Official Articles of Incorporation Document

When embarking on the journey of establishing a corporation, one crucial step is the completion and submission of the Articles of Incorporation. This document serves as the birth certificate for your corporation, legally documenting its existence and delineating its basic operational structure. It is through these articles that a corporation spells out key information, including its name, purpose, duration, stock details, and information about its registered agent and incorporators. Each state has its own specific requirements for what must be included in the articles, making it imperative for founders to familiarize themselves with local regulations to ensure compliance. Moreover, the process of filing these articles usually marks the official start of your business entity under law, setting the stage for all future legal and business activities. As such, understanding the major aspects of the Articles of Incorporation is not just a bureaucratic necessity but a foundational step in crafting the identity and legal framework of your corporation.

State-specific Information for Articles of Incorporation Forms

Document Example

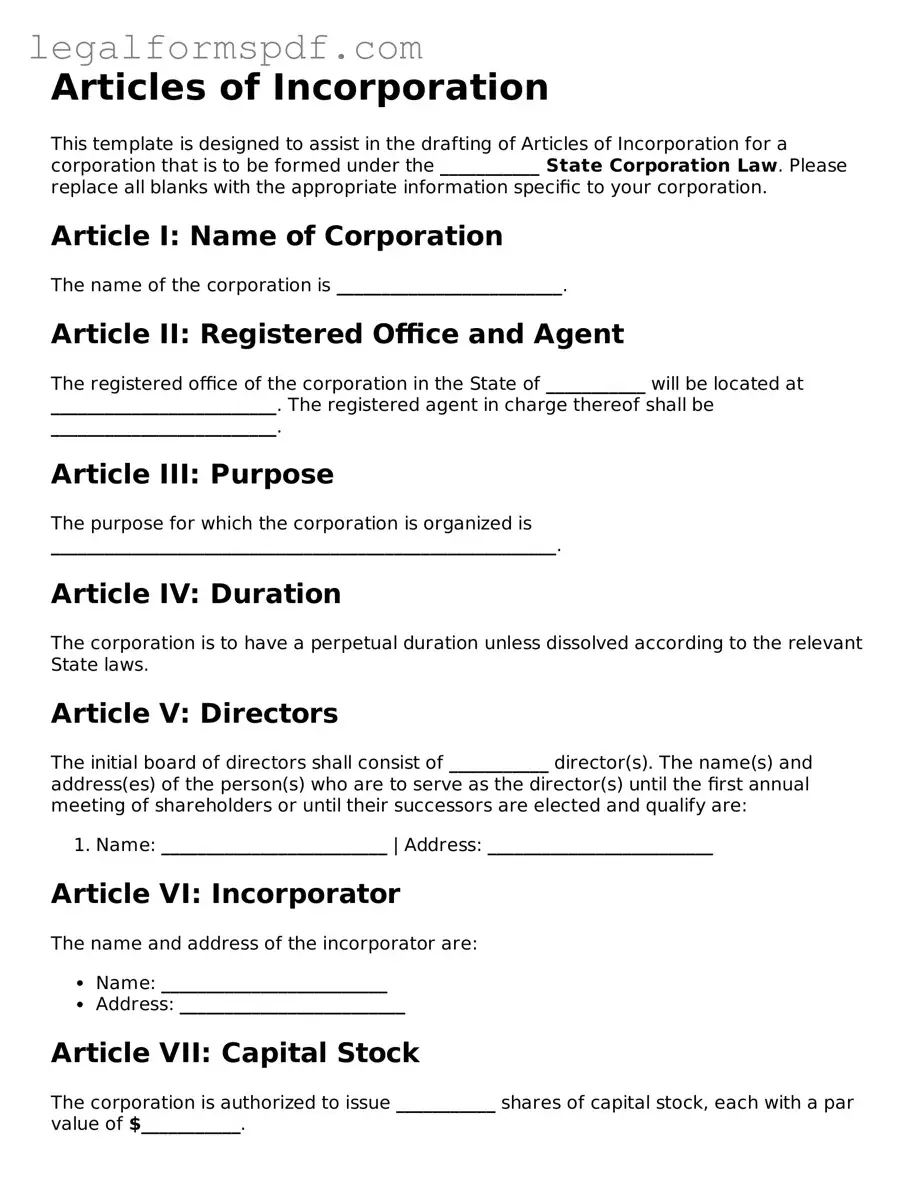

Articles of Incorporation

This template is designed to assist in the drafting of Articles of Incorporation for a corporation that is to be formed under the ___________ State Corporation Law. Please replace all blanks with the appropriate information specific to your corporation.

Article I: Name of Corporation

The name of the corporation is _________________________.

Article II: Registered Office and Agent

The registered office of the corporation in the State of ___________ will be located at _________________________. The registered agent in charge thereof shall be _________________________.

Article III: Purpose

The purpose for which the corporation is organized is ________________________________________________________.

Article IV: Duration

The corporation is to have a perpetual duration unless dissolved according to the relevant State laws.

Article V: Directors

The initial board of directors shall consist of ___________ director(s). The name(s) and address(es) of the person(s) who are to serve as the director(s) until the first annual meeting of shareholders or until their successors are elected and qualify are:

- Name: _________________________ | Address: _________________________

Article VI: Incorporator

The name and address of the incorporator are:

- Name: _________________________

- Address: _________________________

Article VII: Capital Stock

The corporation is authorized to issue ___________ shares of capital stock, each with a par value of $___________.

Article VIII: Indemnification

The corporation shall indemnify any director, officer, employee, or agent of the corporation to the fullest extent permitted by the ___________ State Corporation Law, as it may be amended from time to time.

Article IX: Amendments

