Fillable Self-Proving Affidavit Document for Texas

Preparing for the future involves numerous considerations, among which ensuring that one's will is unquestionably authentic and valid stands paramount. In Texas, individuals have the opportunity to streamline this process through the utilization of a Self-Proving Affidavit form. This particular document serves a critical function by accompanying a will, thereby helping to confirm its legitimacy without necessitating the presence of witnesses during probate proceedings. With this affidavit, the executor of the will can expedite the probate process, reducing potential delays and complications that can arise when proving the validity of the document. The affidavit needs to be signed by the testator and the witnesses, all of whom must do so in front of a notary public to ensure its acceptance by the court. This mechanism not only simplifies the legal validation of a will but also provides peace of mind to all parties involved, knowing that the testator's wishes will be honored as intended. Understanding and making use of the Texas Self-Proving Affidavit form can thus be seen as a practical step in the meticulous planning of one's estate.

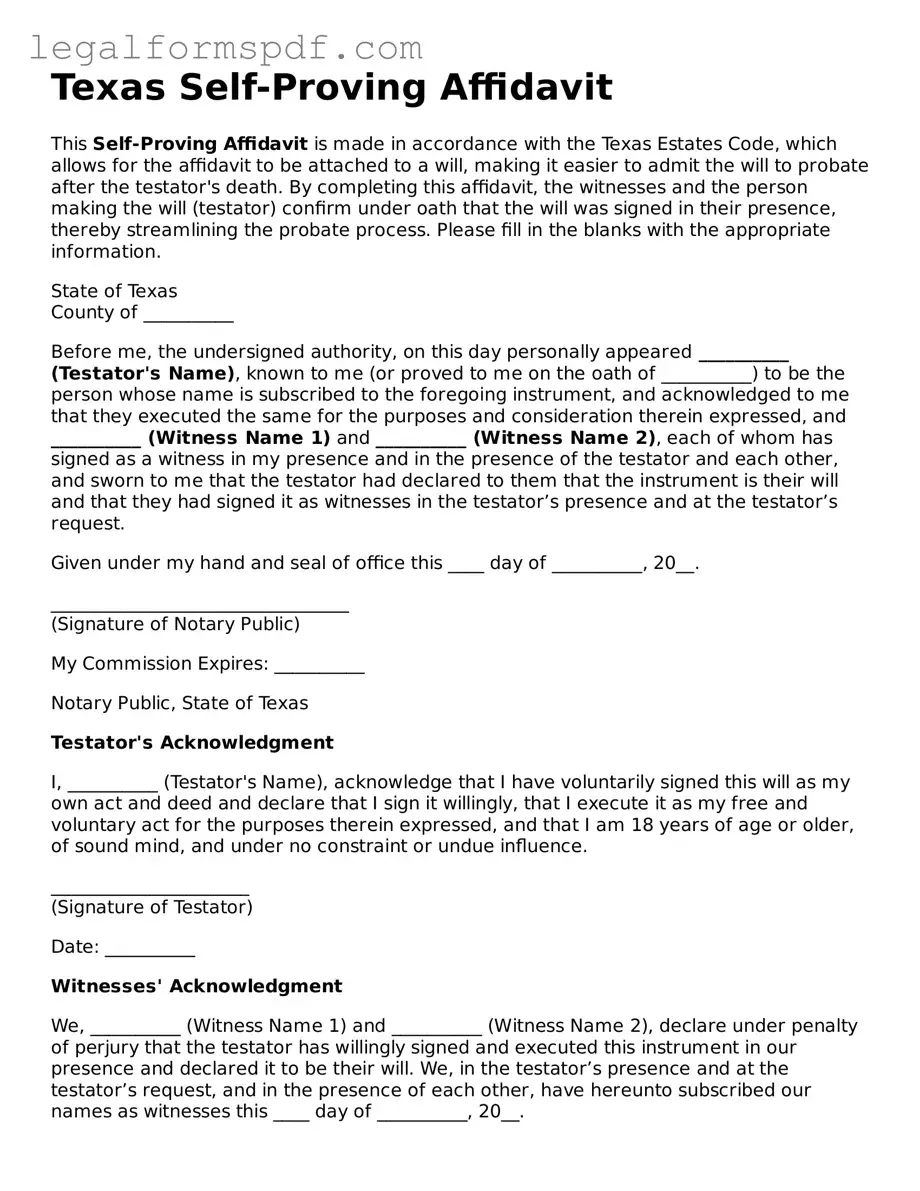

Document Example

Texas Self-Proving Affidavit

This Self-Proving Affidavit is made in accordance with the Texas Estates Code, which allows for the affidavit to be attached to a will, making it easier to admit the will to probate after the testator's death. By completing this affidavit, the witnesses and the person making the will (testator) confirm under oath that the will was signed in their presence, thereby streamlining the probate process. Please fill in the blanks with the appropriate information.

