Fillable Articles of Incorporation Document for New York

Embarking on the journey of founding a new corporation in New York demands careful navigation through various legal requirements, with the completion of the Articles of Incorporation form standing as a critical initial step. This form, a fundamental document, lays the groundwork for the establishment of a corporation within the state, outlining key pieces of information such as the corporation’s name, purpose, the number of shares it’s authorized to issue, and details concerning its registered agent and office. Not only does it serve to officially register the business with the New York State Department of State, but it also signifies the business's commitment to adhere to state laws and regulations. Furthermore, the form plays a pivotal role in defining the operational framework for the corporation and provides a public record of its existence, accessible to potential investors, customers, and other interested parties. Though it might appear straightforward, the Articles of Incorporation form encompasses essential details that require careful consideration to ensure the long-term success and legal compliance of the corporation.

Document Example

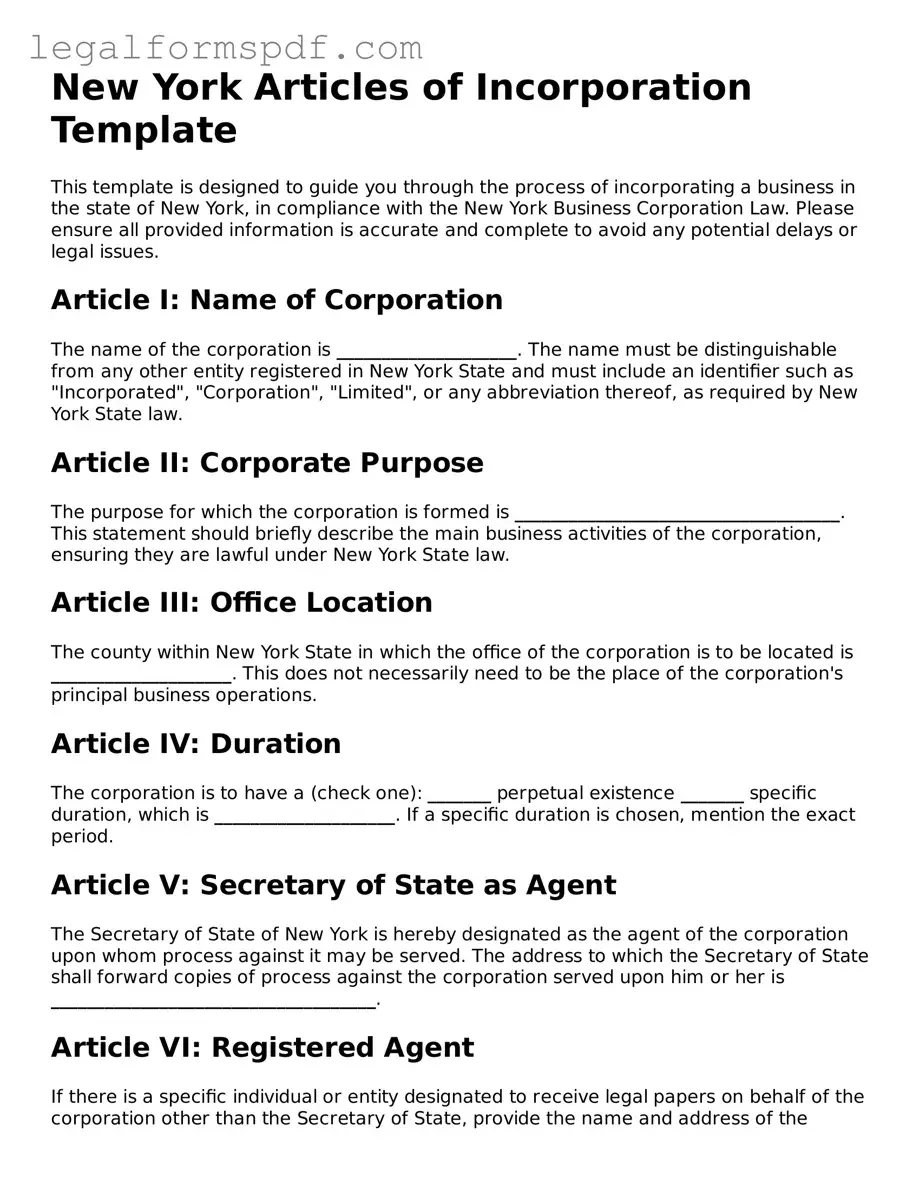

New York Articles of Incorporation Template

This template is designed to guide you through the process of incorporating a business in the state of New York, in compliance with the New York Business Corporation Law. Please ensure all provided information is accurate and complete to avoid any potential delays or legal issues.

