Fillable Articles of Incorporation Document for Illinois

Embarking on the journey of establishing a business entity in Illinois requires a pivotal step: filing the Articles of Incorporation. This form serves as the official registration of a corporation, setting the legal foundation for its existence under state law. It captures essential details such as the corporation’s name, purpose, registered agent, and information about its shares and incorporators. The significance of this document cannot be overstated as it not only marks the birth of the corporation but also outlines its structural and operational framework, making it a key element in safeguarding legal rights and establishing the entity’s identity within the Illinois business landscape. The process, while straightforward, mandates precision in filling out the form to ensure compliance with state regulations, thus avoiding potential hurdles that could impede the smooth launch and growth of the business. Understanding the major aspects of the Articles of Incorporation is crucial for entrepreneurs aiming to navigate through these initial legal waters with confidence and secure a solid footing for their corporate ventures.

Document Example

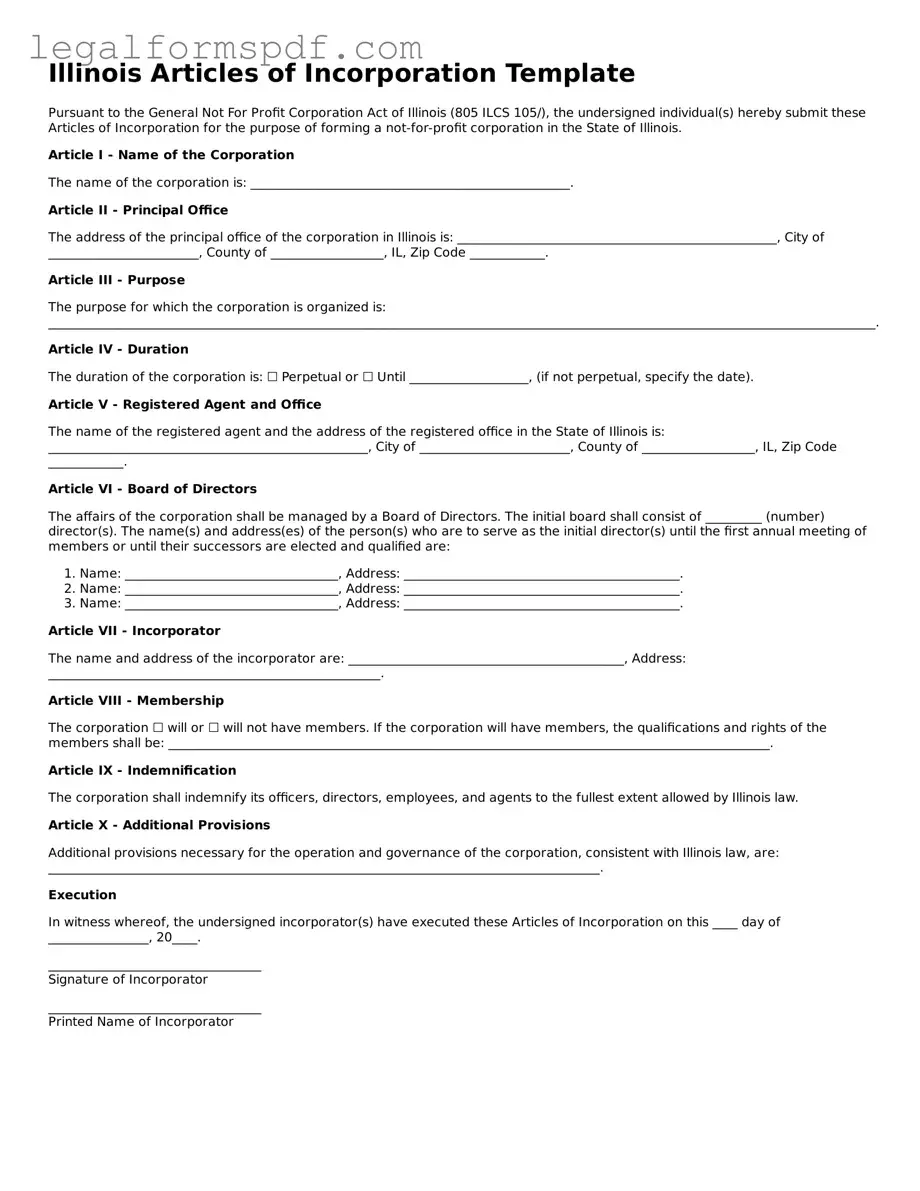

Illinois Articles of Incorporation Template

Pursuant to the General Not For Profit Corporation Act of Illinois (805 ILCS 105/), the undersigned individual(s) hereby submit these Articles of Incorporation for the purpose of forming a not-for-profit corporation in the State of Illinois.

