Official Affidavit of Domicile Document

Navigating the complexities of estate management and the transfer of securities after a loved one has passed can be challenging. The process often necessitates documentation that verifies the decedent's primary place of residence at the time of their passing. This is where the Affidavit of Domicile becomes crucial. It serves as a sworn statement, typically required by financial institutions and transfer agents, to facilitate the transfer of ownership of stocks, bonds, and other securities. By providing a legal declaration of the deceased's domicile, this document plays a pivotal role in ensuring that the assets are transferred according to the laws of the proper jurisdiction. Drafting this affidavit requires attention to detail and accuracy, as it must include specific information about the decedent and the affiant, the individual affirming the contents, to be considered valid. Handling this form with care and understanding its significance can streamline the process of settling an estate and transferring assets, making it an essential component of post-mortem affairs.

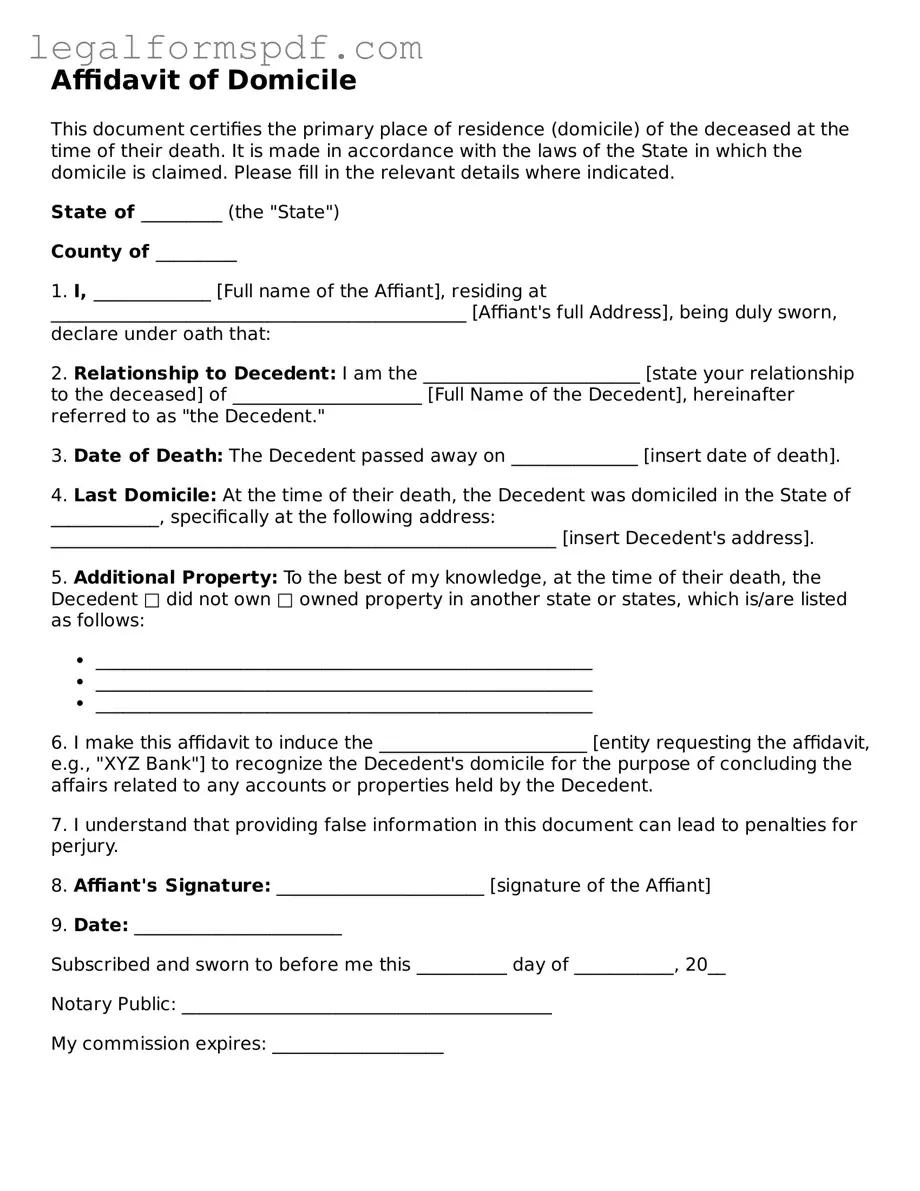

Document Example

Affidavit of Domicile

This document certifies the primary place of residence (domicile) of the deceased at the time of their death. It is made in accordance with the laws of the State in which the domicile is claimed. Please fill in the relevant details where indicated.

