Fillable Articles of Incorporation Document for Michigan

For any business owner looking to establish a corporation in Michigan, the Articles of Incorporation form serves as a fundamental step. This crucial document, filed with the state, lays the groundwork for a company's legal structure, defining its purpose, ownership, and operational framework. It outlines key details such as the corporation's name, the number and type of authorized shares, the address of its principal place of business, and the information about its registered agent. Ensuring that this form is correctly completed and submitted is vital, as it not only grants the corporation legal recognition but also provides important protections under Michigan law. Moreover, it signals the beginning of compliance with state regulations, a crucial aspect for any entity aiming to operate smoothly within Michigan's business landscape.

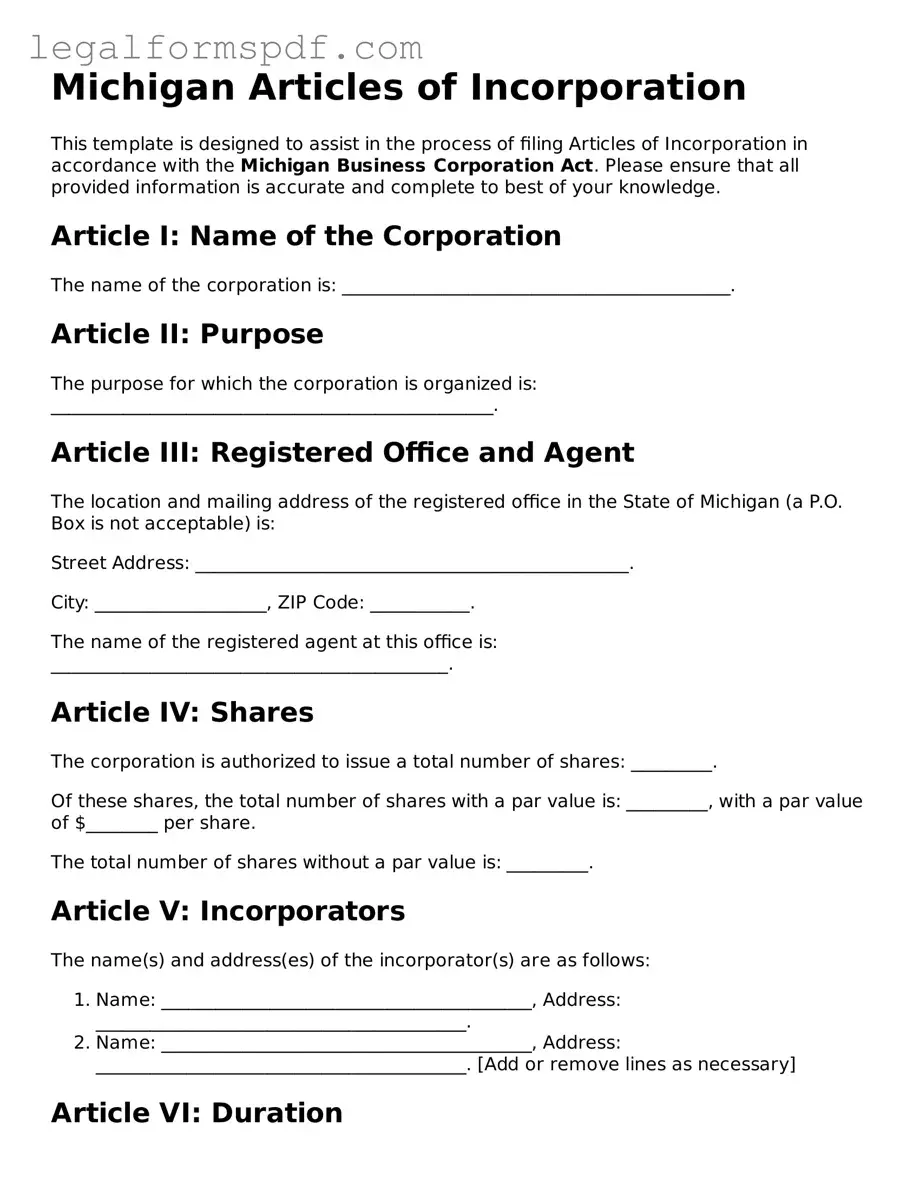

Document Example

Michigan Articles of Incorporation

This template is designed to assist in the process of filing Articles of Incorporation in accordance with the Michigan Business Corporation Act. Please ensure that all provided information is accurate and complete to best of your knowledge.