Article I - Name of the Corporation

The name of the corporation is: ___________________________________________________.

Article II - Principal Office

The address of the principal office of the corporation in Illinois is: ___________________________________________________, City of ________________________, County of __________________, IL, Zip Code ____________.

Article III - Purpose

The purpose for which the corporation is organized is: ____________________________________________________________________________________________________________________________________.

Article IV - Duration

The duration of the corporation is: ☐ Perpetual or ☐ Until ___________________, (if not perpetual, specify the date).

Article V - Registered Agent and Office

The name of the registered agent and the address of the registered office in the State of Illinois is: ___________________________________________________, City of ________________________, County of __________________, IL, Zip Code ____________.

Article VI - Board of Directors

The affairs of the corporation shall be managed by a Board of Directors. The initial board shall consist of _________ (number) director(s). The name(s) and address(es) of the person(s) who are to serve as the initial director(s) until the first annual meeting of members or until their successors are elected and qualified are:

- Name: __________________________________, Address: ____________________________________________.

- Name: __________________________________, Address: ____________________________________________.

- Name: __________________________________, Address: ____________________________________________.

Article VII - Incorporator

The name and address of the incorporator are: ____________________________________________, Address: _____________________________________________________.

Article VIII - Membership

The corporation ☐ will or ☐ will not have members. If the corporation will have members, the qualifications and rights of the members shall be: ________________________________________________________________________________________________.

Article IX - Indemnification

The corporation shall indemnify its officers, directors, employees, and agents to the fullest extent allowed by Illinois law.

Article X - Additional Provisions

Additional provisions necessary for the operation and governance of the corporation, consistent with Illinois law, are: ________________________________________________________________________________________.

Execution

In witness whereof, the undersigned incorporator(s) have executed these Articles of Incorporation on this ____ day of ________________, 20____.

__________________________________

Signature of Incorporator

__________________________________

Printed Name of Incorporator

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose of Form | Used to legally form a corporation in the state of Illinois. |

| Governing Law | Illinois Business Corporation Act of 1983. |

| Minimum Requirements | Includes information such as corporate name, purpose, registered agent, and office address. |

| Filing Authority | Filed with the Illinois Secretary of State. |

| Electronic Filing | Available for submission online through the Illinois Secretary of State's website. |

| Paper Filing | Option to file by mail or in person is also available. |

| Fee Structure | Submission fees vary depending on the type of corporation being formed. |

Instructions on Writing Illinois Articles of Incorporation

When establishing a corporation in Illinois, one of the most important steps is filing the Articles of Incorporation with the Secretary of State. This document legally creates your corporation and includes essential information such as the corporation's name, purpose, office address, directors, and information about shares. Properly filling out this form requires attention to detail and accuracy to ensure the process moves smoothly. The following steps are designed to assist you in completing the Illinois Articles of Incorporation form correctly.

- Determine the corporation's name: Ensure the name is unique and meets Illinois state requirements, including the use of a corporate designator like "Inc.," "Corporation," or a similar term.

- Specify the purpose of the corporation: Write a brief statement about the business's nature, ensuring it is broad enough to encompass all possible business activities.

- Identify the registered agent and office: Input the name and Illinois street address of the registered agent who will receive legal documents on behalf of the corporation. A P.O. Box is not acceptable.

- List the names and addresses of the initial directors: Provide the names and addresses of the individuals who will serve as the corporation's initial board of directors until the first annual meeting.

- Determine the number of shares the corporation is authorized to issue: Specify the total amount of shares the corporation is permitted to issue, and if there are more than one class of shares, provide details for each class.

- Include the incorporator's information: The incorporator, who files the Articles of Incorporation, must provide their name, address, and signature. The incorporator doesn't need to be a director or officer.

