Fillable Articles of Incorporation Document for California

Setting up a business in California marks the beginning of an exciting journey. Central to this process is the California Articles of Incorporation form, a crucial document that every entrepreneur looking to establish a corporation in the Golden State needs to be familiar with. This form acts as the foundation of a corporation, providing essential information like the corporation's name, purpose, and the details of its agents and shares. Completing and filing this document with the California Secretary of State is not just a formality; it officially breathes life into a corporation, granting it legal status and the ability to operate within the state. While the process may seem daunting at first glance, understanding the major aspects of the form, such as its requirements, the implications for the corporation's governance, and how it fits into the broader legal framework in California, ensures that businesses get off on the right foot, paving the way for future prosperity and compliance.

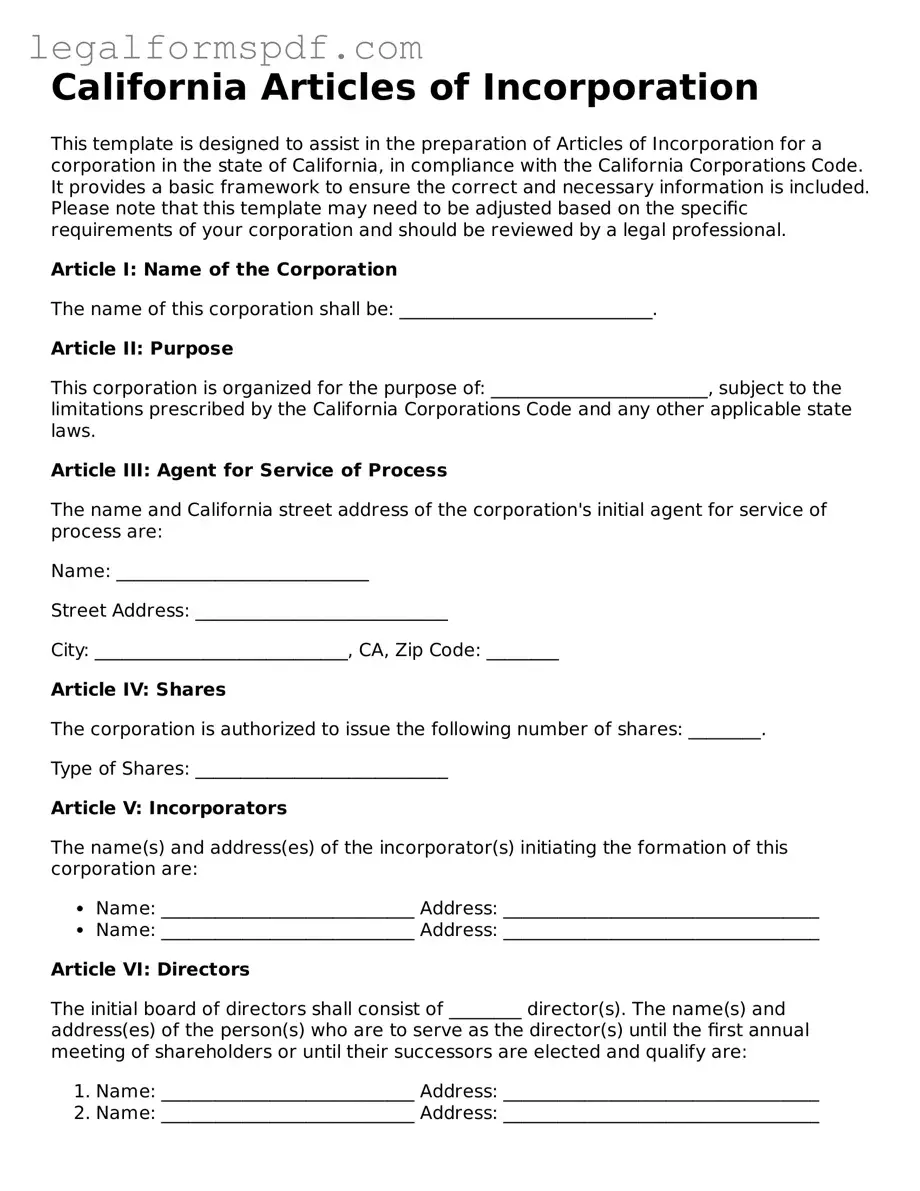

Document Example

California Articles of Incorporation

This template is designed to assist in the preparation of Articles of Incorporation for a corporation in the state of California, in compliance with the California Corporations Code. It provides a basic framework to ensure the correct and necessary information is included. Please note that this template may need to be adjusted based on the specific requirements of your corporation and should be reviewed by a legal professional.

