Fillable Articles of Incorporation Document for Ohio

Starting a corporation in Ohio is a significant step for any entrepreneur or group looking to formalize their business structure. Central to this process is the Ohio Articles of Incorporation form, a document that establishes a corporation's existence under state law. This form, filled with essential details about the company, includes the corporation's name, principal place of business, type of corporation, authorized shares, initial directors, and statutory agent, among other important information. The form's completion and submission mark the beginning of the corporation's legal life, setting the foundation for its operations, governance, and compliance with Ohio's regulatory environment. Given its significance, understanding the form's components, requirements, and the implications of the information provided is critical for anyone looking to navigate the complexities of incorporating in Ohio successfully. This initial step, while administrative, paves the way for the entity's future endeavors, making a thorough and accurate completion crucial.

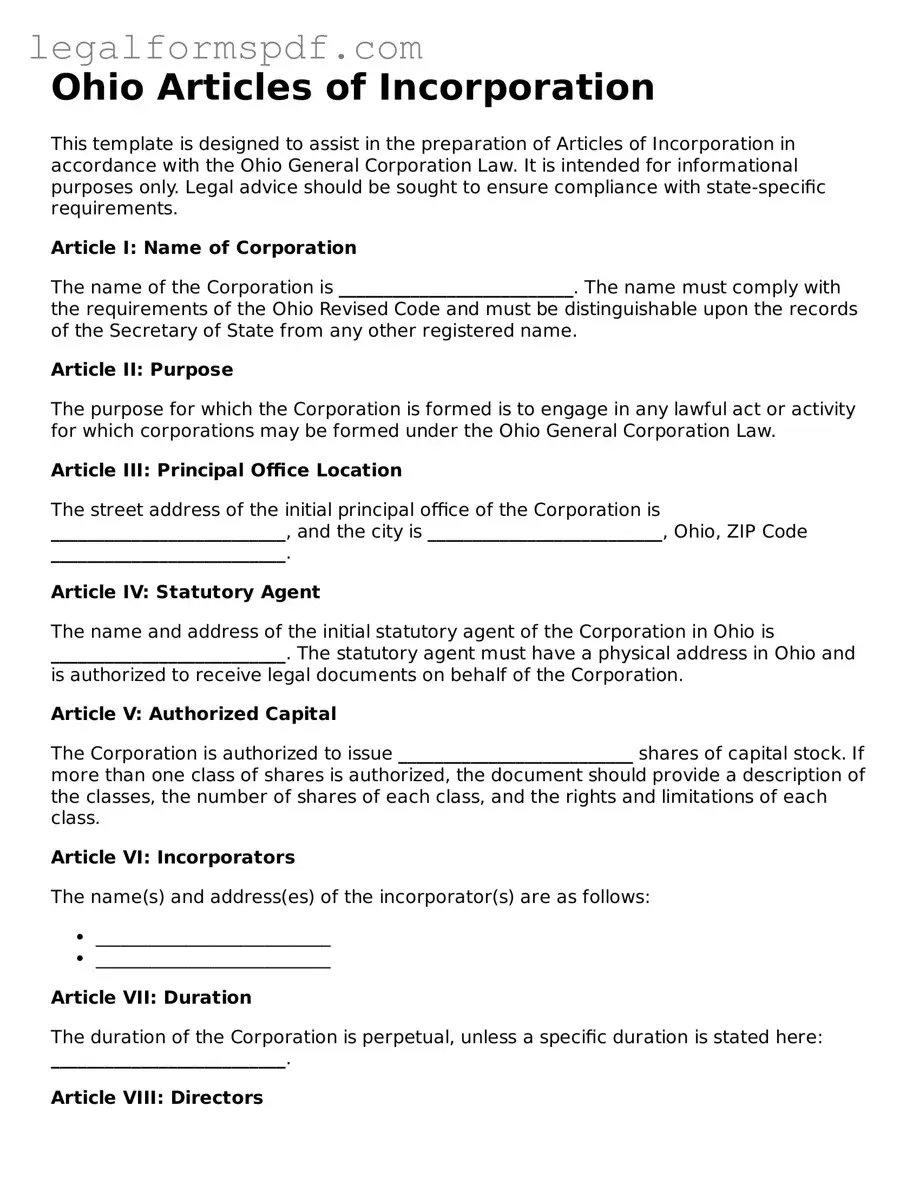

Document Example

Ohio Articles of Incorporation

This template is designed to assist in the preparation of Articles of Incorporation in accordance with the Ohio General Corporation Law. It is intended for informational purposes only. Legal advice should be sought to ensure compliance with state-specific requirements.