Article I: Name of the Corporation

The name of the corporation is: ___________________________________________.

Article II: Purpose

The purpose for which the corporation is organized is: _________________________________________________.

Article III: Registered Office and Agent

The location and mailing address of the registered office in the State of Michigan (a P.O. Box is not acceptable) is:

Street Address: ________________________________________________.

City: ___________________, ZIP Code: ___________.

The name of the registered agent at this office is: ____________________________________________.

Article IV: Shares

The corporation is authorized to issue a total number of shares: _________.

Of these shares, the total number of shares with a par value is: _________, with a par value of $________ per share.

The total number of shares without a par value is: _________.

Article V: Incorporators

The name(s) and address(es) of the incorporator(s) are as follows:

- Name: _________________________________________, Address: _________________________________________.

- Name: _________________________________________, Address: _________________________________________. [Add or remove lines as necessary]

Article VI: Duration

The corporation will exist perpetually unless dissolved.

Article VII: Bylaws

The initial bylaws of the corporation shall be adopted by the board of directors and may be altered, amended, or repealed as set forth in the bylaws.

Article VIII: Directors

The affairs of the corporation shall be managed by a Board of Directors. The number of directors shall be fixed by the Bylaws, provided that there shall be ___________ director(s).

Article IX: Indemnification

The corporation shall indemnify any and all of its directors or officers to the fullest extent permitted by the Michigan Business Corporation Act or any other law as may be applicable.

Article X: Incorporation Statement

We, the undersigned, being the incorporator(s) of the corporation, execute these Articles of Incorporation on this day __________, ________ [date] and affirm under the penalties of perjury that the statements made herein are true.

Signature of Incorporator(s)

_______________________________________ [Signature]

Printed Name: _______________________________________

Date: _______________________________________________

This document is provided as a template and does not constitute legal advice. We strongly recommend consulting with a legal professional or the Michigan Department of Licensing and Regulatory Affairs for guidance specific to your situation.

PDF Specifications

| Fact Number | Detail |

|---|---|

| 1 | The Michigan Articles of Incorporation form is governed by the Michigan Business Corporations Act, Act 284 of 1972. |

| 2 | This form is used to officially register a corporation with the state of Michigan. |

| 3 | It must include the corporation's name, which needs to be distinguishable from other entities already registered in Michigan. |

| 4 | The form requires the address of the corporation's registered office and the name of the registered agent at that office. |

| 5 | It must state the purpose for which the corporation is formed, although a broad statement of purpose is generally acceptable. |

| 6 | Information on the authorized share structure must be included, detailing the number of shares the corporation is authorized to issue and their par value, if any. |

| 7 | The Articles of Incorporation require the names and addresses of the incorporators. |

| 8 | Once filed and approved, the corporation is legally created and can begin operation, subject to completing any other regulatory requirement. |

Instructions on Writing Michigan Articles of Incorporation

Completing the Articles of Incorporation is a significant step for establishing a corporation in Michigan. This document formally registers your corporation with the state, allowing it to legally operate. The process requires precise information about your corporation, including details about its purpose, capital, and management. Following the right steps will ensure that your submission is successful and that you're on the right path to launching your business. Let's go through these steps one by one to ensure clarity and completeness in your filing.

- Gather all necessary information about your corporation, including its proposed name, the purpose for which it is being formed, the names and addresses of the incorporators, the number of shares the corporation is authorized to issue, and the name and address of the registered agent.

- Ensure the corporation's name is available in Michigan by conducting a name availability search on the Michigan Department of Licensing and Regulatory Affairs website.

- Access the Michigan Articles of Incorporation form via the Michigan Department of Licensing and Regulatory Affairs website. The form can typically be downloaded as a PDF for ease of use.

- Fill in the Articles of Incorporation form with the collected information, starting with the corporation's name. Ensure that the name includes a corporate identifier such as "Incorporated," "Corporation," "Limited," or an abbreviation of one of these terms.

- Enter the purpose for which the corporation is formed. This can be a specific purpose or a general statement of any lawful business activity under Michigan law.

- Provide the names and addresses of the incorporators. Incorporators are the individuals responsible for filing the Articles of Incorporation. There must be at least one, but there can be more.

- Specify the number of shares the corporation is authorized to issue. This will define the corporation's capital structure.