Article I: Name of the Corporation

The name of this corporation shall be: ____________________________.

Article II: Purpose

This corporation is organized for the purpose of: ________________________, subject to the limitations prescribed by the California Corporations Code and any other applicable state laws.

Article III: Agent for Service of Process

The name and California street address of the corporation's initial agent for service of process are:

Name: ____________________________

Street Address: ____________________________

City: ____________________________, CA, Zip Code: ________

Article IV: Shares

The corporation is authorized to issue the following number of shares: ________.

Type of Shares: ____________________________

Article V: Incorporators

The name(s) and address(es) of the incorporator(s) initiating the formation of this corporation are:

- Name: ____________________________ Address: ___________________________________

- Name: ____________________________ Address: ___________________________________

Article VI: Directors

The initial board of directors shall consist of ________ director(s). The name(s) and address(es) of the person(s) who are to serve as the director(s) until the first annual meeting of shareholders or until their successors are elected and qualify are:

- Name: ____________________________ Address: ___________________________________

- Name: ____________________________ Address: ___________________________________

Article VII: Bylaws

The initial bylaws of the corporation shall be adopted by the board of directors. The power to alter, amend, or repeal the bylaws or adopt new bylaws, unless otherwise provided in the bylaws, is granted to the board of directors.

Article VIII: Indemnification

The corporation elects to be governed by the indemnification provisions provided in the California Corporations Code, offering protection to its directors, officers, employees, and other agents to the fullest extent permissible under law.

Signatures

In witness whereof, the undersigned incorporator(s) have executed these Articles of Incorporation on this ___ day of _____________, 20__.

______________________________________

Signature of Incorporator

Printed Name: ____________________________

______________________________________

Signature of Incorporator

Printed Name: ____________________________

This document is intended to serve as a starting point and should be used in consultation with a legal professional. Submitting this form to the California Secretary of State's office is just one step in the process of forming a corporation. Certain requirements, such as obtaining a Federal Tax Identification Number, registering for state taxes, obtaining necessary licenses, and more, must also be met.

PDF Specifications

| Fact | Detail |

|---|---|

| 1. Form's Official Name | Articles of Incorporation of a General Stock Corporation |

| 2. Governing Law | California Corporations Code |

| 3. Purpose of Form | To legally establish a corporation within the state of California |

| 4. Filing Agency | California Secretary of State |

| 5. Minimum Requirements | Includes corporation name, purpose, agent for service of process, share structure, and incorporator information |

| 6. Filing Fee | Varies, but commonly around $100 |

| 7. Online Filing Option | Available through the California Secretary of State's website |

| 8. Processing Time | Varies; expedited processing available for an additional fee |

| 9. Annual Requirements | Annual Statement of Information and possible franchise tax |

Instructions on Writing California Articles of Incorporation

Filing the Articles of Incorporation is a pivotal step in creating a corporation in California. This document officially registers your corporation with the Secretary of State, allowing you to operate legally within the state. The process involves detailing key aspects of your corporation, such as its name, purpose, and structure. Below, we'll outline the steps required to accurately complete the form, ensuring a smooth application process for establishing your business entity.

- Start by downloading the most recent version of the Articles of Incorporation form from the California Secretary of State's website.

- Provide the name of the corporation exactly as you wish it to appear in official documents. Ensure the name complies with California's naming requirements and is distinguishable from existing entity names.

- Determine the type of corporation you are registering, such as a general stock, close, professional, or nonprofit corporation, and mark the appropriate box on the form.

- Specify the corporation's purpose. While you can list a specific business activity, a general statement that the corporation may engage in any lawful act or activity is usually sufficient and provides greater flexibility.

- Fill in the street address of the corporation's initial principal executive office. If the office is located outside of California, also provide a mailing address within the state.

- Designate the corporation's initial agent for service of process. This can be either an individual residing in California or an active corporation in California that agrees to accept legal documents on behalf of your corporation. Include the agent's complete address.

- If the form requires it, include the number of shares the corporation is authorized to issue. For many small corporations, a relatively low number of shares is common, but ensure the amount aligns with your business plan and funding structure.

- Provide information about the incorporator—the person or entity completing and filing the form. Include the name and address. The incorporator will sign the form, declaring under penalty of perjury that the information provided is accurate.

