Fillable Articles of Incorporation Document for Florida

The journey to establishing a legal business entity in Florida marks a significant milestone for entrepreneurs, requiring careful attention to several crucial steps and documents. Among these, the Florida Articles of Incorporation form stands out as a foundational document that breathes life into a corporation. It serves as the official registration of a new business in the state, detailing essential information such as the corporation's name, principal address, purpose, and information about its shares and initial officers or directors. Additionally, it establishes the legal presence of the corporation, enabling it to engage in business activities, enter into contracts, and ensures protection under Florida's corporate laws. Navigating through the process of accurately completing and filing this form is pivotal, as any discrepancies or omissions can lead to delays or rejection of the application. Therefore, understanding the form's various components, from its basic requirements to the more intricate details about corporate structure and compliance, is imperative for a smooth registration process and the successful launch of a corporation in Florida.

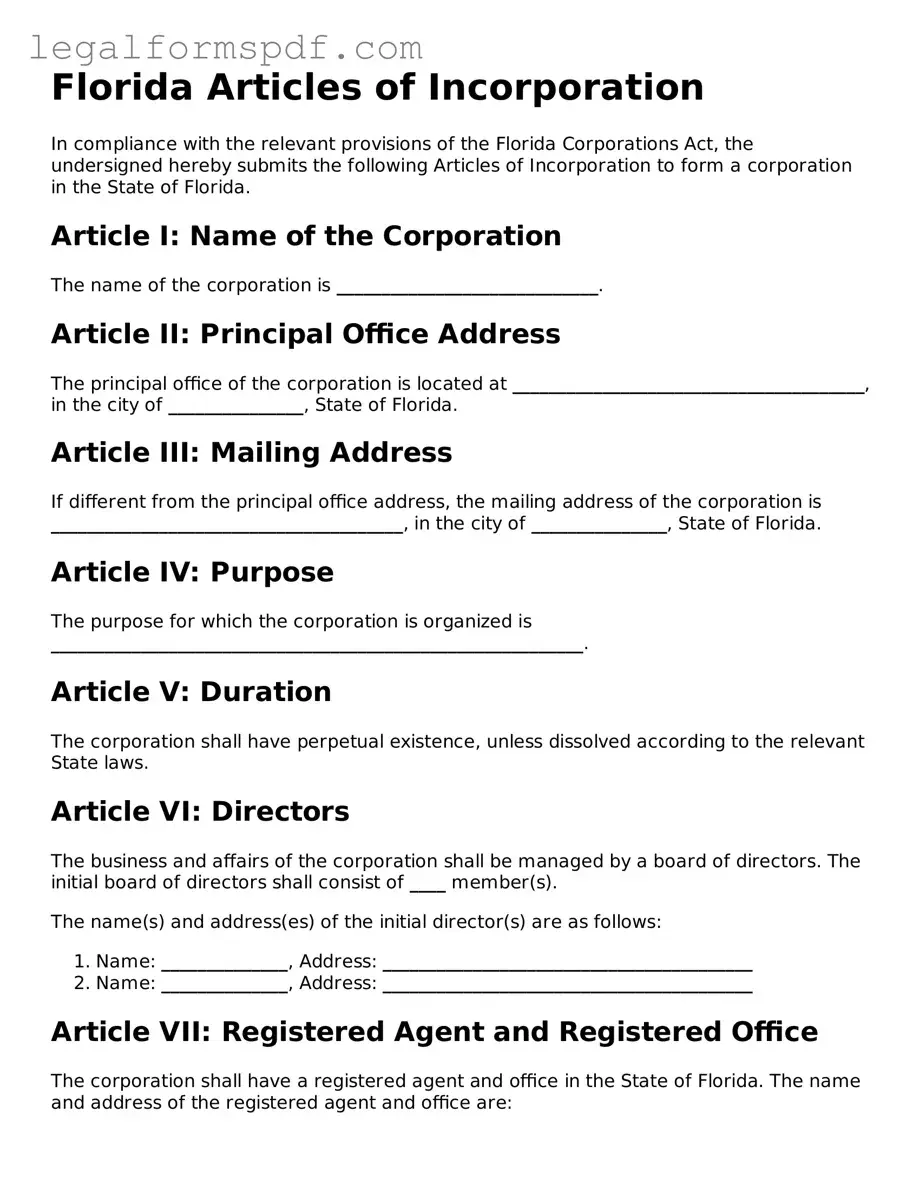

Document Example

Florida Articles of Incorporation

In compliance with the relevant provisions of the Florida Corporations Act, the undersigned hereby submits the following Articles of Incorporation to form a corporation in the State of Florida.

