking off your business activities. Remember, the way you manage and operate your corporation must comply with Pennsylvania state laws, including yearly reporting and tax obligations.

Understanding Pennsylvania Articles of Incorporation

What are the Pennsylvania Articles of Incorporation?

The Pennsylvania Articles of Incorporation is a document that legally establishes a corporation within the state. It outlines key details about the corporation, including its name, purpose, office address, incorporator information, and shares structure. Filing this document with the Pennsylvania Department of State is a critical step in creating a recognized business entity.

Who needs to file the Pennsylvania Articles of Incorporation?

Any group seeking to form a corporation in Pennsylvania must file the Articles of Incorporation. This applies to both profit and non-profit organizations intending to operate within the state.

What information is needed to complete the Articles of Incorporation?

To properly complete the form, you will need the corporation's name, the purpose for which it is being established, the address of its initial registered office in Pennsylvania (this cannot be a P.O. Box), the names and addresses of the incorporators, and details about the corporation's authorized stock, if applicable.

Is there a fee to file the Articles of Incorporation in Pennsylvania?

Yes, there is a filing fee required with the submission of the Articles of Incorporation. The fee amount varies depending on the type of corporation being established. For the most current fee schedule, it's recommended to check directly with the Pennsylvania Department of State or its website.

How long does it take to process the Articles of Incorporation in Pennsylvania?

The processing time can vary depending on the current workload of the Pennsylvania Department of State and the filing method used. Generally, filings can take several weeks to process. Expedited service options may be available for an additional fee.

Can the Articles of Incorporation be filed online?

Yes, Pennsylvania allows for the online filing of the Articles of Incorporation through the Pennsylvania Department of State's website. Online filing can streamline the process and may lead to faster processing times.

After filing, what are the next steps?

Once the Articles of Incorporation are filed and approved, the corporation should obtain any necessary local and state business licenses, set up a corporate records book, issue stock certificates to the initial owners, and hold an organizational meeting to adopt bylaws and select directors (if not already named in the articles).

Can amendments be made to the Articles of Incorporation?

Yes, amendments to the Articles of Incorporation can be filed with the Pennsylvania Department of State. This is necessary when making changes to the corporation's name, purpose, authorized shares, or other key details initially filed. There's a separate form and fee for filing amendments.

Where can one find help in completing the Articles of Incorporation?

Assistance with completing the Articles of Incorporation can come from several sources, including legal professionals specializing in business law, various business support services, and the Pennsylvania Department of State's website, which offers guidelines and contact information for further questions.

Common mistakes

Filling out the Pennsylvania Articles of Incorporation requires careful attention to detail, yet many individuals make common mistakes during this process. One of the most frequent errors is not checking the name availability before submission. Pennsylvania law requires that each corporation has a unique name, and failing to verify this can lead to the rejection of the application. A quick search on the Pennsylvania Department of State website can help avoid this pitfall.

Another typical mistake involves the improper specification of the corporation's purpose. It's crucial to be precise yet comprehensive in defining the purpose for which the corporation is being formed. A vague or overly broad purpose statement may not satisfy the legal requirements, leading to unnecessary delays in the approval process.

Additionally, incorrect or incomplete information about the corporation's shares can cause issues. The form requires specific details about the number and type of shares the corporation is authorized to issue. Neglecting to fill out this section correctly can complicate future funding efforts or alter the corporation's legal and financial structure in unintended ways.

Omitting the registered office address or providing a non-Pennsylvania address is a common oversight. The law mandates that every corporation has a registered office in the state, which may or may not be the same as its place of business. This address is crucial for receiving legal and official correspondence.

Many filers overlook the necessity of including a Consent to Appropriation of Name if the chosen name is already in use by another entity but consent has been granted for its use. This document must accompany the Articles of Incorporation when applicable, and failing to include it can result in the rejection of the filing.

Another area often mishandled is the designation of the incorporator’s information. The incorporator, who may or may not be a future officer or director of the corporation, is responsible for executing the Articles of Incorporation. Their name and address must be accurately listed, yet this is frequently either inaccurately completed or altogether missed.

