Fillable Affidavit of Gift Document for Florida

When a gift of significant value, such as a vehicle or a parcel of real estate, changes hands in Florida, the transfer is not as simple as handing over a set of keys or a deed. The process legitimizes through documentation, primarily via the Florida Affidavit of Gift form. This essential document serves multiple purposes: it clarifies the item as a gift, thus distinguishing it from a sale or commercial transaction, and it releases the giver from any further financial obligations related to the item, including taxes that typically accompany a sale. Additionally, for the receiver, this affidavit is a critical piece in avoiding unnecessary taxation, as it proves the item was received as a gift. Its role in formalizing the transfer of ownership without the exchange of money underscores its importance in the legal landscape of property and asset management in Florida. By navigating the specifics of this form, both the giver and the receiver can ensure a smooth transition, free from potential legal complications. This process underscores the affidavit's value in facilitating such transitions within the state's regulatory framework.

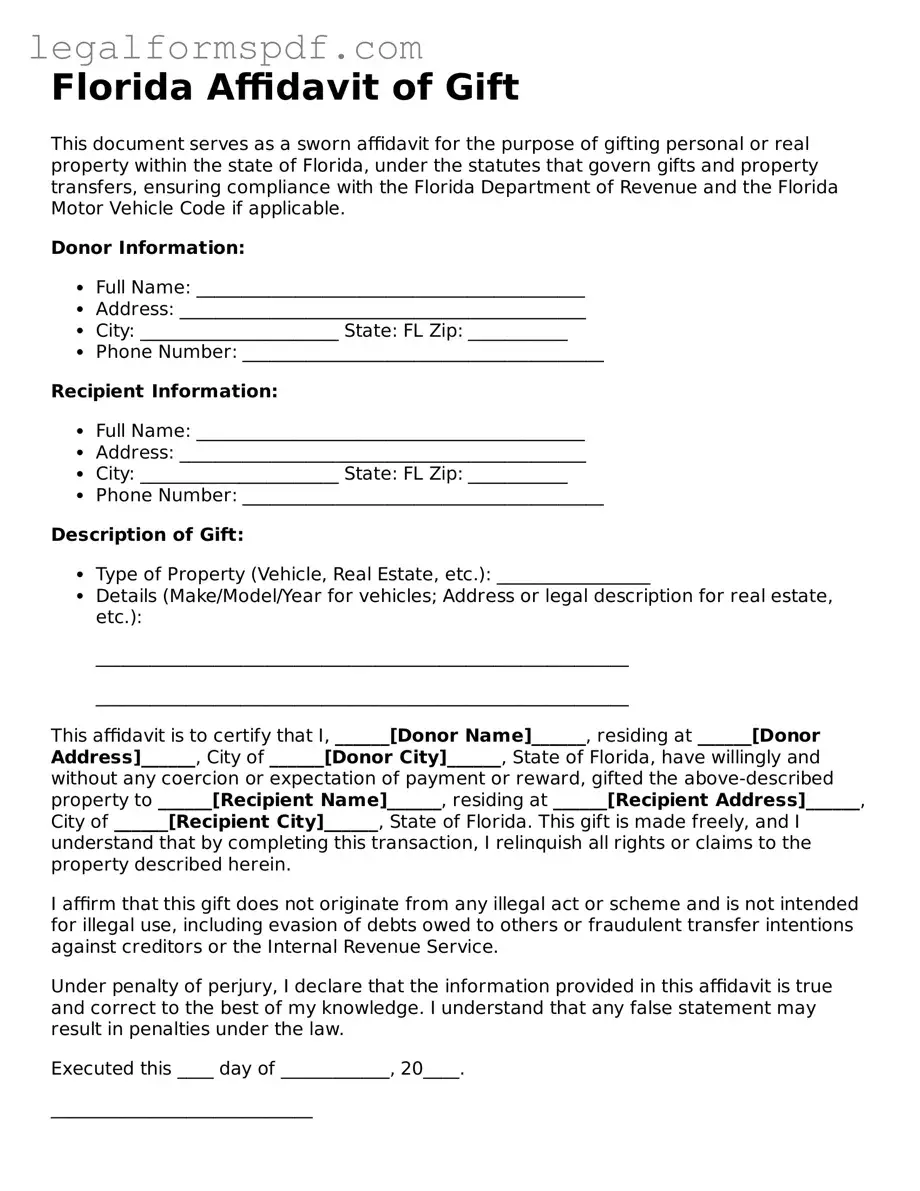

Document Example

Florida Affidavit of Gift

This document serves as a sworn affidavit for the purpose of gifting personal or real property within the state of Florida, under the statutes that govern gifts and property transfers, ensuring compliance with the Florida Department of Revenue and the Florida Motor Vehicle Code if applicable.