- Review the document thoroughly to ensure all information is accurate and complete. Mistakes or omissions can delay the incorporation process.

- Submit the completed form along with the necessary filing fee to the Secretary of State’s office. This can typically be done by mail, in person, or online, depending on the state's options.

Once filed, you'll wait for the Secretary of State to process your Articles of Incorporation. This processing time can vary, so it's advisable to check current estimates. After approval, your corporation will be officially recognized in California, allowing you to proceed with setting up bank accounts, applying for licenses, and conducting business under your new corporate entity. Remember, this registration is just the beginning. Future filings, such as Statement of Information forms, and tax obligations, will be necessary to keep your corporation in good standing with the state.

Understanding California Articles of Incorporation

What are the California Articles of Incorporation?

The California Articles of Incorporation is a legal document required for the creation of a corporation in the state of California. It establishes the corporation’s existence and provides basic information about the corporation to the Secretary of State. This document is necessary to obtain corporate status, which includes benefits such as limited liability for the corporation's shareholders.

Who needs to file the California Articles of Incorporation?

Any group of individuals or a single individual seeking to form a corporation in California must file the Articles of Incorporation. This applies to both for-profit and nonprofit organizations looking to incorporate within the state.

What information is required to complete the California Articles of Incorporation?

The form requires several pieces of information, including but not limited to the corporation’s name, its purpose, the address of its principal office, the name and address of the agent for service of process, and the number of shares the corporation is authorized to issue. Additionally, the incorporator(s) must sign the document, indicating their intent to establish the corporation.

How does one file the California Articles of Incorporation?

Filing can be done either by mail or online through the California Secretary of State’s website. The completed form, along with the appropriate filing fee, must be submitted following the guidelines provided by the Secretary of State. It is important to ensure that all information is accurate and complete to avoid processing delays or rejections.

What is the filing fee for the California Articles of Incorporation?

The filing fee varies depending on the type of corporation being formed. As of the most recent update, the fee for most general stock corporations is set by the Secretary of State's office. Nonprofit corporations may have a lower fee. It is advised to check the Secretary of State’s website for the most current filing fees.

How long does it take to process the California Articles of Incorporation?

Processing times can vary based on the volume of filings the Secretary of State is handling. Generally, it can take from a few days to several weeks. Expedited processing options are available for an additional fee for those who require faster processing times.

Can amendments be made to the California Articles of Incorporation?

Yes, amendments can be made to the Articles of Incorporation after they have been filed. To do so, the corporation must file Articles of Amendment with the Secretary of State, detailing the changes to be made. An amendment might be necessary to change the corporation's name, its stated purpose, or other key details originally filed.

What happens if the California Articles of Incorporation are not filed?

Without filing the Articles of Incorporation, the group cannot legally operate as a corporation within the state of California. This status limits the group's ability to enjoy benefits such as limited liability protection for its members, potential tax advantages, and the ability to raise capital more easily.

Where can one get assistance with the California Articles of Incorporation?

Assistance with completing and filing the Articles of Incorporation can be obtained from the California Secretary of State’s office. Furthermore, legal professionals specializing in corporate law can provide guidance and ensure that the filing meets all state requirements and is completed correctly.

Common mistakes

When filling out the California Articles of Incorporation form, many people overlook the importance of precisely naming their corporation. The name must be distinguishable from that of any existing business in the state and comply with California’s naming conventions. Failure to do so may result in the rejection of the form, causing delays and possibly requiring a new submission with an adjusted name.

Another common mistake involves the statement regarding the corporation’s purpose. Often, individuals provide too specific a description of their business activities. California law allows for a broad, general purpose statement, enabling companies to avoid unintentionally limiting their corporate activities.

Incorrect or incomplete agent for service of process information is a frequent error as well. The agent is responsible for receiving official and legal documents on behalf of the corporation. Providing inaccurate details or failing to name an agent can lead to significant legal and operational consequences. The agent must also confirm their willingness to serve in this role, something often overlooked.

Issues with share structure documentation within the Articles of Incorporation can also pose problems. Some individuals mistakenly provide too little detail about the number and types of shares the corporation is authorized to issue, which can complicate future financial arrangements and investor relationships.

By not attaching the necessary additional documentation for certain types of corporations, like those intending to qualify for tax-exempt status, applicants may inadvertently delay the approval process. It’s crucial to research and attach all relevant documents beyond the basic requirements of the form.