Article I: Name of Corporation

The name of the corporation is ____________________. The name must be distinguishable from any other entity registered in New York State and must include an identifier such as "Incorporated", "Corporation", "Limited", or any abbreviation thereof, as required by New York State law.

Article II: Corporate Purpose

The purpose for which the corporation is formed is ____________________________________. This statement should briefly describe the main business activities of the corporation, ensuring they are lawful under New York State law.

Article III: Office Location

The county within New York State in which the office of the corporation is to be located is ____________________. This does not necessarily need to be the place of the corporation's principal business operations.

Article IV: Duration

The corporation is to have a (check one): _______ perpetual existence _______ specific duration, which is ____________________. If a specific duration is chosen, mention the exact period.

Article V: Secretary of State as Agent

The Secretary of State of New York is hereby designated as the agent of the corporation upon whom process against it may be served. The address to which the Secretary of State shall forward copies of process against the corporation served upon him or her is ____________________________________.

Article VI: Registered Agent

If there is a specific individual or entity designated to receive legal papers on behalf of the corporation other than the Secretary of State, provide the name and address of the registered agent: Name: ____________________ Address: _________________________. This is optional but recommended for facilitating timely receipt of legal documents.

Article VII: Incorporators

The name(s) and address(es) of the incorporator(s), individuals who are completing and filing this document, are as follows:

- Name: ____________________ Address: ____________________

- Name: ____________________ Address: ____________________

Additional incorporators can be added as necessary. Each incorporator must sign the Articles of Incorporation before submission.

Article VIII: Initial Directors

The corporation will have an initial board of directors consisting of _______ member(s). The name(s) and address(es) of the person(s) who are to serve as director(s) until the first annual meeting of shareholders or until their successors are elected and qualify are:

- Name: ____________________ Address: ____________________

It's important that the initial directors are appointed to ensure the corporation can begin its operations and governance processes effectively.

Article IX: Share Structure

The corporation is authorized to issue a total of ____________________ shares of stock. If the corporation is to have more than one class of stock, describe the different classes and the rights and restrictions of each class in detail.

Article X: Additional Provisions

Include any additional provisions necessary for the operation and governance of the corporation, or state "Not Applicable" if there are none. Be mindful that all provisions must comply with New York State law.

____________________________________________________________________

Article XI: Incorporator's Statement

I, the undersigned, certify that I am the incorporator named in these Articles of Incorporation and that the information provided herein is accurate and complete.

Signature: ____________________ Date: ____________________

Please note, after completing this template, it must be filed with the New York Department of State along with the required filing fee. Consult the Department's website or reach out to a legal professional for guidance on the filing process and fee structure.

PDF Specifications

| Fact | Description |

|---|---|

| Name of the Document | New York Articles of Incorporation |

| Purpose | To legally form a corporation in the State of New York |

| Governing Law | New York Business Corporation Law |

| Filing Entity Type | Corporations (both for-profit and non-profit) |

| Key Required Information | Corporate name, Corporate purpose, County in New York where the corporation will be based, Registered Agent information, Number of shares the corporation is authorized to issue, Names and addresses of the incorporators |

| Filing Method | Online or via mail |

| Fee | Varies depending on the type of corporation and the number of shares authorized |

Instructions on Writing New York Articles of Incorporation

Filing the New York Articles of Incorporation is a critical step for individuals aiming to establish a corporation in New York State. By completing and submitting this document, founders formally register their corporation with the state, paving the way for their business to officially operate, be recognized for tax purposes, and pursue other legal and operational activities. The process involves providing detailed information about the corporation, its principals, and its purpose. The following steps aim to guide individuals through the procedure of filling out this form accurately.