State of _________ (the "State")

County of _________

1. I, _____________ [Full name of the Affiant], residing at ______________________________________________ [Affiant's full Address], being duly sworn, declare under oath that:

2. Relationship to Decedent: I am the ________________________ [state your relationship to the deceased] of _____________________ [Full Name of the Decedent], hereinafter referred to as "the Decedent."

3. Date of Death: The Decedent passed away on ______________ [insert date of death].

4. Last Domicile: At the time of their death, the Decedent was domiciled in the State of ____________, specifically at the following address: ________________________________________________________ [insert Decedent's address].

5. Additional Property: To the best of my knowledge, at the time of their death, the Decedent □ did not own □ owned property in another state or states, which is/are listed as follows:

- _______________________________________________________

- _______________________________________________________

- _______________________________________________________

6. I make this affidavit to induce the _______________________ [entity requesting the affidavit, e.g., "XYZ Bank"] to recognize the Decedent's domicile for the purpose of concluding the affairs related to any accounts or properties held by the Decedent.

7. I understand that providing false information in this document can lead to penalties for perjury.

8. Affiant's Signature: _______________________ [signature of the Affiant]

9. Date: _______________________

Subscribed and sworn to before me this __________ day of ___________, 20__

Notary Public: _________________________________________

My commission expires: ___________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose of the Affidavit of Domicile | This document is used to legally declare the state of residence of a deceased individual at the time of their death. |

| Primary Use | It is often used by the executor of an estate to transfer ownership of securities or other assets that were held by the deceased. |

| Required by Financial Institutions | Many banks, brokerage firms, and transfer agents require an Affidavit of Domicile to release or transfer the assets of the deceased. |

| Legal Significance | The document provides official evidence of the deceased's primary residence for tax purposes and for determining the applicable state laws for estate administration. |

| Components of the Form | Typically includes the decedent's full name, date of death, last known address, and a statement affirming the domicile state. |

| Notarization Requirement | The affidavit usually needs to be notarized to verify the identity of the executor or affiant signing the document. |

| State-Specific Forms | Some states have specific forms or requirements for the Affidavit of Domicile, reflecting the particular state laws that govern estate administration. |

| Governing Law | The laws governing the Affidavit of Domicile vary by state but typically involve probate or estate laws of the state where the deceased was domiciled. |

| Execution by Executor or Administrator | The document is usually signed by the executor of the estate or the administrator appointed by the court if there is no will. |

Instructions on Writing Affidavit of Domicile

When managing the estate of someone who has passed away, it's often necessary to legally establish the decedent's place of residence at the time of their death. This is where the Affidavit of Domicile comes into play. It's a document required by financial institutions and other entities to ensure that the transfer of assets is conducted under the appropriate jurisdiction's laws. Completing this document accurately is crucial for a smooth process in estate management. Follow the steps below to fill out an Affidavit of Domicile correctly.

- Start by providing the full name of the decedent, exactly as it appeared on their legal documents.

- Enter the date of death using the format MM/DD/YYYY.

- Fill in the legal address of the decedent at the time of their death, including the street address, city, state, and ZIP code.

- Specify the length of time the decedent lived at the address provided, to the best of your knowledge.

- Provide the name and address of the appointed executor or administrator of the estate, if applicable.

- Indicate your relationship to the decedent to clarify your authority in handling the estate matters.

- Read the affirmation or oath section carefully, which typically declares that you swear or affirm the information provided is true to the best of your knowledge.

- Sign and date the form in the presence of a notary public. Ensure the notary completes their section, including their stamp or seal, which verifies your identity and your acknowledgment of the document under oath.

Filling out the Affidavit of Domicile with meticulous attention ensures that financial institutions and other necessary parties have the correct information to process the estate's assets according to state laws. Handling this form accurately and efficiently aids in the smooth resolution of the estate, paving the way to fulfill the decedent's final wishes without unnecessary legal complications or delays.

Understanding Affidavit of Domicile

What is an Affidavit of Domicile and why might I need it?

An Affidavit of Domicile is a legal document that confirms where someone lived at the time of their death. It's often required by financial institutions or during the probate process to help manage or distribute the deceased's assets. For instance, if you're inheriting stocks or need to transfer ownership of securities, this affidavit provides the necessary proof of the decedent's residence.

Who is authorized to complete the Affidavit of Domicile?

Typically, the executor of the estate or the administrator assigned by the court has the authority to complete it. This person is responsible for gathering the necessary information and signing the affidavit in the presence of a notary public, certifying that the information provided is true to the best of their knowledge.

