Fillable Articles of Incorporation Document for North Carolina

The journey to forming a corporation in North Carolina begins with a critical step: completing the Articles of Incorporation form. This document plays a pivotal role in the establishment of a corporation, requiring detailed information to legally create and recognize the entity within the state. Entrepreneurs and business owners must navigate through various sections, providing specifics about their corporation, including the name, purpose, duration, and information regarding incorporators and initial directors, as well as the corporation's principal office. Additionally, the type of corporation - whether for-profit or nonprofit - influences the content and details required in the form. Properly filling out this form is not just a bureaucratic necessity but a foundational element that determines how the corporation will be treated under North Carolina law and affects its operations, governance, and compliance obligations. As such, careful attention to accuracy and completeness when preparing the Articles of Incorporation is paramount for a successful start to any corporate venture in the state.

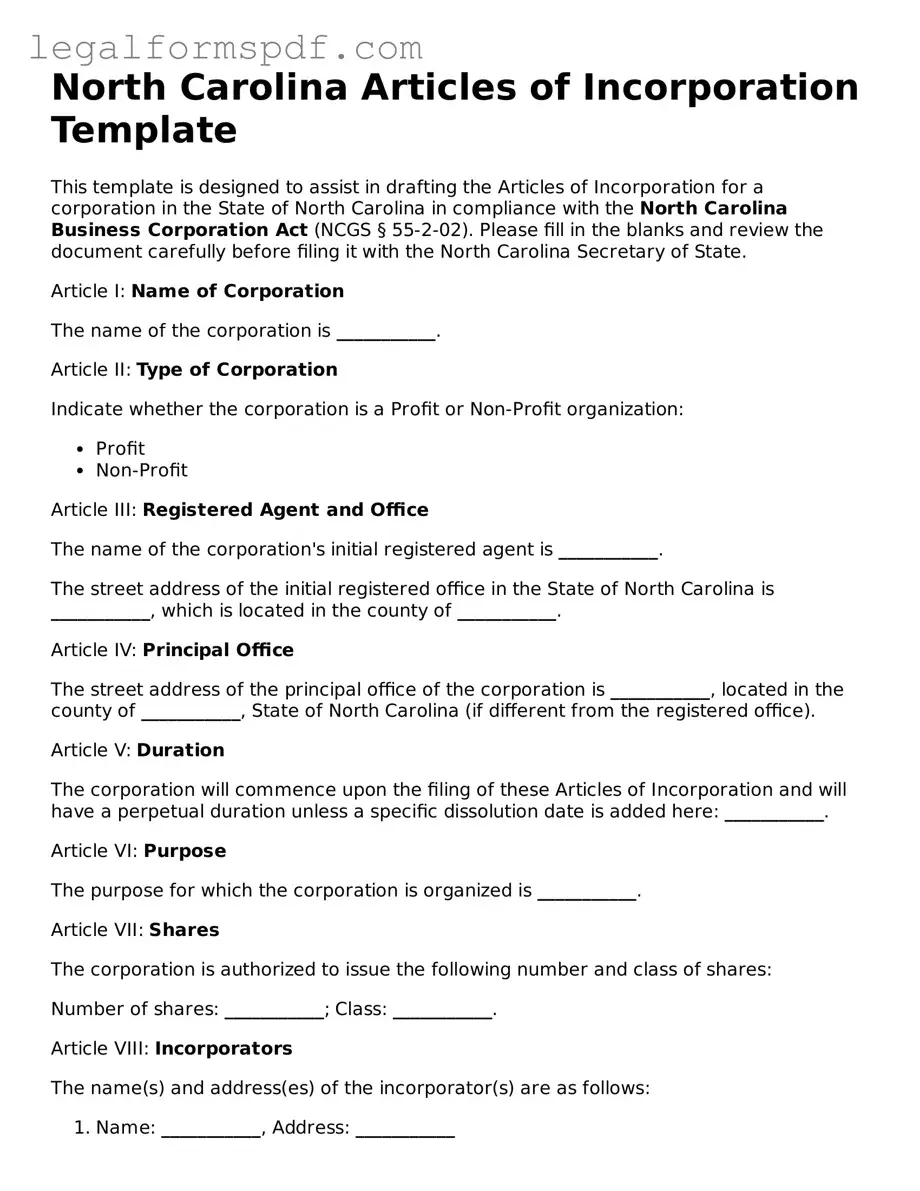

Document Example

North Carolina Articles of Incorporation Template

This template is designed to assist in drafting the Articles of Incorporation for a corporation in the State of North Carolina in compliance with the North Carolina Business Corporation Act (NCGS § 55-2-02). Please fill in the blanks and review the document carefully before filing it with the North Carolina Secretary of State.

