Fillable Affidavit of Death Document for California

Dealing with the passing of a loved one is an emotionally challenging time that also brings a myriad of administrative tasks, one of which may involve handling their real property in California. In such times, the California Affidavit of Death form becomes an indispensable document. It serves as a legal instrument used to formally declare the death of a person, primarily for the purpose of transferring real property from the deceased to their rightful heirs or beneficiaries. Upon a person's passing, this affidavit allows for a smoother transition of property ownership, ensuring that the county records are updated to reflect the change. It's a critical step for executors and beneficiaries, simplifying what would otherwise be a complex legal process. The form requires some specific information, including details about the deceased, the property in question, and the person or entity taking ownership. Filled out correctly and filed with the appropriate county recorder's office, it plays a crucial part in estate management and the fulfillment of the deceased's wishes regarding their assets.

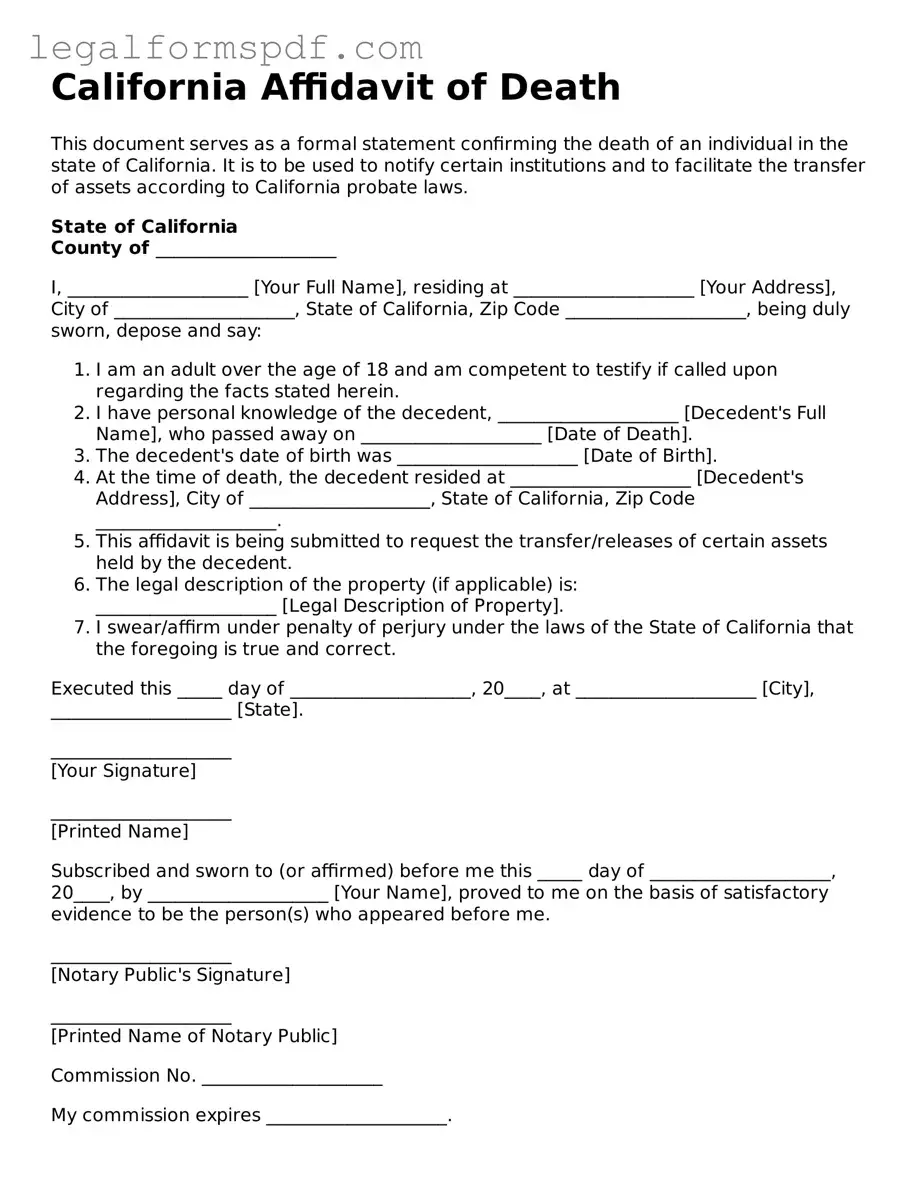

Document Example

California Affidavit of Death

This document serves as a formal statement confirming the death of an individual in the state of California. It is to be used to notify certain institutions and to facilitate the transfer of assets according to California probate laws.