What key information is required on the Affidavit of Domicile?

The document must include the full name of the deceased, their last address, the date of their death, and a statement confirming the state in which they were legally considered to have their permanent home at the time of their death. It also includes the signature of the affiant (the person making the affidavit) and the date signed, typically in front of a notary public.

How do I obtain an Affidavit of Domicile form?

Forms can usually be obtained from the office of the court clerk in your local jurisdiction, a lawyer, or online legal resource websites. Each state may have specific requirements or formats for the affidavit, so ensure the form meets your state’s criteria.

Do I need a lawyer to complete the Affidavit of Domicile?

While it’s not mandatory to have a lawyer, consulting one can help ensure the affidavit is completed correctly and meets all legal requirements, especially if the estate is complicated. A lawyer can also offer guidance on the probate process and how to handle the deceased's assets properly.

What happens after the Affidavit of Domicile is completed?

Once the affidavit is correctly filled out and notarized, it's submitted alongside other necessary documents to the relevant financial institutions or courts. This action allows the estate to be administered, including the transfer of securities or assets as dictated by the deceased’s will or state law.

Is the Affidavit of Domicile the same in every state?

No, while the purpose of the Affidavit of Domicile is generally consistent, the specific requirements and the form itself may vary from one state to another. It's important to verify that you are using the correct form and following the proper procedures as dictated by the state in which the deceased was considered to have their domicile.

Common mistakes

Filling out an Affidavit of Domicile is a critical step in managing the assets of someone who has passed away, but it’s a process where mistakes can easily be made. One common error is overlooking the importance of precision in filling out the deceased’s address. The affidavit requires the last known address to be fully detailed, including any apartment or suite number, if applicable. This specificity helps in accurately identifying the decedent's primary residence, which is crucial for legal and tax purposes.

Another mistake involves not properly verifying the document. It’s essential to understand that this document, once completed, must be notarized to confirm its authenticity. Individuals sometimes submit the affidavit without this crucial step, leading to unnecessary delays. The notarization process is a way to prove that the person who signed the document is indeed who they claim to be, making the affidavit legally valid.

Failing to correctly identify the date of death can also lead to complications. This date should match the one found on the death certificate exactly. Any discrepancies between these two documents can raise questions about the veracity of the affidavit, potentially complicating financial and legal processes that depend on this information.

Some people make the mistake of not adequately describing the decedent's property. The Affidavit of Domicile is often used to transfer ownership of securities and other assets. A vague or incomplete description of these assets can hinder this process. Detailing the types and locations of assets with precision is crucial for the institutions managing these transfers to correctly interpret the decedent’s intentions.

Another error is assuming that only one copy of the affidavit is enough. In practice, multiple institutions might request a certified copy of this document. Failing to prepare the necessary number of copies can delay the settlement of the decedent's estate.

Incorrectly assuming that personal knowledge is sufficient for filling out the form is a further mistake. In some instances, verification from external sources, like banks or government bodies, may be necessary to provide accurate information about the decedent’s domicile and assets. Relying solely on personal knowledge without this verification can result in inaccuracies.

Not updating the affidavit to reflect any changes in the estate or assets, if needed before the submission, is also an oversight. For example, if an asset listed in the affidavit is sold or transferred between the time of completion and submission, this change must be documented and the affidavit updated accordingly.

Lastly, a significant mistake is failing to consult with legal professionals when there is uncertainty regarding the form. The Affidavit of Domicile can affect legal and financial matters significantly. When individuals are unclear about how to accurately complete the form, seeking advice from a lawyer can prevent errors that could complicate the estate’s settlement process.

Documents used along the form

The Affidavit of Domicile is a pivotal document, primarily used in the administration of estates. It confirms the legal residence of a deceased person at the time of death, which is crucial for transfer of securities and other assets. This form often works in concert with other legal documents to ensure the smooth execution of a decedent's estate. Below is a list of documents that are frequently used alongside the Affidavit of Domicile, aiming to provide a more comprehensive understanding of the estate management process.

- Will: This legal document outlines how a person's assets and estate will be distributed upon their death. It names an executor who will manage the estate and carry out the deceased's wishes.

- Death Certificate: Issued by a government official, it officially declares the date, location, and cause of a person's death. This document is fundamental in proving the demise for legal purposes.

- Letters Testamentary: These are issued by a probate court giving an executor the authority to act on behalf of the deceased's estate, according to the will.