- Start by locating the official New York Articles of Incorporation form. This can typically be found on the New York Department of State's website or obtained in person at their office.

- Read through the entire form before beginning to fill it out. This ensures an understanding of all required information and instructions.

- Enter the proposed name of the corporation in the designated section. Make sure the name complies with New York State naming requirements and is distinguishable from other business names already on file.

- Specify the type of corporation you are establishing (e.g., business, nonprofit, professional) in the indicated space on the form.

- Provide the county within New York State where the corporation's office will be located.

- List the corporation's primary address, including the street address, city, state, and zip code. If there is a separate mailing address, include this as well.

- Detail the specific purpose of the corporation. This should be a concise explanation of the main business activities or objectives.

- Include the number of shares the corporation is authorized to issue, if applicable. This section is relevant for corporations that plan to issue stock.

- Enter the names and addresses of the initial directors in the spaces provided. There may be a minimum number of directors required, depending on the type of corporation.

- If a registered agent is required or appointed, fill in the registered agent's name and address. A registered agent is responsible for receiving legal documents on behalf of the corporation.

- Provide the name and address of each incorporator. Incorporators are the individuals responsible for submitting the Articles of Incorporation.

- Review the form to ensure all provided information is accurate and complete. Any inaccuracies or omissions can delay the filing process or lead to potential legal issues.

- Sign and date the form where indicated. This may require the signature of all incorporators or just a designated representative, depending on the corporation's structure.

- Submit the completed form and any required filing fee to the New York Department of State. This can typically be done online, by mail, or in person, depending on the preferred submission method.

Once the Articles of Incorporation form has been submitted and accepted by the New York Department of State, the corporation will be officially registered in New York. The state will issue a certificate of incorporation, after which the corporation can proceed with additional setup activities, such as obtaining necessary licenses and permits, opening bank accounts, and starting its business operations.

Understanding New York Articles of Incorporation

What is the purpose of the New York Articles of Incorporation?

The New York Articles of Incorporation form serves as a formal document required to establish a corporation in New York. It provides the state with necessary information about the corporation, including its name, purpose, office location, and details about its shares and incorporators. This document is integral to giving the corporation legal standing and the ability to conduct business within the state.

Who needs to file the New York Articles of Incorporation?

Any group of individuals or a single individual aiming to form a corporation in the state of New York must file the Articles of Incorporation. This is a crucial step for those looking to structure their business as a corporation, offering them benefits such as limited liability protection for its shareholders and potential tax advantages.

What information do I need to complete the form?

To successfully complete the form, you will need details such as the corporation’s name, its specific purpose, the county within New York where the office will be located, the total number of shares the corporation is authorized to issue, and the name and address of the incorporator(s). Additionally, the form requires the designation of a registered agent who will receive legal documents on behalf of the corporation.

How do I submit the Articles of Incorporation in New York?

The completed Articles of Incorporation can be submitted to the New York Department of State either through mail or online submission, depending on your preference. It’s important to include the filing fee, which varies based on the corporation type and other factors. After submission, you will receive confirmation that the state has accepted your corporation's establishment.

Is there a filing fee for the Articles of Incorporation?

Yes, there is a filing fee that must be paid when you submit the Articles of Incorporation. The specific amount depends on several factors, including the type of corporation you are establishing and the number of shares it is authorized to issue. It’s advisable to check the most current fees on the New York Department of State’s website or contact them directly for the most accurate information.

How long does the process take?

The processing time for the Articles of Incorporation can vary based on the method of submission and the current workload of the New York Department of State. Typically, online submissions are processed faster than those sent via mail. You can expect a general timeframe but checking with the Department directly for the most current processing times is best.

What happens after the Articles of Incorporation are filed?

Once your Articles of Incorporation are filed and approved by the New York Department of State, your corporation is legally established. You will receive official documentation as proof of this status. Following this, you can proceed with other necessary steps to operate your business in New York, such as obtaining any required licenses and permits, opening a bank account in the corporation's name, and staying compliant with state reporting and tax obligations.

