Fillable Articles of Incorporation Document for Georgia

When starting a corporation in Georgia, one of the first and most critical steps is the filing of the Articles of Incorporation. This legal document plays a pivotal role in the life of a business, marking its birth into the world of legal entities. It not only establishes the corporation's existence under Georgia law but also sets out essential details like the corporation's name, type of corporate structure, address of the principal office, the number and type of authorized shares, the name and address of the registered agent, and the names of the incorporators. By submitting this document to the Secretary of State, founders lay down the legal foundation of their corporation, which is crucial for compliance, governance, and the establishment of liability protections for its owners. The process, while straightforward, requires careful attention to detail to ensure that all the necessary information is accurately and completely provided. This initial step is instrumental in setting the tone for the corporation’s legal and operational journey, signifying the importance of understanding and correctly executing the Articles of Incorporation form.

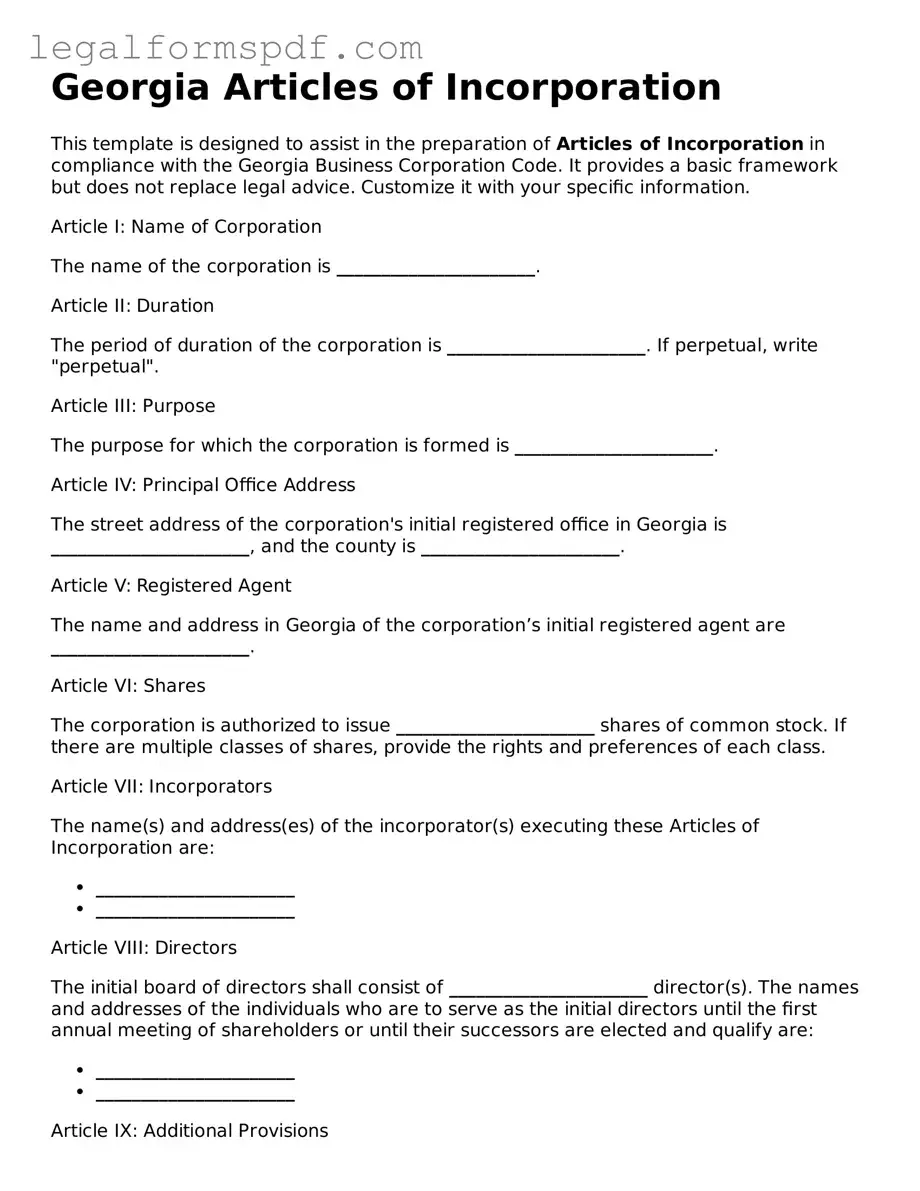

Document Example

Georgia Articles of Incorporation

This template is designed to assist in the preparation of Articles of Incorporation in compliance with the Georgia Business Corporation Code. It provides a basic framework but does not replace legal advice. Customize it with your specific information.

Article I: Name of Corporation

The name of the corporation is ______________________.

Article II: Duration

The period of duration of the corporation is ______________________. If perpetual, write "perpetual".

Article III: Purpose

The purpose for which the corporation is formed is ______________________.

Article IV: Principal Office Address

The street address of the corporation's initial registered office in Georgia is ______________________, and the county is ______________________.

Article V: Registered Agent

The name and address in Georgia of the corporation’s initial registered agent are ______________________.

Article VI: Shares

The corporation is authorized to issue ______________________ shares of common stock. If there are multiple classes of shares, provide the rights and preferences of each class.

Article VII: Incorporators

The name(s) and address(es) of the incorporator(s) executing these Articles of Incorporation are:

- ______________________

- ______________________

Article VIII: Directors

The initial board of directors shall consist of ______________________ director(s). The names and addresses of the individuals who are to serve as the initial directors until the first annual meeting of shareholders or until their successors are elected and qualify are:

- ______________________

- ______________________

Article IX: Additional Provisions

