Fillable Self-Proving Affidavit Document for Illinois

In Illinois, the process of ensuring that a will is considered valid and can be executed without unnecessary delay often includes a measure known as the Self-Proving Affidavit form. This document, while not an essential part of will preparation, significantly simplifies the probate process by corroborating the authenticity of the will ahead of time. Essentially, it acts as a testimonial endorsement, attached to the will, where witnesses affirm that they observed the will-maker (testator) sign the will and that they believe the testator was of sound mind and not under any duress at the time of signing. By completing this affidavit, the testamentary document gains an extra layer of legitimacy, usually averting the need for witnesses to appear in court to validate the will after the testator's death. The practical benefits of such a form are manifold, offering peace of mind to both the will-maker and the beneficiaries, and ensuring a smoother transition of assets according to the deceased’s wishes. Although the concept is straightforward, understanding the specifics of how the Self-Proving Affidavit operates within Illinois's legal framework presents a valuable opportunity to streamline the probate proceedings and underscore the importance of meticulous estate planning.

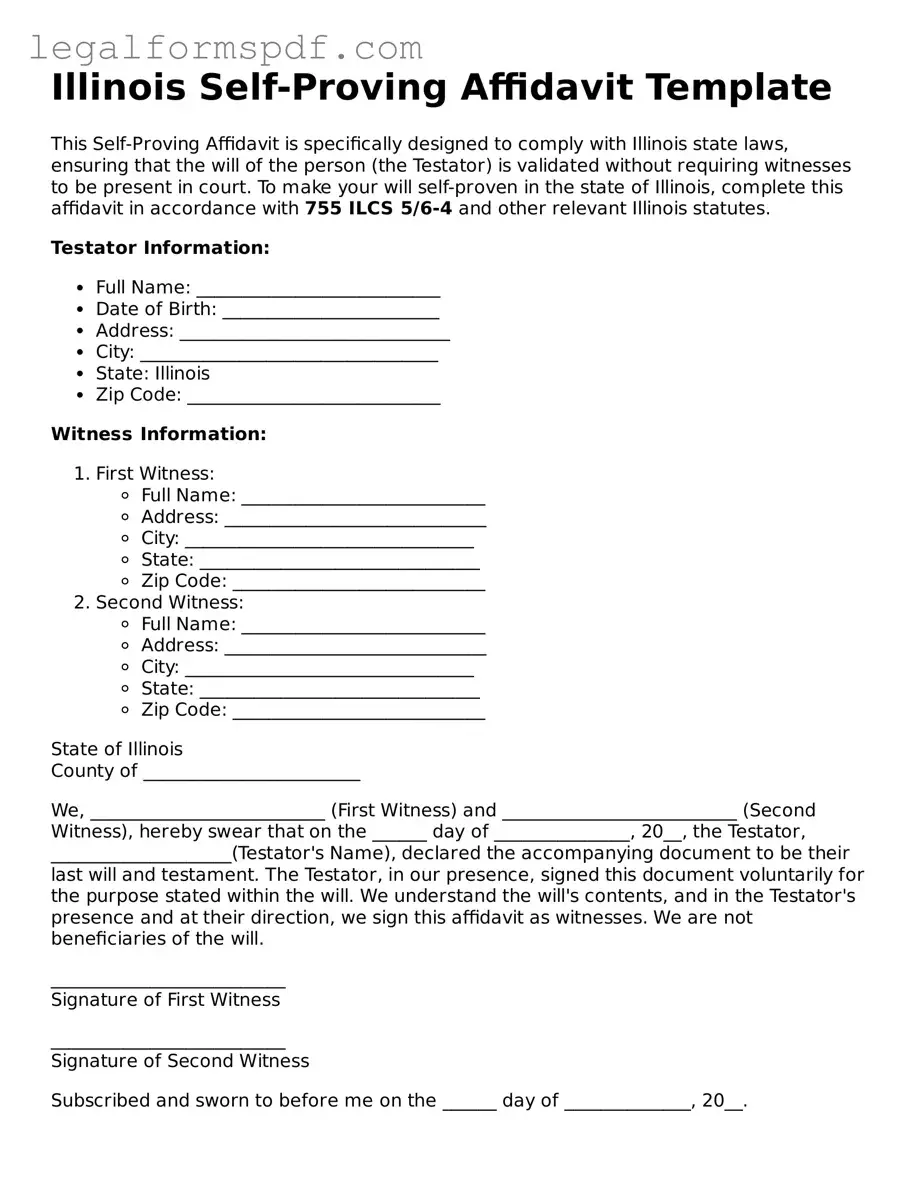

Document Example

Illinois Self-Proving Affidavit Template

This Self-Proving Affidavit is specifically designed to comply with Illinois state laws, ensuring that the will of the person (the Testator) is validated without requiring witnesses to be present in court. To make your will self-proven in the state of Illinois, complete this affidavit in accordance with 755 ILCS 5/6-4 and other relevant Illinois statutes.

Testator Information:

- Full Name: ___________________________

- Date of Birth: ________________________

- Address: ______________________________

- City: _________________________________

- State: Illinois

- Zip Code: ____________________________

Witness Information:

-

First Witness:

- Full Name: ___________________________

- Address: _____________________________

- City: ________________________________

- State: _______________________________

- Zip Code: ____________________________

-

Second Witness:

- Full Name: ___________________________

- Address: _____________________________

- City: ________________________________

- State: _______________________________

- Zip Code: ____________________________

State of Illinois

County of ________________________

We, __________________________ (First Witness) and __________________________ (Second Witness), hereby swear that on the ______ day of _______________, 20__, the Testator, ____________________(Testator's Name), declared the accompanying document to be their last will and testament. The Testator, in our presence, signed this document voluntarily for the purpose stated within the will. We understand the will's contents, and in the Testator's presence and at their direction, we sign this affidavit as witnesses. We are not beneficiaries of the will.