Article I: Name of the Corporation

The name of the corporation is _____________________________.

Article II: Principal Office Address

The principal office of the corporation is located at _______________________________________, in the city of _______________, State of Florida.

Article III: Mailing Address

If different from the principal office address, the mailing address of the corporation is _______________________________________, in the city of _______________, State of Florida.

Article IV: Purpose

The purpose for which the corporation is organized is ___________________________________________________________.

Article V: Duration

The corporation shall have perpetual existence, unless dissolved according to the relevant State laws.

Article VI: Directors

The business and affairs of the corporation shall be managed by a board of directors. The initial board of directors shall consist of ____ member(s).

The name(s) and address(es) of the initial director(s) are as follows:

- Name: ______________, Address: _________________________________________

- Name: ______________, Address: _________________________________________

Article VII: Registered Agent and Registered Office

The corporation shall have a registered agent and office in the State of Florida. The name and address of the registered agent and office are:

Name of Registered Agent: ______________________

Address: _________________________________________, in the city of _______________, State of Florida.

Article VIII: Shares

The corporation is authorized to issue ____ shares of common stock. The value of each share is $______.

Article IX: Incorporator

The name and address of the incorporator authorizing these Articles of Incorporation are:

Name: ______________________

Address: _________________________________________

Article X: Indemnification

The corporation shall indemnify its officers, directors, employees, and agents to the fullest extent permitted by the Florida Corporations Act.

Declaration

By submitting these Articles of Incorporation, the incorporator affirms that the information provided herein is accurate to the best of their knowledge and believes that the corporation is formed in compliance with the laws of the State of Florida.

Signature

__________________________________

Name: ______________________ (Incorporator)

Date: ______________________

PDF Specifications

| Fact | Detail |

|---|---|

| Purpose | Used to legally establish a corporation in the state of Florida. |

| Governing Law | Chapter 607, Florida Statutes, governs the creation and operation of corporations in Florida. |

| Filed With | Florida Department of State, Division of Corporations. |

| Requirement | Mandatory for anyone looking to form a corporation in Florida. |

| Filing Fee | Subject to change; it is essential to consult the official Florida Department of State website for the current fee. |

| Accessibility | Forms can be accessed and filed online via the Florida Department of State website, offering ease of use and quick processing. |

Instructions on Writing Florida Articles of Incorporation

Filling out the Florida Articles of Incorporation is a crucial step for anyone looking to formalize their business structure within the state. This document, once filed with the Florida Division of Corporations, marks the official creation of your corporation. It's essential for legitimizing your business, outlining the basic structure, and ensuring compliance with state law. The process, while detailed, is straightforward when approached methodically. Follow the steps below to complete your form accurately and efficiently.

- Begin by gathering all required information, including the proposed name of your corporation, the principal place of business address, and the name and address of each incorporator.

- Check the availability of your proposed corporate name by searching through the Florida Division of Corporations’ records to ensure it is unique and meets state naming requirements.

- Decide on the number of shares the corporation is authorized to issue. This will influence potential growth and investment in the future.

- Appoint a registered agent who resides in Florida or a corporation authorized to act in such capacity. This agent will handle legal documents on behalf of the corporation.

- Complete the official Florida Articles of Incorporation form, which can be found on the Florida Division of Corporations website. Be meticulous in filling out the form to avoid errors that could delay processing.

- Include the name of your corporation, ensuring it complies with Florida state laws regarding corporate names (e.g., including a corporative designator such as "Inc." or "Corporation").

- Specify the principal place of business address, which might be different from your corporate mailing address.

- Detail the number of shares the corporation is authorized to issue and the par value of each share, if applicable.

- Provide the name and address of the incorporator(s) who are initiating the corporation's formation. If there is more than one incorporator, include the information for each.

- List the name and physical address (P.O. Boxes are not acceptable) of the registered agent who has agreed to accept process on behalf of the corporation.

- Have the registered agent sign the form, indicating their consent to act as such for the corporation.

- Review the form for accuracy and completeness. Missing or inaccurate information can result in delays.

- Submit the completed form along with the required filing fee to the Florida Division of Corporations. This can typically be done online, by mail, or in person.

- Wait for confirmation that the Articles of Incorporation have been filed and approved. This will officially establish your corporation in the state of Florida.

Following these steps will help streamline the process, ensuring that your corporation is established accurately and in compliance with state regulations. Remember, the foundation of a successful business starts with thorough preparation and attention to detail, starting from its incorporation. Once the Articles are filed and approved, you can move forward with confidence, focusing on growing and managing your new corporation.

Understanding Florida Articles of Incorporation

What are the Florida Articles of Incorporation?