Failure to properly execute the document is another common error. The Articles of Incorporation require a signature from the incorporator(s), and sometimes this is either omitted or not properly witnessed, depending on the requirements at the time of filing. This seemingly minor oversight can invalidate the entire submission.

The scheduling of the effective date of incorporation is often misunderstood. Some individuals assume the corporation becomes legally effective on the date of filing, but it's possible to specify a different effective date within a certain timeframe. Not understanding or utilizing this feature can lead to confusion regarding the official start date of the corporation.

Lastly, neglecting to attach the required filing fee, or attaching an incorrect amount, is a straightforward yet surprisingly common mistake. Without the correct fee, the Pennsylvania Department of State will not process the Articles of Incorporation, leading to delays or the need to resubmit the documents entirely.

By attending to these details and ensuring that all information is accurate and complete, filers can avoid common pitfalls and facilitate a smoother incorporation process in Pennsylvania.

Documents used along the form

When forming a corporation in Pennsylvania, the Articles of Incorporation represent just the first step in a comprehensive process. To ensure compliance with state and federal law and to establish the operational framework of your new entity, numerous other documents and forms come into play. These range from basic registrations and permits to more complex agreements defining the internal governance of the corporation. Understanding each of these documents is crucial for a smooth start and successful operation of your business.

- Bylaws: These internal documents outline the corporation's operational rules, including the roles of officers, the procedure for holding meetings, and how decisions are made. Drafting bylaws is essential for defining the governance structure of the corporation.

- Initial Report: Some states require a new corporation to file an initial report after incorporation. This report typically includes basic information about the corporation, such as the names of directors and the business address.

- Employer Identification Number (EIN): Issued by the Internal Revenue Service (IRS), this is a unique nine-digit number used to identify your business entity for federal tax purposes. It's essential for opening a bank account, hiring employees, and filing tax returns.

- Share Certificates: These documents certify the ownership of shares in the corporation. They are issued to each of the corporation’s shareholders to signify their ownership interest in the company.

- Operating Agreement: Although more commonly associated with limited liability companies (LLCs), corporations, especially those with a small number of shareholders, might also adopt operating agreements to specify the financial and functional decisions of the business, including rules, regulations, and provisions for running the company.

- Stock Ledger: A critical record that tracks the issuance and transfer of a corporation's stock. It includes details of the stock owned by each shareholder, including the number of shares, issue date, and any transfers of ownership.

- Corporate Resolutions: These are formal decisions or statements approved by the board of directors or shareholders. Corporate resolutions can cover a wide range of actions, from opening bank accounts to authorizing transactions and other significant business decisions.

- Banking Resolution: A specific type of corporate resolution that authorizes certain individuals to open and manage accounts in the name of the corporation. This document is usually required by banks when opening a business account.

While the Articles of Incorporation are essential for legally forming your corporation in Pennsylvania, these additional documents are equally important for establishing its operational, financial, and governance frameworks. Proper preparation and management of these documents will help ensure your corporation operates smoothly, remains in good legal standing, and is prepared for future growth and changes. Being thorough and attentive to these requirements from the start can save your business considerable time and resources down the line.

Similar forms

The Pennsylvania Articles of Incorporation form shares similarities with the Certificate of Formation used in several states. Both documents are fundamental in officially recognizing a business as a legal entity within their respective jurisdictions. They include essential information such as the company name, its purpose, the office's registered address, and the names of the incorporators. While the terminology might differ, with some states opting for 'Certificate of Formation' rather than 'Articles of Incorporation,' the primary purpose of legitimizing a business entity under state law remains constant.

Another related document is the Corporate Bylaws, which, though not filed with the state like the Articles of Incorporation, outlines the internal management structure of the corporation. The Bylaws detail the rules and regulations that govern the operation of the business, including the roles of directors and officers, meeting schedules, and shareholder voting rights. The creation of Bylaws is a critical step that follows the filing of the Articles of Incorporation, providing a comprehensive framework for corporate governance.

The Operating Agreement resembles the Articles of Incorporation but is used by Limited Liability Companies (LLCs) instead of corporations. This document serves a similar purpose in setting forth the company's financial and functional decisions, including rules, regulations, and provisions for the business's operation. While the Articles of Incorporation are more focused on the establishment of the company, the Operating Agreement delves into the management and logistical aspects, catering to the unique needs of LLCs.