- Provide the effective date of the incorporation: If you want the corporation to start on a specific date other than the filing date, specify this date, which cannot be more than 60 days from the filing date.

- Attach any necessary additional provisions: If there are particular rules or agreements relevant to the corporation, attach the detailed information on a separate sheet.

- Review the form for accuracy and completeness. Double-check all entered information to ensure it is correct.

- Submit the form and filing fee: Once completed, submit the form to the Illinois Secretary of State along with the required filing fee. Check the current fee and acceptable forms of payment on the Secretary of State's website.

After submitting the Articles of Incorporation, your corporation will not immediately be active. The Secretary of State needs to process your submission, which can take several weeks. During this time, it's wise to use the waiting period to prepare for the next steps, such as drafting bylaws, obtaining any necessary licenses or permits, and setting up a corporate bank account. Once your Articles of Incorporation are approved, you will receive a certificate of incorporation, marking your corporation's official start.

Understanding Illinois Articles of Incorporation

What are the Articles of Incorporation?

The Articles of Incorporation is a formal document required to legally establish a corporation in the state of Illinois. It sets out the basic information about the corporation, including its name, purpose, and the details about its shares and initial directors. Once filed with the state, this document officially creates your corporation under Illinois law.

Who needs to file the Articles of Incorporation in Illinois?

Anyone wishing to form a corporation in Illinois must file the Articles of Incorporation. This applies whether you're starting a new business, or if an existing business outside of Illinois wants to operate legally within the state.

Where do I file the Illinois Articles of Incorporation?

The Articles of Incorporation should be filed with the Illinois Secretary of State. You can submit your documents online, by mail, or in person at their office. The Illinois Secretary of State's website provides detailed instructions and the necessary forms for submission.

What information is required to complete the Illinois Articles of Incorporation?

To complete the Articles of Incorporation, you will need to provide:

- The corporation's name and address

- The purpose for which the corporation is being formed

- Information about the corporation's shares and their distribution

- The names and addresses of the initial directors

- The name and address of the registered agent

- The incorporator's information, including name and signature

How much does it cost to file the Articles of Incorporation in Illinois?

The filing fee for the Articles of Incorporation in Illinois varies depending on the type of corporation being formed and other factors. The latest fee schedule can be found on the Illinois Secretary of State's website. Note that fees may change, so it's always a good idea to check for the most current information before submitting your filing.

How long does it take to process the Illinois Articles of Incorporation?

The processing time can vary based on the method of filing and the current workload of the Secretary of State's office. Online filings are typically processed faster than paper submissions. During busy periods, processing times may extend. It's recommended to check the current processing times on the Secretary of State's website or contact them directly for the most accurate estimate.

Can the Articles of Incorporation be amended after they are filed?

Yes, corporations in Illinois can amend their Articles of Incorporation. To do so, you will need to file an Articles of Amendment form with the Illinois Secretary of State. This form allows you to make changes to information such as the corporation's name, purpose, number of authorized shares, and other details originally filed. There is a filing fee associated with this process, and the form and current fees can be found on the Secretary of State's website.

Common mistakes

Filling out the Illinois Articles of Incorporation is a crucial initial step for entrepreneurs wanting to formalize their business presence in the state. However, errors in completing this document can lead to delays or even rejection of the incorporation application. Understanding common mistakes can help ensure the process goes smoothly.

One common mistake is not providing a specific enough purpose for the corporation. The state of Illinois requires that businesses state their purpose beyond generic terms like "to do business." This means a detailed objective must be outlined, explaining the nature of the business activities in a clear and concise manner.

Another error occurs when individuals fail to properly designate the registered agent and registered office. The registered agent is responsible for receiving legal documents on behalf of the corporation, and this role must be filled by either an individual resident of Illinois or a company authorized to conduct business in Illinois. The address provided cannot be a P.O. box and must be the registered agent's physical address where they can be reached during normal business hours.

Choosing an appropriate corporate name also presents challenges. The name must be distinguishable from other businesses already registered in Illinois. It is imperative to conduct a thorough search through the Illinois Secretary of State's database to ensure the desired name is available and complies with state naming requirements, including the inclusion of a corporate designator such as "Incorporated," "Corporation," "Limited," or their abbreviations.

