Fillable Affidavit of Death Document for Texas

In the state of Texas, the transfer of property following the death of a loved one necessitates navigating through a series of legal procedures, among which the Texas Affidavit of Death form is a crucial component. This document serves as a formal declaration, attesting to the death of an individual and facilitating the smooth transition of assets as per the deceased individual's will or state inheritance laws. It holds significant value for heirs or beneficiaries seeking to assert their rights over the deceased's property, including real estate, bank accounts, and other assets. The form requires detailed information about the deceased, the affiant (the person filing the affidavit), and the property in question. It acts as a linchpin in ensuring that the legal transfer of assets is conducted without unnecessary delays, preventing potential disputes among claimants. By meticulously completing and filing this affidavit, involved parties can expedite the process of managing and distributing the deceased's estate, aligning with the principles of simplicity and efficiency that underpin the Texas legal system.

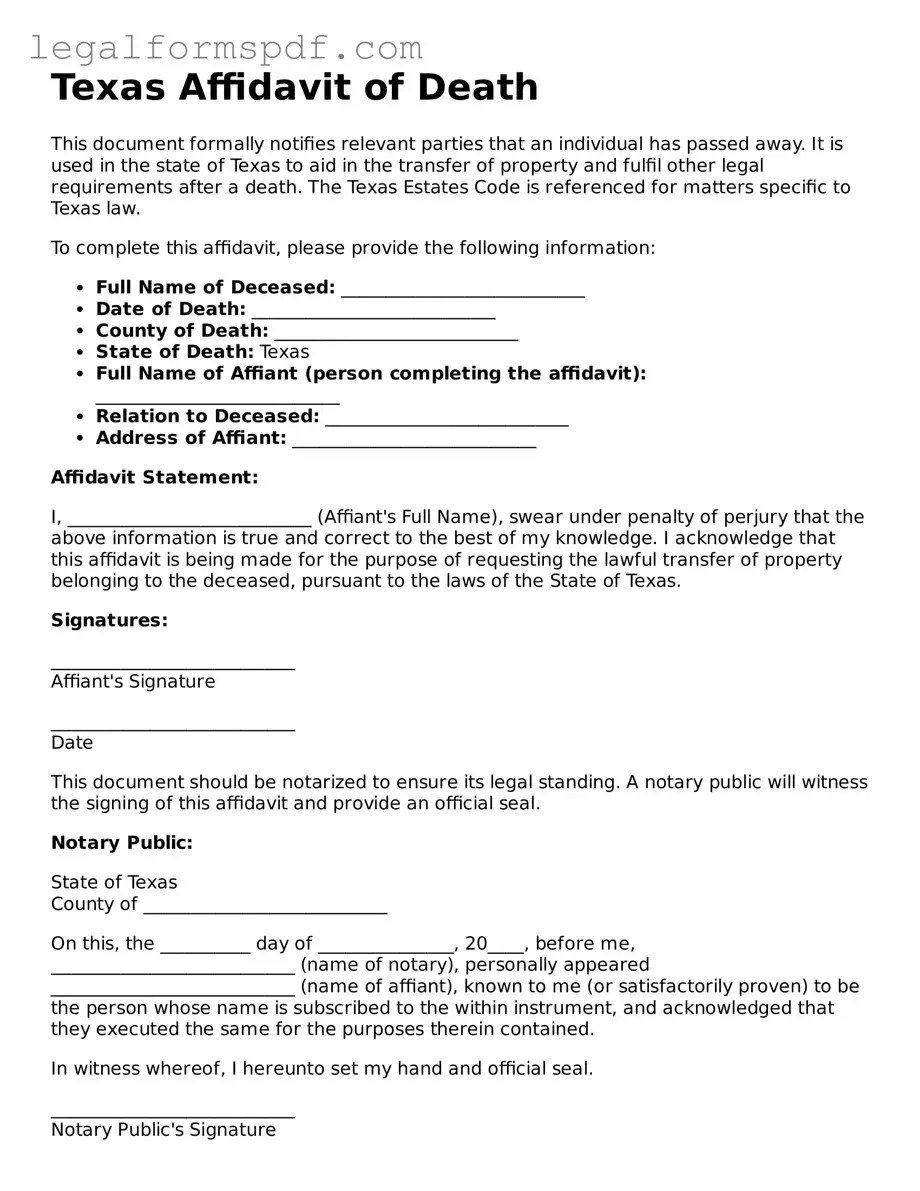

Document Example

Texas Affidavit of Death

This document formally notifies relevant parties that an individual has passed away. It is used in the state of Texas to aid in the transfer of property and fulfil other legal requirements after a death. The Texas Estates Code is referenced for matters specific to Texas law.