The DBA (Doing Business As) Filing is another document that, while distinct, shares a common purpose with the Articles of Incorporation in terms of business identity. A DBA allows a business to operate under a name different from its legal name filed in the Articles of Incorporation. This is particularly useful for branding and marketing, enabling a corporation to present itself to the public under a more relatable or relevant trade name without altering its official registered name.

Business Licenses, although more varied in nature, also complement the Articles of Incorporation. Once a business is legally incorporated, it may still need specific licenses to operate legally in its chosen industry or location. These permits and licenses vary widely depending on the nature of the business, its location, and the applicable regulatory requirements. They signify the company's compliance with local laws and regulations, similar to how the Articles signify compliance with state incorporation laws.

The Employer Identification Number (EIN) Application is a critical document for new businesses, akin to the Articles of Incorporation. The Internal Revenue Service (IRS) uses the EIN to identify a business entity for tax purposes. While the Articles officially recognize the corporation at the state level, the EIN is a federal acknowledgment, enabling the business to hire employees, open bank accounts, and fulfill other essential operational needs.

Statement of Information filings are required periodically by many states to update or confirm the information about a corporation or LLC on record. Similar to the Articles of Incorporation, which initially registers the business's details with the state, the Statement of Information maintains the accuracy of this information over time. Details such as the business address, directors, and officers might need updating, ensuring the state’s records remain current.

Stock Certificates are issued by corporations to signify ownership in the company. While the Articles of Incorporation establish the company's existence and authorize the issuance of stock, the Stock Certificates are tangible evidence of the ownership conveyed thereby. These certificates indicate the number of shares owned by an individual or entity, playing a pivotal role in the distribution of dividends, voting rights, and ownership transfers.

The Certificate of Good Standing, although not part of the initial incorporation process, is directly related to the maintenance of the status introduced by the Articles of Incorporation. Issued by the state, this certificate confirms that a corporation is in compliance with state regulations and has fulfilled its annual reporting and fee obligations. It often is required for business transactions, financing, and in the registration of the business in other states, acting as a testament to the company’s adherence to legal requirements post-incorporation.

Lastly, the Nonprofit Articles of Incorporation share a foundational purpose with their corporate counterparts but are specifically tailored to the creation of nonprofit organizations. These documents outline not only the basic information like the business name and address but also the nonprofit’s specific purpose, how it will operate, and the rules for the distribution of assets on dissolution. This delineation highlights the dual nature of nonprofits, balancing a charitable mission with operational sustainability, under the oversight provided initially by their Articles of Incorporation.

Dos and Don'ts

When you're ready to incorporate a business in Pennsylvania, filling out the Articles of Incorporation form accurately is a crucial step. This document lays the foundation for your business's legal structure and compliance. Here’s a handy list of do's and don'ts to keep in mind:

Do's:

- Provide complete and accurate information for every question. Incomplete forms may result in delays or rejection.

- Check that the business name you wish to use is available in Pennsylvania. It should be distinguishable from other names already registered.

- Include the required filing fee with your submission. Failure to do so can lead to your application not being processed.

- Specify the type of corporation you are establishing. Pennsylvania recognizes several types, each with its own regulations.

- Appoint a registered agent with a physical address in Pennsylvania. This agent will handle official correspondence on behalf of your corporation.

Don'ts:

- Omit the signature of the incorporator. A form without the proper signatures will not be accepted.

- Forget to specify the number of shares the corporation is authorized to issue, if applicable. This is a critical detail for defining ownership.

- Use vague language in describing the corporation's purpose. Be as specific as possible to avoid potential legal ambiguities.

- Ignore the need for bylaws. While not submitted with the Articles of Incorporation, bylaws are an internal document that should be prepared in conjunction with incorporation.

- Assume the process ends with filing the Articles of Incorporation. Remember, there may be additional federal, state, or local requirements to start operating.

Filling out the Articles of Incorporation correctly is a step that should be approached with careful attention to detail. It’s important to remember that while the form itself is a starting point, the real journey of compliance and regulation begins after filing. Seek professional guidance if you have questions or concerns about the process, ensuring that your business is on solid legal ground from day one.