__________________________

Signature of First Witness

__________________________

Signature of Second Witness

Subscribed and sworn to before me on the ______ day of ______________, 20__.

__________________________

Notary Public

My Commission Expires: __________________

PDF Specifications

| Fact | Detail |

|---|---|

| Purpose | Used to validate a will in Illinois, ensuring it is accepted by the probate court without needing live witness testimony. |

| Governing Law | Illinois Probate Act, specifically 755 ILCS 5/6-4. |

| Requirements | Must be signed by the testator and two credible witnesses, all of whom must sign in each other's presence. |

| Notarization | Required for the affidavit to be considered self-proving, making the notary public the third necessary signatory. |

| Form Availability | Can be obtained from legal form providers or attorneys familiar with Illinois law. |

| Witness Qualifications | Witnesses must be at least 18 years old and not stand to benefit from the will. |

| Validity Across States | While valid in Illinois, the affidavit’s acceptance in other states depends on each state's specific laws and reciprocity agreements. |

| Revocation | The process can be revoked or replaced by a new will or codicil that complies with Illinois law. |

| Benefit | Streamlines the probate process, potentially saving time and reducing legal fees. |

Instructions on Writing Illinois Self-Proving Affidavit

Filing out the Illinois Self-Proving Affidavit form is a critical step in making your estate planning documents ironclad. This particular affidavit is a companion document to your will, offering a streamlined way to validate the will without requiring your witnesses to appear in court after your passing. Although it might seem daunting, completing this form is relatively straightforward. Below are the step-by-step instructions designed to help guide you through each section of the form, ensuring that everything is filled out correctly and efficiently.

- Locate and download the most current version of the Illinois Self-Proving Affidavit form from a reliable source. Ensure you have the correct form that matches your state's requirements.

- Read the form thoroughly before you begin filling it out. This step ensures you understand all the information required and how to provide it accurately.

- Enter the full legal name of the will's executor—the person creating the will—at the top of the form where indicated.

- Fill in your full legal name, date of birth, and address in the designated sections of the affidavit. Be sure to double-check the accuracy of this information.