To complete this affidavit, please provide the following information:

- Full Name of Deceased: ___________________________

- Date of Death: ___________________________

- County of Death: ___________________________

- State of Death: Texas

- Full Name of Affiant (person completing the affidavit): ___________________________

- Relation to Deceased: ___________________________

- Address of Affiant: ___________________________

Affidavit Statement:

I, ___________________________ (Affiant's Full Name), swear under penalty of perjury that the above information is true and correct to the best of my knowledge. I acknowledge that this affidavit is being made for the purpose of requesting the lawful transfer of property belonging to the deceased, pursuant to the laws of the State of Texas.

Signatures:

___________________________

Affiant's Signature

___________________________

Date

This document should be notarized to ensure its legal standing. A notary public will witness the signing of this affidavit and provide an official seal.

Notary Public:

State of Texas

County of ___________________________

On this, the __________ day of _______________, 20____, before me, ___________________________ (name of notary), personally appeared ___________________________ (name of affiant), known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

___________________________

Notary Public's Signature

___________________________

My commission expires: _____________

PDF Specifications

| Fact | Description |

|---|---|

| Definition | An Affidavit of Death is a legal document used to affirm the passing of an individual, typically required to transfer or establish ownership of property. |

| Primary Use | It is primarily used in estate planning and property matters to record the death of a property owner. |

| State Specific | While the usage of this document is common across various states, the Texas Affidavit of Death may include clauses and requirements unique to Texas law. |

| Governing Law | In Texas, the Affidavit of Death is governed by the Texas Estates Code, particularly regarding its use in real property transactions. |

| Requirement for Use | The affidavit must be completed by a knowledgeable party, often a close relative or executor of the deceased’s estate, affirming the death. |

| Attachments Necessary | A certified copy of the death certificate is often required to be attached to the affidavit for it to be considered valid and complete. |

| Notarization | The affidavit must be notarized to validate the identity of the signatory and the authenticity of their statement. |

| Recording Requirement | Once properly executed, the Affidavit of Death should be filed with the county recorder’s office where the property is located. |

| Legal Effect | Filing the affidavit helps in updating the public record, facilitating the transfer or establishment of title on property. |

| Considerations | Individuals should consult legal advice when preparing an Affidavit of Death to ensure compliance with Texas laws and avoid disputes. |

Instructions on Writing Texas Affidavit of Death

Filling out the Texas Affidavit of Death form is a necessary step in the process of legally formalizing the death of a person in the context of certain legal and financial matters. This document is typically used to clarify and confirm the death of an individual, particularly in situations involving the transfer of property or to manage assets held by the deceased. It's a straightforward form but requires attention to detail to ensure that the information presented is accurate and complies with Texas law.

- Gather necessary documents: Before filling out the affidavit, ensure you have a certified copy of the death certificate and any relevant documents related to the property or asset in question.

- Identify the appropriate form: Make sure you are using the current version of the Texas Affidavit of Death form that is recognized by your local jurisdiction.

- Fill in the decedent’s full name: Write the full legal name of the deceased as it appears on the death certificate.

- Include the date of death: Accurately enter the date on which the individual passed away, as recorded on the death certificate.

- Provide a legal description of the property: If the affidavit is being used to transfer property, include a detailed legal description of the property. This information can often be found on the deed or previous title documents.

- List the decedent's heirs: Clearly state the names and relationships of all known heirs to the decedent. If the affidavit is being filed as part of a probate process, ensure this information matches the records filed with the court.

- Signature and notarization: The person filling out the affidavit must sign it in front of a notary public. The notary will fill out their section, confirming the identity of the signer and the date of signing.

- File the completed form: Once the form is correctly filled out and notarized, submit it to the appropriate local office. This could be the county recorder, clerk’s office, or another entity depending on your jurisdiction and the purpose of the affidavit.

Correctly filling out and filing the Texas Affidavit of Death form represents a crucial step in managing the affairs of someone who has passed away. It's a process that serves as a foundation for many subsequent actions, from transferring assets to closing accounts. Ensuring the information is accurate and the form is properly filed can help avoid delays and complications in these matters.

Understanding Texas Affidavit of Death

What is an Affidavit of Death?

An Affidavit of Death is a legal document used to formally declare the death of an individual. In Texas, it serves to notify interested parties and government agencies of the person's passing, often as a necessary step in the process of transferring or releasing assets held by the deceased.