State of California

County of ____________________

I, ____________________ [Your Full Name], residing at ____________________ [Your Address], City of ____________________, State of California, Zip Code ____________________, being duly sworn, depose and say:

- I am an adult over the age of 18 and am competent to testify if called upon regarding the facts stated herein.

- I have personal knowledge of the decedent, ____________________ [Decedent's Full Name], who passed away on ____________________ [Date of Death].

- The decedent's date of birth was ____________________ [Date of Birth].

- At the time of death, the decedent resided at ____________________ [Decedent's Address], City of ____________________, State of California, Zip Code ____________________.

- This affidavit is being submitted to request the transfer/releases of certain assets held by the decedent.

- The legal description of the property (if applicable) is:

____________________ [Legal Description of Property]. - I swear/affirm under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

Executed this _____ day of ____________________, 20____, at ____________________ [City], ____________________ [State].

____________________

[Your Signature]

____________________

[Printed Name]

Subscribed and sworn to (or affirmed) before me this _____ day of ____________________, 20____, by ____________________ [Your Name], proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

____________________

[Notary Public's Signature]

____________________

[Printed Name of Notary Public]

Commission No. ____________________

My commission expires ____________________.

PDF Specifications

| Fact | Description |

|---|---|

| Purpose | The California Affidavit of Death form is used to formally recognize the death of an individual, particularly for the purpose of transferring or clearing title to real property. |

| Governing Law | It is governed by the probate codes and laws of the State of California, specifically sections that deal with the transfer of property upon death. |

| Who Files | This document is typically filed by the surviving joint tenant, trustee, or executor of the estate of the deceased person. |

| Required Information | It requires detailed information about the deceased, including their full name, date of death, and a legal description of the property in question. |

| Attachment | A certified copy of the death certificate must be attached to the affidavit when it is filed. |

| Filing Location | The completed form, along with the death certificate, should be filed with the county recorder’s office where the property is located. |

| Effect | Once filed and recorded, the affidavit serves as official notice of death and aids in the process of transferring the property to the rightful heirs or surviving joint tenants. |

Instructions on Writing California Affidavit of Death

When someone passes away, certain legal steps must be taken to ensure that property and assets are transferred according to the deceased's wishes or state laws. One such step involves filing an Affidavit of Death in California. This document officially records the death and assists in the process of transferring assets held in the deceased's name. Completing this form accurately is crucial to avoid delays in the estate administration process. Follow these steps to fill out the California Affidavit of Death form correctly.

- Start by obtaining the correct form. Ensure you have the latest version of the California Affidavit of Death.

- Enter the full legal name of the decedent (the person who has died) at the top of the form, where indicated.

- Fill in the date of death exactly as it appears on the official death certificate.

- Insert the decedent's date of birth, if required, to help identify them accurately.

- Provide the legal description of the property affected by the death, including county, assessor's parcel number (APN), and the legal description used in the deed or title documents. This section may require consulting previous property documents for accuracy.

- List your (the affiant's) full legal name, stating your relationship to the decedent and your interest in the property (if applicable).

- Attach a certified copy of the death certificate to the affidavit. This is a crucial step as the form cannot be processed without it.

- Review the affidavit carefully to ensure all information provided is accurate and complete.

- Sign the affidavit in front of a notary public. The notary will need to notarize the document, officially acknowledging that it was you who signed the form.

- Lastly, file the completed affidavit and attached death certificate with the county recorder's office in the county where the property is located. Fees may be associated with filing, which vary by county.

After submitting the Affidavit of Death, the recorded document serves as official notice of the death concerning the property specified. This helps facilitate the transfer of the decedent's property to the rightful heirs or designated beneficiaries. It's advisable to retain copies of the filed affidavit and death certificate for personal records. If issues arise or additional information is needed, directly contact the county recorder's office for guidance.

Understanding California Affidavit of Death

What is a California Affidavit of Death form?

An Affidavit of Death form is a legal document used in the state of California to officially declare the death of an individual. This document is typically used to notify businesses, courts, and agencies to update records or transfer assets according to a will or the state’s succession laws.