Common mistakes

Filing the Articles of Incorporation in New York is a crucial step for anyone looking to form a corporation in the state. However, common mistakes can delay this process, leading to unnecessary headaches and setbacks. By being aware of these pitfalls, you can ensure a smoother journey in officially establishing your business.

One frequent error is the failure to specify the type of corporation being formed. New York recognizes different classifications, such as S Corporations and C Corporations, each with its unique tax implications and operational requirements. Not clearly indicating the chosen classification on the form can result in processing delays or even the rejection of the application.

Another oversight involves the corporate name. New York has stringent naming guidelines that must be adhered to, including the requirement that the name be distinguishable from existing entities and include specific corporate designators like "Inc." or "Corp." Neglecting to research the name adequately or omitting the required suffix can lead to immediate disapproval.

Incorrect or incomplete information about the corporation's principal office address is also a common mistake. This address serves as the main point of contact and is essential for receiving official communications. Therefore, listing an inaccurate or incomplete address can have significant consequences, including missed critical notices.

When it comes to appointing the board of directors, many filers forget to include the necessary details about each member, such as names and addresses. This oversight can impact the corporation's governance and operational legitimacy, as these details are critical for state records and future correspondence.

A surprising number of applicants also neglect to identify their registered agent or provide incorrect information. This agent acts as the corporation's legal representative in the state, responsible for receiving legal documents and government notices. Failure to appoint a registered agent, or nominating one without the proper qualifications, can jeopardize the corporation's legal standing.

Additionally, improperly allocating shares can lead to complications. Defining the number and type of shares the corporation is authorized to issue is essential for delineating ownership and voting rights. An unclear or incorrect allocation can hinder potential funding opportunities and complicate ownership structures.

Not adhering to the required filing fee or submitting an incorrect amount is another common mistake. This financial oversight can delay the processing of the Articles of Incorporation, as the New York Department of State will not review the application until the correct fee is received.

Failure to include necessary addenda or attachments, such as consent forms from New York State agencies if required, is a critical error. Some types of corporations must obtain preliminary approvals before filing the Articles of Incorporation, and overlooking this step can invalidate the entire submission.

Submitting the form without the necessary signatures is a simple yet frequent mistake. The form must be signed by the incorporator(s), who are responsible for executing the document. An unsigned form is considered incomplete and will be rejected.

Finally, a lack of attention to detail, such as misspellings or incorrect information, can undermine the entire effort. Even minor errors can cast doubt on the accuracy of the corporate record, leading to delays and the potential for having to resubmit the form.

By avoiding these common mistakes, filers can smooth the path toward incorporating their business in New York, setting a solid foundation for their enterprise's future.

Documents used along the form

When forming a corporation in New York, the Articles of Incorporation form is a critical document. However, this foundational step often necessitates accompanying documents to fully establish the corporation's legal and operational structure. These documents fulfill various regulatory, financial, and organizational roles, each integral to the smooth functioning and legal compliance of the corporation. Below is an overview of other forms and documents frequently used in conjunction with the New York Articles of Incorporation form.

- Bylaws: This internal document outlines the rules for the corporation's governance and the rights and responsibilities of its directors, officers, and shareholders.

- Operating Agreement: Though more common for LLCs, corporations, especially those opting for S corporation status, may utilize an operating agreement to detail the operational processes and ownership agreements.

- IRS Form SS-4: Required to obtain an Employer Identification Number (EIN), which is necessary for tax reporting and other financial activities.

- Subscription Agreement: An agreement between the corporation and its initial shareholders, detailing the purchase of shares in the corporation.

- Share Certificates: Physical or digital certificates that provide evidence of stock ownership in the corporation.

- Initial Report: Certain states require a report after incorporation, detailing basic information about the corporation, such as its directors and officers.

- Bank Resolution: A document needed to open a bank account for the corporation, authorizing certain individuals to conduct banking on behalf of the corporation.

- Stock Ledger: A record of the corporation's stock transactions, used to track the issuance and transfer of shares.

