Fillable Affidavit of Gift Document for Texas

Gifting a vehicle or a piece of property in the vast state of Texas comes with its own set of formalities, one of which is the completion of the Texas Affidavit of Gift form. This crucial document, often overlooked in the excitement of giving, is the linchpin in officially transferring ownership without the exchange of money. It serves a dual purpose - protecting the giver from any future liability associated with the property and ensuring the receiver can rightfully claim ownership without unforeseen hitches. The form succinctly captures all necessary information to legalize the act of gifting, from detailed descriptions of the gift to personal details about the parties involved. But its significance stretches beyond the mere transfer of items; it plays a pivotal role in tax considerations, potentially exempting the transaction from taxes typically associated with the sale and purchase of property. Navigating through this process, while seemingly straightforward, requires a meticulous understanding of state laws and regulations to avoid common pitfalls and ensure a smooth transition of ownership, embodying the true spirit of generosity through compliance.

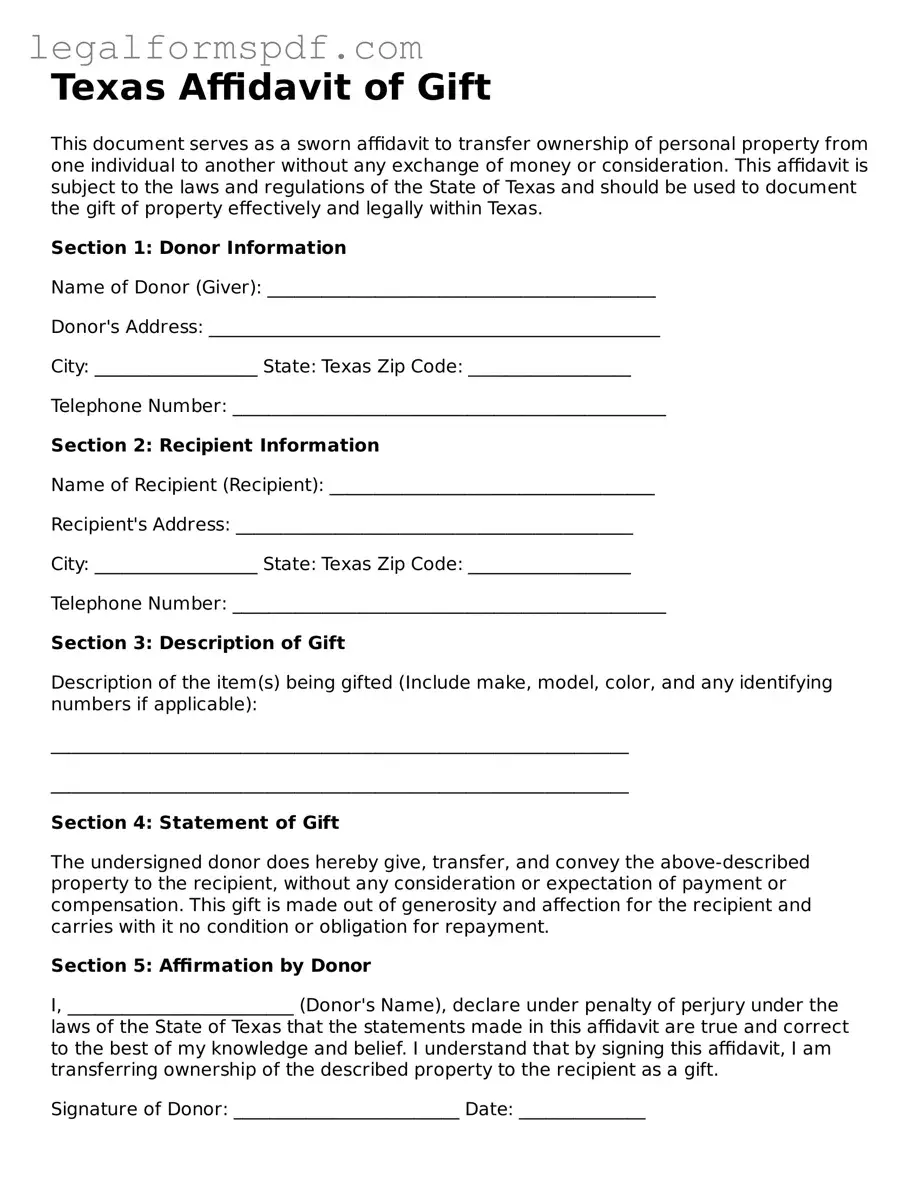

Document Example

Texas Affidavit of Gift

This document serves as a sworn affidavit to transfer ownership of personal property from one individual to another without any exchange of money or consideration. This affidavit is subject to the laws and regulations of the State of Texas and should be used to document the gift of property effectively and legally within Texas.