These Articles of Incorporation may be amended as allowed by law, upon the affirmative vote of a majority of the board of directors then in office and, if required by law, by a vote of the shareholders.

In witness whereof, the undersigned incorporator has executed these Articles of Incorporation on this ____ day of _______________, ______.

___________________________________

Incorporator's Signature

___________________________________

Printed Name of Incorporator

PDF Specifications

| Fact Number | Description |

|---|---|

| 1 | The Articles of Incorporation is a document that is required to legally form a corporation in the United States. |

| 2 | This document is filed with a state government or corporate filing office. |

| 3 | Information typically required on the form includes the corporation’s name, purpose, office address, agent for service of process, and incorporator information. |

| 4 | Different states have varying requirements for what must be included in the Articles of Incorporation. |

| 5 | The document serves as a charter to establish the existence of a corporation in the United States. |

| 6 | Upon approval, the state issues a certificate of incorporation, making the entity's legal status as a corporation official. |

| 7 | Fees for filing the Articles of Incorporation vary by state. |

| 8 | Some states offer expedited processing for an additional fee. |

| 9 | The process of filing the Articles of Incorporation is often the first step in establishing a business’s legal structure. |

| 10 | State-specific laws governing the Articles of Incorporation include the Delaware General Corporation Law for Delaware corporations and the California Corporations Code for California corporations. |

Instructions on Writing Articles of Incorporation

Filing the Articles of Incorporation is a foundational step in establishing a corporation in the United States. This document officially registers your corporation with the state government, allowing you to conduct business legally. The process may vary slightly depending on the state, but generally follows a similar structure. Completing this form accurately is crucial for setting your business on the right path. After submitting the form, the next steps usually involve obtaining any necessary licenses and permits, setting up financial accounts in the corporation's name, and staying compliant with ongoing state requirements.

- Start by gathering all required information about your corporation, including the business name, principal address, and the names of the incorporators.

- Select a registered agent for your corporation. This is an individual or company authorized to receive legal documents on behalf of the corporation.

- Determine the number of shares of stock the corporation is authorized to issue, and the par value, if any, of each share.

- Specify the purpose of the corporation. While some states allow for a general purpose statement, others may require a more detailed explanation.

