Official Affidavit of Gift Document

When a person decides to give a significant gift, such as a car, to someone else without expecting compensation, the transaction becomes more than just a generous act; it enters the realm of legal formalities. This is where the Affidavit of Gift form plays a crucial role. Essentially, this document serves as a sworn statement, confirming that the giver, known as the donor, is willingly transferring ownership of an item to the recipient, known as the donee, without any payment or consideration in return. The form not only helps to clearly establish the intentions of both parties involved in the transfer but also acts as a critical piece of evidence that can prevent potential disputes or misunderstandings about the ownership of the item. Moreover, it satisfies legal requirements for gift transactions, which may vary from one jurisdiction to another, ensuring that the transfer adheres to the law. It is particularly important in transactions where titles to property, such as vehicles or real estate, are transferred, as it can significantly affect the taxation process and related legal obligations.

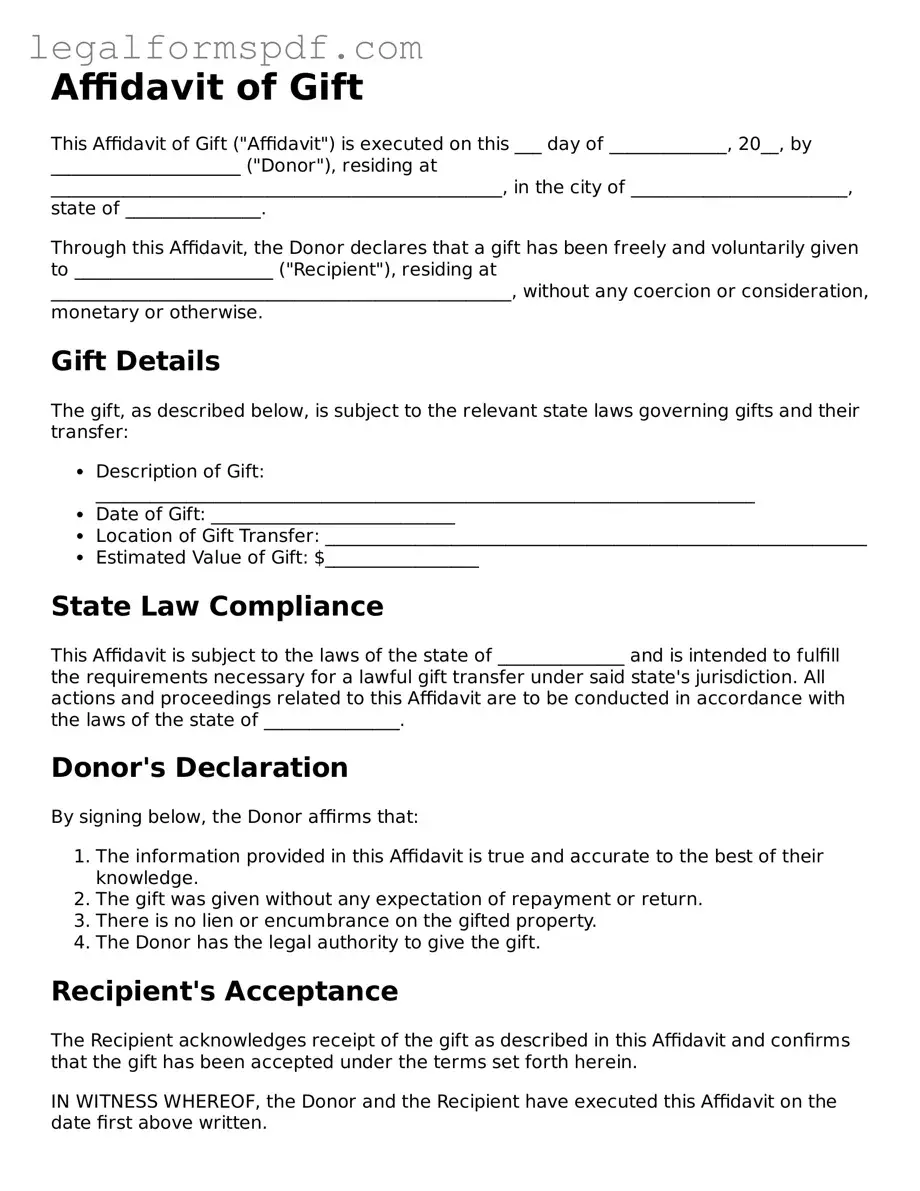

Document Example

Affidavit of Gift

This Affidavit of Gift ("Affidavit") is executed on this ___ day of _____________, 20__, by _____________________ ("Donor"), residing at __________________________________________________, in the city of ________________________, state of _______________.