Section 1: Donor Information

Name of Donor (Giver): ___________________________________________

Donor's Address: __________________________________________________

City: __________________ State: Texas Zip Code: __________________

Telephone Number: ________________________________________________

Section 2: Recipient Information

Name of Recipient (Recipient): ____________________________________

Recipient's Address: ____________________________________________

City: __________________ State: Texas Zip Code: __________________

Telephone Number: ________________________________________________

Section 3: Description of Gift

Description of the item(s) being gifted (Include make, model, color, and any identifying numbers if applicable):

________________________________________________________________

________________________________________________________________

Section 4: Statement of Gift

The undersigned donor does hereby give, transfer, and convey the above-described property to the recipient, without any consideration or expectation of payment or compensation. This gift is made out of generosity and affection for the recipient and carries with it no condition or obligation for repayment.

Section 5: Affirmation by Donor

I, _________________________ (Donor's Name), declare under penalty of perjury under the laws of the State of Texas that the statements made in this affidavit are true and correct to the best of my knowledge and belief. I understand that by signing this affidavit, I am transferring ownership of the described property to the recipient as a gift.

Signature of Donor: _________________________ Date: ______________

Section 6: Notarization (If Applicable)

This section to be completed by a Notary Public if required/applicable.

State of Texas

County of ___________________

On this day, ____________________, before me, _________________________ (Name of Notary Public in and for the State and County aforesaid, personally appeared _________________________ (Name of Donor), known to me (or satisfactorily proven) to be the person whose name is subscribed to within this instrument, and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

____________________________________

Notary Public for the State of Texas

My Commission Expires: _______________

PDF Specifications

| Fact | Detail |

|---|---|

| Definition | An Affidavit of Gift is a legal document used to prove that an item was given as a gift from one person to another without any expectation of payment or return. |

| Usage in Texas | In Texas, this form is often used for the gifting of a motor vehicle, wherein the giver transfers ownership to the receiver without financial compensation. |

| Governing Law | The form is governed by Texas state law, particularly statutes related to the gifting and transfer of personal property, including motor vehicles. |

| Requirements for Validity | The form must be completed accurately, include all required information, and be signed by both the giver and the receiver of the gift. |

| Witnesses or Notarization | Depending on the type of gift and its value, the affidavit might need to be notarized or witnessed to ensure its validity under Texas law. |

| Impact on Taxes | Using an Affidavit of Gift may have implications for taxes, both for the giver and the receiver, under certain conditions. |

| DMV Requirements | When gifting a vehicle, the Texas Department of Motor Vehicles requires this affidavit to be submitted along with the vehicle title and other necessary documentation for the transfer. |

| No Exchange of Money | The form explicitly states that no money has been exchanged for the gift, distinguishing it from a sale. |

| Legal Disputes | Should disagreements arise regarding the gift, this affidavit serves as evidence of the intent and agreement between the parties at the time of transfer. |

Instructions on Writing Texas Affidavit of Gift

Completing the Texas Affidavit of Gift form is a necessary step when a vehicle is given as a gift between two parties. This document is vital for officially transferring vehicle ownership without the exchange of money. To ensure the process is navigated smoothly, follow these outlined steps. Remember, accuracy is key to avoiding any delays or issues with the transfer.

- Begin by entering the vehicle's information at the top of the form. This includes the make, model, year, and Vehicle Identification Number (VIN).

- Next, fill in the donor's (giver’s) full legal name and address. Ensure this matches their identification and any other documents provided.

- Enter the recipient's (receiver’s) full legal name and address with the same level of accuracy.

- Detail the relationship between the donor and the recipient. Be specific to avoid any ambiguity.

- If applicable, specify any lien or encumbrance on the vehicle. If the vehicle is clear of liens, state this clearly.

- Both the donor and recipient must sign and date the form in the designated sections. These signatures must be witnessed and notarized to validate the affidavit.

- Review the completed form for accuracy. Ensure all information is correct and that there are no omissions.

- Submit the completed form to the Texas Department of Motor Vehicles or the county tax office, depending on local requirements. You may need to provide additional documentation, such as a title transfer form.

- Keep a copy of the submitted form for your records.

Following these steps will aid in a seamless vehicle transfer process. Remember, this affidavit is an official document that should reflect the true intention of gifting a vehicle. Honesty and accuracy in filling out the form are paramount to uphold the integrity of the vehicle transfer.

Understanding Texas Affidavit of Gift

What is an Affidavit of Gift form in Texas?