Article I: Name of Corporation

The name of the corporation is ___________.

Article II: Type of Corporation

Indicate whether the corporation is a Profit or Non-Profit organization:

- Profit

- Non-Profit

Article III: Registered Agent and Office

The name of the corporation's initial registered agent is ___________.

The street address of the initial registered office in the State of North Carolina is ___________, which is located in the county of ___________.

Article IV: Principal Office

The street address of the principal office of the corporation is ___________, located in the county of ___________, State of North Carolina (if different from the registered office).

Article V: Duration

The corporation will commence upon the filing of these Articles of Incorporation and will have a perpetual duration unless a specific dissolution date is added here: ___________.

Article VI: Purpose

The purpose for which the corporation is organized is ___________.

Article VII: Shares

The corporation is authorized to issue the following number and class of shares:

Number of shares: ___________; Class: ___________.

Article VIII: Incorporators

The name(s) and address(es) of the incorporator(s) are as follows:

- Name: ___________, Address: ___________

- Name: ___________, Address: ___________ (if applicable)

Article IX: Indemnification

The corporation elects to indemnify, to the extent allowed by the North Carolina Business Corporation Act, any director, officer, employee, or agent of the corporation against expenses incurred by them in connection with any action, suit, or proceeding to which they are made a party by reason of being or having been one of the foregoing.

Article X: Additional Provisions

Additional provisions, including but not limited to, limitations on director liability and shareholder actions, are as follows: ___________.

Please ensure all the information provided is accurate and complete before submitting these Articles of Incorporation to the North Carolina Secretary of State for filing.

PDF Specifications

| Fact | Detail |

|---|---|

| Document Name | North Carolina Articles of Incorporation |

| Purpose | Used to officially form a corporation in North Carolina |

| Governing Law | North Carolina General Statutes Chapter 55 - North Carolina Business Corporation Act |

| Requirement | Mandatory for starting a corporation in North Carolina |

Instructions on Writing North Carolina Articles of Incorporation

Filling out the North Carolina Articles of Incorporation is a crucial step in forming a corporation within the state. This document, once submitted and approved, marks the legal start of your corporation. It's important to complete this form with accuracy and attention to detail to ensure a smooth path toward establishing your business entity. Here, we will guide you through each step needed to properly fill out the form, ensuring that you provide all necessary information required by the North Carolina Secretary of State.

- First, be ready with the name of your corporation. The name should be unique and must comply with North Carolina's business name requirements. Check for name availability to avoid any issues.

- Next, provide the name and address of the registered agent for your corporation. A registered agent is someone you designate to receive official documents on behalf of your corporation. This person or entity must have a physical address in North Carolina.

- Specify the number of shares the corporation is authorized to issue. This detail is important for defining the ownership structure of your company.

- Indicate whether the corporation will have preemptive rights. Preemptive rights allow current shareholders the first opportunity to buy new shares before the corporation offers them to the public.

- State the purpose for which the corporation is being formed. Be as specific as possible, as this will outline the primary business activities of your corporation.

- Identify the incorporators. These are the individuals preparing and filing the Articles of Incorporation. Include their names and addresses.

- Provide the name and address of each initial director of the corporation. Directors are tasked with the governance and oversight of the corporation.

- Include any additional articles you wish to add, provided they are compliant with North Carolina law. This could relate to the management structure, shareholder rights, or any other corporate governance aspects not covered in the standard form.

- Finally, sign and date the form. The incorporator or an authorized representative must sign the Articles of Incorporation. If you have a co-incorporator, they should also sign the document.

Once the form is completed, review it thoroughly to ensure all information is accurate and complete. Submit the form to the Secretary of State's office along with the appropriate filing fee. Filing can usually be done online, by mail, or in person, depending on your preference. After submission, it may take a few weeks to process. Once approved, your corporation will be officially formed, and you will receive a certificate of incorporation, marking the completion of this foundational step in your business journey.

Understanding North Carolina Articles of Incorporation

What are the Articles of Incorporation in North Carolina?