Who needs to file an Affidavit of Death in Texas?

Generally, the executor of the deceased’s estate or a close relative might need to file this document. It's particularly important for those handling the deceased's affairs, such as distributing assets according to a will or managing property that was owned by the deceased.

What information is required on a Texas Affidavit of Death?

This document typically includes the full name of the deceased, their date of death, the location (county) of the death, and the relationship of the affiant (the person making the affidavit) to the deceased. It might also require a certified copy of the death certificate to be attached.

Where do I file a Texas Affidavit of Death?

You would usually file an Affidavit of Death with the county clerk’s office in the county where the dead person owned property or resided. This ensures that the death is officially recorded in the local public records, aiding in the proper transfer of assets.

Is there a filing fee for the Affidavit of Death in Texas?

Yes, most county clerks will charge a filing fee to record an Affidavit of Death. The amount varies by county, so it's advisable to contact the local county clerk's office directly to inquire about the current fee schedule.

How does an Affidavit of Death affect property transfer?

An Affidavit of Death helps clarify the legal standing of the property by officially noting the owner's passing. It's often used in conjunction with other legal processes to transfer or release the deceased's interest in real estate or other assets to their heirs or beneficiaries.

Can I prepare and file a Texas Affidavit of Death myself?

Yes, it is possible to prepare and file this affidavit yourself, especially if the estate is straightforward and uncontested. However, consulting with a legal professional can provide guidance, ensure accuracy, and help navigate any potential complexities related to the deceased’s estate.

Common mistakes

When handling the Texas Affidavit of Death form, individuals often encounter stumbling blocks that can lead to errors in the submission process. One common mistake is not verifying the deceased's legal name and any aliases they may have used. This step is crucial as inconsistencies can result in processing delays or even the denial of the form. Ensuring that the name on the form matches exactly with the one on official documents, such as the death certificate, is vital for the smooth processing of the affidavit.

Another area where mistakes are frequently made is in the description of the property involved. If the affidavit pertains to real estate, the legal description of the property must be precise. Many people inadvertently provide an address or a simple description that lacks the detail needed for legal identification. This precision is essential for the correct administration of the estate as it ensures the property is accurately identified and transferred.

Incorrectly listing the heirs or failing to include all necessary parties is also a common error. The affidavit requires a complete listing of all individuals entitled to the property, under Texas law. Sometimes, individuals mistakenly omit heirs under the assumption that they are not interested or willing to claim the property. However, for the affidavit to be valid, all statutory heirs should be included, regardless of their current stance or interest in the estate.

People often neglect to attach the required documentation, such as the official death certificate. The Texas Affidavit of Death form requires a certified copy of the death certificate to be attached. This oversight can lead to automatic rejection of the application, as the document serves as the primary proof of death.

A technical but less recognized mistake involves not having the affidavit notarized. The form must be signed in the presence of a notary to verify the identity of the person filing it. This step is a legal requirement that adds a level of security to the process, ensuring that the information provided is credible and that the individual submitting the form has the authority to do so.

Finally, people frequently submit the form without the necessary filing fee or fail to send it to the correct office. Each county in Texas may have its own requirements regarding where and how to file the Affidavit of Death, including the payment of a processing fee. It's critical for filers to check with the local county clerk's office for the specific requirements, including where to send the form and the amount of the fee, to avoid unnecessary complications.

Documents used along the form

When managing the affairs of a deceased individual in Texas, the Affidavit of Death form plays a crucial role in the legal process, especially in the transfer of property without a formal probate proceeding. However, this document is often just one part of a suite of forms and documents required to adequately address the complexities of estate management and the proper legal transfer of assets. Here is a list of seven other forms and documents commonly used alongside the Texas Affidavit of Death to ensure a smooth transition of assets and adherence to legal requirements.

- Will: This is a legal document that outlines the deceased's wishes regarding the distribution of their property and the care of any minor children. If a will exists, it directs the distribution process under the guidance of the court through probate.

- Letters Testamentary: Issued by a court, these letters grant the executor the authority to act on behalf of the deceased's estate. They are necessary when the deceased has left a will and the estate must go through probate.

- Small Estate Affidavit: For estates under a certain value threshold, this document can be used to expedite the property transfer process without formal probate. It's a sworn statement that summarizes the estate's assets, liabilities, and intended distribution.

- Transfer on Death Deed (TODD): This form allows property owners to name a beneficiary to their real estate, enabling the property to bypass the probate process and transfer directly to the beneficiary upon the owner’s death.