An Affidavit of Gift form in Texas is a legal document used when someone gives another person a gift that has significant value, like a car or a piece of land. This form is a way to officially document the transfer of the item from one person to another without any payment being exchanged. It's mainly used to inform the relevant authorities, like the Texas Department of Motor Vehicles (DMV), about the gift for record-keeping and tax purposes.

Who needs to fill out an Affidavit of Gift form in Texas?

Anyone who gives or receives a significant gift in Texas, such as a vehicle, may need to fill out this form. Specifically, the giver (donor) of the gift fills out the form to document the transfer and provide proof that the item was indeed given as a gift. This is particularly important for the receiver (donee) when updating official records or addressing any tax responsibilities.

Where can I get an Affidavit of Gift form in Texas?

You can obtain an Affidavit of Gift form from the Texas Department of Motor Vehicles (DMV) website. Additionally, the form may be available at local DMV offices or possibly at county clerk's offices, depending on your area. Some legal document websites also offer the form, but be sure to get it from a reliable source to ensure it is the correct document.

Is there a cost to file an Affidavit of Gift in Texas?

Typically, there is no fee to file an Affidavit of Gift itself; however, the recipient of the gift may be responsible for paying a fee when they register the gifted item in their name, such as a vehicle registration fee. It's best to check with the Texas DMV or the relevant local authority for the most accurate and current information regarding any associated costs.

Are there any tax implications when filling out an Affidavit of Gift in Texas?

While the act of gifting itself might not immediately trigger taxes, there could be future tax implications for the recipient or the giver. For instance, if the gift is a vehicle, the recipient might have to pay a new owner tax when registering the vehicle. Additionally, for very high-value gifts, there might be federal gift tax implications. It's advisable to consult with a tax professional to understand any potential tax obligations.

What information do I need to complete the Affidavit of Gift?

To fill out an Affidavit of Gift, you'll need detailed information about both the giver and the recipient, including full names and addresses. You also need a thorough description of the gift, including, for example, the make, model, and year if the gift is a vehicle, along with the vehicle identification number (VIN). The form must also be signed and dated by the giver, and in some cases, notarization may be required.

Does the Affidavit of Gift need to be notarized in Texas?

In many cases, yes, the Affidavit of Gift requires notarization in Texas. This means the giver must sign the document in front of a notary public, who verifies the identity of the signer and ensures that the signature is genuine. Notarization helps prevent fraud and protects the interests of both the giver and the recipient by formally validating the authenticity of the document.

Common mistakes

When completing the Texas Affidavit of Gift Form, a common pitfall involves not thoroughly reading the instructions before beginning. This oversight can lead to misunderstandings about the required information and how it should be presented. It's imperative that each section is approached with a clear understanding of its purpose to ensure accurate and complete information is provided.

Another frequent mistake is failing to correctly identify the donor and recipient. The names and addresses of both parties must be accurately filled in, reflecting their legal identification documents. This error can cause unnecessary delays or even invalidate the document, complicating the gift transfer process.

Filling out the form without detailing the relationship between the donor and the recipient is also a common oversight. Clarifying this relationship is crucial, as it impacts the tax implications of the gift. Incomplete information on this aspect can raise questions about the legitimacy of the transfer, potentially bringing unwanted attention from tax authorities.

Many also neglect to specify the date of the gift accurately. The date of transfer is essential not just for record-keeping but also for any tax considerations that may apply. An incorrect date can lead to complications in establishing when the property officially changed hands, affecting the recipient's ownership rights.

A significant number of individuals overlook the requirement to describe the gifted property with sufficient detail. It is important to include a clear, thorough description of the item or property being gifted, including any identifying numbers or features. This description ensures that there is no ambiguity about what is being transferred, safeguarding both the donor's and recipient’s interests.

Not securing a notary's services to witness the signing of the document is another common error. The presence of a notary public during the signing lends credibility to the affidavit, formally acknowledging the authenticity of the signatures. Without notarization, the document may not be considered legally binding, which could invalidate the gift transfer.

Finally, individuals often submit the Texas Affidavit of Gift Form without keeping a copy for their records. Maintaining a copy is vital for future reference, especially if any questions arise regarding the terms of the gift or its valuation. This foresight can prevent potential legal disputes and ensure that both parties have access to the agreed terms of the gift.

Documents used along the form

When transferring ownership of a vehicle or other property as a gift in Texas, several documents may accompany the Affidavit of Gift form to ensure the transaction complies with state laws and regulations. These documents help to establish the details of the gift, the identities of the parties involved, and any conditions related to the transfer. They also serve to protect both the giver and the receiver from potential future disputes or confusion regarding the transfer. Below is a list of documents often used in conjunction with the Texas Affidavit of Gift form.