The Florida Articles of Incorporation is a document that officially forms your corporation in the state of Florida. It includes basic information about your corporation such as its name, purpose, office address, registered agent, and incorporator details, among others. Filing this document with the Florida Department of State is a critical step in legally establishing your business as a corporation.

How do I file the Florida Articles of Incorporation?

You can file the Florida Articles of Incorporation online through the Florida Department of State's website or by mailing the completed form to their office. Online submission is the fastest way to file, and it allows you to receive immediate confirmation of your filing.

What information do I need to provide in the Articles of Incorporation?

You need to provide several key pieces of information when filing your Articles of Incorporation, including the corporation's name, principal place of business, the name and address of the registered agent, the nature of the business, the number of shares the corporation is authorized to issue, and the names and addresses of the incorporators.

Who can act as a Registered Agent?

In Florida, a registered agent can be either an individual resident of Florida or a business entity authorized to do business in Florida. The agent must have a physical street address in the state (not a P.O. Box) where they can receive legal documents on behalf of the corporation.

Is there a filing fee for the Articles of Incorporation?

Yes, there is a filing fee for the Articles of Incorporation in Florida. The fee varies depending on several factors, including the type of corporation. It's recommended to check the current fee schedule on the Florida Department of State's website or contact them directly for the most up-to-date information.

How long does it take to process the Florida Articles of Incorporation?

The processing time can vary depending on the method of filing. Online submissions are typically processed more quickly, often within a few business days. If you submit your Articles of Incorporation by mail, it may take several weeks for processing. Expedited processing options may be available for an additional fee.

Can I make changes to the Articles of Incorporation after they’ve been filed?

Yes, changes to the Articles of Incorporation can be made after they've been filed. To do so, you'll need to submit an Articles of Amendment form to the Florida Department of State. This form should be used for any changes to the information initially provided in the Articles of Incorporation, such as the corporation’s name, address, or the number of authorized shares.

What happens if I don’t file the Articles of Incorporation?

If you don't file the Articles of Incorporation, your business will not be legally recognized as a corporation in the state of Florida. This means you won't be able to enjoy the legal benefits and protections offered to corporations, such as limited liability for owners (shareholders) and tax advantages. It's important to complete and submit this document if you want your business to be officially recognized and operational as a corporation.

Common mistakes

Filing the Articles of Incorporation in Florida is a critical step for forming a corporation, yet many people make errors during this process. One common mistake is not providing a specific enough name for the corporation. The name must be unique and distinguishable from others already on file with the Florida Department of State. Without ensuring this uniqueness, the filing can be rejected, delaying the incorporation process.

Another error involves neglecting to appoint a registered agent or to provide complete information for this agent. A registered agent acts as the corporation's official point of contact for legal documents. Failing to appoint a registered agent or providing incomplete information about the agent can result in the inability to proceed with the incorporation.

People often overlook the necessity of stating the corporation's principal place of business accurately. This address must be a physical location in Florida where the corporation will carry out its primary business activities. Mistakes or omissions concerning this address can lead to misconceptions about the corporation's legitimacy and its ability to conduct business.

Some filers forget to specify the purpose for which the corporation is being formed, assuming it's either unnecessary or obvious. However, stating the purpose is mandatory and provides clarity on the corporation's intended activities. Being too vague or omitting this information altogether can result in the rejection of the filing.

Incorrectly stating the number of shares the corporation is authorized to issue is another common mistake. This detail influences the corporation's structure and potential for growth. Failure to accurately list the authorized shares can limit the corporation's ability to attract investors or allocate ownership appropriately.

A significant number of people fail to include the names and addresses of the initial officers or directors. This information is crucial for the state to record who is responsible for managing the corporation. Omitting this information can cause delays and additional steps in completing the incorporation process.

Another common error is not adhering to the signature requirements. All necessary parties must sign the Articles of Incorporation, including the incorporator and registered agent. Missing signatures can invalidate the entire filing, necessitating a resubmission and further delaying the incorporation.

Sometimes, individuals make the mistake of not choosing the correct type of corporation for their needs, such as a non-profit versus a for-profit corporation. This decision impacts taxation, fundraising abilities, and the overall operation of the corporation. Incorrect selection can lead to legal and financial complications down the line.

Finally, failing to include the filing fee or submitting an incorrect amount can halt the incorporation process. The state will not process the Articles of Incorporation without the correct fee. This oversight can cause unnecessary delays in starting the corporation's operations.

Documents used along the form

When starting a corporation in Florida, the Articles of Incorporation form is just the beginning. This foundational document is crucial, but to navigate the legal landscape effectively, several other documents are often needed. They serve various purposes, from defining the operational guidelines of your business to ensuring compliance with state laws. Let's explore five such forms and documents that are commonly used alongside the Florida Articles of Incorporation.