- Identify the board of directors. At minimum, include their names and addresses.

- If applicable, decide on any special provisions or regulations for the operation of your corporation that align with state laws. This could relate to the management of the business, shareholder rights, or other operational details.

- Review and ensure all information is accurate and complete. Errors or omissions can delay the processing of your Articles of Incorporation.

- Sign and date the form. Depending on the state, one or more incorporators might need to sign the document.

- Submit the form to the appropriate state department, usually the Secretary of State's office, along with the required filing fee. Fees vary by state.

- Wait for confirmation. Once processed, you will receive an official certificate of incorporation, marking the completion of the registration process.

By following these steps, you can ensure your corporation is legally recognized and ready to do business. Remember, the specific requirements can vary, so it’s important to consult your state's guidelines or seek professional advice if needed. Keeping careful records and staying informed about legal obligations will help your corporation maintain good standing in the state where it operates.

Understanding Articles of Incorporation

What are the Articles of Incorporation?

The Articles of Incorporation form a legal document that officially establishes a corporation. It outlines the primary aspects of the corporation, including its name, purpose, structure, and stock details. Once filed with the appropriate state authority, it marks the corporation's legal birth.

Who needs to file the Articles of Incorporation?

Any group of individuals or a single individual intending to form a corporation needs to file the Articles of Incorporation with their state's secretary of state or corresponding government agency. This step is obligatory to legally recognize the entity as a corporation.

Where do I file the Articles of Incorporation?

The Articles of Incorporation must be filed with the secretary of state's office or a similar regulatory body in the state where the corporation will be headquartered. The specific requirements and filing fees vary by state.

What information is required in the Articles of Incorporation?

Typically, the Articles of Incorporation require the corporation's name, its purpose, the names and addresses of its directors, the location of its principal office, the name and address of its registered agent, the number of authorized shares of stock, and the incorporation's duration. Requirements can vary by state.

Is there a filing fee for the Articles of Incorporation?

Yes, a filing fee is generally required when submitting the Articles of Incorporation. The amount of the fee varies significantly from state to state. It's essential to check with the relevant state agency for the exact fee.

Can the Articles of Incorporation be amended?

After the initial filing, the Articles of Incorporation can be amended. Amendments might be necessary to change the corporation's name, alter the scope of its business, increase or decrease authorized shares of stock, or make other significant changes. State-specific procedures must be followed to amend these articles.

What is the difference between the Articles of Incorporation and Bylaws?

While the Articles of Incorporation legally establish the corporation within a state, the Bylaws are internal documents that outline the corporation's governance structures, including detailed rules and procedures for operations, decision-making, and handling disputes. Unlike the Articles, Bylaws are not typically filed with the state.

How long does it take to process the Articles of Incorporation?

The processing time for the Articles of Incorporation can vary significantly from one state to another. Some states offer expedited services for an additional fee. Without expedited processing, it may take a few weeks to several months to receive confirmation of incorporation.

Common mistakes

Filling out the Articles of Incorporation is a crucial step for new business owners, but it's easy to make mistakes that can lead to delays or even the rejection of the application. One common error is not checking the availability of the business name beforehand. The name chosen must be unique and not too similar to any existing business registered in the state. This helps avoid confusion and potential legal issues down the line.

Another mistake often made is the improper listing of the registered agent. The registered agent acts as the business's legal point of contact, and their information needs to be accurate and up-to-date. A failure to provide correct details can result in missed important legal documents, including lawsuit notifications and tax documents.

Incorrectly stating the purpose of the corporation can also lead to issues. While some states allow for a broad, general purpose statement, others may require more specific information about the nature of the business. Providing too little or overly specific information can restrict the business’s activities or require unnecessary amendments in the future.

Many people inadvertently overlook the necessity to specify the type and amount of stock the corporation is authorized to issue. This detail is crucial since it impacts the corporation's financing and ownership structure. A lack of clarity in this section can complicate matters for investors and shareholders.