Incorrectly detailing the shares of stock the corporation is authorized to issue is another frequent mistake. The Articles of Incorporation must specify the number of shares the corporation is allowed to issue, along with the class of these shares if there are multiple classes. Failing to outline this information correctly can impact the corporation's financial and governance flexibility in the future.

Failure to include required attachments or additional provisions mandated by specific types of corporations, such as professional corporations, can also derail the filing process. Some businesses may need to attach additional documents that outline special agreements or conditions related to their operations or governance.

Often, applicants overlook the necessity of obtaining necessary approvals from state agencies that regulate certain industries. For example, financial institutions, insurance companies, and educational institutions might need endorsements from respective regulatory bodies before they can be successfully incorporated. Not securing these approvals in advance can result in delays.

Submitting incomplete or inaccurately filled forms is yet another common error. Every section of the Articles of Incorporation needs to be reviewed for completeness and accuracy to avoid the state returning the document for corrections.

Not updating the form before submission can cause issues as well. The Illinois Secretary of State periodically updates the Articles of Incorporation form to reflect changes in law or filing procedures. Using an outdated form can lead to unintended non-compliance or rejection.

Finally, neglecting to pay the correct filing fee or submitting the fee in an incorrect format can result in processing delays. The Illinois Secretary of State's office requires exact payment of the filing fee, and it often must be paid with a certain type of payment method. Failing to adhere to these requirements can add unnecessary complications to the incorporation process.

Documents used along the form

When you're starting a business in Illinois, filling out the Articles of Incorporation is a big step towards making your business official. But that's just one piece of the puzzle. To fully establish your corporation and ensure it runs smoothly, there are several other forms and documents you might need to prepare and file. Some of these documents help you comply with state laws, while others are important for internal governance and financial tasks. Here's a list of documents often used alongside the Illinois Articles of Incorporation.

- Bylaws: Bylaws are internal documents that outline the rules for how your corporation operates. They cover topics like how directors are elected, the roles of officers, and how meetings are conducted.

- IRS Form SS-4 (Application for Employer Identification Number, EIN): After incorporating, you'll need an EIN for tax purposes. This number is used to identify your corporation for federal taxes, hiring employees, opening bank accounts, and more.

- Illinois Business Registration Application: This form registers your corporation with the Illinois Department of Revenue, which is necessary for state tax purposes, including sales tax, if applicable.

- Shareholder Agreement: Although not required, a shareholder agreement is crucial for defining the rights and responsibilities of shareholders, how shares can be bought or sold, and how disputes among shareholders will be resolved.

- Stock Certificates: These certificates serve as a physical representation of share ownership in the corporation. They include details like the name of the shareholder and the number of shares owned.

- Annual Report: Illinois requires corporations to file an annual report, which updates the state on key information like your corporate address and details about directors and officers.

- Meeting Minutes: Corporations are required to keep detailed records of what happens during official meetings, including decisions made and resolutions passed, in the form of minutes.

- Operating Agreement: While more common in LLCs, an Operating Agreement can also be useful for corporations, especially if you have a close corporation. It can provide structure for operational procedures and agreements among shareholders.

- Bank Resolution: When opening a bank account in the name of your corporation, a bank resolution authorizes specific individuals to conduct financial transactions on behalf of the corporation.

Preparing and managing these documents after filing your Illinois Articles of Incorporation takes diligence, but it's necessary for laying a strong foundation for your corporation. While this list covers some of the key documents, depending on your specific business activities, there may be additional forms and permits required. Ensuring you have all the right paperwork in order can help avoid legal troubles and smooth the path for your business's future growth.

Similar forms

The Illinois Articles of Incorporation form shares similarities with the Articles of Organization used in forming a Limited Liability Company (LLC). Both documents serve as foundational legal documents required to officially form a business entity within their respective state. They provide important information about the business, such as the business name, purpose, office address, and details about the management structure. However, the Articles of Incorporation specifically apply to corporations, whereas the Articles of Organization are used for LLCs, reflecting different management structures and obligations under state law.