For any other provisions, including any limitations on the directors’ liability or indemnification of officers and directors, specify here: ______________________.

Article X: Date

The date of signing these Articles of Incorporation is ______________________.

Submission Information:

Prepare a signed copy of the Articles of Incorporation and file them with the Georgia Secretary of State's Office along with the filing fee. Ensure all information is accurate and complete before submission.

Note: This template is a reference and should be reviewed for accuracy and completeness. Consult a legal professional for advice or if you have any questions.

PDF Specifications

| Fact | Description |

|---|---|

| 1. Governing Law | The Georgia Articles of Incorporation are governed by the Georgia Business Corporation Code, found in Title 14 of the Official Code of Georgia Annotated (O.C.G.A.). |

| 2. Purpose of Filing | The form is used by individuals or groups to legally establish a corporation in the State of Georgia. It sets the foundation for the company’s legal identity, rights, and obligations. |

| 3. Mandatory Information Required | It must include the corporation’s name, its registered agent's name and address, the corporation's initial principal office address, the number of shares the corporation is authorized to issue, and the names and addresses of the incorporators. |

| 4. Filing Fee | There is a mandatory filing fee, which must be paid at the time of submission to the Georgia Secretary of State's office. The fee amount is subject to change, so it’s advised to check the current rate before filing. |

| 5. Optional Provisions | While there are requirements, incorporators may include additional provisions for managing the corporation's affairs, providing more flexibility and customization for corporate governance. |

Instructions on Writing Georgia Articles of Incorporation

Filling out the Georgia Articles of Incorporation marks a significant step towards establishing a corporation in the state. This form, once completed and filed with the Georgia Secretary of State, legally documents the creation of a corporation, setting the foundation for its operations, governance, and compliance with state regulations. Ensuring accuracy and completeness in this process is critical, as it affects the entity's legal standing and operational capabilities. Follow these steps to navigate the complexities of the form thoroughly and efficiently.

- Locate and download the form: Access the most recent version of the Georgia Articles of Incorporation from the Georgia Secretary of State’s website.

- Choose a corporate name: Decide on a unique name for your corporation, making sure it adheres to Georgia’s naming requirements. It must include "Corporation," "Incorporated," "Company," or "Limited" (or abbreviations of these terms) and be distinguishable from existing names on file with the state.