Misunderstanding the filing fee structure leads to the incorrect fee being submitted. The California Secretary of State provides a schedule of fees associated with the filing of the Articles of Incorporation, which varies depending on the type of corporation being established. Underpaying or overpaying can delay processing.

Overlooking the initial corporate bylaws and organizational meetings is a less direct, yet significant mistake. While these are not part of the Articles of Incorporation form itself, failing to plan for the creation and adoption of bylaws or the holding of the initial organizational meeting can put the corporation on unstable footing from the start.

Electing to file the form via paper mail without considering online submission options is a choice that can extend the processing time significantly. The state offers electronic filing methods that are typically faster and provide immediate confirmation of receipt, an advantage not to be underestimated in time-sensitive situations.

Lastly, assuming immediate approval of the Articles of Incorporation is a common but misguided expectation. The review process can take several weeks, and any errors on the form can extend this period. Patience and careful planning, including leaving ample time for potential revisions, are essential to a successful filing.

Documents used along the form

When entrepreneurs decide to bring their visions to life by forming a corporation in California, they embark on a significant but rewarding journey. The Articles of Incorporation are a crucial first step in this voyage, laying the groundwork for the legal establishment of the company. Yet, this foundational document is often accompanied by several other forms and documents that are equally vital for ensuring compliance with state regulations and establishing the operational framework of the corporation. Understanding these documents is essential for a smooth incorporation process.

- Bylaws: An indispensable document for any corporation, the Bylaws serve as the internal rulebook that governs the company’s operations. They outline the procedures for holding meetings, electing officers and directors, and managing other corporate affairs. Crafting Bylaws that are tailored to the company’s specific needs is crucial for its efficient governance.

- Statement of Information: After filing the Articles of Incorporation, a corporation is required to submit a Statement of Information to the California Secretary of State. This document provides updated information on the corporation, including the address of the corporate office, the chief executive officer, and the board of directors. It’s a way to keep the state informed about who is responsible for the corporation.

- Stock Certificate: For corporations that decide to issue stock, creating and issuing Stock Certificates is an essential step. These certificates serve as physical proof of stock ownership, specifying the number of shares owned by a shareholder. They are crucial for tracking ownership in the corporation.

- Shareholder Agreement: While not required by California law, many corporations choose to establish a Shareholder Agreement. This document outlines the rights and obligations of shareholders, including how shares can be sold or transferred. It's key for preventing and resolving any disputes between shareholders.

Together, these documents form the backbone of a corporation’s legal and operational structure. While the Articles of Incorporation are crucial for establishing the corporation's existence, the Bylaws, Statement of Information, Stock Certificates, and Shareholder Agreement are equally important for setting the rules, maintaining transparency, and clarifying the roles and rights of all parties involved. Entrepreneurs should approach these documents with the seriousness and attention to detail they deserve, as they lay the foundation for the company's future success.

Similar forms

The Articles of Incorporation form used in California shares similarities with the Certificate of Formation used in some other states, such as Texas and Delaware. Both documents serve the foundational purpose of legally establishing a corporation within their respective jurisdictions. They contain essential details about the corporation, including the name of the corporation, its purpose, the address of its principal office, the number of shares the corporation is authorized to issue, and information about the registered agent and incorporators. The primary function of both documents is to register the corporation with the state's secretary of state or equivalent department, laying the groundwork for its legal operations.

Similar to the Articles of Incorporation, the Articles of Organization are used to establish a limited liability company (LLC) in many states. While the Articles of Incorporation are for corporations, the Articles of Organization fulfill a parallel role for LLCs by officially documenting the formation of the company and providing necessary information such as the LLC's name, principal place of business, duration, and management structure. This document is crucial for LLCs to be recognized as legal entities by the state.

Nonprofit Articles of Incorporation are another document type that parallels the standard Articles of Incorporation but are specifically tailored for nonprofit organizations. Similar to their corporate counterparts, these articles establish a nonprofit corporation's legal existence in the state. The document typically includes the organization's name, principal office address, purpose, duration, and information on its initial directors and registered agent. The key difference is the inclusion of statements regarding the nonprofit nature of the organization and specifics regarding asset distribution upon dissolution, necessary for obtaining tax-exempt status.

Operating Agreements, while primarily used by LLCs, share common ground with the Articles of Incorporation in terms of outlining the governance of a business entity. Operating Agreements detail the operating procedures, financial decisions, and ownership percentages among members of an LLC. Though focused on internal governance rather than state registration, this document complements the Articles of Organization in establishing the company's legal and operational structure.