Article I: Name of Corporation

The name of the Corporation is __________________________. The name must comply with the requirements of the Ohio Revised Code and must be distinguishable upon the records of the Secretary of State from any other registered name.

Article II: Purpose

The purpose for which the Corporation is formed is to engage in any lawful act or activity for which corporations may be formed under the Ohio General Corporation Law.

Article III: Principal Office Location

The street address of the initial principal office of the Corporation is __________________________, and the city is __________________________, Ohio, ZIP Code __________________________.

Article IV: Statutory Agent

The name and address of the initial statutory agent of the Corporation in Ohio is __________________________. The statutory agent must have a physical address in Ohio and is authorized to receive legal documents on behalf of the Corporation.

Article V: Authorized Capital

The Corporation is authorized to issue __________________________ shares of capital stock. If more than one class of shares is authorized, the document should provide a description of the classes, the number of shares of each class, and the rights and limitations of each class.

Article VI: Incorporators

The name(s) and address(es) of the incorporator(s) are as follows:

- __________________________

- __________________________

Article VII: Duration

The duration of the Corporation is perpetual, unless a specific duration is stated here: __________________________.

Article VIII: Directors

The number of directors constituting the initial Board of Directors of the Corporation is __________________________, and their names and addresses are as follows:

- __________________________

- __________________________

- __________________________

Article IX: Indemnification

The Corporation shall indemnify a director, officer, employee, or agent of the Corporation to the fullest extent permitted by the Ohio General Corporation Law.

Article X: Bylaws

The initial bylaws of the Corporation shall be adopted by the Board of Directors at their first meeting. The power to alter, amend, or repeal the bylaws or adopt new bylaws shall be vested in the Board of Directors unless otherwise provided in the Articles of Incorporation or the laws of Ohio.

Article XI: Adoption of Articles

The undersigned incorporator(s) hereby adopt these Articles of Incorporation on this ____ day of ____________, 20____.

__________________________

Name of Incorporator

__________________________

Signature of Incorporator

This template serves as a guide to ensure the comprehensive inclusion of information necessary for filing Articles of Incorporation in Ohio. For legal advice or more detailed information regarding the process, consulting with a legal professional is recommended.

PDF Specifications

| Fact Name | Detail |

|---|---|

| Purpose | The form is used to legally create a corporation in Ohio. |

| Governing Laws | It is governed by the Ohio Revised Code (ORC), specifically Section 1701. |

| Mandatory Information | Includes corporation name, type, registered agent, and incorporator details. |

| Filing Fee | There's a required filing fee, which varies depending on the type of corporation. |

| Online Filing Option | Ohio allows for the form to be filed online for convenience. |

| Annual Requirements | Corporations must file annual reports to maintain good standing. |

Instructions on Writing Ohio Articles of Incorporation

Filling out the Ohio Articles of Incorporation is a fundamental step for individuals seeking to establish a corporation in the state of Ohio. The process involves providing detailed information about the corporation to be registered, including its name, type, statutory agent, incorporators, and capital structure, among other requirements. Completing this form accurately is essential as it forms the legal basis for the corporation's operations, rights, and obligations under Ohio law. Once submitted and approved, it signifies the official creation of the corporation, enabling it to commence business activities, enter into legal contracts, and meet other statutory obligations. The following steps are designed to assist you in filling out the form with the required information.

- Determine the type of corporation you wish to establish: a profit, nonprofit, professional association, or limited liability company. This choice will affect the sections of the form you need to complete.

- Identify a unique name for your corporation that complies with Ohio state requirements. The name must distinguish your corporation from others and include a corporate designator such as "Inc.," "Corporation," or an abbreviation thereof.

- Appoint a statutory agent who resides in Ohio. This person or entity will be responsible for receiving legal documents on behalf of the corporation. Include the statutory agent's full name and physical address in Ohio (no P.O. Boxes).