- Designate a registered agent and provide their name and registered office address. This agent will be the legal recipient of all statutory notices and legal processes on behalf of the corporation.

- Review the form for accuracy and completeness. Make sure all the information provided is correct to the best of your knowledge.

- Sign the form. The incorporator(s) must sign the Articles of Incorporation, indicating their intention to form the corporation under Michigan law.

- Submit the form along with the required filing fee to the Michigan Department of Licensing and Regulatory Affairs. This can usually be done by mail, in person, or online, depending on the available services.

After submitting your Articles of Incorporation, it will take some time for the state to review and process your application. Once approved, your corporation will be officially registered in Michigan, paving the way for business operations. Keep an eye on your application status and be prepared to respond to any queries from the state during this period. Successful registration is only the beginning of your business journey, but it lays the fundamental groundwork for your corporation's legal identity and authority to conduct business.

Understanding Michigan Articles of Incorporation

What are the Michigan Articles of Incorporation?

The Michigan Articles of Incorporation is a document that must be filed with the state to legally form a corporation. This document outlines the primary characteristics of the corporation, including its name, purpose, the number of authorized shares, the par value of shares, and the information about its registered agent and incorporators.

Who needs to file the Michigan Articles of Incorporation?

Any individual or group of individuals who wish to establish a corporation in the state of Michigan must file the Articles of Incorporation with the Michigan Department of Licensing and Regulatory Affairs (LARA).

How do I file the Michigan Articles of Incorporation?

Filing can be done online through the LARA website or by mailing a completed Articles of Incorporation form to the appropriate office. Online filing is generally faster and allows for immediate processing, while mailed applications may take longer to process.

What information is required in the Articles of Incorporation?

The form requires detailed information including the corporation's name, its purpose, the total number of shares the corporation is authorized to issue, the address of its registered office, the name and address of its registered agent, and the name(s) and address(es) of the incorporator(s).

Is there a filing fee for the Articles of Incorporation in Michigan?

Yes, there is a filing fee associated with the Articles of Incorporation in Michigan. The fee can vary, so it’s advised to check the latest fee schedule on the LARA website or contact their office directly for the most current information.

How long does it take to process the Michigan Articles of Incorporation?

The processing time can vary depending on the method of submission. Online filings are typically processed more quickly, often within the same day or by the next business day. Mailed submissions may take several weeks. For the most accurate processing times, it's best to consult directly with LARA.

Can I reserve a corporation name before filing the Articles of Incorporation in Michigan?

Yes, Michigan allows for the reservation of a corporate name prior to filing the Articles of Incorporation. The name reservation can be completed through LARA and is valid for a specific period. This can ensure your desired name is available when you are ready to file.

What happens after I file the Articles of Incorporation?

Once filed and approved, your corporation is officially formed and recognized by the state of Michigan. You will receive a certificate of incorporation, after which you can proceed with other necessary steps, such as obtaining an EIN, opening a business bank account, and applying for any necessary licenses and permits.

Do I need an attorney to file the Michigan Articles of Incorporation?

While not required, consulting with an attorney can be beneficial, especially for more complex incorporations or for those unfamiliar with corporate law. An attorney can offer guidance on the filing process and ensure that the incorporation aligns with your business goals and legal requirements.

Where can I find more information about the Michigan Articles of Incorporation?

More information can be found on the Michigan Department of Licensing and Regulatory Affairs (LARA) website. Additionally, legal counsel or a business advisor can provide detailed guidance specific to your situation.

Common mistakes

When individuals embark on the journey of forming a corporation in Michigan, the Articles of Incorporation stand as a critical foundational document required by the Michigan Department of Licensing and Regulatory Affairs. However, errors in completing this document can lead to delays or rejection. One common mistake is failing to thoroughly check the availability of the corporate name. The chosen name must be distinguishable from other names already on file, and overlooking this can lead to unnecessary complications.

Another frequent oversight is neglecting to specify the purpose of the corporation beyond the broad language that Michigan law permits. While Michigan allows corporations to state a general purpose, providing a specific purpose can clarify the corporation’s intentions to stakeholders and regulatory authorities. Furthermore, many individuals mistakenly provide an incomplete address for their registered office or designate a registered agent without obtaining their consent first. This can not only invalidate the filing but also impede legal service processes in the future.