The Articles of Incorporation is a document that legally establishes a corporation in North Carolina. It is filed with the North Carolina Secretary of State and includes essential information about the corporation, such as its name, purpose, number of shares it is authorized to issue, and the contact information of the incorporators and initial directors. This form is a crucial first step in creating a corporate entity that is recognized by the state.

Who needs to file the Articles of Incorporation?

Any group seeking to form a corporation in North Carolina must file the Articles of Incorporation. This applies to both profit and nonprofit organizations. The process is crucial for legally establishing the corporation, allowing it to operate within the state, open bank accounts, enter into contracts, and comply with tax obligations.

How do you file the Articles of Incorporation in North Carolina?

Filing can be done either online through the North Carolina Secretary of State's website or by mailing a printed form. The online method is generally faster and more convenient, but some may choose to mail the document for various reasons. A filing fee is required, and the amount depends on the type of corporation being established. Upon approval, the state issues a certificate of incorporation, officially recognizing the corporation.

What information must be included in the Articles of Incorporation?

The Articles of Incorporation form for North Carolina requires several pieces of information, including the corporation's name, which must be distinguishable from other entities registered in the state; the purpose of the corporation; the principal office address; the name and address of the registered agent; the number and types of shares the corporation is authorized to issue; and the names and addresses of the incorporators. For corporations planning to have a board of directors, the initial board members' names and addresses must also be included.

Can you amend the Articles of Incorporation once they are filed?

Yes, corporations in North Carolina can amend their Articles of Incorporation. Amendments may be necessary to change the corporation's name, the number of authorized shares, the corporation’s purpose, or any other information originally filed. This process involves filing an Articles of Amendment form with the Secretary of State along with the required fee. The amendments take effect upon filing unless specified otherwise in the document.

What are the fees for filing the Articles of Incorporation in North Carolina?

The filing fee for the Articles of Incorporation varies depending on the type of corporation being established. For profit corporations, the fee is typically lower than for nonprofit corporations. Fees are subject to change, so it is recommended to check the current fees on the North Carolina Secretary of State website or contact their office directly. Additional fees may apply for expedited processing.

Is legal assistance required to file the Articles of Incorporation?

While legal assistance is not strictly required to file the Articles of Incorporation in North Carolina, consulting with a legal expert can provide valuable insights, especially for complex filings or for those unfamiliar with corporate law. Legal professionals can help ensure that all necessary information is included correctly and can offer advice on the best structure for your business. However, many individuals and small business owners successfully file on their own without legal assistance.

Common mistakes

One common mistake made when filling out the North Carolina Articles of Incorporation is overlooking the requirement to designate a registered agent. A registered agent is essential as they are the individual or entity designated to receive legal and tax correspondence on behalf of the corporation. This oversight can delay the incorporation process and expose the corporation to potential legal vulnerabilities.

Another error involves the misclassification of shares. The form requires specifics about the number and type of shares the corporation is authorized to issue. Frequently, individuals inaccurately record this information without understanding the implications of their choices on the corporation's structure and governance, as well as on their tax liabilities. This misstep can create significant complications in the future, especially when seeking to attract investment or redistribute ownership.

Failure to provide a detailed purpose for the corporation is also a notable mistake. While it might seem sufficient to provide a broad or vague description, the North Carolina Secretary of State requires a specific outline of the corporation's intended business activities. A well-defined purpose not only complies with the filing requirements but also clarifies the corporation's scope of operations to stakeholders and regulatory bodies.

Last but not least, applicants often neglect the importance of double-checking the document for accuracy and completeness before submission. Missing signatures, incorrect dates, and typographical errors can lead to processing delays or outright rejection of the application. Ensuring that all information is correct and that the document is fully completed can save time and prevent unnecessary frustration during the incorporation process.

Documents used along the form

Starting a business in North Carolina involves more than just filling out the Articles of Incorporation. This crucial document lays the foundation of your corporate entity but it's only one step in setting up a robust legal framework for your business. Alongside it, there are several other forms and documents that entrepreneurs should be aware of to ensure compliance with state laws and to secure the business's legal and financial footing. Here's a look at nine key documents that are often used in conjunction with the North Carolina Articles of Incorporation.

- Bylaws: This internal document outlines the corporate governance rules and procedures, including details on board meetings, the election of officers, and the roles of directors and shareholders.

- Operating Agreement: For LLCs, the operating agreement serves a similar purpose to bylaws, detailing the management structure, member responsibilities, and profit-sharing among other operational protocols.