The Corporate Bylaws document, akin to the Articles of Incorporation, plays a critical role in defining the internal management structure of a corporation. While the Articles of Incorporation register the corporation with the state, the Corporate Bylaws set forth the rules and procedures for corporate governance, including the roles and duties of directors and officers, meeting protocols, and shareholder rights. This document is essential for the corporation's day-to-day operations and legal compliance.

Stock Certificates, while more specific in nature, relate to the Articles of Incorporation through their connection with a corporation's equity structure. Upon incorporation, a corporation is authorized to issue a certain number of shares, as stated in the Articles of Incorporation. Stock Certificates are then issued to investors as physical evidence of ownership in the corporation. This document specifies the number of shares owned, the class of shares, and the share serial number, acting as a tangible link between the shareholder and the corporation.

The Statement of Information, required periodically by state governments, echoes the Articles of Incorporation by providing updated essential information about the corporation. This document usually includes current details about the corporation's officers, directors, registered agent, and business address. Though submitted after the corporation has been established, the Statement of Information ensures that the state maintains current records of the company’s operational and contact information.

Business Licenses and Permits, while not directly establishing a corporation, are intricately linked with the information filed in the Articles of Incorporation. Depending on the corporation's industry and location, various licenses and permits may be required to legally operate. The process for obtaining these often requires details established in the Articles of Incorporation, such as the business name and type, demonstrating how foundational information aids in compliance with local, state, and federal regulations.

The Initial Report or Initial Statement of Information, required by some states shortly after a corporation is formed, serves a similar informational purpose as the Articles of Incorporation but in a post-formation context. This document often includes details about the corporation’s officers, directors, registered agent, and principal office — information that aligns closely with what is provided in the Articles of Incorporation, acting as an initial update to the state after the company’s establishment.

Lastly, the Foreign Qualification Application is akin to the Articles of Incorporation for corporations seeking to operate in states other than where they were originally incorporated. This application often requires submission of a Certificate of Good Standing from the corporation’s home state, along with details similar to those in the Articles of Incorporation, such as the corporation’s name, purpose, and principal office location. It legally authorizes the corporation to conduct business across state lines, underscoring the interconnected nature of these legal documents in broader corporate operations.

Dos and Don'ts

When embarking on the journey of establishing a corporation in California, the completion of the Articles of Incorporation form is a pivotal step. This document not only gives your entity legal standing but paves the way towards a structured and compliant business operation. To navigate this process smoothly, consider adhering to a set of dos and don'ts that can significantly influence the outcome of your filing.

Do:- Ensure Accuracy: Double-check all the information provided on the form for accuracy. Incorrect or outdated information can lead to delays or rejection of your filing.

- Follow State Guidelines: Adhere strictly to the guidelines provided by the California Secretary of State. These guidelines are designed to ensure that all necessary legal requirements are met.

- Use the Legal Name: Include the complete legal name of your corporation exactly as you want it to appear on all legal documents. Be sure to include a corporate designator like "Inc." or "Corporation".

- Appoint a Registered Agent: Designate a registered agent who has a physical address in California. This agent will be responsible for receiving official legal and tax correspondence on behalf of the corporation.

- Specify Share Structure: Clearly define the number and type of shares the corporation is authorized to issue. This is crucial for future financial planning and investor relations.

- Include Necessary Additional Articles: If your corporation has specific legal requirements, such as professional licenses, include these as additional articles in your filing to ensure compliance.

- Overlook Signature Requirements: Failing to sign the form where required or not having the appropriate officer sign can invalidate your document. Ensure all signatures are correctly placed and belong to authorized individuals.

- Ignore Filing Deadlines: Procrastination can cost you dearly. Late filings can result in penalties or delayed business operations. Always be mindful of the submission deadlines.

- Use a P.O. Box for the Registered Agent Address: The law requires the registered agent to have a physical address in California. P.O. Boxes are not acceptable for this purpose.

- Forget the Filing Fee: Submission without the appropriate filing fee can delay the process. Verify the current fee and make sure it accompanies your form.

- Neglect to Keep a Copy: Always keep a copy of the filed Articles of Incorporation for your records. This document is crucial for future legal and business processes.

- Assume Approval is Immediate: The approval process can take time. Patience is important. Planning for delays can help avoid any disruption to your business plans.