Inaccuracies in detailing the number of authorized shares and the classes of shares can also be problematic. This requires a precise understanding of the corporation's planned ownership structure. An inaccurate portrayal of this can affect the corporation's ability to raise capital and distribute dividends. Additionally, some people overlook the significance of the incorporator's information, including their signature. The incorporator, who files the Articles, must provide complete and accurate information to affirm the legitimacy of the document.

Another common error lies in submitting the form without the required filing fee or with incorrect payment amounts. This can delay the processing of the Articles of Incorporation, as the Department may return the document for correction. Similarly, overlooking the necessity to attach additional approved forms for specific types of corporations, such as professional corporations, can invalidate a submission.

Failing to review the document for common typographical mistakes or missing information can lead to its rejection. Every field on the form should be double-checked for accuracy. Lastly, neglecting to keep a copy of the filed Articles for the corporation’s records is a frequent oversight. Having a copy is crucial for future legal and operational reference. These errors, while common, can be easily avoided with careful attention to detail and an understanding of the filing requirements in Michigan.

Documents used along the form

When forming a corporation in Michigan, the Articles of Incorporation form is a vital initial step. However, to fully establish the legal entity and ensure compliance with state and federal laws, several other documents and forms are often utilized alongside the Articles of Incorporation. These documents serve various purposes, from tax registrations to internal governance. Understanding what each document is for can help streamline the incorporation process and lay a sound foundation for the corporation's operations.

- Bylaws: Bylaws are essential for defining the corporation's internal management structure, including the roles of directors and officers, meeting procedures, and other fundamental operating rules. Although not submitted to the state, bylaws are crucial for the corporation's organization.

- IRS Form SS-4: This form is used to apply for an Employer Identification Number (EIN), which is necessary for tax administration purposes, including hiring employees and opening a business bank account.

- Initial Report: Sometimes required shortly after incorporation, an initial report documents the corporation's key information, such as principal business address and details about directors and officers.

- Stock Certificates: For corporations that will issue stock, stock certificates represent the ownership of shares in the corporation. They are a physical proof of stock ownership.

- Corporate Minutes: Keeping records of meetings and resolutions passed by the corporation’s board of directors and shareholders is required for compliance and governance. Corporate minutes fulfill this need.

- Operating Agreement: While more common in LLCs, corporations, especially those with a small number of shareholders, may also use an operating agreement to outline the business's operational aspects and shareholders’ rights and responsibilities.

- State Tax Registration: Depending on the nature of the business and where it operates, the corporation may need to register with the Michigan Department of Treasury for state taxes, such as sales tax or unemployment insurance.

- Zoning Permits: If the corporation operates from a physical location within Michigan, checking with local zoning laws and obtaining the necessary permits is essential to ensure the location is zoned for the intended use.

- Business Licenses: Depending on the type of business and its location, various federal, state, or local licenses and permits may be required to legally operate the business in Michigan.

Navigating the process of incorporating and managing a corporation in Michigan involves more than just filing the Articles of Incorporation. The additional forms and documents listed play a key role in ensuring the corporation is fully operational and compliant with all relevant laws and regulations. Careful preparation and understanding of these documents can contribute significantly to the smooth operation and long-term success of the corporation.

Similar forms

The Articles of Incorporation in Michigan share similarities with the Certificate of Formation used in some other states, such as Delaware and Texas. Both documents serve the foundational function of legally establishing a business entity. They contain essential details about the company, including its name, purpose, office address, and information about its shares and the incorporators. While they may have different names, the core purpose and the type of information requested in the forms establish the legal existence of a corporation or LLC.

Bylaws are another type of document related to the Articles of Incorporation, though they are more detailed and focus on the internal governance of the corporation. Bylaws outline the rules for how the corporation will operate, including the roles and responsibilities of directors and officers, meeting protocols, and procedures for amending the bylaws or articles themselves. While the Articles of Incorporation register the corporation with the state, bylaws tailor the organizational structure to the corporation's specific needs.

The Operating Agreement for a Limited Liability Company (LLC) bears resemblance to the Articles of Incorporation but is tailored specifically for LLCs. This document outlines the operational and financial decisions of a business, detailing the members' rights, responsibilities, and allocation of profits and losses. Unlike the Articles of Incorporation, an Operating Agreement is an internal document and not typically filed with the state, but it serves a crucial role in governing the LLC's operations.