- Letters of Administration: Similar to Letters Testamentary, but issued when the deceased did not leave a will, granting an administrator the authority to settle the estate according to state laws.

- Trust Documents: If the deceased had a trust, these documents outline the management and disposition of assets placed in the trust, bypassing the probate process.

- Inventory of Assets: A detailed list of the deceased’s personal and real property at the time of death, essential for estate distribution and tax purposes.

- Appraisal Documents: Professional appraisals of real estate, personal property, and other valuable assets that help determine the estate's value for distribution and taxation.

- Final Income Tax Return: A tax return filed for the deceased, covering income received and taxes owed for the last year of their life.

- Estate Tax Returns: If the estate exceeds federal or state tax exemption limits, these returns calculate the tax due on the transfer of the estate's assets.

- Transfer-on-Death (TOD) and Payable-on-Death (POD) Designations: Documents that specify beneficiaries for certain assets, such as bank accounts and securities, allowing these to bypass probate and transfer directly to the named individuals.

Understanding and preparing these documents in the context of estate planning and administration can significantly affect the process's efficiency and compliance with legal requirements. While the Affidavit of Domicile provides a foundational piece by establishing residency of the deceased, the complementary documents each serve integral roles in thorough estate management. Legal professionals often guide executors and administrators through these complexities to ensure accurate and lawful handling of the deceased's estate.

Similar forms

The Affidavit of Domicile shares similarities with the Certificate of Residence. Both documents serve to officially declare a person's primary place of living at a certain point in time. However, while the Affidavit of Domicile is often used to clarify the decedent's state of residence for estate settlement purposes, the Certificate of Residence is commonly required for determining eligibility for in-state tuition at colleges or to comply with local tax obligations. They both require substantiation of the individual's residence through various forms of proof such as utility bills or voter registration.

Similar to the Affidavit of Domicile, the Declaration of Residency form is another legal document used to assert one's place of residence. This declaration can be particularly essential in legal situations involving divorce, custody, or immigration cases, where the jurisdiction may depend on the residency of the individuals involved. Both documents necessitate the party completing the form to provide truthful information under penalty of perjury, thus underscoring the legal seriousness and similarities they share in verifying an individual's living situation.

The Homestead Declaration is akin to the Affidavit of Domicile as it relates to an individual's primary residence. This document is used to protect a portion of the homeowner's value from creditors and can also affect property tax assessments. While the Affidavit of Domicile often accompanies the execution of a will or the administration of an estate, the Homestead Declaration focuses on financial protection and tax relief for homeowners, yet both center around the significance of the primary residence in legal contexts.

A Last Will and Testament, though broader in scope, connects with the Affidavit of Domicile through its requirement to establish the domicile of the decedent at the time of death. The domicile determines the applicable state law for probate and estate taxes. This testamentary document outlines how a person's estate should be distributed upon their death, including assets and custody of dependents, relying on the domicile stated in the Affidavit of Domicile to enforce the decedent's wishes according to the correct jurisdiction.

Voter Registration forms also bear relevance to the Affidavit of Domicile, as both establish a person's legal residence within a specific jurisdiction. Voter registration requires proof of residence to ensure an individual votes in the correct precinct, affecting local elections. Like the Affidavit of Domicile, failing to update this information can have legal repercussions, emphasizing the importance of accurately declaring one's current place of residence in both documents.

The Change of Address Form submitted to postal services has a practical similarity to the Affidavit of Domicile. While the Affidavit of Domicile is often required for legal proceedings and estate matters, a Change of Address Form ensures mail delivery continuity when an individual moves. Both are straightforward declarations of a new residence, integral to maintaining accurate records for both legal and everyday purposes.

Lastly, the Affidavit of Support, used in immigration proceedings, somewhat parallels the Affidavit of Domicile by affirming an individual's residing location. This affidavit confirms a sponsor's financial ability to support the immigrant to avoid them becoming a public charge. Though dealing with different aspects of the law — one with estate matters and the other with immigration — both documents fundamentally declare specific living circumstances under oath, highlighting their connection in the legal domain for verifying personal situations.

Dos and Don'ts

When filling out the Affidavit of Domicile form, there are several important dos and don'ts to follow. Adhering to these guidelines ensures the process is smooth and the document is accurately completed.

- Do carefully review the entire form before you start to ensure you understand what information is required.

- Do use black ink or type the information if the form allows to ensure clarity and legibility.

- Do double-check the details of the deceased's domicile, including full legal names, the address at the time of death, and any other required identification information.

- Do provide accurate financial information regarding the deceased's assets located in the domicile state, as this pertains to the legal and tax implications of the estate.