- Appoint a registered agent: Nominate an individual or entity to act as your registered agent in Georgia. This agent accepts legal papers and official correspondence on behalf of the corporation. Provide the name and physical Georgia address of your registered agent.

- Determine the share structure: Specify the number of shares the corporation is authorized to issue. Note that this figure can impact both the corporation’s ability to raise capital and the amount of annual franchise taxes owed.

- Specify the incorporators: List the names and addresses of all individuals serving as incorporators. An incorporator's role is to sign and file the Articles of Incorporation.

- Additional provisions: If applicable, include any other lawful provisions or information required for the management and regulation of the corporation’s affairs. This might involve preferences, rights, limitations, and restrictions on shares.

- File with the state: Review your completed form for accuracy and completeness, then submit it to the Georgia Secretary of State, along with the appropriate filing fee. Filing can typically be done online, by mail, or in person; however, online filing is encouraged for its added convenience and faster processing times.

Once filed, the Articles of Incorporation undergo a review process by the Secretary of State's office. Successful filing results in the official recognition of the corporation, enabling it to begin its business activities under the protection and regulations provided by Georgia law. Keep in mind the importance of retaining a copy of the filed document for your records and for use in future legal and business proceedings.

Understanding Georgia Articles of Incorporation

What are the Georgia Articles of Incorporation?

The Georgia Articles of Incorporation is a form that needs to be filed by individuals wishing to incorporate their business in Georgia. This document officially registers the business with the state, marking the beginning of its legal existence as a corporate entity.

Where can I find the Georgia Articles of Incorporation form?

You can find the form on the Georgia Secretary of State's website. It's available for download, and you can also file it online through their user-friendly platform.

What information do I need to complete the form?

When filling out the Georgia Articles of Incorporation, you'll need to include the corporation's name, its principal office address, the number of shares the corporation is authorized to issue, the name and address of the registered agent, and the names and addresses of the incorporators.

Is there a fee to file the Georgia Articles of Incorporation?

Yes, there is a filing fee associated with the Articles of Incorporation. The specific amount can change, so it's best to check the latest fee on the Georgia Secretary of State's website or give them a call.

How long does the filing process take?

The processing time can vary depending on whether you file online or by mail, as well as the current workload of the Georgia Secretary of State's office. Online filings are generally processed quicker than mail-in submissions.

Do I need an attorney to file the Georgia Articles of Incorporation?

While it's not mandatory to have an attorney to file the Articles of Incorporation, consulting with one can be beneficial. An attorney can ensure that everything is filled out correctly and can provide advice tailored to your situation.

Can I file the Articles of Incorporation for any type of business?

The Georgia Articles of Incorporation are specifically for incorporating a business as a corporation. If you're looking to form a different type of business entity, like a limited liability company (LLC), you'll need to file different paperwork with the state.

What happens after I file the Articles of Incorporation?

Once filed and approved, your business will be officially recognized as a corporation in the state of Georgia. You'll then need to comply with state requirements such as holding an organizational meeting, adopting bylaws, and issuing stock certificates, if applicable. Additionally, there may be annual reporting and tax obligations to maintain your corporation's good standing.

Common mistakes

Filling out the Georgia Articles of Incorporation form is a critical step for those looking to establish a corporation in the state. Yet, several common mistakes can complicate this process, potentially delaying or even derailing the incorporation. Awareness and attention to detail can help avoid these pitfalls, ensuring a smoother path to officially starting your business.

One frequent error involves the naming conventions. Georgia law requires corporate names to be distinguishable from those already existing in the state database. Overlooking this requirement can lead to rejection of the application. Additionally, certain words may require additional paperwork or professional licensing proof. It’s advisable to conduct a thorough search and adhere to naming rules to avoid unnecessary delays.

Another area often fraught with mistakes is the designation of the registered agent. A registered agent is crucial as they are the corporation's official point of contact for legal documents. Failure to appoint a registered agent, or providing incorrect or incomplete agent information, can invalidate the application. The agent must be available during regular business hours and authorized to conduct business in Georgia.