Similarly, the Corporate Bylaws document is akin to the Illinois Articles of Incorporation, as it outlines rules and procedures for the governance of a corporation. While the Articles of Incorporation establish the legal existence of the corporation and include basic information required by the state for registration, the Corporate Bylaws delve into more detailed governance aspects, such as the frequency of board meetings, roles and responsibilities of directors and officers, and procedures for amending the bylaws or articles themselves. Both documents work together to provide a framework for the corporate structure and operations.

Another document bearing resemblance to the Illinois Articles of Incorporation is the Operating Agreement used by LLCs. While serving different types of business entities, both documents outline the internal workings and structure of the business. Operating Agreements for LLCs, much like Corporate Bylaws for corporations, detail the members’ rights and responsibilities, profit distributions, and rules for making business decisions. These documents are essential for ensuring smooth and agreed-upon operations within their respective business entity types.

The Business Plan is often associated with the strategic planning of a business, yet it shares a common purpose with the Illinois Articles of Incorporation in laying a foundation for the business entity. Although the Articles of Incorporation are a legal requirement and the Business Plan is not, both documents are crucial at the early stages of forming a business. They guide the direction and decisions of the entity; however, the Business Plan focuses more on operational, marketing, and financial strategies, whereas the Articles of Incorporation address legal formation requirements.

The Employer Identification Number (EIN) Application, while not a formation document per se, is closely connected to the process initiated by the Illinois Articles of Incorporation. Once a corporation is formed through filing the Articles of Incorporation, obtaining an EIN from the IRS is a crucial next step. The EIN is essentially the business’s social security number, needed for tax purposes, opening a business bank account, and hiring employees. This process complements the legal establishment of the business, enabling it to operate within the economic system.

Last but not least, the Statement of Information, required periodically by many states for registered business entities, shares commonalities with the Illinois Articles of Incorporation. Though typically filed after the corporation is initially registered, this document updates the state on essential information about the business, such as the current directors and officers, address changes, or business activity updates. Both the Articles of Incorporation and the Statement of Information ensure that the state has accurate and current information on file for the legal entity, facilitating transparency and compliance with state regulations.

Dos and Don'ts

Filling out the Illinois Articles of Incorporation is a significant step towards establishing your business as a legal entity. To ensure the process goes smoothly, here are 10 dos and don'ts to keep in mind:

Do:

Ensure all information is accurate and complete to avoid delays or rejections.

Use the exact legal name of the corporation, including any designators such as "Inc." or "Corp." that confirm its corporate status.

Provide a valid Illinois registered agent and office. This agent acts as the corporation's official liaison for legal documentation.

Specify the purpose of the corporation. While some choose a broad purpose to allow for business flexibility, it's critical to comply with state requirements.

Detail the number of authorized shares the corporation will issue, as this affects potential investment and ownership structure.

Include the names and addresses of the initial directors who will serve until the first annual meeting or until successors are elected.

Attach any necessary additional Articles if your corporation has specialized needs or requirements.

Sign and date the form as required. An electronic signature is often acceptable, but verify current guidelines.

Review the entire form for completeness and compliance with Illinois state law.

Keep a copy of the filed Articles of Incorporation for your records once submitted.

Don't:

Ignore the specific formatting requirements for the document, such as font size or margins. These might seem minor but can lead to processing delays.

Forget to check the availability of your business name in Illinois before filing, which can prevent duplicate names and potential legal issues.

Overlook the need to appoint a registered agent with a physical address in Illinois, as P.O. Boxes are not acceptable for this crucial role.

Fail to specify whether your corporation will be managed by Directors or Managers, a choice that affects governance structure.

Underestimate the importance of accurately reporting the share structure, which can impact taxes, ownership, and more.

Leave sections of the form blank, assuming they're not applicable. Each question must be answered or marked as not applicable.

Attempt to file without checking for the most current filing fees and requirements, as these can change.

Submit the form without double-checking for typographical errors or omissions. These mistakes can significantly slow down the process.

Assume that filing the Articles of Incorporation is the final step in establishing your corporation. There are often additional steps required by Illinois law.

Rely solely on generic advice without considering the specific needs of your corporation.