Through this Affidavit, the Donor declares that a gift has been freely and voluntarily given to ______________________ ("Recipient"), residing at ___________________________________________________, without any coercion or consideration, monetary or otherwise.

Gift Details

The gift, as described below, is subject to the relevant state laws governing gifts and their transfer:

- Description of Gift: _________________________________________________________________________

- Date of Gift: ___________________________

- Location of Gift Transfer: ____________________________________________________________

- Estimated Value of Gift: $_________________

State Law Compliance

This Affidavit is subject to the laws of the state of ______________ and is intended to fulfill the requirements necessary for a lawful gift transfer under said state's jurisdiction. All actions and proceedings related to this Affidavit are to be conducted in accordance with the laws of the state of _______________.

Donor's Declaration

By signing below, the Donor affirms that:

- The information provided in this Affidavit is true and accurate to the best of their knowledge.

- The gift was given without any expectation of repayment or return.

- There is no lien or encumbrance on the gifted property.

- The Donor has the legal authority to give the gift.

Recipient's Acceptance

The Recipient acknowledges receipt of the gift as described in this Affidavit and confirms that the gift has been accepted under the terms set forth herein.

IN WITNESS WHEREOF, the Donor and the Recipient have executed this Affidavit on the date first above written.

Donor Signature

___________________________________

Print Name: _________________________

Recipient Signature

___________________________________

Print Name: _________________________

Witness Signature (if required)

___________________________________

Print Name: _________________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | This form is used to legally document the gift of an item or sum of money from one person to another. |

| Key Components | Includes details of the donor and recipient, description of the gift, and the date of the gift. |

| Witness Requirement | Typically requires at least one witness or notary public to sign, verifying the gift. |

| No Exchange of Money | Affirms that the item or money is given freely without any expectation of payment or compensation. |

| State-Specific Forms | Some states may have specific requirements or forms to be used, adhering to local laws. |

| Common Uses | Often used for gifting vehicles, large sums of money, or real estate to avoid misunderstandings. |

| Tax Implications | May affect tax obligations; the IRS requires reporting for gifts over a certain amount. |

| Not a Contract | It does not establish a contract but solely documents a gift without future obligations. |

| Governing Law | Subject to the laws of the state where the gift is given and, if applicable, federal law. |

Instructions on Writing Affidavit of Gift

Completing an Affidavit of Gift requires careful attention to detail and accuracy, ensuring all necessary information is provided to legally document the transfer of personal or real property from one person to another without any exchange of money. This legal document is particularly useful for tax purposes and to avoid any misunderstandings regarding the gift's nature. Following the required steps to fill out the form correctly is crucial for the document to be valid and accepted by any involved legal or governmental entities.

- Identify the full legal names of both the giver (donor) and the receiver (donee) of the gift. Make sure to spell the names accurately as they appear on official identification.

- Describe the gifted item or property in detail. Include any identifying information such as serial numbers, model numbers, or legal descriptions for real estate. The more precise, the better.

- State the exact date the gift was or will be transferred. If the transfer is conditional, specify the conditions clearly.

- Include both parties' addresses. List the current addresses of the donor and donee to ensure they can be contacted if needed.

- Assert the relationship between the donor and donee, if applicable. Some states require this information for tax purposes.

- Clarify that the gift is given freely, without any expectation of payment or compensation. This statement confirms the transaction is a genuine gift.

- Detail any encumbrances or liabilities associated with the gift. If the item is being given free of liens or debts, state this explicitly.

- Have the donor sign the affidavit in the presence of a notary public. The donor's signature must be witnessed and the document notarized to confirm the identity of the signer and the voluntary nature of the gift.

- Record any additional acknowledgments or legal requirements as per state law. Some jurisdictions may have specific clauses or disclosures that need to be included.

Once the Affidavit of Gift is fully completed and notarized, it becomes a legally binding document. Both the donor and the donee should keep copies for their records. Depending on the nature of the gift and the laws of the jurisdiction, it may also be necessary to file this affidavit with a government body or legal entity to formalize the gift's transfer and to comply with any relevant tax laws. Following these steps ensures the smooth completion and legal acknowledgment of the gift transaction.

Understanding Affidavit of Gift

What is an Affidavit of Gift form?

An Affidavit of Gift form is a legal document that verifies the transfer of a gift from one person to another without any consideration or payment in return. This form serves as proof that the item or property has indeed been given as a gift. It is typically used to document the transfer of tangible goods, such as vehicles, or to attest to financial gifts for tax purposes. By completing this form, the giver legally declares that the item or sum of money has been willingly given to the recipient, who accepts it as a gift.