A Shareholder Agreement is akin to the Articles of Incorporation in that it outlines the structure and operation of a corporation but from the viewpoint of its shareholders. This agreement specifies the rights and obligations of shareholders, addresses the management of the company, share distribution, and resolves any disputes among shareholders. It complements the Articles of Incorporation by providing a detailed framework for ownership and investor rights within the corporation.

State-specific Business Filings, such as the Statement of Information (or Annual Report) required in many states, are periodically necessary updates that corporations must file after the initial Articles of Incorporation. These documents keep the state updated on key information such as the corporation's current address, its directors, and officers. While not the foundational document that the Articles of Incorporation are, these filings are crucial for maintaining good standing with the state.

DBA Registration Forms (Doing Business As) share a procedural kinship with the Articles of Incorporation in that they are official documents filed with state or local governments. While the Articles establish the legal entity of a corporation, a DBA form allows the business to operate under a name different from its legal name. It's a way for corporations to brand their business or operate multiple ventures under distinct names without forming new legal entities.

Employee Identification Number (EIN) Application forms, while strictly not for incorporation, are essential for the next steps post-incorporation. Obtained from the IRS, the EIN is akin to a Social Security number for the business, allowing it to open bank accounts, file taxes, and hire employees. The process of obtaining an EIN follows the establishment of the corporation through the Articles of Incorporation and is another critical step in formalizing the business's operations.

Trademark Application Forms at the U.S. Patent and Trademark Office, though focusing on intellectual property rather than the formation of a business entity, share the legal formalism with the Articles of Incorporation. Both mark a significant step in safeguarding a business’s identity—trademarks protect brand names, logos, and slogans, while the Articles of Incorporation protect the business's legal name and structure. A newly formed corporation often considers trademark registrations soon after filing its Articles of Incorporation to ensure its brand is legally protected.

Dos and Don'ts

When embarking on the journey of filling out the Michigan Articles of Incorporation form, it's critical to approach the task with caution and diligence. This document is a pivotal step in legitimizing your corporate entity in the eyes of the law. Below, you'll find a list of essential dos and don'ts that should guide you through this process. Observing these tips can significantly smooth your path to establishing your corporate identity.

Things You Should Do- Read the Instructions Carefully: Before filling out the form, make sure you thoroughly understand each section. This prevents common mistakes and ensures you provide all the required information.

- Use Black Ink: To ensure legibility and to comply with filing standards, always fill out the form in black ink if you're completing it by hand.

- Ensure Accuracy: Double-check the information you enter, especially critical details like the corporation name, registered agent information, and business address. Mistakes can lead to processing delays or legal complications.

- Consider Professional Help: If certain sections of the form are unclear, consulting with a legal professional can provide clarity and prevent errors. They can offer invaluable advice tailored to your situation.

- Include the Filing Fee: Make sure you include the correct filing fee with your form, as this is a prerequisite for processing. Check the latest fee structure to avoid underpayment or overpayment.

- Keep a Copy: Retain a copy of the filled-out form and any correspondence for your records. This documentation can be crucial for future legal or business needs.

- Follow Up: After submitting your form, follow up to ensure it was received and processed. Keeping track of your filing status can help you address any issues promptly.

- Rush Through the Process: Avoid the temptation to complete the form in haste. Mistakes made in a hurry can cause unnecessary delays.

- Use Pencil: Filling out the form in pencil is not recommended as it can smudge or be altered, leading to potential discrepancies.

- Forget the Signature: An unsigned form is invalid. Ensure that all required parties sign the form where indicated.

- Leave Sections Blank: If a section doesn't apply, it's better to write "N/A" or "None" instead of leaving it blank. This shows that you've reviewed the section and confirmed it's not applicable.

- Ignore State Specifics: Every state has unique requirements for incorporation. Make sure you're adhering to Michigan's specific guidelines and not those from another jurisdiction.

- Underestimate the Importance of the Registered Agent: Choosing a registered agent is a critical decision. Ensure the agent is reliable and authorized to operate in Michigan.

- Fail to Review Before Submission: Always review the entire document before submission. This final step can catch any overlooked errors or omissions.

By following these dos and don'ts, you'll pave a smoother path for your corporation's establishment in Michigan. Remember, while this process is a significant step towards your business's future, it doesn't have to be a daunting one. With attention to detail and proper preparation, you can confidently navigate through filling out the Michigan Articles of Incorporation form.