Incorrectly filling out the shares information can also pose problems. This section, detailing the number and type of shares the corporation is authorized to issue, requires precise information. Misunderstanding how shares affect the corporation's structure and ownership can lead to significant issues down the line, affecting everything from governance to how profits are shared.

A less obvious but impactful mistake is the failure to include necessary additional articles. Depending on the nature of the corporation, specific articles may need to be included in the Articles of Incorporation. This can relate to the corporation's planned duration, business purpose, or management structure. Neglecting these details can lead to rejection or the need for amendment submissions later on.

Last but not least, overlooking the need for specific clauses demanded by the Internal Revenue Service (IRS) for tax-exempt status can be a critical misstep for non-profits. The Articles must contain specific language concerning the organization’s purpose, distribution of assets upon dissolution, and operational limitations to ensure compliance with tax-exemption requirements. Neglecting these IRS requirements can prevent non-profits from achieving or maintaining their tax-exempt status.

By paying close attention to these areas and consulting with professionals when necessary, individuals can navigate the incorporation process in Georgia more confidently and efficiently, setting a solid foundation for their corporate venture.

Documents used along the form

Incorporating a business in Georgia involves more than just filling out the Articles of Incorporation form. While this foundational document is crucial for establishing a corporation's legal identity, several other forms and documents are often required to ensure compliance with state laws and support the operational facets of the business. These documents facilitate various functions, from tax registration to the establishment of the company's internal rules and procedures. Understanding these associated documents can significantly streamline the incorporation process and help new business owners set a solid foundation for their corporate ventures.

- Bylaws: Bylaws are integral to setting up a corporation's internal operating rules. While not filed with the state, these documents outline the governance structure, detailing how corporate decisions are made, the roles of directors and officers, and the procedures for shareholder meetings. Bylaws are essential for ensuring organizational structure and are often requested by banks, investors, and other stakeholders.

- IRS Form SS-4 (Application for Employer Identification Number): Obtaining an Employer Identification Number (EIN) is a critical step for any new corporation, as it is required for tax purposes, opening a business bank account, and hiring employees. This form is submitted to the IRS, either online or by mail, to apply for the unique nine-digit number used to identify the business entity.

- Operating Agreement: Even though most commonly associated with Limited Liability Companies (LLCs), corporations, particularly those with multiple shareholders, can benefit from having an operating agreement to outline the financial and functional decisions of the business, including rules, regulations, and provisions. The purpose is to govern the internal operations of the entity in a way that suits the specific needs of the business owners.

- Shareholder Agreement: This is a contract between the shareholders of a corporation, detailing the rights, privileges, and obligations of each shareholder. The shareholder agreement addresses issues like the transfer of shares, how decisions are made, and how disputes are resolved among shareholders. It supplements the bylaws by covering areas not typically addressed in the bylaws.

- Georgia State Tax Identification Number Application: Apart from an EIN, corporations in Georgia may also need to apply for a state tax identification number for state tax purposes. This number is necessary for various state tax responsibilities, including sales tax collection and employee withholdings.

Navigating the process of incorporating in Georgia involves a detailed understanding and utilization of these documents in conjunction with the Articles of Incorporation. By adequately preparing and organizing the necessary forms, entrepreneurs can ensure a smooth incorporation process, laying a strong and compliant foundation for their business operations. It's advisable to consult with legal professionals or business advisors to ensure all documentation is correctly completed and filed, setting your corporation up for success from the start.

Similar forms

The Georgia Articles of Incorporation shares similarities with the Alabama Certificate of Formation. Both documents signal the birth of a new corporation within their respective states. Each document requires basic information about the company, such as its name, purpose, and registered agent, setting a legal foundation for the business's operations. The main difference lies in their jurisdictional applicability—each tailored to meet the specific requirements and legal standards of Georgia or Alabama.