Who needs to fill out an Affidavit of Death form?

This form is usually filled out by a surviving spouse, a close relative, the executor of the deceased’s estate, or anyone who has a legal interest in the estate of the deceased. It serves as a formal notification to relevant entities about the person’s death.

Where can I obtain an Affidavit of Death form in California?

You can obtain this form from several sources including legal aid offices, some courthouses, or online legal services. Many county recorder's offices in California also provide forms or can guide you on where to find them.

What information do I need to complete the form?

Completing the form requires information about the deceased, including their full name, date of death, and county of death. You'll also need to describe the relationship between the deceased and the person filling out the form, and detail the property or interest affected by the death.

Do I need to file the Affidavit of Death with the county recorder?

Yes, in most cases, the Affidavit of Death needs to be filed with the county recorder's office in the county where the deceased owned property. This filing is crucial for the legal transfer of real property and to ensure all records are updated accordingly.

Is there a fee to file the Affidavit of Death form?

Yes, there is typically a filing fee associated with recording the Affidavit of Death. The fee can vary by county, so it’s a good idea to contact the local recorder’s office to find out the exact amount.

How long does it take for the form to be processed?

The processing time can vary significantly depending on the county recorder’s office. However, once submitted, it usually takes a few weeks to a couple of months for the form to be processed and for records to be updated.

Do I need a lawyer to fill out an Affidavit of Death form?

While it is not mandatory to have a lawyer fill out the form, consulting with a legal professional specializing in estate planning or probate law can be beneficial, especially if the estate of the deceased is complex or if you are unsure about the process.

What should I do if I make a mistake on the form?

If you make a mistake while filling out the form, it’s important to correct it before submitting. If the form has been filed, contact the county recorder's office where the document was recorded to learn about the process for making corrections. They may require filing an amended affidavit or a new form to correct the error.

Common mistakes

Filling out the California Affidavit of Death form might seem straightforward, but even the smallest mistake can lead to big headaches. This document plays a crucial role in the legal process following a person's death, particularly in the transfer of property. Ensuring that all information is correct and complete is paramount. Here are seven common mistakes people make when completing this form.

First and foremost, a frequent mistake is not double-checking the decedent’s personal information. Names, dates, and especially the Social Security Number must be accurate. Any discrepancy between the details on the affidavit and official documents can complicate the property transfer process, potentially leading to legal disputes or delays.

Another common error is failing to attach a certified copy of the death certificate. The California Affidavit of Death form requires this document as a vital piece of verification. Without it, the affidavit lacks the legitimacy needed for the transfer of property or to claim benefits.

People often overlook the requirement for notarization. The form is not valid unless it is signed in the presence of a notary public. This step is crucial as it confirms the identity of the person filing the affidavit and the authenticity of their signature. Skipping this process can invalidate the entire document.

Incorrectly identifying the property in question is a mistake that can lead directly to more complex legal issues. Listing the wrong address, parcel number, or legal description of the property can misdirect the transfer or benefits intended by the deceased. Precision is key when detailing the property involved.

Another mistake lies in neglecting to file the affidavit with the appropriate county recorder's office. Once completed and notarized, the document must be officially recorded to effectuate the legal transfer of property. Failure to do so means the property's title does not officially pass to the intended recipient, leaving the estate unsettled.

Assuming one form fits all circumstances can also lead to complications. The California Affidavit of Death form differs depending on whether the deceased was a joint tenant, trustee, or a trustor. Using the incorrect form based on the relationship to the property can nullify the intended legal actions regarding the property.

Lastly, attempting to navigate the process without professional advice is a gamble. While it's certainly possible to fill out and file the form without legal help, understanding its implications and ensuring all related legal documents are in order can be daunting. A small oversight or misunderstanding of the law can result in significant legal and financial repercussions. Consulting with a legal professional can provide peace of mind and ensure that the process is handled correctly from start to finish.

Mistakes in preparing the California Affidavit of Death can be costly and time-consuming to rectify. Paying close attention to detail, understanding the form’s requirements, and seeking appropriate legal counsel can help avoid these common pitfalls, ensuring the smooth transfer of property and fulfillment of the decedent’s wishes.