- Employer Identification Number (EIN) Application: Securing an EIN from the IRS is essential for tax purposes, hiring employees, opening business bank accounts, and legally conducting business.

- Business Licenses and Permits: Depending on the nature of the business and its location, various local, state, and federal licenses and permits may be required to operate legally.

- Shareholder Agreement: This agreement outlines the rights and obligations of the shareholders, including how shares can be bought, sold, or transferred and how decisions are made among shareholders.

- Stock Certificates: For corporations issuing stock, these certificates serve as physical proof of stock ownership and detail the number of shares owned by a shareholder.

- Annual Reports: Most businesses are required to file an annual report with the North Carolina Secretary of State, which updates the state on key business details and maintains the company's good standing.

- Meeting Minutes: Documenting the proceedings and resolutions passed during corporate meetings (both for directors and shareholders) is not only a best practice but often a legal requirement.

- Register of Members/Directors: Keeping a current list of the company’s members (for LLCs) or directors and officers (for corporations) is required for internal records and may be requested by various state agencies.

Together, these documents form the backbone of a corporate entity's legal structure and operational governance. While the Articles of Incorporation is a crucial starting point, the additional documentation assists in defining the business’s operational mechanics, ensuring legal compliance, and safeguarding the interests of founders, shareholders, and stakeholders. Attention to these documents at the outset can save businesses from potential legal headaches and challenges down the road.

Similar forms

The North Carolina Articles of Incorporation form shares similarities with the LLC Operating Agreement, albeit serving different entities. Both documents establish the foundational structure and operating rules for the entity, yet while the Articles of Incorporation apply to corporations, the LLC Operating Agreement is used by Limited Liability Companies. Each outlines the business structure, member responsibilities, and how decisions are made, providing a clear framework for governance and operation.

Comparable to a Partnership Agreement, the Articles of Incorporation form sets the stage for the entity's formation and function. However, while a Partnership Agreement is used by two or more individuals who want to manage and operate a business together with the intent to share profits, losses, and management, the Articles of Incorporation specifically cater to corporations, defining their legal standing, share distribution, and the rights and responsibilities of directors and officers.

Similar in purpose to Bylaws, the Articles of Incorporation also lay down key foundational elements of a corporation. Bylaws go into more detail about the internal management structure of the corporation, including the process for handling disputes, electing officers, and scheduling meetings. In contrast, the Articles of Incorporation generally include the corporation’s name, purpose, and information about shares and initial directors. Both documents are crucial for the governance and legal recognition of the corporation but serve at different levels of organizational detail.

The Articles of Incorporation are akin to the DBA (Doing Business As) Registration in that both are formal declarations used in the formation or operation of a business. While the Articles of Incorporation declare the creation of a corporation to the state and lay out its fundamental aspects, a DBA Registration allows a business to operate under a name different from its legal name. This parallels the function of Articles in establishing a legal identity, with DBAs enabling flexibility in branding and marketing for both corporations and other forms of business entities.

Dos and Don'ts

Filling out the North Carolina Articles of Incorporation requires a careful approach to ensure that the document accurately reflects the establishment and governance of your corporation. Below are lists of what you should and shouldn't do during this important process:

What You Should Do:

- Verify the availability of your corporation name with the North Carolina Secretary of State to ensure it is unique and complies with state naming requirements.

- Provide a specific and detailed purpose for your corporation, which clearly defines the nature of your business activities.

- Designate a registered agent with a physical address in North Carolina. This agent must be available during normal business hours to accept legal documents on behalf of the corporation.

- List the names and addresses of the initial directors until the first annual meeting, ensuring that their roles and responsibilities are clear from the outset.

- Include complete contact information for the incorporator(s), including address and phone number, to facilitate any necessary correspondence regarding the incorporation process.

- Ensure all required fields and signatures are completed accurately to avoid delays in the incorporation process.

What You Shouldn't Do:

- Avoid using a P.O. Box as the address for the registered agent, as a physical address within North Carolina is required for accepting legal documents.

- Do not leave the 'Purpose' section vague or incomplete; failing to specify the nature of your business can lead to processing delays or rejections.

- Refrain from appointing directors or officers who are not fully informed or agreeing to their roles within the corporation, as their knowledge and consent are crucial for effective governance.

- Avoid overlooking the requirement to detail the number of shares the corporation is authorized to issue, including the par value, if any, as this is a critical component of your corporate structure.