Another common oversight is neglecting to adhere to state-specific requirements. Each state has its own set of rules regarding the Articles of Incorporation. These can include specific clauses or additional paperwork. Not tailoring the application to meet these requirements can result in the rejection of the filing.

Additionally, the failure to sign the document is a surprisingly frequent error. An unsigned form is considered incomplete and will be rejected outright. It’s a simple yet critical step in the process.

Misunderstanding the fee structure associated with filing the Articles of Incorporation is another pitfall. States charge varying fees for the filing, and sometimes additional services or expedited processing options are available at different costs. Incorrect payment can delay the process significantly.

Finally, assuming that filing the Articles of Incorporation is the final step in establishing a corporation can be a costly mistake. In many cases, additional steps such as obtaining business licenses, an Employer Identification Number (EIN), and setting up corporate bylaws are necessary to legally operate and comply with state and federal laws.

Documents used along the form

When forming a corporation, the Articles of Incorporation is a critical document, but it's just the beginning. Other documents and forms are essential for establishing the structure, ensuring legal compliance, and defining the operational guidelines of the new corporation. These documents serve various purposes, from detailing the company's internal rules to ensuring tax compliance. Understanding each document's role can help streamline the corporation setup process and ensure a solid foundation for the business's future. Here's a look at eight other forms and documents frequently used alongside the Articles of Incorporation.

- Bylaws: Bylaws are internal documents that outline the corporation's operational rules, including the process for electing directors, holding meetings, and other procedural guidelines necessary for the corporation's governance.

- Operating Agreement: Mainly used in a limited liability company (LLC) setting, an operating agreement details the business arrangements among the members, such as ownership percentages, distribution of profits and losses, and managerial roles. While not always required, an operating agreement is recommended for multi-member LLCs.

- Initial Board Resolutions: After filing the Articles of Incorporation, the initial board resolutions issue officially sets up the corporate entity. These resolutions might include appointing officers, issuing stock, selecting a corporate bank account, and other initial decisions.

- Shareholder Agreement: This agreement outlines the rights and obligations of the shareholders, including transfer of shares, dividend distribution policies, and how to resolve disputes. It's crucial for clarifying expectations and preventing future conflicts.

- Stock Certificates: These documents certify ownership of shares within the corporation. They include details such as the name of the shareholder, the number of shares owned, and the date of issuance, serving as a physical representation of share ownership.

- Employer Identification Number (EIN) Application: An EIN, also known as a federal tax identification number, is required for a corporation to legally hire employees, open a business bank account, and file federal taxes. The application process is straightforward, and the number is essential for numerous business transactions.

- Corporate Minutes Template: Corporate minutes document the proceedings and decisions taken during corporate meetings. A template helps ensure consistency and compliance with legal requirements for documenting decisions and actions.

- Business Plan: Although not a legal document, a business plan is a crucial tool for outlining the strategic vision of the corporation, including market analysis, operations plan, and financial projections. It's vital for guiding the corporation's direction and securing financing.

The journey of establishing and running a corporation involves meticulous attention to legal and operational details. These documents, when used alongside the Articles of Incorporation, provide a comprehensive legal framework and structure for the corporation, ensuring that it operates within the bounds of the law while striving toward its strategic goals. Armed with these documents, business owners can navigate the complexities of corporate governance with confidence, setting the stage for success.

Similar forms

The Articles of Incorporation are fundamentally similar to a Corporate Charter. Both documents serve as a formal declaration of the creation of a corporation, outlining the firm's basic aspects like its name, purpose, and structure. Where the Articles of Incorporation are filed with the government to legally establish the corporation, the Corporate Charter is more so a detailed manifesto of the corporation's governance and operational guidelines, establishing the rules under which the corporation will operate.