- Do have the affidavit notarized, if required, as this verifies the integrity and legality of the document.

- Don't rush through filling out the form without verifying the accuracy of the information provided; errors can cause delays.

- Don't leave any required fields blank; if a section does not apply, write "N/A" (not applicable) to show that the question was considered.

- Don't forget to sign and date the form in the designated areas, as failure to do so may invalidate the document.

- Don't hesitate to seek legal advice if there are any uncertainties or questions about the form or the information it requires.

Misconceptions

When dealing with the Affidavit of Domicile, several misconceptions can lead to confusion. Understanding what this document is and what it is not can help in many legal and financial situations. Here are some common misunderstandings:

It's often thought that an Affidavit of Domicile is the same as a Last Will and Testament. However, an Affidavit of Domicile is used to legally declare the primary residence of a deceased person at the time of their death, whereas a Last Will outlines a person's wishes for their estate and assets after they pass away.

A common misconception is that anyone can prepare and sign an Affidavit of Domicile. In truth, this document must be signed by the executor or administrator of the deceased person's estate.

Many believe that an Affidavit of Domicile is not legally binding. This is incorrect. Once signed and notarized, it serves as a legal statement regarding the decedent's place of domicile at the time of their death.

There's a misconception that the form is only used for tax purposes. While it is often used to handle estate or inheritance taxes, its purpose also extends to assisting in the transfer of assets, such as stocks or bonds, from the deceased to their heirs or beneficiaries.

Some think the Affidavit of Domicile is required for all deceased persons' estates. The necessity for this document can vary depending on the state laws and the specific assets involved in the estate.

It's mistakenly believed that the Affidavit of Domicile must be filed with a court. Typically, this document is provided to the financial institutions or parties requiring proof of domicile, not the court.

Another misunderstanding is that if a person owns homes in multiple states, they need multiple Affidavits of Domicile. Actually, only one Affidavit is needed, reflecting the legal domicile or primary residence at the time of death.

There is a misconception that the Affidavit of Domicile cannot be contested. Like many legal documents, its contents can be challenged, particularly if new evidence regarding the decedent's intended state of domicile emerges.

Finally, some believe that creating an Affidavit of Domicile is a lengthy and complicated process. While it requires careful attention to detail and accuracy, the process is straightforward, especially with the guidance of a legal professional.

Key takeaways

An Affidavit of Domicile is a legal document used primarily in the execution of a deceased person's estate. It certifies the residence of the deceased at the time of their death, impacting the transfer of securities and other asset-related transactions. Understanding this form and its implications is crucial for executors, beneficiaries, and legal professionals. Here are eight key takeaways about filling out and using the Affidavit of Domicile form:

- The Affidavit of Domicile must be completed by the executor or administrator of the estate. This individual is responsible for declaring the legal residence of the deceased at the time of death.

- This document requires notarization to validate the identity of the executor or administrator, ensuring the information provided is true and correct to the best of their knowledge.

- Accuracy is paramount when filling out the form. Any inaccuracies can delay the transfer of assets or result in legal penalties for the executor.

- The primary purpose of the Affidavit of Domicile is to assist in the smooth transfer of securities (like stocks or bonds) from the deceased to their beneficiaries. It helps financial institutions determine the correct state law to apply for tax purposes.

- It's essential to check with the relevant financial institutions regarding their requirements for an Affidavit of Domicile, as some may have specific forms or additional documentation requirements.

- Legal jurisdiction matters: The deceased's domicile affects how their estate is taxed and distributed. Different states have various laws regarding estate and inheritance taxes.

- Preparing an Affidavit of Domicile often requires additional documentation to prove the deceased's domicile, such as tax returns, a valid driver’s license, or property deeds.

- The document helps prevent potential conflicts among beneficiaries over state-specific asset distribution laws and clarifies the executor's duties in managing and distributing the estate assets.

Filling out and properly using an Affidavit of Domicile simplifies the legal processes associated with estate management, providing a clear path for executors and administrators. It's a key step in ensuring that the transfer of assets after a loved one's death is handled with respect, efficiency, and legal accuracy. Always consider consulting with a legal professional to navigate these matters effectively.

Consider More Types of Affidavit of Domicile Forms

Affidavit of Singleness Philippines - For those divorced or widowed, this affidavit may also require presenting additional documentation, such as a divorce decree or death certificate, to verify the end of any previous marriages.

Identity Affidavit - It is a legal tool designed to assist in the swift verification of a person’s identity with minimal complications.