Similar to the Georgia Articles of Incorporation, the Florida Articles of Incorporation serve the same primary purpose for businesses looking to establish themselves as corporations within Florida. This document also collects fundamental details about the company but may have different requirements for information on company officers or specifics concerning the type and number of authorized shares. Despite these nuances, both documents play a pivotal role in the corporate formation process in their respective states.

The Texas Certificate of Formation matches closely with Georgia's Articles of Incorporation when it comes to establishing a legal business entity. Like its Georgia counterpart, the Texas document outlines crucial company details, including its name, management structure, and registered agent. Key distinctions may arise in state-specific norms around filing procedures or the detail level required in describing the business's purpose, but the overarching goal of legally registering a corporation remains consistent between the two.

Delaware's Certificate of Incorporation is another document that echoes the function of Georgia's Articles of Incorporation but with a focus on companies incorporating in Delaware. Renowned for its business-friendly laws, Delaware requires this document to include information similar to what's found in Georgia's Articles, such as corporate name and office address. The Delaware certificate, however, may emphasize different aspects of corporate structure or shareholder rights, reflective of the state's unique legal landscape for businesses.

The Bylaws of a Corporation, while not a state-filed document, are intimately related to the Georgia Articles of Incorporation. After filing the Articles and officially forming the corporation, the bylaws are internally adopted to dictate the corporation's operational rules, including governance, voting rights, and officer roles. These bylaws complement the Articles by providing a detailed framework for the company's day-to-day management and decision-making processes.

Corporate Resolutions bear resemblance to Georgia's Articles of Incorporation because they both serve foundational roles within a corporation's lifecycle. Whereas the Articles establish the corporation's legal existence, Corporate Resolutions are used thereafter to document important decisions made by the company's board of directors or shareholders, such as opening bank accounts, authorizing loans, or entering into contracts. These resolutions further the operational realities initiated by the Articles.

The Operating Agreement for a Limited Liability Company (LLC) is akin to the Articles of Incorporation for corporations but tailored for LLCs. This document outlines the ownership structure, member roles, and operational guidelines of an LLC. While serving a comparable purpose as the Articles—providing a framework for the business—Operating Agreements are for LLCs, showing the adaptability of business documentation across different legal entity types.

A Business Plan, though not a legal document, shares a conceptual resemblance with the Georgia Articles of Incorporation. Both are foundational to a new business, with the Articles legally establishing the corporation and the Business Plan providing a strategic blueprint. The plan outlines goals, strategies, and the financial model, guiding the company toward growth and operational success, similar to how the Articles guide legal and structural configuration.

Shareholder Agreements complement the Georgia Articles of Incorporation by detailing the rights and obligations of shareholders within the corporation. While the Articles serve to legally form the corporation and outline its basic structure, Shareholder Agreements delve into specifics about share ownership, voting rights, and procedures for resolving disputes among shareholders, thereby providing a more in-depth governance framework.

The Employer Identification Number (EIN) Application, though a form rather than a narrative document, is an essential follow-up to filing the Georgia Articles of Incorporation. This IRS form is necessary for the corporation to be recognized as a tax entity, allowing it to open bank accounts, hire employees, and file taxes. Both the Articles and the EIN Application are required steps in establishing the corporation’s identity and operational viability within the legal and financial systems.

Dos and Don'ts

Filing the Georgia Articles of Incorporation is a key step in creating a corporation in the state. It's essential to approach this process carefully to ensure that your corporation is legally recognized. Below are lists of things you should and shouldn't do when completing this form:

Do:

- Include the exact name of the corporation that meets Georgia's naming requirements. Ensure it is distinguishable from other names on record.

- Provide a valid registered office address in Georgia. The location must be a physical address and cannot be a PO Box.

- Appoint a registered agent who is authorized to receive legal documents on behalf of the corporation. The agent must have a physical presence in Georgia.

- List the names and addresses of the incorporators. These individuals are responsible for executing the Articles of Incorporation.

- Specify the number of shares the corporation is authorized to issue if applicable. This should reflect your financial and operational needs.