State of Texas

County of __________

Before me, the undersigned authority, on this day personally appeared __________ (Testator's Name), known to me (or proved to me on the oath of __________) to be the person whose name is subscribed to the foregoing instrument, and acknowledged to me that they executed the same for the purposes and consideration therein expressed, and __________ (Witness Name 1) and __________ (Witness Name 2), each of whom has signed as a witness in my presence and in the presence of the testator and each other, and sworn to me that the testator had declared to them that the instrument is their will and that they had signed it as witnesses in the testator’s presence and at the testator’s request.

Given under my hand and seal of office this ____ day of __________, 20__.

_________________________________

(Signature of Notary Public)

My Commission Expires: __________

Notary Public, State of Texas

Testator's Acknowledgment

I, __________ (Testator's Name), acknowledge that I have voluntarily signed this will as my own act and deed and declare that I sign it willingly, that I execute it as my free and voluntary act for the purposes therein expressed, and that I am 18 years of age or older, of sound mind, and under no constraint or undue influence.

______________________

(Signature of Testator)

Date: __________

Witnesses' Acknowledgment

We, __________ (Witness Name 1) and __________ (Witness Name 2), declare under penalty of perjury that the testator has willingly signed and executed this instrument in our presence and declared it to be their will. We, in the testator’s presence and at the testator’s request, and in the presence of each other, have hereunto subscribed our names as witnesses this ____ day of __________, 20__.

______________________

(Signature of Witness #1)

Date: __________

______________________

(Signature of Witness #2)

Date: __________

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Texas Self-Proving Affidavit form is a document attached to a will, confirming its validity and making the probate process smoother. |

| Governing Law | This form is governed by the Texas Estates Code, specifically Section 251.104. |

| Signature Requirements | The form must be signed by the testator (the person making the will) and two witnesses, all in the presence of a notary public. |

| Witnesses | Witnesses must be over the age of 14 and should not be beneficiaries of the will to avoid conflicts of interest. |

| Notarization | The affidavit needs to be notarized, requiring the notary public to stamp and sign the document. |

| Probate Advantage | Having a self-proving affidavit can expedite the probate process by pre-verifying the authenticity of the will's signatures. |

Instructions on Writing Texas Self-Proving Affidavit

Filling out the Texas Self-Proving Affidavit form is a straightforward process, crucial for ensuring that a will is easily and effectively validated when the time comes. This form, when properly executed, can streamline the probate process by verifying the authenticity of the will without the need for in-person testimony from witnesses. The steps to complete the form are simple, requiring only careful attention to detail and the presence of a notary public.

- Begin by locating a current version of the Texas Self-Proving Affidavit form, ensuring it complies with the latest state laws and requirements.

- Fill in the full legal names of the testator (the person to whom the will belongs) and the two witnesses. It's essential that these names are printed clearly and match the identification presented to the notary.

- Review the affidavit to ensure that it includes language stating the testator has willingly signed the will, that they are in sound mind, and that the witnesses believe the testator is of sound mind. If any of this language is missing, the form may not be correctly completed.

- Gather the testator and both witnesses to sign the affidavit in the presence of a notary public. It's important that this step is not done until everyone is together and in front of the notary to comply with legal requirements.

- Have the notary public review the affidavit, witness the signing process, and then notarize the document. This usually includes the notary's signature, seal, and the date the affidavit was notarized.

- Once completed and notarized, attach the Self-Proving Affidavit to the will. While not a requirement, this action is strongly recommended to ensure the documents are not separated over time.

Following these steps, the Texas Self-Proving Affidavit should be correctly filled out and legally binding. It becomes a critical part of the estate planning and probate process, offering peace of mind to all involved by verifying the will's authenticity in a manner recognized by the state. Remember, while this process is a legal formality, it is advisable to consult with a legal professional if there are any uncertainties or questions about the process or its implications.

Understanding Texas Self-Proving Affidavit

What is a Texas Self-Proving Affidavit form?

A Texas Self-Proving Affidavit form is a legal document that accompanies a will. It's designed to make the probate process smoother and more straightforward. When a will includes this affidavit, signed by the testator (the person who created the will) and witnesses, it verifies that the will is authentic and properly executed in the eyes of Texas law. This means that during the probate process, witnesses are not required to testify in court to affirm the will's validity, speeding up the proceedings.