- Specify the number of shares the corporation is authorized to issue. This includes detailing the classes of shares and any series within those classes, if applicable. Provide the par value of the shares or a statement that the shares have no par value.

- List the names and addresses of the incorporators. Incorporators are individuals involved in forming the corporation and may or may not be shareholders.

- Include any additional provisions that govern the corporation's operations. These can range from internal management processes to how assets are distributed upon dissolution. Specific requirements may vary depending on the corporation type.

- Review the form to ensure all information is correct and complete. Any inaccuracies can delay the process or affect the legal standing of the corporation.

- Sign and date the form. The incorporator(s) or the president and secretary of the corporation, depending on who is filling out the form, must sign.

- Pay the required filing fee. The amount depends on the type of corporation being established and is subject to change. Check with the Ohio Secretary of State's office for the current fee structure.

- Submit the completed form and any required attachments, along with the filing fee, to the Ohio Secretary of State's office. Forms can typically be submitted by mail, in person, or online, depending on the state's available services.

After submitting the Articles of Incorporation, it's important to be patient as the review process can take some time. Once the form is approved, the state will issue a certificate of incorporation, officially recognizing your corporation's legal existence. It's recommended to keep a copy of this certificate and all related documentation for your records. Following incorporation, there may be additional regulatory and tax obligations to be aware of to maintain good standing with the state. Consulting with a legal professional can provide guidance tailored to your specific situation.

Understanding Ohio Articles of Incorporation

What is the purpose of the Ohio Articles of Incorporation form?

The Ohio Articles of Incorporation form serves as a critical document for establishing a corporation's legal existence within the state of Ohio. By filing this document, an entity is officially recognized as a corporation under Ohio law, which is essential for conducting business, entering into contracts, hiring employees, and ensuring limited liability protection for its owners.

Who needs to file the Ohio Articles of Incorporation?

Any individual or group of individuals planning to form a corporation in Ohio must file the Articles of Incorporation. This requirement applies regardless of the corporation's size or purpose, encompassing both profit and nonprofit entities seeking to operate within the state's jurisdiction.

What information is required to complete the Ohio Articles of Incorporation?

Completing the Ohio Articles of Incorporation necessitates various pieces of information about the corporation, including, but not limited to, the corporate name, principal place of business, registered agent's name and address, incorporator(s) information, the corporation's purpose, and stock details such as the number of shares and class.

Where can one obtain the Ohio Articles of Incorporation form?

The Ohio Articles of Incorporation form can be accessed and downloaded from the official website of the Ohio Secretary of State. Additionally, physical copies can be obtained by visiting the Secretary of State's office or requesting a copy through mail or phone.

Is there a filing fee for the Ohio Articles of Incorporation, and if so, how much?

Yes, there is a filing fee required to process the Ohio Articles of Incorporation. The standard filing fee is subject to change; therefore, it is advisable to consult the Ohio Secretary of State's website or contact their office directly for the most current fee structure.

How long does it take to process the Ohio Articles of Incorporation?

The processing time for the Ohio Articles of Incorporation can vary based on the method of submission and the current workload of the Secretary of State's office. Typically, processing times range from a few days to several weeks. Expedited services may be available for an additional fee for those requiring faster processing.

What happens if there is an error in the form?

If an error is identified in the Ohio Articles of Incorporation form after submission, the Secretary of State's office may reject the filing or request amendments to correct the inaccuracies. It is crucial to review the form carefully before submission to avoid delays.

Can the Ohio Articles of Incorporation be filed electronically?

Yes, the Ohio Secretary of State offers an online filing option for the Articles of Incorporation. This method is often faster and more convenient, allowing for quicker processing times and immediate confirmation of submission.

Common mistakes

Filling out the Ohio Articles of Incorporation is a crucial step in establishing a corporation in the state. Sadly, mistakes in completing this form can lead to delays, additional costs, and sometimes, rejection of the application itself. One common error individuals make is neglecting to specify the type of corporation they are forming. Ohio law permits the establishment of various types of corporations, including for-profit, non-profit, and professional corporations. Each type comes with its own set of rules and obligations. Failing to explicitly state the type of corporation not only complicates the incorporation process but may also result in legal and financial repercussions down the line.