Documents used along the form

When managing the affairs of a loved one who has passed away, the California Affidavit of Death is a crucial document. It helps in transferring or confirming title to assets held in the deceased's name. However, this form is often just one part of a series of documents required to fully settle an estate or handle other post-death formalities. The list below outlines several other forms and documents that are typically used in conjunction with the Affidavit of Death, explaining the purpose of each.

- Certificate of Death: This official government-issued record validates the death, providing crucial details such as date, location, and cause. It is often required to obtain the Affidavit of Death and for other legal processes.

- Will: This legal document outlines the deceased person's wishes regarding the distribution of their assets and the care of any dependents. It is essential for guiding the probate process.

- Trust Documents: If the deceased established a trust, these documents delineate how their assets should be managed and distributed, often allowing the estate to avoid probate.

- Letters of Administration or Letters Testamentary: Issued by a probate court, these documents authorize an individual to act as the executor or administrator of the estate, giving them legal power to distribute assets as per the will or state law.

- Notice of Death: This document is used to notify creditors, financial institutions, and government agencies of the death, initiating the process of settling debts and finalizing personal affairs.

- Property Deed Transfer Form: In cases where real estate is involved, this form is used to legally transfer property ownership from the deceased to the rightful heirs or buyers as determined by the will or state law.

- Tax Forms: Various tax forms, including the final individual tax return and estate tax return, may be required to fulfill the deceased's tax obligations to federal and state authorities.

Navigating the aftermath of a loved one's death involves coping with grief and handling a multitude of legal responsibilities. Understanding and preparing the necessary documents, including but not limited to the California Affidavit of Death, can facilitate a smoother process during such a challenging time. Each document serves its unique role in ensuring that the deceased's affairs are settled according to their wishes and legal requirements.

Similar forms

The California Affidavit of Death form shares similarities with the Affidavit of Heirship. This document is also used in the process of transferring property after someone dies. While the Affidavit of Death is typically used to notify financial institutions and other entities about a person's death, the Affidavit of Heirship provides detailed information about the deceased's family and potential heirs. This is particularly useful when settling estates without a will, as it helps in identifying legal heirs to the property.

Another related document is the Death Certificate, a formal government-issued record that proves the death of an individual. Like the Affidavit of Death, the Death Certificate is essential in the initial steps of administrating the deceased's estate. It serves as the primary source of death verification and is required by various organizations to process claims, transfer ownerships, and complete other official actions initiated by the affidavit.

Similar in purpose to the Affidavit of Death form is the Small Estate Affidavit. This form is utilized when handling small estates, providing a simplified method for property distribution without going through formal probate. The process requires a declaration under oath by the successor(s) of the deceased, stating their right to the assets of the deceased. This document streamlines estate proceedings for estates under a certain value threshold, much like how the Affidavit of Death facilitates certain notifications and transactions.

Transfer on Death Deed (TODD) is another document that operates within the sphere of estate management but caters to a specific function before the death of the property owner. It allows homeowners to name a beneficiary who will receive the property upon the owner’s death without the need for probate. While the Affidavit of Death is used after death to confirm the decedent's demise, the TODD is an estate planning tool that ensures the smooth transition of property upon the owner’s death.

Likewise, the Revocable Living Trust bears resemblance to the effects facilitated by an Affidavit of Death, albeit functioning quite differently. This estate planning document allows individuals to manage their assets during their lifetime and specify how they should be distributed upon their death. Upon the death of the trust's grantor, the Affidavit of Death may be required to prove the grantor's death so that the distribution of the assets can proceed according to the terms of the trust.

Finally, a Joint Tenant with Right of Survivorship (JTWROS) Agreement is another document related by its utility in avoiding probate upon one owner’s death. This agreement allows property held by two or more individuals to pass automatically to the surviving owner(s) without the need for probate court proceedings. In the event of one owner's death, an Affidavit of Death might be used to document and formalize the transfer of the deceased’s interest in the property to the surviving partner(s), highlighting its central role in affirming transitions of ownership linked with death.

Dos and Don'ts

When filling out the California Affidavit of Death form, accuracy and attention to detail are crucial. This document is a legal statement that confirms someone's death and can significantly impact the transfer of property among other legal procedures. Here’s a list of dos and don'ts to guide you through the process:

Do:- Verify the form’s current version by checking the official California Courts or County Recorder's website to ensure compliance with the most recent legal requirements.