Misconceptions

When dealing with the Illinois Articles of Incorporation, several misconceptions often arise. Clearing up these misunderstandings is key to ensuring businesses are properly informed about the incorporation process in Illinois. Below are nine common misconceptions about the Illinois Articles of Incorporation form:

- It's only for large corporations: Many people believe that the Articles of Incorporation are only necessary for large businesses. However, in reality, any business that wants to be formally recognized as a corporation in Illinois, regardless of size, must file this document.

- The process is too complicated: Another misconception is that the process of filing the Articles of Incorporation is overly complex and difficult. Although it requires attention to detail, the state provides guidelines that make the process straightforward for most applicants.

- It's too expensive: The cost associated with filing the Articles of Incorporation may deter some businesses. While there is a fee, it is generally considered a reasonable cost for the legal and tax benefits of incorporating.

- Instant approval is guaranteed: Some believe that once the Articles of Incorporation are filed, the corporation is immediately recognized. In reality, the approval process takes time as the documents are reviewed by the state.

- Only an attorney can file them: While it's beneficial to consult with a legal professional, particularly for complex situations, it is not a requirement. Business owners can file the Articles of Incorporation themselves or use online services to assist them.

- Personal information is kept private: Many assume that all personal information provided in the Articles of Incorporation is kept confidential. However, certain information becomes public record, such as the names of the incorporators and the registered agent.

- No annual requirements exist after filing: Some people think that once they file their Articles of Incorporation, there's nothing else to do. However, Illinois corporations are required to file an annual report and pay the associated fee to maintain good standing.

- Articles of Incorporation and Bylaws are the same: This is a common confusion. The Articles of Incorporation officially form your corporation with the state, while bylaws are internal documents that outline how the corporation will operate.

- Amending the Articles is a sign of failure or instability: Circumstances and business needs change, leading corporations to amend their Articles of Incorporation. Amendments are a normal part of business growth and adaptation, not a negative indicator.

Key takeaways

Filing the Illinois Articles of Incorporation is a foundational step for establishing a corporation within the state. This process, while straightforward, requires careful attention to ensure accuracy and compliance with state regulations. The following key takeaways offer guidance on filling out and using the form effectively:

- Ensure accuracy in entering the corporation's name, including the required corporate designator such as "Inc.," "Corporation," or an equivalent. Illinois law mandates distinctiveness from existing entities.

- Clearly state the purpose of the corporation. Illinois allows for a broad purpose statement, but being specific can clarify the business's intentions.

- Detail the registered agent's information. This individual or entity will receive legal documents on behalf of the corporation. They must have a physical address in Illinois.

- Specify the number of shares the corporation is authorized to issue. This will impact the corporation's ownership structure and potential for raising capital.

- Include information on the initial directors. In Illinois, corporations are required to have one or more directors whose names and addresses must be listed in the Articles of Incorporation.

- Clarify the duration of the corporation if it is not perpetual. While most corporations choose a perpetual duration, some may have a specific end date.

- Attach any additional provisions or articles that are necessary for the particular corporation. This could include shareholder rights, indemnification of officers and directors, or other unique corporate governance matters.

- Ensure the incorporator(s) sign the form. The incorporator is the individual or entity completing the Articles of Incorporation, and their signature acknowledges the responsibility and accuracy of the information provided.

- Review the filing fee and payment methods. Illinois requires a fee to file the Articles of Incorporation, which varies depending on the type of corporation and its authorized shares.

- Consider seeking legal advice for complex structures or provisions. While many corporations can be straightforward to establish, some may benefit from professional guidance to navigate specific legal or financial strategies.

Following these key takeaways can help streamline the process of filing the Illinois Articles of Incorporation, ensuring a solid foundation for the corporation's legal and operational structure.

More Articles of Incorporation State Forms

Articles of Incorporation Sunbiz - By clarifying the corporation's principal business activities, it helps in aligning operations with strategic objectives.

Registration Certificate - For entities seeking tax-exempt status, such as non-profits, the Articles of Incorporation include specific language required by the IRS.

Ca Biz File - Once filed, amendments to the Articles of Incorporation can usually be made, but this often involves additional paperwork and fees.

How to Open a Corporation in Ny - Requires adherence to state-specific filing procedures, including fee submissions, which may vary significantly from one jurisdiction to another.