Another frequent oversight is the incorrect listing of the registered agent and the registered office. The registered agent is an individual or business entity responsible for receiving legal documents on behalf of the corporation. The registered office, on the other hand, refers to the physical location within Ohio where the agent is available. Providing inaccurate information or simply a P.O. Box instead of a physical address can render the document invalid. This role is vital for ensuring that the corporation can be legally contacted and failing to properly designate a registered agent can lead to serious legal complications, including the inability to receive crucial legal notices.

Additionally, many filers underestimate the importance of detailing the corporation’s purpose. A statement of purpose that is too vague or overly broad can impede the corporation’s ability to operate efficiently within the scope of Ohio law. It’s essential to provide a clear and concise description that accurately reflects the intended business activities. This not only aids in the establishment of a solid legal foundation for the corporation but also ensures compliance with state regulations, potentially avoiding costly legal challenges or operational restrictions.

Lastly, a critical yet often overlooked mistake is neglecting to check the corporation’s name availability before submission. The Ohio Secretary of State requires that each corporation’s name be distinguishable from other names already on file. Overlooking this step can lead to an outright rejection of the Articles of Incorporation, requiring the applicant to restart the submission process. This includes not only ensuring that the chosen name is available but also that it complies with Ohio’s naming conventions and restrictions. A preliminary name availability check can save time, effort, and the frustration of having to re-submit documents.

Documents used along the form

When you set the foundation for your business entity in Ohio by filing your Articles of Incorporation, it's just the first step in a journey of compliance and official documentation. These foundational documents are part and parcel of laying out your business's legal structure, but what follows are equally essential forms and documents that ensure your business maintains its good standing and adheres to Ohio's legal and regulatory requirements. Below is a curated list of forms and documents typically used along with the Ohio Articles of Incorporation to help you navigate the administrative side of establishing your business.

- Operating Agreement: Although not officially filed with any state agency, this document is crucial for delineating the operating procedures, financial decisions, and ownership among members of an LLC. It’s an internal document that adds a level of organization and clarity to the business's operations.

- Employer Identification Number (EIN) Application: Obtained through the IRS, the EIN is essential for tax purposes, hiring employees, opening a business bank account, and more. It essentially serves as the social security number for your business.

- Business Licenses and Permits: Depending on your business’s nature and location, various local, state, and federal licenses and permits may be required to legally operate. These can range from a basic business operation license to more specific professional licenses.

- DBA (Doing Business As) Registration Form: If your business operates under a name different from the one registered with the Articles of Incorporation, a DBA form needs to be filed with the state or local government, allowing for transparency and legal operation under the alternate name.

- Corporate Bylaws: Similar to an Operating Agreement for LLCs, corporate bylaws provide the framework for the corporation's operations and decision-making processes. While not filed with the state, they are critical for internal governance.

- Annual Reports: Most businesses need to file annual reports with the Ohio Secretary of State, detailing current contact information, operations, and compliance status to maintain good standing within the state.

- Registered Agent Acceptance Form: This form documents the acceptance of your appointed registered agent - the individual or service authorized to receive legal documents on behalf of your corporation.

- Shareholder Agreement: For corporations with multiple shareholders, this agreement outlines the rights, responsibilities, and share ownership details among shareholders. It’s crucial for preventing and resolving conflicts.

- Stock Certificates: While digital tracking is common, issuing stock certificates may be a formal way of denoting share ownership within the corporation.

- Amendment Forms: As your business grows and evolves, amendments to your Articles of Incorporation might be necessary. These forms are filed with the state to officially document changes in the business’s structure, name, or operational scope.

Filing the Articles of Incorporation is a significant initial step, but it's just the beginning. Each of these documents plays a vital role in the life of your business, from establishment to daily operations, and eventual expansion or restructuring. By understanding and utilizing these forms, you can ensure that your business not only starts on a solid legal foundation but continues to thrive within the regulatory landscape of Ohio. It’s a journey of compliance, but with the right resources, it’s one that can be navigated successfully.