- Judgment Declaring Heirship: In cases without a will, this court-issued document determines the legal heirs and their respective shares of the estate, paving the way for asset distribution according to state laws.

- Trust Agreement: This document establishes a trust and outlines the terms under which assets held in the trust are to be managed and distributed. Trusts can be used to bypass probate, reduce estate taxes, and manage assets after the owner's death.

- Death Certificate: A certified death certificate is often required to prove the death of the estate's owner. It's used in conjunction with other legal documents to facilitate the transfer of assets, close accounts, and claim benefits.

Together, these documents assist in the seamless transfer of assets and resolution of the deceased's affairs. Each serves a unique purpose and may be required under different circumstances, depending on whether the deceased had a will, the size of the estate, and the specific types of assets involved. Understanding the role and requirement of each form is essential for executors, beneficiaries, and legal professionals navigating the processes of estate settlement and asset distribution in Texas.

Similar forms

The Texas Affidavit of Death form shares similarities with the Death Certificate in that both documents serve as official confirmations of an individual's demise. The Affidavit of Death, much like the Death Certificate, is utilized to validate the death of a person, often required for legal and financial proceedings. While the Death Certificate is an official government-issued document, the Affidavit of Death can be prepared and signed by a close relative or legal representative, making both critical in the process of settling an estate or proving death for insurance claims and transfer of property ownership.

Comparable to the Texas Affidavit of Death form, the Transfer on Death Deed (TODD) also functions in the realm of estate management but focuses specifically on the direct transfer of property upon death. While the Affidavit of Death helps affirm the death of the individual, which is a step towards transferring assets, the TODD is a legal document that directly facilitates the transfer of real property to a designated beneficiary upon the death of the property owner. Both interact closely in the process of bypassing probate for real estate assets, streamlining the inheritance process.

Similarly, the Joint Tenancy with Right of Survivorship (JTWROS) agreement has a functional resemblance to the Texas Affidavit of Death form in the context of asset management following death. The JTWROS is an arrangement allowing co-owners of property to automatically inherit the other's share of the property upon their death, without the need for probate. When a co-owner dies, the Affidavit of Death is often required to prove the death and facilitate the transfer of property rights, making both documents pivotal in the seamless transition of assets between owners.

The Life Insurance Claim form is another document akin to the Texas Affidavit of Death form, primarily because both are instrumental in the claims process following an individual's passing. The Affidavit of Death may be required by insurance companies as proof of death before a life insurance claim can be processed. While the Life Insurance Claim form initiates the claim for the policy benefits after a policyholder's death, the Affidavit supports by verifying the event, thereby ensuring that the beneficiaries can access the financial benefits due.

Lastly, the Last Will and Testament bears a resemblance to the Texas Affidavit of Death form in the broader scope of estate planning and execution. The Last Will outlines an individual’s wishes regarding the distribution of their estate after death, while the Affidavit of Death serves as a proof-of-death document necessary to initiate the execution of those wishes. In the probate process, where the Last Will is enforced, the Affidavit of Death is often one of the first documents required to confirm the cause for probate, linking these documents in their fundamental roles in finalizing a deceased person’s affairs.

Dos and Don'ts

When dealing with the Texas Affidavit of Death form, it is crucial to take certain steps to ensure accuracy and legality. Below are lists of things you should and shouldn't do when filling out this important document.

What You Should Do

- Verify the details of the deceased: Double-check the full name, date of birth, and date of death against official documents to prevent any discrepancies.

- Use black ink: Fill out the form in black ink to ensure that the document is legible and can be copied or scanned without issue.

- Provide accurate property information: If the affidavit pertains to real estate, include the legal description of the property, ensuring it matches the description on the deed.

- Include a certified copy of the death certificate: Always attach a certified copy of the death certificate to validate the affidavit.

- Sign in the presence of a notary: Ensure that the affidavit is notarized to confirm the identity of the person signing the document and to solidify its authenticity.

- Consult with a legal professional: If you have any doubts or questions, consulting with someone knowledgeable in Texas estate law can help prevent mistakes.

- Keep a copy for your records: After filing the affidavit with the appropriate county office, retain a copy for your personal records in case of future disputes or inquiries.

What You Shouldn't Do

- Do not leave sections blank: Fill out all required sections of the form to avoid delays or the form being returned for corrections.

- Do not guess on information: If you're uncertain about specific details, it's better to verify first rather than providing incorrect information.

- Do not use correction fluid or tape: Mistakes should be corrected by neatly striking through the error and initialing beside the correction. Using correction fluid or tape can cause the document to be questioned or invalidated.