How do you create a Texas Self-Proving Affidavit?

To create a Texas Self-Proving Affidavit, the testator and two witnesses must sign the affidavit in the presence of a notary public. It's important that this action is done willingly and that all parties understand the document's purpose. Ideally, this should be done at the same time the will is signed to ensure that the document aligns with the will's intentions. The affidavit should be securely attached to the will, ensuring they are kept together and presented simultaneously during the probate process.

Who can serve as witnesses for a Texas Self-Proving Affidavit?

In Texas, the witnesses for a Self-Proving Affidavit should be individuals who are not beneficiaries of the will. This helps to avoid any potential conflicts of interest and ensures the affidavit's credibility. Witnesses must be at least 18 years old and competent to testify about the will's execution should it ever be required. It is crucial that the witnesses do not have any vested interest in the will to maintain the document's integrity and purpose.

Is a Texas Self-Proving Affidavit always necessary?

While not always required, having a Texas Self-Proving Affidavit is highly recommended. It significantly simplifies the probate process by negating the need for witnesses to physically appear in court to validate the will. This can be particularly valuable if the will is contested or if the witnesses are unavailable or unable to testify. Including this affidavit can save time, reduce legal expenses, and minimize potential stress for the executor and beneficiaries.

Common mistakes

In Texas, finalizing a will often involves completing a Self-Proving Affidavit form, an essential step that streamlines the probate process. Yet, despite its significance, individuals commonly err when filling it out. From oversight to misunderstanding, these missteps can haphazardly complicate what should be a straightforward endeavor.

First and foremost, a frequent mistake involves not having the affidavit witnessed by two individuals. This step is critical because the law requires the presence of two adult witnesses to your signature, who then also sign the affidavit. Interestingly, these witnesses should ideally have no vested interest in your will to maintain objectivity and avoid any appearance of undue influence.

Another area where errors occur is in the notarization process. The Self-Proving Affidavit must be notarized to be valid. Unfortunately, it's not uncommon for individuals to overlook this requirement, mistakenly assuming that witness signatures alone suffice. This misunderstanding can invalidate the affidavit, necessitating corrective action down the line.

Incorrect information constitutes yet another pitfall. Whether it’s a misspelled name, a wrong date, or inaccurate personal details, such errors can cast doubt on the affidavit's validity. It’s prudent to review the document thoroughly before finalization, ensuring every detail precisely matches the corresponding information on the will.

Additionally, neglecting to attach the affidavit to the will is a surprisingly common oversight. This document serves as an adjunct to the will, confirming the latter's authenticity. Without it, the will's verification process during probate becomes more cumbersome, potentially delaying the distribution of the estate.

A subtle yet impactful mistake is failing to update the affidavit. Life changes—such as marriage, divorce, or the birth of children—can render previous details invalid. Regularly revising the affidavit to reflect current circumstances ensures its continued relevance and efficacy.

Furthermore, using an outdated form can lead to complications. Laws and requirements evolve, and using the most recent version of the Self-Proving Affidavit ensures compliance with current legal standards.

Lastly, an all-too-common error is attempting to navigate this process without professional guidance. Misunderstandings about the form’s requirements can lead to avoidable mistakes. Consulting with a legal professional offers clarity, safeguarding against the pitfalls that can hinder the affidavit's intended purpose—expediting the probate process.

Understanding and avoiding these eight mistakes can make a significant difference in how smoothly the estate planning process unfolds. By paying close attention to the details and seeking appropriate advice when needed, individuals can ensure their wishes are honored with minimal complications.

Documents used along the form

When preparing or updating a will in Texas, individuals often utilize a Self-Proving Affidavit to streamline the probate process, ensuring the will is accepted by the court as genuine without requiring in-person testimony from witnesses. Alongside this important document, several others commonly play roles in the comprehensive estate planning process. Understanding these documents can help individuals and their families establish a well-rounded legal foundation for asset management, care decisions, and end-of-life planning.

- Last Will and Testament: This core document outlines how an individual’s property should be distributed upon their death. It names beneficiaries and can appoint guardians for minor children.

- Durable Power of Attorney: It grants another person the authority to make financial decisions on behalf of the individual, should they become unable to do so themselves.

- Medical Power of Attorney: Similar to the Durable Power of Attorney, this document authorizes someone to make medical decisions for the individual if they are incapacitated.