- Do not neglect to review the completed form for accuracy and completeness before submission, as errors or omissions can significantly delay the incorporation process.

- Avoid submitting the form without the required filing fee, as this will result in an incomplete submission and delay in processing.

Misconceptions

The process of setting up a business entity in North Carolina, like elsewhere, involves navigating through a series of legal steps, one of which includes filing the Articles of Incorporation. There are common misconceptions about this document that need clarification to ensure business owners comply with state laws adequately while protecting their interests.

Filing is the final step: Many individuals assume once the Articles of Incorporation are filed, the process of establishing a legal business entity is complete. However, this is just the beginning. Following the submission, businesses must comply with additional requirements such as obtaining necessary licenses or permits, adhering to annual reporting obligations, and maintaining good standing with the state.

Only large businesses need to file: This misconception could not be further from the truth. Regardless of size, if a business seeks the benefits of operating as a corporation, such as limited liability protection for its owners, it must file the Articles of Incorporation with the North Carolina Secretary of State. This applies to small family businesses as much as it does to larger corporations.

The process is complicated and requires a lawyer: While legal advice can be invaluable, especially for complex structures or situations, the process of filing Articles of Incorporation in North Carolina has been designed to be straightforward. The state provides resources and instructions that can help most people complete this process without the necessity of hiring a lawyer.

Articles of Incorporation are the same as bylaws: This is a common misunderstanding. The Articles of Incorporation are the official document that forms the corporation and is filed with the state, providing essential details such as the corporation’s name, address, and incorporators. Bylaws, on the other hand, are internal documents that outline the rules and procedures for how the corporation will operate but are not filed with the state.

Personal information is protected: When individuals file the Articles of Incorporation, some of the information becomes a matter of public record, including names and addresses of the incorporators and initial directors. It's important to recognize that certain details submitted become accessible to the public, which might influence decisions about what information to provide, especially concerning privacy concerns.

Understanding these key points about the Articles of Incorporation in North Carolina can help prospective business owners navigate the process more effectively. It’s essential to approach this task with the right information to set a solid foundation for your business's future activities and legal compliance.

Key takeaways

Starting a corporation in North Carolina involves a critical step: filling out the Articles of Incorporation. This document is essential for legally establishing your business in the state. Here are some key takeaways to guide you through the process and help you use the form correctly:

Available Online: The North Carolina Articles of Incorporation form can be found and submitted online, providing a convenient and faster way to file your corporation's formation documents.

Required Information: You'll need to provide specific information, including the name of your corporation, its purpose, the period of duration, the number of shares the corporation is authorized to issue, and details about its registered agent and office.

Corporate Name: The name of your corporation must be unique and not too similar to other business names registered in North Carolina. It should also meet the state's naming requirements, such as including a corporate identifier like "Inc." or "Corporation".

Registered Agent: Your registered agent acts as the corporation's official point of contact for legal documents. The agent can be an individual or another corporate entity, but they must have a physical address in North Carolina.

Fees: There is a filing fee for the Articles of Incorporation. Be sure to check the current fee on the North Carolina Secretary of State's website as it is subject to change.

Filing Options: Beyond online submission, you can also file the Articles of Incorporation by mail or in person. Choose the method that's most convenient for you, but remember, online filing usually processes faster.

Processing Time: Processing times vary depending on the filing method. Online filings are typically processed quicker than paper filings. Check the Secretary of State's website for the most current processing times.

Pre-filing Review: Ensure all information on your form is complete and accurate before submitting. Mistakes or missing information can delay the processing of your Articles of Incorporation.

After Filing: Once filed, you should receive a confirmation that your corporation has been legally formed. Keep this confirmation with your corporate records. Additionally, consider the next steps, such as obtaining any necessary licenses or permits your corporation may need to operate legally in North Carolina.

Filling out the North Carolina Articles of Incorporation accurately is a foundational step in establishing your corporation. Paying attention to the details and understanding the state's requirements can set your corporation up for a smooth start and future success.

More Articles of Incorporation State Forms

Ohio Secretary of State Business Search Ohio - The completion of this form is a critical step for entrepreneurs and business owners in formalizing their business operations and achieving corporate status.

How Much Is Llc in Texas - A compulsory documentation process for corporations, involving details on the entity's name, location, and agent.

Articles of Incorporation Michigan - This form is fundamental for startups seeking to establish themselves and secure their name in a competitive market.