- Sign and date the form. An incorporator or an attorney representing the incorporator must sign the Articles of Incorporation to validate the document.

Don't:

- Leave sections of the form blank. Provide all requested information to prevent delays or rejection of your filing.

- Submit the form without reviewing for accuracy and completeness. Errors or omissions can lead to processing delays or legal issues down the line.

- Forget to include the filing fee. Filing the Articles of Incorporation requires a fee; failing to include it will result in your form not being processed.

- Use a PO Box for the registered office address. Georgia law requires a physical address for the office of the registered agent.

- Appoint a registered agent without their consent. Ensure that the individual or entity agrees to act as your registered agent before listing them on the form.

- Ignore the requirement for original signatures. Photocopied or digital signatures may not be accepted for this official document.

Misconceptions

The Georgia Articles of Incorporation is a critical document for establishing a corporation in the state. However, several misconceptions surround this form, often leading to confusion and potential mistakes. Understanding the facts can significantly streamline the incorporation process.

Only large businesses need to file the Articles of Incorporation. This is a common misconception. Regardless of size, if a business chooses to operate as a corporation in Georgia, it must file the Articles of Incorporation. This requirement applies to small, family-owned businesses as much as it does to larger companies.

The process is complicated and requires an attorney. While legal advice is beneficial, especially for complex structures, the process of filing the Articles of Incorporation in Georgia is designed to be straightforward. Many businesses successfully file without hiring an attorney, using resources provided by the Georgia Secretary of State.

Filling out the form is all that's required to start doing business. Submitting the Articles of Incorporation is a crucial step, but it's not the only requirement. Businesses must also obtain the necessary permits and licenses, comply with state and federal tax requirements, and follow other regulatory mandates.

The Articles of Incorporation protect the business name statewide. Filing the Articles does reserve the business name in Georgia, but it doesn't provide total protection against others using a similar name in trade or commerce. A trademark might be necessary for broader protection.

There's no need to update the Articles of Incorporation. Circumstances change, and when they do, the Articles of Incorporation may need updating. Events such as changes in corporate officers, business address, or company purpose can necessitate filing amended articles with the state to keep records current and accurate.

Dispelling these misconceptions about the Georgia Articles of Incorporation can help ensure businesses comply with state requirements effectively, avoiding pitfalls that could impede their operations. Attention to detail and adherence to state guidelines are paramount in the incorporation process.

Key takeaways

Filling out and using the Georgia Articles of Incorporation form correctly is a foundational step in establishing a corporation within the state. This process necessitates attention to detail and an understanding of specific requirements that ensure compliance with state laws. The following key takeaways are designed to guide individuals through this important legal procedure:

- Ensure all required information is complete and accurate before submission. The form requires details such as the corporation's name, the number of shares the corporation is authorized to issue, the name and address of the initial registered agent, and the names and addresses of the incorporators.

- The name of the corporation must be distinguishable from other business names already on file with the Georgia Secretary of State. It is advisable to check the availability of your proposed name before filing to avoid rejection.

- The initial registered agent named in the Articles must have a physical address (not a P.O. Box) in Georgia, as this agent acts as the corporation’s official point of contact for legal and state communications.

- Filing the Articles of Incorporation can be done online or through mail, but an online submission is often processed faster. The filing fee is required at the time of submission and varies depending on the method of filing.

By closely following these guidelines, individuals can more effectively navigate the process of incorporating in Georgia, ensuring legal compliance and a solid foundation for their corporation's future operations.

More Articles of Incorporation State Forms

Articles of Incorporation Illinois - Upon processing, the state issues a certificate of incorporation, formally recognizing the corporation’s legal existence.

How Much Is Llc in Texas - An incorporation form that legally registers a business as a corporation, detailing its purpose and operational blueprint.

Ohio Secretary of State Business Search Ohio - Successfully filing the Articles of Incorporation marks the legal birth of the corporation, allowing it to begin operating as its own entity.

Ca Biz File - The successful filing of the Articles of Incorporation marks the official start date of the corporation's existence under law.