- Directive to Physicians (Living Will): This specifies the individual’s wishes regarding life-sustaining treatment if they become terminally ill or permanently unconscious.

- Designation of Guardian in Advance: Should the individual become incapacitated, this document outlines their preferences for a court-appointed guardian.

- HIPAA Release Form: The Health Insurance Portability and Accountability Act (HIPAA) release form allows designated individuals to access the person’s healthcare information, critical for making informed medical decisions.

- Declaration of Guardian for Minor Children: This specifies the individual’s choice for guardianship of their minor children in the event of the individual’s death or incapacitation.

- Revocable Living Trust: This allows the individual to maintain control over their assets while alive but ensures the assets are transferred to beneficiaries upon death, potentially bypassing the probate process.

The creation and maintenance of these documents are foundational to protecting an individual’s wishes and ensuring their affairs are handled appropriately and respectfully. It is advisable for individuals to consult with a legal professional to tailor these documents to their unique circumstances, thereby securing peace of mind for themselves and their loved ones.

Similar forms

The Texas Self-Proving Affidavit form is similar to a Notarized Letter in that both documents require a notary public to witness the signing. This process gives legal weight to the statements made in the documents. A Notarized Letter can be used for a variety of purposes, serving as proof that the signatory acknowledged the letter's content in front of a notary. Similarly, the Self-Proving Affidavit adds authenticity to a will, helping to streamline the probate process by verifying the testator's signature.

Comparable to the Texas Self-Proving Affidavit form is the Power of Attorney (POA). Both documents facilitate critical legal actions involving someone's assets or decisions. While a POA grants an individual the authority to make decisions on behalf of someone else, the Self-Proving Affidavit supports the execution process of a will by confirming its legitimacy, both aiming to ensure personal wishes are honored.

Advance Directive forms share similarities with the Texas Self-Proving Affidavit form. They both deal with planning for future scenarios where a person may not be able to make decisions for themselves. An Advance Directive outlines a person’s wishes regarding medical treatment, while the Self-Proving Affidavit is used to expedite the validation of a will, ensuring that the individual's end-of-life property and asset distribution wishes are recognized.

Last Will and Testament forms and the Texas Self-Proving Affidavit form go hand in hand. The Last Will outlines how someone wants their estate handled after death, whereas the Self-Proving Affidavit serves as a witness validation document. This affidavit simplifies the probate process by verifying the authenticity of the Last Will, making it a critical supporting document.

Living Trust documents share similarities with the Texas Self-Proving Affidavit by managing assets during a person's lifetime and beyond. While a Living Trust allows for the management and distribution of an individual’s assets without the need for probate, the Self-Proving Affidavit helps confirm the legitimacy of a will’s signatures, thereby assisting in a smooth probate process when a will is involved.

The Declaration of Guardianship in Texas is akin to the Self-Proving Affidavit form since both documents can influence end-of-life arrangements and care. The Declaration of Guardianship allows individuals to choose who will make decisions for them if they become incapacitated, while the Self-Proving Affidavit ensures that a person's will can be admitted to probate swiftly, thereby upholding their wishes regarding their estate.

Similarly, Medical Power of Attorney forms are akin to the Self-Proving Affidavit. Both empower someone to ensure an individual's wishes are respected. A Medical Power of Attorney allows individuals to designate someone to make healthcare decisions on their behalf, whereas the Self-Proving Affidavit facilitates the enactment of a person’s wishes as outlined in their will by authenticating the signatures.

The Transfer on Death Deed (TODD) in Texas also has parallels with the Texas Self-Proving Affidavit form. A TODD allows property owners to name a beneficiary who will receive their property upon their death, bypassing the often lengthy probate process. Like the Self-Proving Affidavit, it is a tool for estate planning that simplifies the transfer of assets, although through different legal mechanisms.

Revocable Living Trust documents are related to the Texas Self-Proving Affidavit form in their purpose to manage and distribute assets both during an individual's lifetime and after death. The main difference lies in their operation: a Revocable Living Trust is an estate planning tool that avoids probate, while the Self-Proving Affidavit helps validate a will’s signatures, facilitating a smoother probate process when a will is used.

Finally, the Durable Power of Attorney for Finances has similarities with the Texas Self-Proving Affidavit form. This document allows someone to act in another person’s stead regarding financial matters, potentially during a period of incapacity. Like the Self-Proving Affidavit, it plays a crucial role in managing affairs according to an individual’s wishes. However, the affidavit specifically supports the will’s execution by attesting to the authenticity of the signatures involved.