Why is it necessary to have an Affidavit of Gift form?

This form is crucial for several reasons. Firstly, it provides a formal record of the gift, helping prevent any future disputes over the ownership or origin of the item gifted. In the case of transferring a vehicle or large sums of money, it may be required by state authorities or financial institutions to ensure the transaction does not involve a sale or require taxation. Furthermore, it assists in the event of an audit by tax authorities, proving that the transfer was indeed a gift and not subject to gift tax, up to the allowed limits.

Who needs to sign the Affidavit of Gift form?

The Affidavit of Gift form must be signed by the donor, the person who is giving the gift, to acknowledge that they are transferring ownership without expecting any form of compensation. In many cases, the recipient is also required to sign the form, accepting the gift. This dual-signature requirement helps ensure that both parties recognize the transaction as a gift. Additionally, the form often needs to be notarized to verify the identity of the parties involved and the authenticity of their signatures.

Are there any tax implications associated with filing an Affidavit of Gift?

Yes, there can be tax implications when transferring a gift, and using an Affidavit of Gift form does not necessarily exempt one from these considerations. For gifts of significant value, the donor may be required to report the gift to the Internal Revenue Service and may be subject to gift tax, depending on the amount. However, there are annual and lifetime exemptions that can apply, potentially reducing or eliminating the gift tax owed. It is recommended to consult with a tax advisor to understand the specific implications for any large gift.

Common mistakes

When filling out an Affidavit of Gift form, it’s not uncommon for people to slip into a few errors, often without realizing it. One frequent mistake is leaving blank spaces. Each section of the form should be completed to ensure clarity. Leaving blank spaces not only causes confusion but may also result in the rejection of the form. It's important to fill in every field, even if the answer is "N/A" for not applicable.

Another area where errors occur is in the misidentification of the gift. Precise descriptions are crucial. Instead of vaguely identifying the gift, the donor should provide specific details like serial numbers or unique identifying features. This precise information helps in eliminating any ambiguity about what is being transferred.

A common oversight is neglecting to date the document. The date is crucial as it can affect the validity of the affidavit or its recognition by authorities. It's not just about having a date but ensuring that the date is correct and clearly written. This simple step is often overlooked but can significantly impact the document's legal standing.

People often forget to include a witness or notary public’s attestation. A notarized document or one witnessed by an impartial third party lends credibility and authenticity to the affidavit. This oversight can render the affidavit less effective or even unusable in certain legal contexts.

Underestimating the importance of a clear gift declaration is another mistake. The statement that the item is indeed a gift, with no expectation of payment or compensation in return, should be unequivocal. Ambiguities in this declaration can lead to legal complications, transforming what should be a straightforward gifting process into a complicated legal matter.

Incorrectly identifying the parties involved is an error that can have significant implications. The names of the donor and recipient should be spelled correctly and match their identification documents. Even minor discrepancies in names can raise doubts about the affidavit's validity.

A lack of signatures is a critical oversight. Both the donor and recipient must sign the affidavit to confirm their agreement and understanding of the gift transaction. Without these signatures, the document lacks the necessary personal endorsement to be considered legally binding.

Failure to check the need for additional documentation is another common pitfall. Depending on the nature of the gift and local laws, additional paperwork might be required. Ignoring this detail can delay or invalidate the entire process.

Last but not least, people often submit the affidavit without retaining a personal copy. Keeping a copy of the completed affidavit ensures that both parties have a record of the agreement and its specifics. This protective measure can be invaluable in resolving any future disputes or discrepancies regarding the gift transfer.

Documents used along the form

When transferring ownership through a gift, an Affidavit of Gift is a crucial document. However, it often requires additional documents to support the transaction fully and ensure legal compliance. Here is a list of forms and documents commonly used alongside the Affidavit of Gift to facilitate a smooth and legally sound transfer process.

- Bill of Sale: This document acts as evidence of the transaction, detailing the transfer of property from one person to another. It is particularly important when the gift involves items of substantial value, like vehicles or boats.

- Title Transfer Forms: For gifts involving vehicles or property, title transfer forms are necessary to legally transfer ownership from the giver to the recipient.

- Release of Liability: When transferring vehicles, this form protects the giver from liability for any future accidents or violations involving the vehicle.

- Gift Tax Return (Form 709): If the gift exceeds the annual exclusion limit set by the IRS, this form must be filed to report the gift for tax purposes.