- Bylaws: These are the internal rules that govern how a corporation will operate. While not filed with the state, bylaws are crucial for outlining the structure of the organization, the roles and responsibilities of directors and officers, and setting the procedures for meetings, voting, and other corporate activities.

- Operating Agreement: Primarily used by LLCs (Limited Liability Companies), this document serves a similar purpose to corporate bylaws, detailing the management structure and operational protocols. Although mainly associated with LLCs, corporations sometimes utilize them to clarify the roles and expectations of their members.

- Employer Identification Number (EIN) Application: Often considered more of a requirement than a formality, obtaining an EIN from the IRS is crucial for any corporation. This unique nine-digit number is necessary for tax purposes, opening bank accounts, and hiring employees.

- Shareholder Agreement: A critical document for corporations with multiple shareholders, this agreement outlines how shares can be bought and sold, any restrictions on transfer, and the rights and obligations of shareholders. It helps prevent conflicts and ensures that everyone is aligned with the company's vision and operations.

- Annual Report: Although it's something filed each year following the corporation's establishment, the annual report is fundamental to maintaining good standing with the Florida Department of State. It updates the state on critical information such as the corporation's address, and current directors and officers.

Together, these documents complement the Articles of Incorporation, providing a comprehensive framework for the governance and operation of your corporation. It's important to understand not just the purpose but the requirements and timing for each, ensuring your business not only starts off on the right foot but also remains compliant and on track for success.

Similar forms

The Florida Articles of Incorporation form shares similarities with the Operating Agreement for a Limited Liability Company (LLC). Both set the foundation for how the business is structured and operates, though one is for corporations and the other for LLCs. They provide crucial details such as the business name, purpose, and management structure. The key difference lies in the business entity type they are used for, with the Articles of Incorporation being specific to corporations and the Operating Agreement for LLCs.

Similarly, the Bylaws of a corporation echo elements of the Articles of Incorporation. Bylaws delve deeper into the governance, outlining day-to-day operations, defining roles of officers, and establishing procedures for meetings and decision-making. While the Articles of Incorporation register the corporation with the state, the Bylaws manage its internal affairs, making them complementary documents but with distinct purposes.

The Articles of Organization for an LLC are akin to the Articles of Incorporation but for forming an LLC. Both documents are initial filings with the state to legally establish the business entity, containing basic information such as the business name and principal address. The distinction mainly lies in the type of entity being created, with the Articles of Organization tailored for LLCs, offering a more flexible operational structure compared to corporations.

A Business Plan, though not a legal document, shares the objective nature of the Articles of Incorporation by outlining the business’s foundational structure and strategic vision. It details the business concept, market analysis, management, and financial projections. While the Business Plan serves as a roadmap for business growth and is used to secure funding, the Articles of Incorporation are a legal requirement for corporate entity formation.

The Statement of Information, required periodically after the incorporation, is another document with parallels to the Articles of Incorporation. It updates the state on vital information about the corporation, including the current address and the names of directors and officers. Though it serves more as an update and is filed after incorporation, both documents are critical for maintaining the legal status and compliance of the corporation.

Dos and Don'ts

Starting a corporation in Florida involves several steps, one of the most crucial being the completion and submission of the Articles of Incorporation to the Florida Department of State. This document sets the foundation of your corporation, making it officially recognized. Below are guidelines to ensure the process goes smoothly.

Do:

- Verify the availability of your corporation name. Before filing, ensure that the name you've chosen for your corporation is not already in use. This can be done through a search on the Florida Department of State's website.

- Include all required information. Essential details like the corporation's name, principal place of business, registered agent's name and address, and the names and addresses of the initial officers/directors must be accurately provided.

- Use the correct form. Florida has different forms for profit, non-profit, and professional corporations. Make sure you're filling out the correct version for your type of corporation.

- Sign and date the form. The Articles of Incorporation must be signed by an incorporator or an authorized representative. This signifies that the information provided is accurate and agreed upon.

- Keep a copy for your records. After submitting the form, it's important to keep a copy for your own records. This will be helpful for any future reference or legal necessity.

Don't:

- Overlook the detail in the name. Your corporation’s name must comply with Florida's requirements, including certain suffixes (e.g., Inc., Corporation) that indicate its corporate status.

- Forget to appoint a registered agent. A registered agent is mandatory and must have a physical address in Florida. Their role is to receive legal documents on behalf of the corporation.

- Ignore the Article’s instructions. Each item on the form comes with instructions. Overlooking these can lead to errors, or worse, the rejection of your application.