Donor Information:

- Full Name: ___________________________________________

- Address: _____________________________________________

- City: ______________________ State: FL Zip: ___________

- Phone Number: ________________________________________

Recipient Information:

- Full Name: ___________________________________________

- Address: _____________________________________________

- City: ______________________ State: FL Zip: ___________

- Phone Number: ________________________________________

Description of Gift:

- Type of Property (Vehicle, Real Estate, etc.): _________________

- Details (Make/Model/Year for vehicles; Address or legal description for real estate, etc.):

___________________________________________________________

___________________________________________________________

This affidavit is to certify that I, ______[Donor Name]______, residing at ______[Donor Address]______, City of ______[Donor City]______, State of Florida, have willingly and without any coercion or expectation of payment or reward, gifted the above-described property to ______[Recipient Name]______, residing at ______[Recipient Address]______, City of ______[Recipient City]______, State of Florida. This gift is made freely, and I understand that by completing this transaction, I relinquish all rights or claims to the property described herein.

I affirm that this gift does not originate from any illegal act or scheme and is not intended for illegal use, including evasion of debts owed to others or fraudulent transfer intentions against creditors or the Internal Revenue Service.

Under penalty of perjury, I declare that the information provided in this affidavit is true and correct to the best of my knowledge. I understand that any false statement may result in penalties under the law.

Executed this ____ day of ____________, 20____.

_____________________________

Signature of Donor

State of Florida County of ___________________

Subscribed and sworn to (or affirmed) before me this ____ day of ____________, 20____, by ______[Donor Name]______, who is personally known to me or has produced ___________________ as identification.

_____________________________

Signature of Notary Public

My Commission Expires: ___________

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | Used to legally document the gift of an item or property from one person to another without any payment in return in Florida. |

| Governing Law | This form is governed by the laws of the State of Florida, especially those pertaining to gifts and property transfers. |

| Required Information | Must include the full names and addresses of the donor (giver) and recipient, a detailed description of the gift, and the date of the gift. |

| Witness Requirement | The signing of this document must be witnessed by at least two individuals for it to be considered valid under Florida law. |

| Notarization | While not always required, having the Affidavit of Gift notarized can add an extra layer of legal protection and authenticity. |

| Specific Uses | Often used for the transfer of vehicles or other high-value items to ensure the recipient can prove ownership and register the item if necessary. |

| Revocation | Once the gift is given and the affidavit is completed, the donor typically cannot revoke the gift without the recipient's agreement. |

Instructions on Writing Florida Affidavit of Gift

When you're ready to officially transfer a gift of property or item in Florida without any payment being exchanged, you’ll need to fill out the Florida Affidavit of Gift form. This document is crucial for documenting the transfer and ensuring it's recognized as a legitimate gift under state law. Whether you're gifting a car, a piece of heirloom jewelry, or anything of value, correctly completing this form is essential for both the giver and receiver. Here's a straightforward guide to help you through each part of the form without any stress.

- Start by entering the date the affidavit is being filled out at the top of the form.

- Fill in the full name and address of the donor (the person giving the gift).

- Next, add the recipient's (the person receiving the gift) full name and address.

- Describe the gifted item in detail in the designated section. If it's a vehicle, for instance, include the make, model, year, and VIN (Vehicle Identification Number).

- State the relationship between the donor and the recipient. Are they family members, friends, or something else?

- If applicable, specify the reason for the gift. This isn’t always required, but it can be helpful to provide context, especially for significant gifts.

- Both the donor and the recipient must sign and date the form in the presence of a notary public.

- Finally, have the form notarized. This means the notary will sign the document and add their official seal, officially witnessing the signatures and identities of both parties.

Filling out the Florida Affidavit of Gift form is a straightforward process when you know what information is needed. Take it one step at a time, and you'll have successfully documented the transfer of your generous gift, complete with legal authentication. Always remember to keep a copy of the form for your records and provide one to the recipient as well. This document can be invaluable for tax purposes or as proof of the gift's transfer.

Understanding Florida Affidavit of Gift

What is a Florida Affidavit of Gift form?