- List the names and addresses of the two impartial witnesses you've selected to observe the signing of your will. These witnesses should not be beneficiaries of the will and must be at least 18 years old.

- With both witnesses present, sign and date the affidavit. Your signature should match the one on your will and other official documents to avoid any potential discrepancies.

- Have both witnesses sign and date the form in the assigned places. Their signatures confirm they witnessed your signature and can testify to your capacity to sign the will and your intent to do so voluntarily.

- Seek a notary public to notarize the form. A notary public is a state-authorized individual who can witness the signing of important documents and administer oaths. The notary will verify the identity of all signatories, witness the signing, and then stamp and sign the affidavit, adding an official seal.

Once completed, attach the Self-Proving Affidavit to your will. This document does not replace the legal requirement for a will but supplements it by easing the probate process. Remember, while the steps above provide a general guide, it's always wise to consult with a legal professional or estate planning expert to ensure your documents meet all the specific legal requirements for Illinois. By taking these steps today, you're helping to secure a smoother transition for your loved ones tomorrow.

Understanding Illinois Self-Proving Affidavit

What is a Self-Proving Affidavit form in Illinois?

A Self-Proving Affidavit form in Illinois is a legal document that accompanies a person's will. This document is signed by the person making the will (the testator) and witnesses, under oath, in front of a notary public. It serves as evidence that the will was signed voluntarily and by individuals of sound mind. The primary purpose of this affidavit is to simplify the probate process after the testator's death, making it easier to validate the will.

Who needs to sign the Illinois Self-Proving Affidavit?

The Illinois Self-Proving Affidavit must be signed by the testator - the person to whom the will belongs - and two witnesses. These witnesses are required to observe the testator's signing of the will, to confirm the testator's state of mind and the absence of undue influence. Following this, the affidavit must be notarized, which involves a notary public who validates the identity of the signers and their signatures.

Is a Self-Proving Affidavit mandatory for wills in Illinois?

No, having a Self-Proving Affidavit is not mandatory for wills in Illinois. However, it is highly recommended. Without this affidavit, witnesses may need to appear in court to testify that the will was appropriately signed, which can complicate and lengthen the probate process. An affidavit can help streamline the validation of the will, making it a wise addition to any will.

Can the Illinois Self-Proving Affidavit be added to an existing will?

Yes, an Illinois Self-Proving Affidavit can be added to an existing will. If a will was created without an affidavit, the testator can complete the process by signing a self-proving affidavit later, in front of two witnesses and a notary public. This action does not require amending the will itself, but the affidavit should be securely attached to the existing will document to ensure they are presented together during the probate process.

Common mistakes

One common mistake people make when filling out the Illinois Self-Proving Affidavit form is not matching the details precisely with those on their will. Every piece of information, including full names, addresses, and dates, must mirror the will exactly; discrepancies can cast doubt on the authenticity of the documents, potentially leading to complications during the probate process. This precision in detail ensures that the affidavit solidly supports the will’s execution, making it easier to validate in court.

Another error often encountered is failing to have the affidavit notarized correctly. A self-proving affidavit requires notarization to confirm the identities of the signatories and the voluntary nature of their signatures. Without proper notarization, the affidavit may not serve its purpose of simplifying the will verification process, thereby necessitating live testimony from witnesses during probate, which can be a lengthy and cumbersome process.

People also frequently overlook the requirement that the witnesses signing the affidavit must meet specific qualifications. In Illinois, witnesses cannot be beneficiaries of the will, as this creates a conflict of interest and can challenge the document's credibility. Ensuring that witnesses are disinterested parties is crucial for the affidavit’s acceptance and the smooth execution of the will.

Underestimating the importance of using the most current form available is another common misstep. Laws and regulations regarding wills and affidavits undergo changes, and using an outdated form can lead to non-compliance with current legal standards. Such an oversight can invalidate the affidavit, potentially complicating the probate proceedings and delaying the distribution of the estate.