- Provide accurate information about the deceased, including their full legal name as it appears on their death certificate and any property documentation.

- Include the official death certificate or a certified copy of it, as this is required for the affidavit to be processed.

- Ensure all legal descriptions of property are precise, including parcel numbers and addresses, to prevent any ambiguity regarding the property in question.

- Sign the document in the presence of a notary public to validate the affidavit's authenticity.

- Fill out the form without having the death certificate at hand; discrepancies between documents can cause significant delays or rejection of the affidavit.

- Omit any requested details or provide half-truths about the deceased’s property. Incomplete or inaccurate information may invalidate the affidavit.

- Attempt to use the affidavit for purposes other than what it is intended for, such as trying to transfer property not legally owned by the deceased or without following through the proper legal channels.

Taking these steps seriously ensures the process is smooth and respects the legal requirements of the State of California. Always remember, when in doubt, seeking advice from a legal professional can prevent unnecessary errors and legal challenges.

Misconceptions

Many misunderstandings exist about the California Affidavit of Death form. By clarifying these, individuals can navigate their responsibilities with accuracy and confidence during challenging times.

Only family members can file it: This is not true. While family members are the most common filers, anyone with a vested interest in the deceased's estate, such as beneficiaries or legal representatives, can file the Affidavit of Death form in California.

It serves as a will substitute: Some believe that this affidavit can act as a substitute for a last will and testament. However, it does not serve to distribute assets but rather to provide a legal statement of death, often associated with transferring titles or notifying financial institutions.

It's a complex legal process: The process of completing and filing the affidavit is relatively straightforward. While the implications of the form may involve complex legal matters, the act of completing and filing it does not require legal representation or extensive legal knowledge.

There is a long filing deadline: Contrary to belief, there's no extensive deadline to file this document. However, timely filing is essential to manage property and assets efficiently, and different institutions may have their specific deadlines.

It’s only for probate matters: Although frequently used in probate to facilitate the transfer of property, the affidavit is also utilized outside of probate for tasks such as notifying banks or releasing certain assets to rightful heirs.

Any template will work: It’s crucial to use the specific California form designed for this purpose. Generic forms may not be accepted by California institutions or meet state legal requirements, potentially causing delays or legal issues.

Key takeaways

When dealing with the emotionally tough process of handling a loved one's affairs after their death, understanding the process for legal document preparation is crucial. In California, one such document that often needs to be filled out is the Affidavit of Death form. This form is an essential step for transferring assets from the deceased to the heirs or beneficiaries. Below are seven key takeaways about filling out and using the California Affidavit of Death form:

- Understand the Purpose: The California Affidavit of Death form is used to legally declare the death of a property owner. It's primarily used in situations involving the transfer of property or to claim assets by the deceased's heirs or designated beneficiaries.

- Know When to Use It: This form is necessary when transferring ownership of real estate, vehicles, securities, or other assets without going through probate court. It can simplify the process of asset distribution significantly.

- Preparation is Key: Before filling out the form, gather all necessary documents, including the death certificate of the deceased, property deeds, and any applicable trust or will documents. This will ensure accuracy and conformity with the deceased's wishes.

- Details Matter: Provide accurate and thorough information. This includes the full legal name of the deceased, the date of death, and a legal description of the property or assets in question. Mistakes on the form can delay transfers or lead to legal complications.

- Legal Requirements: The form must be notarized to be legally valid. This means it needs to be signed in the presence of a notary public. The notary will verify your identity and the veracity of your signature before notarizing the document.

- Filing with the Proper Authorities: Once notarized, the Affidavit of Death must be filed with the appropriate county recorder's office or other relevant entities, depending on the asset type. This step is crucial to officially transfer ownership.

- Seek Professional Help if Needed: While the process may seem straightforward, complexities can arise, especially with larger estates or unusual assets. Don't hesitate to seek legal advice from an estate planning attorney to navigate any uncertainties or specific legal questions.

Correctly handling the California Affidavit of Death form is a vital step in managing the legal aspects of a deceased person's estate. Ensuring accuracy and compliance with legal standards can alleviate some of the stress associated with asset transfer after a loved one's death.

More Affidavit of Death State Forms

Sample Affidavit of Death - The affidavit of death is a key document in verifying the decedent’s identity and death for legal, property, and financial resolutions.