Misconceptions

When forming a corporation in Pennsylvania, one critical step is filing the Articles of Incorporation. However, several misconceptions surround this process, leading to confusion and potential mistakes. Understanding these misconceptions is essential for anyone looking to incorporate a business in Pennsylvania.

All businesses must file Articles of Incorporation. Not every business needs to file Articles of Incorporation. This document is specific to corporations. Other business structures, like sole proprietorships or partnerships, have different filing requirements. Limited Liability Companies (LLCs), for example, file Articles of Organization.

It’s a one-size-fits-all form. While the Pennsylvania Department of State provides a standard form, not all corporations will find this sufficient. Depending on the nature and needs of the business, additional provisions may be necessary. Tailoring the Articles to fit specific business needs is often overlooked but crucial.

The filing process is complicated and requires a lawyer. The process to file Articles of Incorporation in Pennsylvania is straightforward, and while having legal advice is beneficial, especially for complex structures, many businesses successfully file on their own with careful research and attention to the instructions provided by the state.

Once filed, no further action is needed. Filing the Articles of Incorporation is a significant step, but it's just the beginning. Businesses must comply with ongoing requirements like reporting, taxes, and maintaining proper records to stay in good standing with the state.

The filing fee is the only cost involved. The initial filing fee is just one part of the cost of incorporating. Corporations may also need to pay for registered agent services, business licenses, and other permits required to legally operate in Pennsylvania.

Electronic filing is instant. While electronic filing can be quicker than paper filing, it doesn’t mean immediate approval. The state still needs to review the filing, which can take time. The turnaround time can vary based on the volume of filings and other factors.

Any name can be used for the corporation. The chosen name for the corporation must be unique and not too similar to existing names on file with the Pennsylvania Department of State. It must also meet state naming requirements, including certain designators like "Incorporated" or "Corporation."

The Articles of Incorporation protect personal assets. While incorporating can offer some protection of personal assets from business liabilities, it’s not absolute. Proper corporate governance and practices must be maintained to ensure this protection. Solely filing the Articles without following corporate formalities can leave personal assets vulnerable.

You can include any information you want in the Articles. The content that can be included in the Articles of Incorporation is governed by state law. Certain information is required, and there are limits on what else can be included. Adding provisions not allowed by law can lead to the rejection of the filing.

Clearing up these misconceptions can pave the way for a smoother incorporation process. It's advisable to carefully review Pennsylvania's guidelines and seek expert advice when needed to ensure that the process is handled correctly.

Key takeaways

Filling out and using the Pennsylvania Articles of Incorporation form correctly is crucial for businesses intending to establish themselves as a corporation within the state. Here are six key takeaways to guide you through the process:

- Collect Necessary Information: Before filling out the form, gather all required information. This includes the corporation's name, its purpose, registered office address in Pennsylvania, the names and addresses of incorporators, and the number of shares the corporation is authorized to issue.

- Ensure Name Availability: The chosen name for your corporation must be unique and not similar to other business names registered in Pennsylvania. It's advisable to check the availability of your proposed name with the Pennsylvania Department of State before submitting the form.

- Identify the Proper Form: Pennsylvania offers different forms for different types of corporations (e.g., non-profit, professional, benefit, etc.). Make sure you are using the correct form for your specific type of corporation.

- Adhere to State Requirements: The Articles of Incorporation must comply with the Pennsylvania Business Corporation Law. This includes specific language and requirements related to corporate structure, shareholder liability, and the issuance of stock.

- File Appropriately: Once completed, the form must be filed with the Pennsylvania Department of State. This can typically be done online or by mail. Remember to include the filing fee, which varies depending on the type of corporation.

- Keep Copies for Your Records: After filing, ensure you keep a copy of the filed Articles of Incorporation and any correspondence from the state. These documents are important for legal and administrative purposes.

More Articles of Incorporation State Forms

Ca Biz File - Details on the initial board members or directors may need to be included, depending on state requirements.

Georgia Secretary of State Corporations - By defining the scope of the corporation’s business activities, it enables the corporation to maintain focus and regulatory compliance.

How to Open a Corporation in Ny - The document acts as a public record, establishing the corporation's legal existence and its rights to operate within the state.