- Do not sign without a notary present: Signing the affidavit without a notary's presence can render the document unusable and legally ineffective.

- Do not alter the form after notarization: Any changes made to the affidavit after it has been notarized can void its legal standing.

- Do not submit without reviewing: Before submitting the form, review all the information to ensure its accuracy and completeness.

- Do not assume it's the final step: Depending on the deceased's estate and the specifics of the situation, additional legal steps may be necessary.

Misconceptions

The Texas Affidavit of Death form is a crucial document in the process of transferring property after someone's death. However, there are several misconceptions surrounding its use and importance. Understanding these can help ensure that the process of handling an estate proceeds smoothly and according to legal standards.

- It Can Transfer Property Automatically: A common misconception is that the Affidavit of Death automatically transfers property to the heirs. In reality, this document serves as a formal statement of death, but it does not in itself transfer ownership. The actual transfer of property requires additional steps according to probate laws or as outlined in a valid will.

- It's Only Necessary for Real Estate Transactions: While it's true that the Affidavit of Death is often used in the context of real estate, it's not limited to such transactions. This form can also be crucial for the transfer or claim of stocks, bank accounts, and other assets depending on the policies of the institution holding the assets.

- It Negates the Need for a Will: Another misunderstanding is that this affidavit can replace a will. While the Affidavit of Death certifies the death of a property owner, it does not specify the intended distribution of assets like a will does. A will is necessary to ensure that the deceased's wishes are followed, while the affidavit serves to validate and acknowledge the person's death as it pertains to legal and financial matters.

- Any Family Member Can Sign It: Often, people believe that any family member is eligible to sign the Affidavit of Death. However, Texas law usually requires the person signing to be the executor of the estate or someone legally authorized to act on behalf of the deceased's estate. Verification of the signer's legal right to file the affidavit is crucial.

- There's No Need to File It with the County: The assumption that the affidavit does not need to be filed with the county records is incorrect. For real estate, for instance, filing the Affidavit of Death with the county recorder’s office is essential for updating the public record, which is important for future transactions or estate settlement processes.

- It Serves as Legal Proof of Death: While the affidavit does declare the death of an individual, it is not the primary legal proof of death. The official death certificate is the recognized document for legally proving someone's death. The Affidavit of Death often complements the death certificate, especially in transactions involving the deceased's property or accounts.

- It Can Be Filed at Any Time After Death: People often believe there's no timeline for filing the Affidavit of Death. However, timely filing is important and sometimes required, depending on the type of transaction or claim being made. Delays in filing can complicate matters, such as the transfer of property or claims against the estate.

Understanding these misconceptions can help individuals navigate the complexities of managing an estate after a loved one's death. It highlights the importance of reviewing legal documents and consulting with legal professionals to ensure that all processes are handled correctly and efficiently.

Key takeaways

When someone passes away, managing their affairs can be a delicate process. In Texas, one important document in this process is the Affidavit of Death form. Understanding how to properly fill out and use this form is crucial. Here are seven key takeaways to guide you:

- The Affidavit of Death form is used to officially confirm the death of an individual. It plays a vital role in the legal process, particularly in matters concerning the transfer of property and assets.

- To fill out the form correctly, you must include the full name of the deceased, their date of birth, death date, and the location of their death. Double-check all information for accuracy to avoid delays or complications.

- It's necessary to have the document notarized. This requires signing the form in front of a notary public. Notarization gives the document legal weight, confirming your identity and the truthfulness of the information provided.

- The form should be filed in the county where the property of the deceased is located. This helps in the smooth transfer of assets to the rightful beneficiaries.

- Accompany the Affidavit of Death with a certified copy of the death certificate. This acts as a supporting document and is often required to complete various transactions.

- It is advisable to consult with a legal professional when filling out the form. They can ensure that all legal criteria are met and can provide guidance on how to handle complex situations.

- Lastly, using the Affidavit of Death form can expedite the asset transfer process. However, it's just one part of managing a deceased person's estate. Be prepared for additional steps, depending on the complexity of the estate.

Filling out and using the Texas Affidavit of Death form is a straightforward process if you follow these guidelines. Ensure all the necessary information is accurate and complete, and seek legal advice when needed. This will help make the estate settlement process as smooth as possible for all parties involved.

More Affidavit of Death State Forms

Affidavit of Death of Joint Tenant - Supports the process of changing the beneficiary names on life insurance policies, should the primary beneficiary predecease the insured.