An Affidavit of Gift form in Florida is a legal document used when someone gives another person a gift of significant value, like a car or a piece of property, and wants to document the transaction. This affidavit serves as a formal declaration, made under oath, where the giver states that the item is indeed a gift, free of any payment, encumbrances, or expectations of anything in return.

Why is it necessary to have an Affidavit of Gift form in Florida?

While it might seem like an extra step, having an Affidavit of Gift can simplify matters of ownership and taxation down the road. In Florida, this document is particularly useful for registering and insuring vehicles, transferring real estate, or any situation where proving the nature of a transaction as a gift can exempt the recipient from certain taxes or fees. It also provides a clear, legal record that can protect both parties in potential future disputes.

Who needs to sign the Florida Affidavit of Gift form?

The person giving the gift (the donor) must sign the affidavit, attesting to the facts stated within it under oath. In addition, a notary public must also witness the signing and apply their official seal to the document, making it legally binding. Depending on the nature of the gift and the requirements of local jurisdiction, the recipient (the donee) may also need to sign, acknowledging receipt of the gift.

What information is required to fill out the Affidavit of Gift form in Florida?

Completing the Affidavit of Gift requires specific information to ensure its validity. This includes the full names and addresses of both the donor and the donee, a detailed description of the gift (including identifying numbers like VINs for vehicles or parcel numbers for property), the date of the gift, and any conditions or restrictions attached to the gift. Additionally, the document must include a statement by the donor declaring the intention to make the gift without any expectation of payment or compensation.

Can the Affidavit of Gift in Florida be revoked once it's signed?

Once an Affidavit of Gift is signed, notarized, and given to the recipient, it becomes a legally binding document that verifies the transfer of the gift from the donor to the donee. As such, revoking the affidavit is not straightforward and can involve complex legal procedures. Typically, revocation is only possible if both parties agree, or if the donor can prove that there was coercion, fraud, or a significant misunderstanding at the time the affidavit was signed. For these reasons, it's important to be certain of the decision to gift before completing and signing the affidavit.

Common mistakes

One common mistake people make when filling out the Florida Affidavit of Gift form is not properly identifying the vehicle. It is crucial that the Vehicle Identification Number (VIN), make, model, and year are accurately recorded. Without this information correctly provided, the affidavit cannot be properly processed, leading to potential delays or rejections.

Another oversight often encountered is failing to list the correct recipient information. The name, address, and relationship to the giver must be clearly and correctly detailed. Errors in this section can lead to confusion and complications in establishing the new ownership in official records.

Signatures are a critical component of the Affidavit of Gift form, and yet, they are frequently mishandled. Signatures of both the donor and the recipient are required. However, people often forget to ensure that these are fully completed. Additionally, failing to have the signatures notarized, when necessary, can invalidate the document.

Date errors also pose a significant problem. The date of the gift must be accurately recorded. Sometimes, people put the current date instead of the actual date the gift was transferred. This mistake can lead to issues with tax assessments and other time-sensitive matters.

Incorrectly handling the odometer disclosure is another pitfall. For vehicles less than ten years old, the actual mileage must be disclosed. Discrepancies or inaccuracies in this section can raise suspicions of fraud or lead to issues with future vehicle sales.

People sometimes misunderstand the purpose of the form and include irrelevant or incorrect information. For instance, detailing financial transactions or agreements that are not pertinent to the gift transaction can cause confusion. The Affidavit of Gift is intended to certify that the vehicle was given without any expectation of compensation, and extraneous details can muddle this declaration.

Forgetting to address liens on the vehicle is another critical oversight. If the vehicle has an outstanding lien, this must be disclosed and addressed per Florida regulations. Failure to do so can result in legal complications for both the giver and the recipient.

Not using the most current form version can also lead to issues. The State of Florida periodically updates the Affidavit of Gift form and its requirements. Using an outdated form can mean missing new declarations or instructions, potentially rendering the affidavit unacceptable.

Lastly, a lack of attention to detail, in general, can lead to mistakes. Rushing through the form without carefully reviewing each section for accuracy and completeness can result in errors. Each piece of information on the form plays a crucial role in the legal transfer of the vehicle as a gift, emphasizing the importance of diligence during completion.

Documents used along the form

When you're handling the transfer of a gift, especially one as significant as a vehicle in Florida, the Affidavit of Gift form is just a starting point. To ensure a smooth and legally sound transfer, there are often several other forms and documents you need to consider. Each plays a critical role in the process, offering protection, legal clarity, and compliance with state laws. Below is a list of documents that are frequently used alongside the Florida Affidavit of Gift.