- Skimp on the details about shares. If your corporation is authorized to issue stock, the form should clearly specify how many shares are authorized for issuance.

- Delay in submitting the form. Timely filing is important, as the name reservation is only temporary. Delaying submission could result in having to restart the process if someone else claims the name.

Misconceptions

When discussing the Articles of Incorporation in the state of Florida, several misconceptions abound, clouding the understanding of those attempting to form a corporation. It's crucial to dispel these myths to ensure clarity and compliance with state requirements.

One-Size-Fits-All Document: A common misunderstanding is that the Florida Articles of Incorporation form is a uniform document that suits all businesses. However, the form must be tailored to meet the specific needs of each corporation, including provisions related to the number of authorized shares, the nature of the business, and the details of the incorporators and initial directors.

Immediate Legal Entity Creation: Another misconception is that the submission of the Articles of Incorporation immediately results in the creation of a legal corporation. In reality, the document must first be reviewed and approved by the Florida Department of State, a process that can take time.

Guaranteed Name Reservation: Filing the Articles of Incorporation does not guarantee the availability or reservation of a corporation's name. A separate name reservation request must be filed, and it is advisable to conduct a thorough name search prior to submission to avoid conflicts with existing entities.

Sufficiency of Online Templates: Relying solely on online templates or generic forms for the Florida Articles of Incorporation can be misleading. These templates may not meet all legal requirements or address specific business needs, which could result in rejection by the state or future legal issues.

Lack of Annual Requirements: Some people mistakenly believe that once the Articles of Incorporation are filed, no further action is required. However, Florida corporations must file annual reports and pay the associated fees to maintain their legal standing.

No Need for Detail: The belief that the Articles of Incorporation require minimal detail is another misconception. While it's true that overly detailed descriptions of a corporation's purpose are not necessary, essential information, such as the principal place of business and the name and address of each initial officer or director, must be accurately provided.

Exclusive State Jurisdiction: It is commonly misunderstood that once incorporated in Florida, a corporation has no obligations outside of the state. If a corporation conducts business in other states, it may need to register as a foreign corporation in those states, adhering to their laws and regulations.

No Legal or Financial Liability for Incorporators: There's a false sense of security that incorporators have no legal or financial responsibility for the corporation's actions. While the corporate structure does provide a level of liability protection, incorporators could be held accountable in certain situations, such as fraud or failure to adhere to corporate formalities.

Understanding these nuances and correcting these misconceptions are fundamental steps in ensuring the successful formation and operation of a corporation in Florida. It's often beneficial to consult legal professionals to navigate these complexities effectively.

Key takeaways

Filing the Articles of Incorporation is a foundational step for starting a corporation in Florida. This document, once approved, legally establishes your business in the state. Here are ten key takeaways to ensure you properly complete and utilize the Florida Articles of Incorporation form:

- The form requires basic information about your corporation, such as the corporate name, principal office address, and the nature of the business. It's crucial that this information is accurate and aligns with your business goals.

- Your corporation's name must be unique and adhere to Florida's naming guidelines. It should not be deceptively similar to other existing business names registered in Florida.

- Appointing a registered agent is mandatory. This agent is responsible for receiving official communications on behalf of the corporation. The agent must have a physical street address in Florida.

- The form asks for the names and addresses of the initial officers and directors. At least one director must be listed, and their information must be kept up to date.

- Deciding on the number of shares the corporation is authorized to issue is a critical step. This decision has long-term implications, impacting your ability to raise capital and expand ownership.

- Filing fees must be paid upon submission of the form. These fees are set by the state and subject to change, so verify the current amount before submitting.

- Accuracy is paramount when filling out the form. Errors or omissions can lead to delays or rejection of your filing.

- The form can usually be submitted online, by mail, or in person. However, online submission is recommended for its speed and efficiency.

- Once the Articles of Incorporation are approved, your corporation will be legally required to adhere to Florida corporate laws, including holding regular meetings and maintaining corporate records.

- Consider consulting with a legal professional to ensure compliance with all legal requirements for incorporation and to address any state-specific considerations.

Filing the Articles of Incorporation is just the beginning of your entrepreneurial journey in Florida. With diligent attention to the details of your filing and ongoing compliance, your corporation will be well-positioned for success.

More Articles of Incorporation State Forms

How Much Is Llc in Texas - The official document to create a corporation, delineating its business objectives, and rules for operation and control.

Ca Biz File - The form may require information on the corporation's intended business activities, although being too specific is not always advisable.

Articles of Incorporation Michigan - Completing and filing this form is the first legal action founders take in creating a corporation, signifying commitment.