- Conflict of Interest Policy: A policy document that outlines procedures to handle potential conflicts of interest involving corporate directors or officers.

Together with the Articles of Incorporation, these documents form the cornerstone of a corporation's legal and operational framework. While some serve to ensure compliance with state and federal regulations, others facilitate internal governance and financial operations. Understanding the role and requirement of each document is essential for the successful formation and ongoing management of a corporation in New York.

Similar forms

The New York Articles of Incorporation form shares similarities with the Certificate of Formation often used in other states. Both documents serve as the founding paperwork for establishing a legal business entity, detailing critical information such as the company name, purpose, and the names of the incorporators. They act as the official registration of a business with state authorities, making the entity legally recognized for conducting business within the state.

Comparable to the Bylaws of a corporation, the Articles of Incorporation lay down the structural framework of an organization. Although Bylaws are more detailed, focusing on the governance, operations, and internal regulations of a company, the Articles of Incorporation initiate this process by officially creating the company and outlining its basic structure. This foundational step is crucial for further detailing in the company's Bylaws.

Similarly, the Operating Agreement of a Limited Liability Company (LLC) echoes the role of the Articles of Incorporation. While the Operating Agreement focuses on the operations, management, and profit distribution among members of an LLC, the Articles of Incorporation serve a parallel purpose for corporations, establishing the company's legal existence and providing a basic legal framework to be detailed further in other documents.

The Employer Identification Number (EIN) application form is another document that, while distinctly different in function, aligns with the initial setup phase of a business alongside the Articles of Incorporation. The EIN application is crucial for tax purposes, representing the business's registration with the Internal Revenue Service (IRS), just as the Articles of Incorporation register the business with the state.

The Stock Certificate issuance process in a corporation also mirrors an aspect of the Articles of Incorporation, in that it represents an early foundational activity of the newly formed company. Stock Certificates indicate ownership and the distribution of the company's equity, a concept that is made possible by the establishment of the company through the Articles of Incorporation.

The Business Plan, often conceptual and strategic, has a complementary relationship with the Articles of Incorporation. While a Business Plan outlines the company's goals, strategies, market, and financial forecasts, the Articles serve as a legal acknowledgment of the company's existence, allowing it to pursue the objectives detailed in the Business Plan.

Annual Reports that corporations must file share a commonality with the Articles of Incorporation in their formal, state-required nature. While the Articles establish the company, Annual Reports ensure ongoing compliance by detailing the company’s activities, financial status, and changes over the past year, keeping the state informed on its progression.

Similar to the Articles of Incorporation, the Statement of Information, required in some states shortly after incorporation, provides updated information on the business. This document includes details such as the company's current directors and officers, updating the state on any changes since the filing of the Articles of Incorporation.

The Intellectual Property Assignment Agreements are crucial for the protection and transfer of a company’s creative assets. Although not directly related to the incorporation process, executing these agreements early on, following the establishment of the company through the Articles of Incorporation, ensures that all intellectual property is legally held by the company from the outset.

Last but not least, the Non-Disclosure Agreements (NDAs) serve a protective role for the nascent corporation, akin to the initial protective step of filing the Articles of Incorporation. By safeguarding sensitive information right from the company's formation, NDAs complement the Articles’ role in establishing the company's legal and operational boundaries.

Dos and Don'ts

When setting up a corporation in New York, the Articles of Incorporation form is a critical document that requires careful attention. To ensure a smooth filing process, here is a list of important dos and don’ts to keep in mind:

Do:Verify the availability of your desired corporate name with the New York Department of State to ensure it's unique and not deceptively similar to existing names.

Accurately identify the corporation's purpose. While it can be broad, it must comply with New York State law.

Include the name and physical address in New York of your registered agent—the individual or service authorized to receive legal documents on behalf of the corporation.

Specify the number of shares the corporation is authorized to issue, as this impacts voting rights and potential for growth.

Ensure that all incorporators sign the form. In New York, the Articles of Incorporation require the signatures of all individuals participating in the corporation's formation.

Overlook detailing any specific provisions or compliance requirements that are unique to your corporation's type of business, as this can cause legal issues down the road.