- Vehicle Title: The legal document issued by the state that proves ownership of the vehicle. It must be transferred to the new owner to complete the gift process.

- Bill of Sale: Although not always required when a vehicle is gifted, a bill of sale provides a record of the transfer for tax purposes and may be requested for registration and titling.

- Odometer Disclosure Statement: Federal and state laws require that the seller disclose the vehicle's odometer reading at the time of the sale or transfer, even if it is a gift.

- Application for Texas Title and/or Registration (Form 130-U): This form is required to register the vehicle in the new owner’s name and to apply for a new title.

- Proof of Insurance: Proof that the new owner has insured the vehicle. Most states, including Texas, require proof of insurance to register a vehicle.

- Release of Lien: If there was a lien on the vehicle, this document from the lienholder is necessary to show that it has been satisfied and that the lienholder has no further claim on the vehicle.

- Photo Identification: Copies of a government-issued photo ID for both the giver and the receiver are often required to verify identities during the transfer process.

- Power of Attorney: If either party cannot be present to sign the necessary documents, a Power of Attorney may be used to grant someone else the authority to sign on their behalf.

- Safety Inspection Certificate: In some cases, a current vehicle safety inspection certificate may be required to register the vehicle.

- Death Certificate: If the vehicle is being transferred due to the death of the previous owner, a copy of the death certificate might be required in addition to a will or other legal documents proving the right of ownership.

Together, these documents form a comprehensive package that supports the transfer of vehicle ownership as a gift. They ensure that the process is carried out smoothly, legally, and with due diligence, providing peace of mind to both the giver and the recipient. It’s advisable for individuals to check the specific requirements of their local county tax office in Texas, as requirements can vary slightly from one county to another.

Similar forms

The Texas Affidavit of Gift form shares similarities with the Bill of Sale document, primarily in its function to transfer ownership of property from one individual to another. Both documents serve as legal evidence of the transaction, detailing the specifics of the item being transferred, the parties involved, and the conditions under which the transfer takes place. Unlike the Affidavit of Gift, which records the transfer as a gift without consideration, the Bill of Sale typically involves a purchase price or exchange of value.

Another document akin to the Texas Affidavit of Gift form is the Deed of Gift. Both are utilized to convey property rights from one party to another without financial compensation. While the Affidavit of Gift is commonly used for personal property or vehicles, the Deed of Gift pertains to the transfer of real estate ownership. Each document is crucial in documenting the transfer and establishing the new owner's legal rights, reinforcing the importance of formally recording such transactions.

The Transfer on Death (TOD) deed also bears resemblance to the Texas Affidavit of Gift form, with both designed to transfer assets upon the owner's death. The TOD deed allows property owners to name beneficiaries who will inherit the property without the need for probate court proceedings. While the Affidavit of Gift effects immediate change in ownership, the TOD deed is contingent on the death of the property owner, highlighting a key difference in their operative conditions.

The Gift Letter is closely related to the Texas Affidavit of Gift form, as both certify that a transfer of property or funds has been made as a gift. This document is particularly relevant in financial transactions, such as when a family member provides a monetary gift to another family member for a home purchase. Both documents confirm that the transfer is a gift rather than a loan, affirming that no repayment is expected. This distinction is vital for tax implications and legal clarity.

Lastly, the Quitclaim Deed shares a connection with the Texas Affidavit of Gift form in its function of transferring property interest from one individual to another. The Quitclaim Deed, however, does not guarantee the grantor’s ownership status or ensure the property is free of claims or liens; it simply transfers whatever interest the grantor has, if any. Though differing in guarantees, both documents are pivotal in changing ownership titles and must be accurately completed and filed with relevant authorities to ensure legal acknowledgment of the transfer.

Dos and Don'ts

When it comes time to fill out the Texas Affidavit of Gift form, it's essential to approach the task with care and attention to detail. The document plays a crucial role in the process of transferring ownership of personal property, such as a vehicle, from one person to another without any payment involved. To ensure the process goes smoothly, here are seven do's and don'ts to keep in mind:

- Do thoroughly read the entire form before beginning to fill it out. This ensures you understand all the requirements and provide accurate information.

- Do use black or blue ink to complete the form, as these colors are typically required for legal documents to ensure readability and permanence.

- Do verify all the information with the recipient of the gift to ensure the details regarding the vehicle (or other property) are accurate.

- Do include all necessary documentation that the form requires, such as proof of the relationship between the giver and the recipient, if applicable.

- Don't leave any sections blank. If a section does not apply, it's better to indicate this with a "N/A" (not applicable) or "None" to show that you didn't overlook it.