Similar forms

The formation of a business requires several key documents, among which the Articles of Incorporation for a corporation in Ohio share similarities with Articles of Organization for a Limited Liability Company (LLC). Just as the Articles of Incorporation establish a corporation's existence, the Articles of Organization fulfill a similar purpose for LLCs. They both serve to legally form the business structure, but with a different focus depending on the entity type. Each set of documents outlines the fundamental aspects of the business, such as the name, purpose, registered agent, and how it will be managed.

Similarly, Corporate Bylaws are closely related to the Articles of Incorporation but provide a more detailed look at the governance of the corporation. While the Articles of Incorporation offer a broad overview necessary for state recognition, Corporate Bylaws delve into the intricate rules and procedures that govern the internal management of the corporation. This includes details on shareholder meetings, the roles and responsibilities of directors and officers, and the process for handling corporate records. Both documents are crucial for the structured operation and legal compliance of the corporation.

Another document bearing resemblance to the Articles of Incorporation is the Operating Agreement for LLCs. Although Operating Agreements are more common within LLC frameworks, they share the purpose of defining the business’s internal management structures and operational protocols. Like Corporate Bylaws in a corporation, an Operating Agreement outlines member roles, voting rights, and how decisions are made within the LLC. Both documents act as an internal manual for the governance of the business entity, albeit tailored to their respective organizational structure.

The Statement of Information, required periodically by many states after the initial registration, also shares a connection with the Articles of Incorporation. This document must be updated regularly to reflect any changes in the business’s key information, such as addresses or directors. Though its nature is more maintenance-oriented compared to the foundational role of the Articles of Incorporation, both are essential filings with the state that keep the public record of the business current and compliant.

Finally, the Application for Employer Identification Number (EIN) issued by the IRS, while primarily a federal tax document, is another pivotal document for new corporations similar in necessity to the Articles of Incorporation. The EIN is crucial for tax identification purposes and is required for corporations to open bank accounts, hire employees, and comply with tax regulations. Although serving different governmental functions, obtaining an EIN and filing the Articles of Incorporation are initial steps in the legal and financial establishment of a corporation.

Dos and Don'ts

When filling out the Ohio Articles of Incorporation form, individuals must navigate the process with attention to detail to ensure their documents are complete and accurate. There are specific dos and don’ts that should be followed to facilitate a smooth filing process.

Do:

- Ensure all required information is complete. The form requires details such as the corporation’s name, type, the number of shares the corporation is authorized to issue, the effective date, and the statutory agent’s information. Missing any required information can lead to delays.

- Check the corporation name’s availability. Before submitting the Articles of Incorporation, verify that the desired corporation name is not already in use or too similar to another name in Ohio’s records. This step is crucial to avoid rejection.

- Be specific about the corporation’s purpose. Although a general purpose clause is acceptable, clearly defining the scope of business activities can prevent misunderstandings or legal complications in the future.

- Provide accurate statutory agent information. The statutory agent is responsible for receiving legal documents on behalf of the corporation. Ensure their name and physical address in Ohio are correctly provided.

- Sign and date the form where required. The Articles of Incorporation must be signed by the incorporator(s). Failing to sign the document can invalidate the filing.

- Review the entire form before submission. Take the time to double-check all entries for accuracy and completeness to prevent processing delays or additional filing fees.

Don't:

- Use unauthorized special characters in the corporation name. Stick to letters, numbers, and allowed symbols to ensure the name meets Ohio’s naming requirements.

- Forget to include the filing fee. Submission without the appropriate fee will not be processed. Check the current fee schedule as it can change.

- Ignore the instructions for each section. Each part of the form has specific instructions meant to guide you in providing the correct information. Overlooking these can lead to errors.

- Omit optional provisions that might benefit your corporation. While not required, including provisions for managing the corporation, indemnification of officers and directors, or the preemptive rights of shareholders can be advantageous.

- Provide incomplete or vague answers. If a section requires a detailed response, provide specific information to avoid the need for amendments later.

- Assume the process ends with filing. After filing the Articles of Incorporation, there are additional responsibilities like appointing a board of directors, adopting bylaws, and obtaining necessary licenses or permits.

Misconceptions

Filing the Articles of Incorporation is a significant step in establishing a corporation in Ohio. However, misconceptions about the process can lead to confusion or errors. Here are six common myths debunked to help clarify the process.