- Proof of Relationship: Documentation proving the relationship between the giver and the recipient may be required, especially for tax purposes, to establish the legitimacy of the gift.

- Notarization Acknowledgment: This document confirms the identity of the parties involved and the voluntary nature of the gift, often required to give legal effect to the affidavit.

- Valuation Appraisal: For high-value gifts, a professional appraisal may be necessary to determine the fair market value of the item for tax and legal purposes.

- Photographic Evidence: Photos of the gifted item can serve as additional proof of the item's condition at the time of the gift and help in identifying specific features or models.

- Warranty or Manufacturer's Certificate: If the gift includes a warranty, transferring the manufacturer's certificate or warranty documents to the new owner is advisable.

Combining the Affidavit of Gift with these documents can help both the giver and the recipient ensure the legitimacy and legality of the gift transfer. Proper documentation protects the interests of both parties and helps in potential future legal or tax considerations.

Similar forms

The Affidavit of Gift form shares similarities with the Bill of Sale document. Just like the Affidavit of Gift form, which is used to formally transfer ownership of property without monetary exchange, the Bill of Sale serves as official documentation of a transaction between two parties. However, the key difference lies in the Bill of Sale being used in transactions where goods are sold and bought, reflecting a financial exchange, unlike the gift form which does not involve a purchase price.

Comparable to the Affidavit of Gift form is the Deed of Gift document. Both are used to transfer personal or real property from one party to another without compensation. Where they differ is in their typical application; the Deed of Gift is often used in real estate transactions to transfer property ownership, indicating a more formalized procedure, especially concerning real property, compared to the more flexible application of the Affidavit of Gift with various types of property.

Gift Letter forms also share a resemblance with the Affidavit of Gift. A Gift Letter is typically used by individuals to prove that money received from another person is genuinely a gift and not a loan that requires repayment. Unlike the Affidavit of Gift, which documents the transfer of tangible or intangible property, the Gift Letter focuses specifically on monetary gifts and is often required by lenders to ensure no additional debt on the recipient's part.

The Quitclaim Deed is another document related to the Affidavit of Gift form. It is primarily used to transfer any ownership, interest, or claim the grantor has in a property to the grantee, without guaranteeing that the title is clear. This similarity in transferring ownership rights without warranty ties the two; however, Quitclaim Deeds are specifically used for real estate transactions, whereas the Affidavit of Gift can apply to various property types.

Transfer-on-Death (TOD) Deed forms bear a resemblance to the Affidavit of Gift as well. Both permit the transfer of property without the necessity of going through probate court upon the owner's death. The TOD Deed, specifically, enables homeowners to name a beneficiary to whom the property will transfer upon their death, distinguishing it from the Affidavit of Gift which facilitates immediate transfer without future conditions.

The Trust Deed is somewhat similar to the Affidavit of Gift form since both involve transferring property. A Trust Deed, however, is used to secure a loan on real property, placing the real estate into a trust with a trustee holding it as security for the loan. This contrasts with the Affidavit of Gift, which is not used in the context of security interests or loans but rather for the outright gift of property.

A Promissory Note can also be compared to the Affidavit of Gift. While the Affidavit of Gift represents the transfer of property as a gift without expectation of payment, a Promissory Note is a written promise to pay a specified sum of money to another party under agreed terms. The two documents cater to opposite scenarios: one formalizes gifting, and the other formalizes a debt obligation.

Lastly, the General Warranty Deed is related to the Affidavit of Gift in its function of transferring property. The General Warranty Deed, however, transfers property with warranties from the seller that guarantee the property's title against any and all claims. This offers a level of protection to the buyer that the Affidavit of Gift does not, as the latter simply facilitates a gift transfer without warranties regarding the property's title.

Dos and Don'ts

When filling out the Affidavit of Gift form, it's important to be thorough and accurate to ensure the process goes smoothly. Here are some essential dos and don'ts to guide you:

Do:

- Read the entire form carefully before you start filling it out. This ensures you understand all the requirements and instructions.

- Use black ink or type your responses to ensure they are legible. This helps in avoiding any misunderstandings or processing delays.

- Include all requested details such as full names, addresses, and the specific details of the gift. Accuracy is key to validating the affidavit.

- Ensure the donor and recipient sign the form in the presence of a notary public to authenticate the document.

- Keep a copy of the completed affidavit for your records. This will be helpful for any future reference.

Don't:

- Leave any sections incomplete. An incomplete form may result in processing delays or the refusal of the affidavit.

- Use white-out or make other alterations to the form after it has been notarized, as this may void its authenticity.