Misconceptions

When forming a corporation in Michigan, the process of completing and filing the Articles of Incorporation is a crucial step. However, there are several misconceptions about this form that can lead to confusion or errors. Understanding these misconceptions can help ensure that the process goes smoothly and that the incorporation is successful.

- Any Business Name Can Be Used: A common misconception is that you can use any name you want for your corporation. However, the name must be distinguishable from other business entities already on file with the Michigan Department of Licensing and Regulatory Affairs (LARA). It also must not contain words or phrases that could confuse your corporation with a government agency.

- The Incorporator Must Be a Michigan Resident: There's a belief that the incorporator, the person who signs and files the Articles of Incorporation, must reside in Michigan. This is not true. An incorporator can be anyone 18 years or older and doesn’t need to be a resident of Michigan or even the United States. The important part is they have the authority to act on behalf of the corporation in this capacity.

- Articles of Incorporation Are the Only Documents Needed to Start a Business: While filing the Articles of Incorporation with LARA is a crucial step, it is not the only requirement for starting a business. Depending on the type of business and where it's located, you may need additional permits or licenses. Furthermore, companies are encouraged to create bylaws, though not filed with the state, are important for defining the corporation's operations and management.

- Filing Articles of Incorporation Automatically Provides Tax-Exempt Status: Some people think that once they file their Articles of Incorporation, especially for non-profit corporations, their organization is automatically tax-exempt. This is not accurate. To obtain tax-exempt status, you must apply to the Internal Revenue Service (IRS) and, depending on the situation, the Michigan Department of Treasury, to receive this designation.

- There is No Need to Renew the Articles of Incorporation: It's true that the Articles of Incorporation are a one-time filing when establishing your corporation in Michigan. However, this does not mean there’s no ongoing paperwork. Corporations must file annual reports and, in some cases, other periodic filings to remain in good standing. Failure to do so can result in penalties or even dissolution of the corporation.

- Personal Information Is Always Required: While the Articles of Incorporation do require some information about the incorporator(s) and the registered agent, they do not typically require personal information such as social security numbers. It’s important to understand what information is necessary to avoid providing more personal information than required.

By dispelling these misconceptions, individuals can navigate the incorporation process more effectively and with confidence. It’s always advisable to consult with legal or professional guidance when forming a corporation to ensure that all legal requirements are met and to maintain compliance with Michigan state law.

Key takeaways

When going through the process of formalizing your business structure in Michigan, using the Articles of Incorporation form is a key step for those looking to establish a corporation. Here are seven essential takeaways to guide you through this crucial process effectively:

-

Understanding the Purpose: The Michigan Articles of Incorporation form serves as the official document to register your corporation with the state, making it a legal entity. It’s the foundation of your corporation’s legal structure.

-

Detail is Key: Accurately filling out every section is critical. This includes the corporation’s name, purpose, registered agent information, shares information, and incorporator details. Inaccuracies can lead to delays or rejection of your filing.

-

Choosing a Name: The name of your corporation must be unique and meet Michigan’s naming requirements. It usually has to include an identifier like "Corporation," "Incorporated," "Company," or an abbreviation of these terms.

-

Selecting a Registered Agent: Your corporation must have a registered agent with a physical address in Michigan. This agent is responsible for receiving important legal and tax documents on behalf of the corporation.

-

Understanding Shares: The form will ask for information about the corporation's authorized shares. It's important to carefully consider how many shares to authorize, as this plays a role in the ownership and potential fundraising aspects of the corporation.

-

Filing Fee: Submitting the Articles of Incorporation comes with a filing fee. Be sure to check the current fee requirement and include it with your submission to avoid delays.

-

Consider Professional Help: While filling out the form can be straightforward, seeking advice from a legal professional or an accountant might be beneficial, especially when dealing with complex issues like share distribution or tax implications.

Remember, once the Articles of Incorporation are filed and approved, your corporation will be subject to both the rights and responsibilities under Michigan law. Keeping good records and staying informed about your obligations will help you maintain your corporation's good standing.

More Articles of Incorporation State Forms

Articles of Incorporation Illinois - The form acts as a public record, placing the corporation's formation information within the public domain.

Articles of Incorporation Sunbiz - This filing can enhance the business's credibility with vendors, customers, and investors by formalizing its corporate status.

How Much Is Llc in Texas - The primary document required for forming a new corporation, including stipulations on shareholder provisions and rights.