- Don't guess on any details. It's crucial to provide accurate information to avoid legal issues or delays in the process. If you're unsure about a piece of information, take the time to verify it.

- Don't sign the form without a notary present, if one is required. Some affidavits must be notarized to be legally valid, so it's important to read the instructions carefully and comply with this requirement.

Following these guidelines will help ensure that the process of gifting a vehicle or other property goes smoothly and according to legal standards. Paying close attention to detail and proceeding with care will save time and prevent potential complications down the line.

Misconceptions

When it comes to transferring ownership of personal property or vehicles in Texas, an Affidavit of Gift form often comes into play. However, misconceptions about the use and implications of this document can lead to confusion and unintended legal consequences. Let’s address some common misunderstandings.

Form is only valid for vehicle transfers: While often associated with the transfer of vehicles, the Texas Affidavit of Gift form can also be used for transferring other types of personal property without a monetary exchange. It is not limited solely to vehicles.

No tax implications: Some people mistakenly believe filing an Affidavit of Gift completely avoids taxes. While it may exempt the transaction from sales tax, other tax implications, such as federal gift tax, may still apply depending on the value of the gift.

Immediate family members only: The misconception that gifting through this affidavit is restricted to immediate family members isn’t accurate. The form can be used for gifts between non-family members, although additional proof might be requested to ensure the transaction isn't a sale disguised as a gift.

Does not require notarization: It’s a common misconception that the form doesn’t need to be notarized. In Texas, notarization is required to verify the signer’s identity and to ensure the document’s enforceability.

Once signed, the transfer is effective immediately: Simply signing the affidavit does not complete the transfer. The form must be filed appropriately with the Texas Department of Motor Vehicles or another relevant agency, depending on the type of property being gifted.

No need for additional documentation: This misunderstanding can lead to legal issues. Often, additional documentation is required, such as a title or registration associated with the item being gifted, to complete the transfer process effectively.

Gifting eliminates all future liability: Givers sometimes think that once they’ve transferred the gift, they’re no longer liable for anything related to the property. However, if the proper transfer procedures aren’t followed, the original owner may still be held responsible for certain liabilities.

The form serves as proof of ownership: Filing an Affidavit of Gift does not by itself serve as proof of ownership. The recipient must take further steps, such as transferring the title into their name, to legally establish ownership.

Validity in other states: People often assume that once completed, the Texas Affidavit of Gift is recognized in all states. However, transferring ownership of property to someone in another state may require additional steps to meet that state’s legal requirements.

Understanding the nuances of the Texas Affidavit of Gift form can ensure that gifts are transferred lawfully and that both giver and recipient can proceed with confidence. It is advisable to consult with a legal professional to navigate the specific requirements and potential tax implications associated with gifting personal property.

Key takeaways

When gifting a vehicle in Texas, the Texas Affidavit of Gift form is a critical document that plays a significant role in the transfer process. Understanding how to properly fill out and use this document ensures that the gift of a vehicle is legally recognized and correctly processed. Here are key takeaways to consider:

- Ensure all information is accurate and complete. The affidavit requires specific details about the donor (giver) and the recipient (receiver), including full names, addresses, and identification information. It's also necessary to accurately describe the vehicle being gifted, incorporating its make, model, year, and Vehicle Identification Number (VIN).

- Both the donor and the recipient must sign the affidavit. Signatures are a critical component of the affidavit, symbolizing that both parties agree to and acknowledge the gift. These signatures must also be notarized to verify the identity of the signers and the authenticity of their signatures.

- There are tax implications. While gifting a vehicle in Texas may exempt the recipient from certain taxes, it's essential to understand that the Texas Comptroller may require the recipient to provide proof of the vehicle's value. The donor should fill out Form 14-317 to ensure compliance with state tax requirements.

- File with the Texas Department of Motor Vehicles. Once the affidavit is fully completed and notarized, it must be submitted with the vehicle title to the Texas Department of Motor Vehicles (DMV) to officially transfer ownership. Filing this document correctly is essential for updating the vehicle's records.

- There's no monetary exchange. The affidavit of gift specifically indicates that the vehicle is being transferred as a gift without any exchange of money. If the DMV suspects a sale rather than a gift, both parties could face legal and financial repercussions. Be clear and truthful about the nature of the transfer.

By taking these key points into account, individuals can navigate the process of gifting a vehicle in Texas with confidence, ensuring that all legal requirements are met and the process is completed smoothly.

More Affidavit of Gift State Forms

Affidavit for Gifting a Car Florida - The affidavit can be an important document in maintaining clear and legal boundaries in relationships, especially in matters of valuable gifts.