- Forget to check for any specific filing requirements in your state, such as witness signatures, additional documents, or filing fees.

- Assume the process is the same in every state. Each state may have different laws and requirements for the transfer of gifts.

- Delay the submission of the affidavit after completion. Timely filing is often required and helps in the smooth transfer of the gift.

Misconceptions

An Affidavit of Gift is a legal document used when one person wants to give another person a gift of significant value, like a car or a piece of property, without any expectation of payment. Despite its straightforward purpose, there are common misconceptions surrounding its use and requirements. Understanding these misconceptions is crucial for anyone considering using an Affidavit of Gift.

An Affidavit of Gift is only for vehicle transfers. While it's often used for transferring the ownership of vehicles without a sale, an Affidavit of Gift can also be used for other types of property, including money and real estate, to legally document the transfer of these items as gifts.

If you fill out an Affidavit of Gift, you don’t need to worry about taxes. This is a common misunderstanding. The truth is, while an Affidavit of Gift does legally transfer ownership of property without payment, it does not exempt the donor or recipient from federal or state tax obligations that may arise from the transfer.

The recipient of the gift automatically becomes responsible for all liabilities associated with the gift. While taking ownership of a gift through an Affidavit of Gift might transfer certain responsibilities, it does not automatically make the recipient liable for all past liabilities related to the property. For example, if a car has unpaid parking tickets, those may still be the responsibility of the donor, depending on state law.

Creating an Affidavit of Gift is a complicated process that requires an attorney. While legal advice is always beneficial, especially for high-value items, the process of creating and filing an Affidavit of Gift is relatively straightforward in most states. Many states provide templates or simple forms that can be filled out without an attorney.

An Affidavit of Gift is binding and cannot be revoked. Once an Affidavit of Gift is executed, it does indeed transfer ownership of the property to the recipient. However, the idea that this cannot be undone is incorrect. Like many legal processes, there are conditions under which an Affidavit of Gift can be contested or revoked, such as fraud or duress.

Witnesses or notarization are not necessary for an Affidavit of Gift to be legally binding. This misconception can lead to issues in the legality of the document. Most jurisdictions require that an Affidavit of Gift be witnessed and/or notarized to verify the identity of the parties involved and the voluntariness of the gift, making it a legally binding document.

Key takeaways

An Affidavit of Gift is a legal document that proves a transfer of property, money, or personal belongings from one person to another without any expectation of payment. Here are key takeaways regarding the completion and application of this form:

- Accuracy is paramount: Ensure all information provided in the Affidavit of Gift is accurate. This includes the names and addresses of both the giver and the receiver, a detailed description of the gift, and its approximate value.

- Detail the gift clearly: Be explicit about what is being given. This could range from money to vehicles, or even property. A clear description helps prevent misunderstandings or legal complications later.

- Include the relationship: Mentioning the relationship between the donor and the recipient can be crucial, especially for tax purposes. Some gifts may be eligible for tax exemptions based on this relationship.

- Witnesses and Notarization: Many jurisdictions require the Affidavit of Gift to be witnessed or notarized. This step validates the authenticity of the document and helps protect against fraud.

- Understand tax implications: Gifts of certain values may be subject to federal gift taxes. It's important to understand these aspects or consult a tax professional to ensure compliance with tax laws.

- Keep copies: Always keep a copy of the completed and signed Affidavit of Gift for your records. The recipient should do the same. This ensures both parties have proof of the transaction.

- Legal advice: Consider seeking legal advice when drafting an Affidavit of Gift, especially for high-value items or property. Legal professionals can provide guidance on the required language and necessary clauses to include.

- Follow state laws: Gift laws can vary by state, especially concerning the transfer of vehicles or property. Ensure the affidavit meets all the legal requirements specific to the state where the transaction occurs.

- Delivery of the gift: For the gift to be legally effective, it must be delivered to the recipient – or at least, the recipient must have the ability to take possession. Document this process where possible.

- Revocation: Generally, once a gift is given and accepted, it cannot be revoked. Make sure you're certain about transferring ownership before completing the affidavit.

In summary, an Affidavit of Gift is a useful legal tool for documenting the voluntary transfer of gifts from one individual to another. Adhering to the legal requirements for completing this form helps ensure the process is smooth and uncontestable.

Consider More Types of Affidavit of Gift Forms

How to Write a Proof of Residency Letter - Updating voter registration to reflect a new residency can only be validated through the completion of an Affidavit of Residency.

How Can I Get a Free Copy of My Birth Certificate - For genealogical research or establishing family connections, this affidavit provides authoritative evidence of lineage and origin.