Misconceptions

When it comes to filing the Articles of Incorporation in California, myths and misunderstandings are quite common. Knowing the facts can smoothen out the process, ensuring that businesses can get off to a strong start without unnecessary delays or legal hiccups. Here are eight common misconceptions about the California Articles of Incorporation and the realities behind them:

- All businesses must file Articles of Incorporation. Actually, this requirement is specific to corporations. Other business structures, such as sole proprietorships and partnerships, do not need to file. Limited Liability Companies (LLCs), for instance, file Articles of Organization, not Articles of Incorporation.

- Filing the form is all you need to start your business. This is just the beginning. In addition to filing Articles of Incorporation, businesses may need to obtain business licenses, Employer Identification Numbers (EINs), and comply with other state and local regulations.

- There's a one-size-fits-all form for everyone. While there is a standard form, California allows for variations to meet the specific needs of different types of corporations, such as non-profit, professional, and closed corporations. Each type has unique requirements and benefits.

- You need a lawyer to file Articles of Incorporation. It's not mandatory to hire a lawyer. Many businesses successfully file on their own or with the help of a professional document preparer. However, seeking legal advice might be beneficial for complex situations or to ensure compliance.

- It's too expensive for a small business. The filing fee for the Articles of Incorporation in California is relatively moderate and can be considered a worthwhile investment for the legal foundation it provides for your business. The cost might vary somewhat based on specific requirements or expedited services, but it's generally accessible.

- Approval is guaranteed upon submission. Approval is not automatic. The California Secretary of State reviews filings to ensure they meet all legal requirements. Submissions might be rejected for incomplete information or non-compliance with California law.

- You can freely choose any name for your corporation. The chosen name must be distinguishable from any existing business entity registered in California. It also must comply with other state-specific requirements, such as including a corporate designator like "Inc." or "Corp."

- Articles of Incorporation protect your business name statewide. Filing the Articles of Incorporation reserves your corporate name in California, but it doesn't grant exclusive rights. To protect the name across different mediums and jurisdictions, consider trademarking it.

Understanding these aspects can help demystify the process of incorporating in California and guide you through getting your corporation correctly set up from the start. This foundational step, while intricate, paves the way for a structured and legally compliant business operation.

Key takeaways

The California Articles of Incorporation form is a critical document for individuals aiming to establish a corporation in the state. When filling out and utilizing this form, several key points must be considered to ensure compliance and smooth processing.

- Accuracy is paramount when completing the Articles of Incorporation. All information provided must be current and correct to avoid processing delays or legal complications.

- Choosing a corporate name requires careful consideration as it must comply with California's naming guidelines. The name should be distinguishable from that of any other registered business in the state to avoid rejection.

- The form requires the appointment of a registered agent who will be responsible for receiving legal and tax documents on behalf of the corporation. The registered agent must have a physical address in California.

- It is essential to clearly articulate the corporation's purpose in the Articles of Incorporation. While some corporations opt for a broad purpose to allow for flexibility, specificity can sometimes be beneficial depending on the corporation's objectives.

- The number of shares the corporation is authorized to issue must be specified. Decisions regarding share structure have long-term implications for the company's governance and financing.

- The Articles of Incorporation form must include the names and addresses of the incorporators. These are the individuals responsible for completing and filing the document.

- Upon completion, the form requires a filing fee, the amount of which varies depending on several factors including the corporation's type and the number of shares it is authorized to issue.

- After filing, the Secretary of State's office will review the Articles of Incorporation. If approved, the corporation becomes a legal entity. However, additional steps are necessary to complete the incorporation process, such as obtaining business licenses and adopting bylaws.

- It's critical to keep a copy of the filed Articles of Incorporation for the corporation's records. This document serves as a certification of the corporation's legal existence and may be required for various legal and business transactions.

Understanding these key takeaways can simplify the process of completing and utilizing the California Articles of Incorporation form, leading to a smoother incorporation process and establishing a strong foundation for the new corporation.

More Articles of Incorporation State Forms

Georgia Secretary of State Corporations - The Articles of Incorporation effectively communicate the business's core operational and structural characteristics to relevant authorities.

Articles of Incorporation Sunbiz - It serves as a public record of the corporation's existence, which is essential for credibility and legal operations.

Articles of Incorporation Michigan - It delineates the process for electing directors and officers, detailing how corporate governance shall be conducted.

How to Open a Corporation in Ny - Outlines the corporation’s purpose, providing a clear scope of the intended business activities and operations.