Finally, people often do not fully complete the form, leaving out critical information or sections. Every field in the affidavit has a purpose and contributes to its legal validity. Incomplete forms can result in the affidavit being disregarded, which then requires witnesses to give their testimony in court, prolonging the probate process and increasing the emotional and financial burden on the deceased's loved ones.

Documents used along the form

When preparing one's estate planning documents in Illinois, a Self-Proving Affidavit is a common and valuable tool. It is a form attached to a will that allows the will to be admitted to probate without the need for the testimony of witnesses. This not only simplifies the process but also speeds up the probate proceedings. However, this document often works in tandem with several other forms and documents to ensure a comprehensive estate plan. Below is a list of other documents frequently used alongside the Illinois Self-Proving Affidavit form.

- Last Will and Testament: The primary document that dictates how an individual's estate should be distributed upon their death. It identifies beneficiaries, outlines the distribution of assets, and nominates an executor.

- Durable Power of Attorney: This document grants someone authority to act on behalf of the individual in financial matters if they become incapacitated and unable to make decisions for themselves.

- Healthcare Power of Attorney: Similar to the Durable Power of Attorney, this document appoints someone to make healthcare decisions on the individual’s behalf if they become unable to do so.

- Living Will: Also known as an advance directive, it outlines the individual's wishes regarding end-of-life medical care in case they become unable to communicate those desires.

- Trust Agreement: A legal arrangement through which assets are held by one party for the benefit of another. A trust can help avoid probate and manage an estate more efficiently.

- Beneficiary Designations: Forms that specify who will inherit assets like retirement accounts and life insurance policies, often bypassing the will.

- Property Deeds: Legal documents that transfer property ownership. If the property is to be transferred upon the owner’s death, it should be clearly stated in the deed.

- Business Succession Plans: Documents that outline what will happen to a business upon the owner’s retirement, death, or incapacitation.

- Funeral instructions: Though not always formal or legally binding, documenting wishes for one’s funeral arrangements can be a relief to family members and ensure that the individual’s preferences are respected.

Efficient estate planning involves more than just writing a will; it's about ensuring that all aspects of one’s estate are addressed. Each of these documents plays a specific role in safeguarding an individual's wishes, assets, and loved ones. Working with a legal professional to create and understand these documents can provide peace of mind and a smooth transition for those left behind. It’s essential to periodically review and update these documents to reflect life changes such as marriage, divorce, the birth of children, or the acquisition of significant assets.

Similar forms

The Illinois Self-Proving Affidavit form shares similarities with a Last Will and Testament, in that both are pivotal in the realm of estate planning. Like a self-proving affidavit, which attests to the authenticity of the will it accompanies, a Last Will and Testament outlines the deceased’s wishes on how their estate should be distributed. Both documents require witnesses to ensure their validity, streamlining the probate process and helping to prevent contestation.

Another document akin to the Illinois Self-Proving Affidavit is the Power of Attorney (POA). Although serving different purposes, both legal instruments grant certain powers and authentications. While a POA designates an individual to make decisions on another's behalf, a self-proving affidavit serves to authenticate a will. However, they both require notarization and serve to affirm the validity of the document and the capacity of the individual(s) involved.

Living Wills also bear resemblance to the self-proving affidavit, as they express an individual's wishes regarding medical treatments in the event they become unable to communicate those preferences. Both documents ensure that a person’s explicit instructions are legally recognized and adhered to. They must be executed according to specific legal standards to be considered valid, which often include notarization and witness signatures.

The Trust Agreement is another document related to the Self-Proving Affidavit. Trust agreements detail how assets placed into a trust should be managed and distributed. Similar to a self-proving affidavit, which authenticates a will, the trust agreement provides a framework for managing an individual’s assets according to their wishes. Both play crucial roles in estate planning with requirements for formalities like notarization to bolster their legitimacy.

Similarly, the Durable Power of Attorney for Healthcare is a legal document that parallels the Self-Proving Affidavit in its purpose to uphold the wishes of an individual, specifically concerning their healthcare decisions. Both documents come into play under specific conditions – the affidavit when a will is probated, and the durable POA for healthcare when the individual is incapacitated – and both necessitate legal formalities to ensure their enforceability.