Dos and Don'ts

When filling out the Texas Self-Proving Affidavit form, it is crucial to adhere to certain guidelines to ensure the document is legally binding and effective. Here is a list of 10 do's and don'ts to help guide you through the process:

- Do ensure that all parties involved, including the testator (the person making the will) and the witnesses, are present together when signing the affidavit.

- Do use black ink to fill out the form, as it provides the best legibility and durability over time.

- Do accurately and completely fill out all required information without leaving blanks, unless instructed otherwise on the form.

- Do have valid identification available for all parties involved, as it may be necessary to confirm identities.

- Do ensure that the witnesses meet the legal requirements set by Texas law, such as being over the age of 14 and not being beneficiaries in the will.

- Don't sign the affidavit without a notary public present, as the notarization of the document is crucial for it to be considered self-proving.

- Don't use correction fluid or tape to correct mistakes. If errors are made, it is best to start over on a new form to avoid any potential challenges to the document's validity.

- Don't allow witnesses who have a vested interest in the will, as their impartiality could be called into question.

- Don't forget to check that the notary public fills out their section completely, including their seal and signature.

- Don't neglect to store the affidavit in a safe place with the will after it has been completed and signed, ensuring that it can be easily found and submitted to the court when necessary.

Misconceptions

When it comes to the Texas Self-Proving Affidavit form, several misconceptions can lead to confusion and misunderstanding about its nature, purpose, and requirements. Clearing up these misconceptions is essential for anyone dealing with estate planning in Texas. Here are four common misunderstandings and the truths behind them:

- It replaces the need for a will. A common misconception is that the Texas Self-Proving Affidavit form can act as a replacement for a will. However, this is not accurate. The affidavit is actually a complementary document that accompanies a will. Its primary purpose is to streamline the probate process by verifying the authenticity of the will, making it unnecessary for witnesses to physically appear in court to validate the will's execution.

- It’s only for wealthy individuals. Some people think that the self-proving affidavit is a tool exclusively reserved for those with large estates or substantial wealth. This belief couldn't be further from the truth. In reality, the affidavit can be a valuable addition to the estate planning process for anyone, regardless of the size of their estate. It is designed to simplify and expedite the probate process, making it beneficial for estates of all sizes.

- It’s valid without a notary. Another widespread belief is that a self-proving affidavit doesn't need to be notarized to be legal and valid. This is incorrect. Texas law requires that the affidavit be signed in the presence of a notary public. The notary's role is to authenticate the identities of the individuals signing the affidavit, ensuring that all legal protocols are strictly followed.

- Once it’s signed, it’s permanently valid. Some people are under the assumption that once a self-proving affidavit is signed, it remains valid indefinitely, regardless of any changes in the law or in personal circumstances. However, this is not the case. While the affidavit does provide a level of validation to a will, changes in personal situations (such as marriage, divorce, or the birth of children) or significant changes in estate law can necessitate updates to both the will and the affidavit to ensure that they accurately reflect the current intentions and legal requirements.

Understanding these misconceptions about the Texas Self-Proving Affidavit form is crucial for anyone involved in estate planning within the state. Properly utilizing this document can significantly ease the probate process, ensuring that one's final wishes are honored without unnecessary delay or legal hurdles.

Key takeaways

When preparing a will in Texas, a self-proving affidavit can streamline the probate process. This document, attached to a will, is a sworn statement by the will's witnesses. Here are four key takeaways regarding the completion and use of the Texas Self-Proving Affidavit form:

- The self-proving affidavit must be signed by the person making the will (the testator) and two witnesses in the presence of a notary public. All parties should be over the age of 18 and not stand to benefit from the will.

- Having a self-proving affidavit means that witnesses do not need to testify in court about the authenticity of the will, making the probate process faster and less complicated.

- To ensure the affidavit is legally binding, it is crucial that the form is filled out completely and accurately. Any mistakes or omissions could lead to challenges during the probate process.

- After it is signed and notarized, the self-proving affidavit should be securely attached to the will. This demonstrates to the probate court that the document meets Texas legal requirements for authenticity.

By following these guidelines when completing a Texas Self-Proving Affidavit form, individuals can help ensure their will is executed according to their wishes with minimal complications.

More Self-Proving Affidavit State Forms

What Is a Self-proving Will - This form serves as a time-saving tool, eliminating the need for witnesses to testify in court about the will’s authenticity.

Guardianship Authorization Affidavit California - Though not mandatory in all states, incorporating this affidavit with a will is considered a best practice in estate planning for its evidentiary benefits.