Bylaws closely resemble the Articles of Incorporation because they provide detailed guidelines for the corporation’s internal management and operations, albeit at a more granular level. While the Articles of Incorporation might state the corporation's broad purpose and structure, bylaws go into specifics, detailing how decisions are made, the roles of directors and officers, and how meetings are conducted. This makes bylaws an essential document for the day-to-day governance of a corporation.

Operating Agreements share similarities with Articles of Incorporation in their foundational role for limited liability companies (LLCs). Like Articles of Incorporation, Operating Agreements outline the basic framework of the company, including its members' roles, ownership percentages, and profit distributions. This Agreement is to an LLC what Articles of Incorporation are to a corporation, providing a legal structure and operational roadmap.

The Business Plan, while not a legal document, is conceptually similar to the Articles of Incorporation. Both documents are used to define the business at its outset, detailing the company's purpose, market analysis, and strategic plans. The key difference is that the Business Plan focuses on the strategy for success and growth, whereas the Articles of Incorporation are concerned with the legal creation and structure of the company.

A Certificate of Formation is to a limited liability company (LLC) what Articles of Incorporation are to a corporation. It is the official document filed with a state authority to legally establish the existence of the LLC. Both documents mark the formal creation of an entity but apply to different forms of business structures, serving similar roles in their respective legal frameworks.

Partnership Agreements resemble Articles of Incorporation in that they formalize the existence and structure of a business entity, in this case, a partnership rather than a corporation. They outline the roles, responsibilities, and profit-sharing among partners, providing a clear framework for the operation and governance of the partnership, akin to how the Articles of Incorporation set the foundational rules for corporations.

Trade Name Registration documents, while primarily focused on the naming aspect of a business, share the foundational characteristic with Articles of Incorporation. Both are filed with governmental agencies to register and recognize a critical aspect of the entity's identity — the former concerning the name under which the business will operate, and the latter concerning the official recognition of the corporation itself.

Shareholder Agreements are connected to Articles of Incorporation through their role in specifying additional details about the company's governance and financial arrangements. While the Articles incorporate the business and outline its general structure, Shareholder Agreements delve into specifics regarding shareholder rights, responsibilities, and the distribution of dividends, acting as a complement to the foundational information in the Articles.

Non-Disclosure Agreements (NDAs) might not directly relate to the formation of a corporation like Articles of Incorporation do, but they play a crucial role in protecting the proprietary information and trade secrets of a business from the outset. Implementing NDAs early on can safeguard a company's confidential information, critical to maintaining competitive advantage and operational security.

Employment Contracts, though more individualized than the Articles of Incorporation, are central to defining the roles, responsibilities, and expectations between the corporation and its employees. These contracts can lay out terms regarding employment duration, compensation, and duties, which are essential for the operational structure of the company, much like how the Articles establish the legal and structural foundation of the corporation.

Dos and Don'ts

When it comes to filling out the Articles of Incorporation form, it's essential to approach the process with care. This document plays a crucial role in officially establishing your business entity in the eyes of the law. Here are some key do's and don'ts to help guide you through the process:

Things You Should Do

- Ensure the company name is unique and adheres to your state's naming requirements.

- Provide a complete and accurate registered agent information. The registered agent is responsible for receiving legal documents on behalf of your company.

- Specify the type of corporation (e.g., nonprofit, for-profit, professional) correctly based on the nature of your business.

- Include the number of authorized shares your corporation will be able to issue, if applicable.

- List the names and addresses of the incorporators and initial directors, if required by your state.

- Detail the purpose of the corporation, keeping the description clear and within the scope of business you intend to conduct.

- Double-check your form for accuracy and completeness before submission. Missing or incorrect information can delay the incorporation process.

Things You Shouldn't Do

- Don't use a company name that's already taken or too similar to another business name. This can cause rejection.

- Don't provide a P.O. Box for the registered agent's address; a physical address is usually required.

- Don't forget to designate a corporate stock structure if your corporation will be issuing stock.

- Don't leave out necessary details about your corporation's structure, operation, or purpose that are required in your state.