- Title Transfer Form – This form officially transfers the title of the vehicle from the giver to the recipient. It's a necessary step to prove ownership and register the vehicle.

- Bill of Sale – Even though money may not exchange hands in a gift transaction, a Bill of Sale can still serve as a recorded agreement that the vehicle was transferred from one party to another without compensation.

- Vehicle Registration Application – The recipient of the gift must apply to register the vehicle in their name with the Florida Department of Highway Safety and Motor Vehicles (DHSMV).

- Odometer Disclosure Statement – Federal law requires that the mileage of a vehicle being transferred is disclosed at the time of the sale or gift. This statement is part of that process.

- Proof of Insurance – The new owner must provide proof of insurance to register the vehicle in Florida. This document confirms the vehicle is covered under a current insurance policy.

- Vehicle Inspection Report – Depending on the age and type of the vehicle, a safety inspection or emissions test may be required to complete registration.

- Power of Attorney – If the gift giver or recipient cannot be present to sign the necessary documents, a Power of Attorney may be needed to authorize another person to act on their behalf.

Navigating the process of transferring a vehicle as a gift in Florida requires attention to detail and understanding the necessary legal documents. The Affidavit of Gift is crucial, but it's equally important to be prepared with the right accompanying documents. By being thorough and cautious, both the giver and the recipient can ensure that the transfer is conducted smoothly and in accordance with the law.

Similar forms

The Florida Affidavit of Gift form shares similarities with the Promissory Note. Both documents formalize the transfer of something valuable from one party to another. In the case of the Promissory Note, it typically involves a promise to pay back a loan, detailing the terms under which the repayment will occur. Similar to the Affidavit of Gift, it creates a written record of the transaction, but with the Affidavit, it's a transfer without the expectation of repayment.

Another document akin to the Florida Affidavit of Gift is the Bill of Sale. Both serve as proof of a transaction; however, the Bill of Sale is used primarily for the purchase and sale of goods and services. It includes information about the buyer, the seller, and the item sold, similar to how the Affidavit of Gift details the giver and the recipient of the gift. The key difference lies in the transaction's nature: one involves a sale, while the other represents a gift.

The Deed of Gift is also comparable to the Florida Affidavit of Gift form. Specifically designed for the transfer of property or ownership of goods without payment, the Deed of Gift closely mirrors the intent behind the Affidavit of Gift, which is to document the voluntary transfer of property from one person to another without any consideration. Both documents are used to legally recognize the transfer of ownership without financial compensation.

The Warranty Deed bears resemblance to the Florida Affidavit of Gift by its function of transferring property; however, it comes with the assurance that the grantor holds a clear title to the property. While the Affidavit of Gift documents the transfer of an asset as a gift, the Warranty Deed is used in transactions that guarantee the property is free from liens or claims. Both documents ensure that a property transfer is formally recorded, yet each provides different levels of protection and guarantees to the parties involved.

Similarly, the Quitclaim Deed aligns with the Florida Affidavit of Gift form in its purpose to convey property rights from one person to another. Unlike the more protective Warranty Deed, the Quitclaim Deed provides no guarantees about the property's title, similar to the Affidavit of Gift, which also does not warrant the property's condition. Both are straightforward ways to transfer interest in property, but they offer minimal legal assurances to the recipient.

The Gift Letter is another document related to the Florida Affidavit of Gift. Often used in financial transactions, especially in the context of obtaining a mortgage, it verifies that funds given from one individual to another are indeed a gift and not a loan. This distinction is critical for lenders to understand the nature of the recipient’s financial resources. The Gift Letter and the Affidavit of Gift both serve to clarify that the transfer of property or funds is meant as a gift, requiring no repayment.

Lastly, the Trust Transfer Deed shares similarities with the Florida Affidavit of Gift as it facilitates the transfer of property into a trust, usually as a gift. It's a tool for estate planning, ensuring that assets are transferred according to the grantor's wishes, much like the Affidavit of Gift which documents the intention to gift property. Both items are integral in planning future asset distribution without immediate compensation or expectation of return.

Dos and Don'ts

Filling out the Florida Affidavit of Gift form is a crucial step in the gifting process of a vehicle or other property, ensuring the transaction is recognized by law without unnecessary taxation. To make this process smoother and error-free, here are important dos and don'ts to keep in mind:

Do:- Ensure all details are accurate, including the full names and addresses of both the giver and the receiver. Mistakes can delay or invalidate the transaction.