Forget to check the New York Department of State's website for the most current filing fees and address any checks correctly to avoid processing delays.

Assume the Articles of Incorporation are the only documents needed. Depending on your corporation’s activities, New York State may require additional documents or permits.

Neglect to draft corporate bylaws after filing the Articles of Incorporation. While not filed with the State, bylaws are crucial for outlining the corporation’s internal operating rules.

Underestimate the importance of keeping copies of all filed documents, including the Articles of Incorporation, for your records. These documents are essential for legal and administrative purposes.

Misconceptions

When setting up a business in New York, entrepreneurs must file the Articles of Incorporation. This crucial document, often misunderstood, lays the foundation for your corporation under state law. Let's clear up some common misconceptions:

- "The Articles of Incorporation form is all that's needed to start operating my business." While filing this document is a significant first step, it's far from the only one. You must also obtain the necessary licenses and permits for your specific type of business, comply with local zoning laws, and, for many businesses, file for a Federal Employer Identification Number (EIN) with the IRS.

- "Filling out the form is complicated and requires a lawyer." Though legal advice can be invaluable, especially for unique or complex business models, the Articles of Incorporation form for New York is designed to be straightforward. Most entrepreneurs can fill it out on their own by following the instructions provided by the New York Department of State. However, don't hesitate to consult a legal advisor to ensure all your documents are in order.

- "Once filed, I don't need to worry about the Articles of Incorporation again." This is a common misconception. Your corporation's existence begins with filing the Articles, but to maintain good standing, you must comply with annual reporting requirements and other ongoing obligations, such as maintaining accurate records and holding regular board meetings.

- "Any mistake on the form can lead to immediate rejection." While accuracy is crucial, a small mistake on the form doesn't necessarily mean it will be rejected outright. The New York Department of State often contacts filers for minor corrections or clarifications. Nonetheless, ensuring the form is correct and complete before submission can save time and prevent delays.

Key takeaways

Setting up a corporation in New York involves filling out the Articles of Incorporation, a crucial step towards establishing your business's legal identity. This process can seem daunting, but armed with the right information, it simplifies greatly. Here are seven key takeaways to guide you through this essential form and the process surrounding it:

- Understand the Requirements: Before diving into the form, ensure you have all necessary information on hand. This includes your corporation's official name, principal business location, registered agent information, and the specific purpose for which the corporation is being formed.

- Choose a Distinct Name: Your corporation's name must be unique and distinguishable from other entities registered in New York. It should also meet the state's naming requirements, including certain corporate designators like "Inc." or "Corporation".

- Appointment of a Registered Agent: A registered agent must be designated in your Articles of Incorporation. This agent is responsible for receiving legal documents on behalf of your corporation. They can be an individual or a company authorized to do business in New York.

- Include Shares Information: If your corporation will issue stock, detail the number of shares authorized for issuance. You may also need to specify the classes of shares and any preferences or rights attached to them.

- Ensure Proper Signatory: The Articles of Incorporation must be signed by an incorporator or legal representative of the corporation. This signifies compliance with New York's filing requirements and asserts that the information provided is accurate.

- File with the State: Once completed, submit the form to the New York Department of State. Filing can often be done online, by mail, or in person, depending on your preference and the specific requirements of the state.

- Pay Attention to Filing Fees: There is a fee associated with filing the Articles of Incorporation. Ensure you are aware of the current fee and include it with your submission. Fees can change, so verify the amount close to your filing time.

By focusing on these key areas, you can navigate the process of filling out and using the New York Articles of Incorporation form more confidently. Remember, this is the first of many steps in establishing your corporation's legal and financial foundation.

More Articles of Incorporation State Forms

How Much Is Llc in Texas - A basic requirement for corporation setup, entailing information on the business model and legal representatives.

Registration Certificate - Amendments to the Articles of Incorporation can be made post-establishment, accommodating growth and changes in corporate direction or policy.

Georgia Secretary of State Corporations - Completing the Articles of Incorporation is a critical first step in securing a corporation’s rights, privileges, and liabilities.