- Don’t underestimate the importance of the corporation’s purpose statement; it needs to be specific enough to encompass your business's operations without being overly restrictive.

- Don't skip the step of obtaining necessary signatures from all required parties on the form.

- Don't neglect to check your state's filing fees and requirements, to avoid any surprises or additional delays.

By following these guidelines, you can ensure a smoother process in getting your company off the ground legally and efficiently. Remember, taking the time to fill out the Articles of Incorporation form correctly is a critical step in setting a firm foundation for your business.

Misconceptions

When it comes to filing the Articles of Incorporation, various misconceptions can lead to confusion. Here, we aim to clarify some of these misunderstandings:

One size fits all: A common misconception is that there is a universal form that applies to all states. In reality, each state has its own specific form and requirements for the Articles of Incorporation.

Only for large businesses: Some people believe that Articles of Incorporation are only necessary for large corporations. However, any company wanting to register as a corporation, regardless of its size, must file these articles.

Requires extensive legal knowledge: While it's beneficial to consult with a legal professional, the process of filling out the Articles of Incorporation is designed to be straightforward enough that business owners can complete it without extensive legal knowledge.

It's just a formality: Filing the Articles of Incorporation is not merely a procedural step. It's a crucial legal action that defines your corporation's structure, liability, and governance.

The same as registering a business name: Incorporating a business and registering a business name are separate processes. Filing the Articles of Incorporation provides legal recognition and protection, while business name registration does not grant corporate status.

Once filed, no further action is required: Another misconception is that once the Articles of Incorporation are filed, no additional paperwork is necessary. In reality, corporations must often file annual reports and other documents to remain in good standing.

Instant approval: People sometimes expect that their Articles of Incorporation will be approved immediately. The approval time can vary significantly depending on the state and its current workload.

Key takeaways

The Articles of Incorporation form plays a pivotal role in legally establishing a corporation in the United States. This document is fundamental for business owners aiming to incorporate their enterprise. Ensuring it is completed accurately and thoroughly is essential. Here are seven key takeaways to guide you through filling out and using the Articles of Incorporation form effectively:

- Understand the requirements of your state: Each state has its own set of requirements for the Articles of Incorporation. Before you begin, familiarize yourself with the specifics by visiting your state's Secretary of State website or contacting them directly. This knowledge will help you avoid common mistakes.

- Choose a unique name for your corporation: Your corporation's name must be unique and not in use by another entity within your state. Most states require that the name ends with a corporate identifier such as "Inc.," "Corporation," or an abbreviation thereof.

- Specify the purpose of the corporation: Some states require you to outline the corporation's purpose, though it may be permissible to state a broad or general purpose. Carefully consider the scope of your intended operations before drafting this section.

- Appoint a registered agent: A registered agent must be nominated to receive legal documents on behalf of the corporation. This agent must have a physical address in the state of incorporation and be available during normal business hours.

- Determine the number and type of shares: The Articles of Incorporation should specify the number of shares the corporation is authorized to issue, as well as the classes or types of shares. This decision has implications for fundraising and voting rights within the corporation.

- Include the incorporators’ and directors’ information: Typically, the form will ask for the names and addresses of the incorporators (those filing the Articles) and possibly the initial directors who will serve until the first annual meeting of shareholders.

- File with the appropriate fees: After completing the form, it must be filed with the Secretary of State's office, accompanied by the correct filing fee. Fees vary by state, so verify the amount with state authorities beforehand.

Once submitted and approved, the Articles of Incorporation legally establish your corporation, allowing it to operate within your state. It's crucial to keep a copy for your records and adhere to any subsequent legal requirements, such as bylaws adoption, holding initial meetings, and registering for taxes. By following these guidelines, you will set a strong legal foundation for your corporation.

Other Templates

California Vehicle Title - It documents the change of ownership, making it a pivotal piece of evidence if disputes arise.

Hold Harmless Clause - This form serves as a safeguard, protecting entities from legal and financial responsibilities related to accidents or mishaps.