Myth 1: The Articles of Incorporation are the only document needed to start a corporation. Many believe that filing the Articles of Incorporation with the Ohio Secretary of State is all that's required to get their corporation up and running. In reality, this is just the first step. Corporations also need to draft bylaws, issue stock certificates, obtain an Employer Identification Number (EIN) from the IRS, and comply with other state and local regulations. It's a process that involves several critical steps beyond the initial filing.

Myth 2: Filing Articles of Incorporation will protect the business name exclusively in Ohio. While filing does grant some level of name protection in the state, it doesn't offer complete exclusivity. Another business could operate under a similar name if they're in a different industry or geographic location. Furthermore, to fully protect your business name, you should also consider trademarking it at the state and federal levels.

Myth 3: Articles of Incorporation can be filed without a registered agent. Ohio law requires that a corporation nominate a registered agent as part of its Articles of Incorporation. This agent acts as the official point of contact for receiving legal documents, government correspondences, and other official communications. Without appointing a registered agent, the filing will not be accepted.

Myth 4: Once filed, the Articles of Incorporation cannot be changed. Changes to the information provided in the Articles, such as the corporation's name, its registered agent, or the number of authorized shares, can all be made after the initial filing. To do this, one must file an Articles of Amendment form with the Secretary of State and pay the required fee. Adjustments are fairly common as businesses evolve.

Myth 5: The process is the same across all states. Each state has its own set of rules and requirements for incorporation. While many aspects of the process are similar, details regarding fees, the information required on the form, annual reporting obligations, and other specifics can vary significantly from state to state. It’s crucial to understand Ohio’s specific requirements when filing within the state.

Myth 6: Electronic filing is not an option in Ohio. Contrary to what some may believe, Ohio does offer the convenience of electronic filing for Articles of Incorporation. This online option simplifies the process, providing a quicker turnaround time for approval compared to traditional paper filings. It’s a streamlined, efficient route for those looking to incorporate in the state.

Understanding these misconceptions can make the process of incorporating in Ohio smoother and more straightforward. Taking the time to research and prepare can help ensure that the process is completed accurately and in compliance with state law.

Key takeaways

Starting a corporation in Ohio requires careful attention to detail, especially when completing the Articles of Incorporation. Here are key takeaways that can help ensure the process is handled correctly and efficiently:

- Before filling out the form, confirm the availability of your business name with the Ohio Secretary of State’s office to make sure it's unique and meets state requirements.

- Ensure you understand the different corporation types (e.g., nonprofit, professional, or business corporation) and select the one that best matches your entity’s purpose.

- Accurately provide the registered agent’s information. The registered agent must have a physical address in Ohio and be available during business hours to receive legal documents on behalf of the corporation.

- Specify the number of shares the corporation is authorized to issue. Thoughtfully consider this number, as it can impact your corporation’s structure, fundraising abilities, and tax obligations.

- If applicable, outline any specific classes of shares and their rights, preferences, limitations, and relative rights in detail to avoid future disputes and ensure clarity among shareholders.

- Be thorough when listing the incorporator’s information, including name and address, as the incorporator is responsible for signing and filing the Articles of Incorporation.

- Don’t overlook the necessity of including any additional provisions that may be relevant to your corporation, such as regulations on how corporate decisions are made or restrictions on transferring shares.

- Whether filing online or by mail, double-check that your form includes all required signatures and that the information is consistent and accurate to prevent delays.

- Understand the fees associated with filing the Articles of Incorporation in Ohio and ensure payment is submitted correctly to avoid processing delays.

- After filing, stay organized and maintain a copy of the filed Articles along with the filing receipt, as these documents are crucial for legal and administrative purposes.

Completing and filing the Articles of Incorporation is a significant step in establishing a legal corporation in Ohio. Paying close attention to these key takeaways can help streamline the process, ensuring your corporation complies with state laws and is set up successfully.

More Articles of Incorporation State Forms

Articles of Incorporation Sunbiz - The Articles of Incorporation can specify provisions for regulating the affairs of the corporation, its directors, and shareholders.

How to Incorporate in Nc - This form serves as a legal declaration of your corporation's existence, including details such as the corporate name, address, purpose, and duration.

Georgia Secretary of State Corporations - The Articles of Incorporation lay the legal foundation for creating a corporate entity capable of engaging in lawful business activities.