A Healthcare Proxy is, in many ways, similar to a Self-Proving Affidavit. It allows an individual to designate another person to make healthcare decisions on their behalf. This parallels the affidavit's role in validating a document (the will) that communicates one’s final wishes. While one focuses on health care decisions, and the other on the authenticity of a will, both documents serve to respect and enforce the principal's wishes.

Advance Directives can also be compared to the Self-Proving Affidavit. Both documents are prepared ahead of need, with the intention of guiding actions on behalf of the person who created the document, whether it pertains to medical decisions (Advance Directives) or the authentication of a will (Self-Proving Affidavit). They reflect foresight and preparation, requiring witnesses or notarization to ensure their validity and to represent the individual’s intentions accurately.

Lastly, a Codicil, which is an amendment to a Last Will and Testament, is conceptually related to the Self-Proving Affidavit. Both serve as tools in the estate planning process, with a codicil modifying the will and the affidavit strengthening the will’s validity by proving its authenticity. Each requires careful execution, including witnessing and notarization, to be legally effective and carry out the testator's intentions.

Dos and Don'ts

Filling out the Illinois Self-Proving Affidavit form is a critical step in ensuring your will is executed smoothly and without unnecessary delay after your passing. This document, attached to your will, helps confirm the authenticity of the will, making the probate process more straightforward. Here are essential do's and don'ts to guide you through completing this form accurately.

Do:- Review the form thoroughly before filling it out: Ensure you understand every part of the document to avoid errors that could invalidate it.

- Use black ink: For clarity and longevity of the document, fill it out using black ink, as it is less likely to fade over time compared to other colors.

- Have your witnesses present: Illinois law requires the presence of two credible witnesses during the signing of the affidavit. Make sure they are physically present and understand their role.

- Include complete and accurate information: Double-check all entries for accuracy, including names, addresses, and dates, to prevent any confusion or disputes.

- Consult with a legal professional if unsure: If any part of the form is unclear, it's advisable to seek clarification from a legal expert to ensure it's filled out correctly.

- Sign and date the form: Do not forget to sign and date the affidavit in the presence of the witnesses, as this act formalizes the document.

- Attach the affidavit to your will: Once completed, securely attach the affidavit to your will to ensure they are not separated, as both are vital during the probate process.

- Use a pencil or erasable pen: These can be altered easily, which might raise questions about the document's integrity.

- Forget to have the witnesses sign: The affidavit is not valid without the signatures of two credible witnesses who watched you sign the document.

- Overlook the notary: The presence of a notary public is essential for the affidavit to be self-proving, as they certify the authenticity of the signatures.

- Leave blank spaces: Unfilled sections can lead to misunderstandings or suggest that the document has been tampered with; be thorough and complete each section.

- Use white-out or correction tape: Making corrections in this manner can cast doubt on the document's authenticity; if errors are made, it's better to start over on a new form.

- Lose the original affidavit: A copy of the affidavit may not carry the same legal weight as the original document; always keep it in a safe, accessible place.

- Assume it's a one-time affair: Life changes, such as marriage or the birth of a child, might necessitate updates to your will and affidavit; review these documents periodically to ensure they reflect your current wishes.

Misconceptions

In Illinois, a Self-Proving Affidavit form is often misunderstood. Many people have misconceptions about its use and its importance in the legal process, especially in relation to wills and estate planning. A Self-Proving Affidavit is a document that accompanies a will, which both the witnesses and the person making the will (the testator) sign, affirming that the will is genuine and that all legal formalities have been observed.

Let's clarify some of the common misconceptions about the Illinois Self-Proving Affidavit form:

- It is required to make a will valid. One widespread misunderstanding is that a Self-Proving Affidavit is necessary for a will to be considered valid in Illinois. This isn't true. A will can be valid without it, as long as it meets all other statutory requirements. The affidavit merely simplifies the court procedures after the testator's death.