- Include the specific details of the gift, such as make, model, and vehicle identification number (VIN) if the gift is a vehicle.

- Have the form notarized, as Florida law requires notarization for the validity of an Affidavit of Gift.

- Keep a copy of the completed and notarized affidavit for your records. It's crucial for both parties to have proof of the transaction.

- Submit the form to the appropriate Florida Department of Motor Vehicles (DMV) office, as different counties might have specific requirements.

- Attempt to fill out the form without having the vehicle's or item's documentation handy. Reference to official documents ensures accuracy.

- Ignore the requirement for a witness. Having a third party witness the signing and notarization can add a layer of legal protection.

By following these guidelines, you can help ensure the process goes smoothly, and both parties enjoy a legally valid transaction, free from potential headaches down the road. Remember, taking the time to fill out the Affidavit of Gift form properly is not just about adhering to legal requirements—it's about providing peace of mind for both the giver and the receiver.

Misconceptions

The Florida Affidavit of Gift form plays a crucial role in the process of gifting a vehicle, yet there are many misconceptions surrounding its use and requirements. These misunderstandings can lead to unnecessary complications. Let's clarify some of these common misconceptions:

It's only for motor vehicles. While the form is frequently associated with the gifting of cars or trucks, it can also be used for other types of personal property within the state that require a formal transfer of ownership without financial compensation. This includes boats and, in some instances, mobile homes.

Any notary can validate it. While it's true that a notary public must witness the signing of the affidavit, Florida law requires that the notary be licensed in the state. The form may not be accepted if it's notarized by an out-of-state notary without proper jurisdiction.

No tax implications. Many believe gifting a vehicle using the Affidavit of Gift form exempts them from all tax obligations. Although the immediate sales tax might be waived, the recipient may still be responsible for federal taxes or other state-imposed fees related to the gift, depending on the value of the vehicle.

Immediate family only. It's a common belief that only immediate family members can gift vehicles using this form. However, the state of Florida allows gifts between both family members and non-family members, as long as the proper documentation and conditions are met.

No need for a bill of sale. Assuming that the Affidavit of Gift negates the need for a bill of sale is a mistake. Although the affidavit does serve as proof that the vehicle was transferred as a gift, a bill of sale or similar document outlining the transfer of ownership may still be required for registration and legal purposes.

It finalizes the transfer of ownership. Completing and notarizing the Affidavit of Gift is a critical step, but it's not the final one. The recipient must submit this affidavit to the Florida Department of Motor Vehicles (DMV) along with other required documents to officially transfer the vehicle's title into their name.

Understanding the facts about the Florida Affidavit of Gift form helps streamline the process of gifting a vehicle, ensuring that all legal requirements are met without unexpected delays or issues.

Key takeaways

The Affidavit of Gift form in Florida serves a specific purpose, streamlining the process of transferring personal property as a gift, from one individual to another. Its correct completion and usage are crucial not only for the immediate transfer but also for future documentation and tax purposes. Here are five key takeaways about filling out and using this form effectively:

- Accuracy is paramount when completing the form. Every detail, including the full names of both the giver and the receiver, the description of the gifted property, and the exact date of the transfer, must be provided with precision. This ensures that the document serves its legal purpose without ambiguities.

- Notarization may be required. Depending on the type of gift and its value, a notary public may need to authenticate the signatures on the affidavit. This adds an extra layer of verification and legal standing to the document.

- Keep a record for tax purposes. Although the primary purpose of the affidavit is to document the transfer of ownership, it also plays a crucial role during tax season. Both parties should retain copies of the notarized affidavit to substantiate the transaction in case of inquiries from the Internal Revenue Service or local tax authorities.

- Understand the implications of gifting. It's essential for both the donor and recipient to be aware of any potential tax liabilities or exemptions related to the gift. Florida may have specific statutes that govern the taxation of gifted property, and these should be considered before completing the form.

- Legal advice may be beneficial. Given the potential complexities and legal ramifications of transferring valuable property, consulting with a legal expert can provide clarity and peace of mind. A knowledgeable advisor can offer insights into the affidavit's nuances and ensure that both parties comply with Florida law.

By adhering to these guidelines, individuals can navigate the intricacies of the Affidavit of Gift form in Florida. It's not merely a bureaucratic step but a significant legal action that requires careful attention to detail and an understanding of the broader legal and tax implications.

More Affidavit of Gift State Forms

Selling a Car in Texas - It provides peace of mind to the giver, as the affidavit formally acknowledges their act of generosity and the voluntary transfer of ownership.