- It eliminates the need for witnesses during probate. Another misconception is that once a will has a Self-Proving Affidavit attached, the witnesses who signed the will no longer need to be involved in any legal process related to the will. While the affidavit does streamline the probate process by potentially reducing the need for witness testimony, it does not entirely eliminate the possibility that witnesses might be called to court under certain circumstances.

- It can only be signed in front of a notary. People often believe that a Self-Proving Affidavit must be signed exclusively in the presence of a notary public. However, in Illinois, while the signatures of the testator and the witnesses must be notarized, the affidavit itself can technically be completed as part of the will signing process, in front of any authorized person, in addition to a notary.

- It protects a will from all contests. There's a common belief that attaching a Self-Proving Affidavit to a will protects the will from being contested in probate court. However, the affidavit only attests to the authenticity of the will's signatures and the proper execution of the will, not to its content. Therefore, heirs or other interested parties can still contest the will on other grounds, such as undue influence or lack of testamentary capacity.

- It is complicated and unnecessary. Finally, some might think that creating a Self-Proving Affidavit is a complicated and unnecessary step in estate planning. While adding this affidavit to a will is an additional step, it is typically straightforward and can significantly simplify the probate process, making it easier for the executor and beneficiaries to settle the estate.

Understanding these aspects of the Illinois Self-Proving Affidavit can help individuals in the estate planning process make informed decisions and ensure their wishes are fulfilled more efficiently after their passing.

Key takeaways

The Illinois Self-Proving Affidavit form is a crucial document that can significantly streamline the probate process after a person's death. When properly completed, it serves as a powerful tool to authenticate a will, ensuring that the wishes of the deceased are honored with minimal delay. Here are ten key takeaways about filling out and using this form:

- The Self-Proving Affidavit must be signed by the person making the will (known as the testator) in the presence of two competent witnesses. These witnesses are affirming not only the identity of the testator but also their mental capacity to execute the will.

- Both witnesses signing the affidavit should not be beneficiaries under the will, to avoid any appearance of conflict of interest or undue influence.

- This form requires notarization; hence, it must be signed in front of a notary public. The notary's role is to verify the identities of the signatories and ensure the authenticity of the signatures.

- The document assists in proving the validity of the will without the need for witnesses to be present in court during the probate process, potentially saving time and reducing complications.

- Proper completion of the form includes ensuring that all fields are filled out accurately, including full legal names, addresses, and relevant dates.

- This affidavit is particularly useful if there is a chance that the witnesses might not be available in the future, for example, due to relocation, illness, or death.

- It’s important to store the affidavit safely, preferably alongside the will, in a secure location such as a safe deposit box or with an attorney. This ensures that it can be found easily after the testator's death.

- In the event of any changes to the will, a new Self-Proving Affidavit should also be executed, to align with the latest version of the will and reaffirm its validity.

- Even though the Self-Proving Affidavit can simplify the probate process, it does not replace the need for proper legal advice. Consulting with an attorney familiar with Illinois estate law is recommended to ensure that all aspects of the estate planning, including the will and affidavit, are in order.

- The Illinois Self-Proving Affidavit form must adhere to Illinois laws and requirements; therefore, it is essential to use the correct form and follow state-specific procedures for execution to ensure its effectiveness.

In conclusion, when preparing for the inevitable, taking steps to ensure your will is self-proving can be a thoughtful act of kindness to your loved ones left behind. It not only expresses your wishes clearly but also simplifies the legal procedures that follow, allowing your beneficiaries to focus on mourning and celebrating your life without undue legal burdens.

More Self-Proving Affidavit State Forms

Texas Estates Code Will Requirements - An important document for estate planning, ensuring that wills are accompanied by verified witness statements to simplify legal proceedings.

Ny Will Requirements - Utilizing this affidavit can be particularly beneficial in states where probate laws are stringent, offering an invaluable layer of legal preparedness.

Self Proving Affidavit Georgia - The affidavit confirms that witnesses to a will are credible and that the document is legitimate, often preempting further proof requirements.